5G Devices Market Size, Share & Trends Analysis Report By Form Factor (Phones, CPE, Modules, Laptop), By Spectrum (sub-6 GHz, mmWave), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-147-5

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2019 - 2021

- Industry:Technology

5G Devices Market Size & Trends

The global5G devices market size was estimated at USD 136.79 billion in 2022and is projected to grow at a compound annual growth rate (CAGR) of 33.5% from 2023 to 2030. One of the primary drivers propelling the market is the continuous expansion of 5G network infrastructure. Telecommunication companies and governments worldwide are investing heavily in rolling out 5G networks, increasing coverage and capacity. As these networks become more accessible, the demand for 5G devices such assmartphones, tablets, and IoT gadgets naturally rises. This expansion is enabling faster data speeds, lower latency, and greater connectivity, which appeals to both consumers and businesses.

Another significant driver of the market is the increasing consumer demand for high-speed connectivity. As people rely on their devices for an array of activities, from streaming high-definition content to online gaming, there is a growing need for quicker and more reliable connections. 5G technology caters to this demand by offering unparalleled data speeds and reduced lag, enhancing the overall user experience. This surge in consumer demand is pushing device manufacturers to produce more 5G-compatible products.

宣布的数量大幅增加d and commercially available 5G devices, as cataloged by GSA, is a strong driving force behind the growth of the market. The remarkable surge of 62% in announced 5G devices and a staggering 76% growth in 5G phones from the beginning of 2022 indicate the rapid pace of innovation within the industry. Consumers, as well as businesses and industries, are witnessing an expanding array of options in the market, catering to diverse needs and preferences. With over 1,650 commercially available 5G devices, reflecting a remarkable annual growth of more than 66%, this market transformation is extending the accessibility of 5G technology. This proliferation of 5G devices is translating into faster network adoption, improved connectivity, and enhanced user experiences, propelling the overall market forward.

The proliferation of theInternet of Things(IoT) and the advent of Industry 4.0 are also contributing to the growth of the market. These trends involve connecting various devices and sensors to the internet for data collection and automation. The low latency and high bandwidth of 5G networks are crucial for IoT and Industry 4.0 applications, as they enable real-time data transfer and decision-making. This is driving the development and adoption of 5G-compatible devices in sectors like manufacturing, healthcare, transportation, and smart cities.

One notable restraint in the 5G devices industry is the relatively higher cost associated with adopting this advanced technology. The deployment of 5G infrastructure and the production of compatible devices involve substantial investments. Consequently, this can drive up the cost of 5G devices, making them less affordable for some consumers or enterprises. To overcome this restraint, manufacturers and service providers need to focus on cost-effective solutions and foster competition in the market.

Form Factor Insights

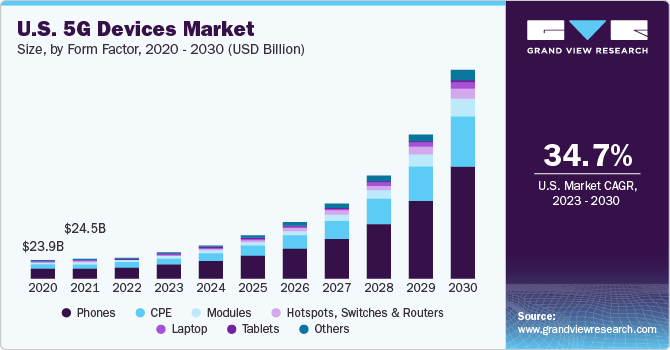

The phones segment dominated the market in 2022 with the largest revenue share of more than 51.0%. Mobile phones have become an integral part of modern life, with millions of users globally. The transition to 5G not only promises faster and more reliable data speeds but also unlocks the potential for various applications, such asAugmented Reality(AR), Virtual Reality (VR), and the Internet of Things (IoT), which are best experienced on mobile devices. In addition, phone manufacturers have recognized the immense market potential and have been actively investing in 5G technology integration, thus further propelling the segment’s growth in the market.

Thelaptopsegment is anticipated to register significant growth over the forecast period. Laptops are essential tools for various professional and personal tasks, making them indispensable in modern life. The integration of 5G connectivity into laptops opens up new possibilities, enabling users to access high-speed internet on the go without the limitations of Wi-Fi hotspots. Laptops with 5G capabilities offer a compelling solution for remote work, as they provide reliable connectivity, ensuring professionals stay productive regardless of their location. The combination of 5G's low latency and high-speed internet access facilitates seamless video conferencing, cloud computing, and data-intensive tasks, further driving the appeal of 5G-enabled laptops.

Spectrum Insights

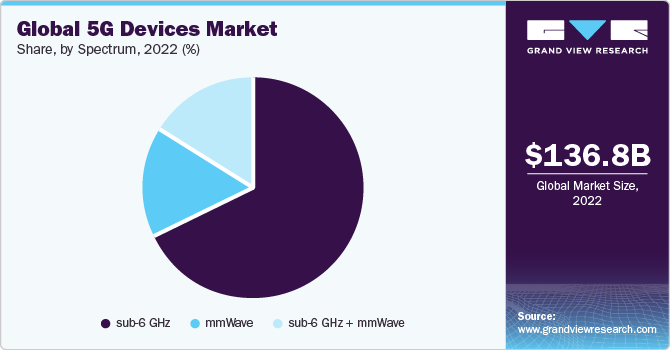

Based on spectrum, the sub-6 GHz segment held the maximum market share in 2022 of over 67.0%. The sub-6 GHz frequencies offer a balanced mix of coverage and capacity. This means that devices operating in this frequency range can provide wide area coverage while also delivering impressive data speeds, making them suitable for both urban and rural areas. The sub-6 GHz 5G devices are also more widespread and accessible, as they are part of the initial phase of 5G deployments.

The mmWave segment is anticipated to register the fastest CAGR of 35% over the forecast period. The mmWave segment's emergence can be attributed to its unique capabilities and the growing demand for high-speed, low-latency connectivity. MmWave technology operates at extremely high frequencies, offering significantly faster data speeds compared to sub-6 GHz counterparts. As consumers and industries increasingly rely on bandwidth-intensive applications like AR,VR, and high-definition video streaming, mmWave's ability to deliver multi-gigabit data rates becomes a crucial selling point.

Regional Insights

Asia Pacific dominated the market in 2022 with a revenue share of more than 37.0%. The region's vast population, particularly in countries like China and India, has fueled a tremendous demand for 5G devices. With growing urbanization and increasing smartphone adoption, consumers are eager to access the benefits of high-speed 5G networks. Furthermore, Asia Pacific hosts some of the world's largest manufacturers of 5G devices, including leading smartphone makers and network equipment providers. These local companies are well-positioned to deliver a wide range of 5G devices, catering to diverse consumer preferences and price points. In addition, Asian countries, including China and South Korea, were at the forefront of 5G network launches, which further propelled the region’s growth.

The North America regional market is anticipated to emerge as the fastest-growing market from 2023 to 2030. North America, particularly the U.S., is home to some of the world's largest tech giants and innovators in the telecommunications industry. The region has been at the forefront of 5G network deployments, with extensive coverage and a strong focus on advancing the adoption of 5G technology. Moreover, North America boasts a tech-savvy consumer base that eagerly embraces the latest technological advancements. Growing demand for advanced technology, 5G network coverage, and investments in 5G networks are driving the regional market’s growth.

关键企业和市场份额的见解乐鱼APP二维码

The competitive landscape among device manufacturers in the market has ignited a flurry of innovation and fueled the continuous release of an array of advanced 5G devices. In the race to secure a strong market presence, companies are actively engaged in a relentless pursuit of excellence. This fervor for market share and customer loyalty is the driving force behind a relentless cycle of development and improvement in the 5G product domain. As each player in the industry strives to carve out their niche and expand their customer base, they understand the pivotal role innovation plays. The competitive spirit encourages manufacturers to push boundaries, challenge the status quo, and think outside the box when it comes to the features and functionalities they can offer.

In July 2023, Ericsson and Intel unveiled a strategic partnership aimed at harnessing Intel's cutting-edge 18A process and manufacturing technology to bolster Ericsson's forthcoming next-generation optimized 5G infrastructure. Within the framework of this collaboration, Intel is set to produce tailor-made 5G SoCs (system-on-chip) to empower Ericsson in crafting highly distinctive, top-tier products for the future landscape of 5G infrastructure. Beyond this, the collaboration extends to the optimization of 4th Gen Intel Xeon Scalable processors with Intel vRAN Boost for Ericsson's Cloud RAN solutions. The core goal is to empower communication service providers with amplified network capacity, heightened energy efficiency, and enhanced scalability and flexibility.

Key 5G Devices Companies:

- ZTE Corporation

- Xiaomi

- Samsung

- Sony Group Corporation

- D-Link

- Huawei

- Nokia Corporation

- Fibocom Wireless, Inc

- MediaTek, Inc.

- HTC Corporation

5G Devices Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 168.38 billion |

Revenue forecast in 2030 |

USD 1,269.20 billion |

Growth rate |

CAGR of 33.5% from 2023 to 2030 |

Base year of estimation |

2022 |

Historical data |

2019 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

Segments covered |

Form factor, spectrum, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Country scope |

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

Key companies profiled |

ZTE Corporation; Xiaomi; Samsung; Sony Group Corporation; D-Link; Huawei; Nokia Corporation; Fibocom Wireless, Inc.; MediaTek, Inc.; HTC Corporation |

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global 5G Devices Market ReportSegmentation

报告预测收入growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the global 5G devices market report based on form factor, spectrum, and region.

Form Factor Outlook (Revenue, USD Billion, 2019 - 2030)

Phones

CPE

Modules

Hotspots, Switches & Routers

Laptop

Tablets

Others

Spectrum Outlook (Revenue, USD Billion, 2019 - 2030)

sub-6 GHz

mmWave

sub-6 GHz + mmWave

Regional Outlook (Revenue, USD Billion, 2019 - 2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Asia Pacific

China

India

Japan

South Korea

Australia

Latin America

Brazil

Mexico

Middle East & Africa

Kingdom of Saudi Arabia (KSA)

UAE

South Africa

Frequently Asked Questions About This Report

b.The global 5G devices market size was estimated at USD 136.79 billion in 2022 and is expected to reach USD 168.38 billion in 2023.

b.The global 5G devices market is expected to grow at a compound annual growth rate of 33.5% from 2023 to 2030 to reach USD 1,269.20 billion by 2030.

b.The Asia Pacific segment dominated the market in 2022. The region's vast population, particularly in countries like China and India, has fuelled a tremendous demand for 5G devices. With growing urbanization and increasing smartphone adoption, consumers are eager to access the benefits of high-speed 5G networks, thus fuelling the demand for 5G devices in the market.

b.Some key players operating in the 5G devices market include ZTE Corporation, Xiaomi, Samsung, Sony Group Corporation, D-Link, Huawei, Nokia Corporation, Fibocom Wireless, Inc., MediaTek, Inc., and HTC Corporation.

b.The continuous expansion of 5G network infrastructure, the increasing consumer demand for high-speed connectivity, and proliferation of the Internet of Things (IoT) and the advent of Industry 4.0 are driving the 5G devices market’s growth.

We are committed towards customer satisfaction, and quality service.