Affective Computing Market Size, Share & Trends Analysis Report By Technology (Touch-based, Touchless), By Software, By Hardware, By End-use (Healthcare Automotive), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-908-1

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry:Technology

Report Overview

全球情感计算市场规模是瓦尔乐鱼体育手机网站入口ued at USD 20.23 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 33.0% from 2020 to 2027. Continued advances in technology coupled with the growing adoption of advanced electronic devices bode well for the growth of the market. Affective computing allows a computational device to sense the users’ non-verbal emotional signals, including gestures, movements, physiology, and other behaviors, and react in real-time. The growing demand for virtual assistants capable of detecting fraudulent activities and the rising need for improved security in various sectors is driving the market growth. The growing usage of affective computing for security applications, such as voice-activated biometrics, to limit access to authorized users is also contributing to the growth.

Affective computing is also referred to as emotional artificial intelligence. It envisages interactions between humans and a computer, whereby the computer detects the user’s stimuli and responds accordingly. For instance, a computational device driven by emotional artificial intelligence can potentially analyze a student’s facial gestures while studying a subject, make out whether the student is facing any problems in understanding the topic, and redirect the student to the appropriate resources helpful in understanding the topic.

几个辅助开发ices, such as sensors and cameras, help in gathering the inputs in the form of different physical and facial gestures, which are fed to various algorithms for analysis to gauge the user’s emotional state. Subconscious or subtle signs of users can also be addressed using appropriate devices and IT systems to facilitate effective interactions. As a result, affective computing is finding applications across several industries and industry verticals to gauge and analyze customers’ subconscious feedback.

Affective computing can also be used for personalization, such as changing the music, room temperature, and lighting, depending upon the mood of the user. For instance, a prototype called Gestele adds to the gestures, emotions, or other forms of communication that can be tracked by individuals suffering from speech impairment or any other impairment. Moreover, the growing deployment of robots is also providing an impetus for the adoption of affective computing. The growing adoption ofartificial intelligence(AI) in logistics, autonomous cars, parking aid software, and surgical robots, among other applications, is also expected to play a decisive role in driving the adoption of affective computing over the forecast period.

The continued rollout of high-speed internet networks, availability of high-resolution cameras, and the adoption ofmachine learning(ML) are particularly driving the adoption of affective computing. Affective computing relies heavily on high-speed broadband connections to ensure effective and real-time communication between high-resolution dual cameras capturing human gestures and emotions and the machine learning models that are supposed to interpret these emotions.Gesture recognitionhas already been gaining traction since 2010, thereby propelling smartphone makers to have high-resolution cameras in their smartphone models. This has opened opportunities for using the cameras installed on smartphones to gauge human emotions and respond and react accordingly.

The outbreak of the COVID-19 pandemic is prompting several enterprises to suspend biometric attendance for employees. This has opened opportunities for various technologies that can potentially reduce physical interactions. Lockdowns are ending in most parts of the world and companies are gradually resuming operations from their premises. At this juncture, companies remain keen on adopting gestures, speech, and facial recognition software not only for attendance purposes but also for replacing all the applications using biometric parameters. For instance, a gesture-based or voice-based contactless biometrics system could be implemented at airports for obtaining boarding passes. Enterprises would be adopting affective computing facilitating touchless interactions on priority and at a rapid pace in the wake of the outbreak of the COVID-19 pandemic.

然而,与技术compatibi有关的问题lity and high implementation costs are some of the major factors that are expected to restrain the growth of the market. While companies are trying to understand how customer behavior and decision-making are reflected in the customers’ emotions and gestures, most of this data is collected in a complex lab environment. As a result, companies are facing challenges in retrieving decisions from the accumulated data and are hence focusing particularly on these challenges while building models for affective computing. Moreover, various factions of affective computing, such as wearable computing and gesture recognition, tend to incur high development costs. This is emerging as a major barrier to market growth. This is prompting solution providers to focus more on technological partnerships to bridge the technology gap and widen the product portfolio.

Technology Insights

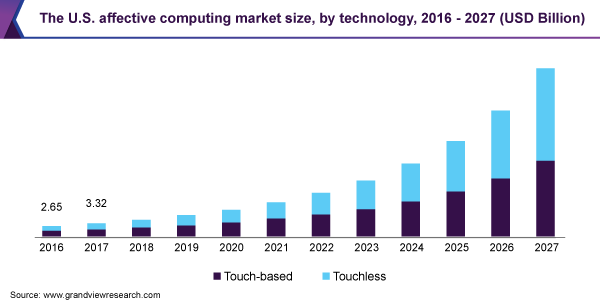

The touch-based segment dominated the affective computing market in 2019 and accounted for a revenue share of more than 50%. Touch-based technologies play a vital role in the implementation of affective computing solutions. A full-fledged solution typically requires hardware components, such as sensors, storage devices, and cameras, to capture facial expressions and physical gestures. It may also require the users to make certain gestures by touching the device or via the controller connected to the device. Some of the most common gesture-based or touch-based technologies deployed to detect or monitor human gestures include gyroscopes, accelerometers, or a combination of both. The touch-based segment is expected to witness significant growth in line with the advances in the market.

The touchless segment is expected to witness the fastest growth over the forecast period as growing awareness of proper hygiene drives the demand for contact-free sensing. The increasing demand for touchless sensing-based biometric solutions and the continued rollout of smartphones with the latest controlling and tracking functionalities are expected to open new growth opportunities for the touchless segment. Although the growth of the touchless segment is restrained at present owing to the high switchover costs combined with user resistance, the outbreak of the COVID-19 pandemic is gradually paving the way for the adoption of touchless affective computing solutions.

Software Insights

The speech recognition segment dominated the market and accounted for a revenue share of over 25% in 2019. Affective computing based on speech recognition helps in interpreting emotions from inputs in the form of speech using real-time speech emotion detection. The system comprises speech segmentation, voice activity detection, signal pre-processing future extraction, emotional categorization, and statistical analysis of the emotional frequency. The system can detect real-time speech emotions for various applications, such as online learning. The demand for speech and voice recognition software is projected to witness significant growth over the forecast period owing to the continued advances in AI- and ML-based techniques and the integration of connected devices with personal assistants.

Thefacial recognitionsegment is expected to witness the fastest growth over the forecast period. Facial recognition guarantees a high level of safety and has hence been gaining wide acceptance over the past few years. Facial recognition leverages a connected camera or a digital camera to identify the faces in the captured images and compare the features of those faces against the images stored in the database. Authorities are particularly using facial recognition to authenticate the traveler’s identity, particularly in airports. Law enforcement agencies are using facial recognition to scan faces caught in the surveillance cameras to locate the targeted person. The growing need for a high level of safety and security and the capability of facial recognition technology to provide the same is expected to drive the growth of the market over the forecast period.

Hardware Insights

The sensors segment dominated the market in 2019 and accounted for a revenue share of over 35%. Sensors can potentially detect changes or events in the environment and provide a conforming output. Sensors are vital components as they are responsible for interpreting, recognizing, processing, and simulating human emotions. Sensors find several applications in flood and water level monitoring, traffic monitoring and controlling, environmental monitoring, animal tracking, and precision agriculture, among others. Advances in sensing technologies, the growing adoption of electronics devices, continued development of smart cities, advances in automation, and the growing preference for IoT technology are expected to drive the growth of the sensors segment.

The camera segment is expected to witness significant growth over the forecast period. Cameras are installed at commercial facilities, government buildings, and other public places and can play a crucial role in affective computing solutions. The rising stakeholder and policy support for pursuing smart city initiatives and the subsequent demand for urban surveillance technologies and advanced technologies for video surveillance systems are expected to open lucrative opportunities for the growth of the cameras segment. The growing concerns over public safety and security, increasing adoption of IP cameras, and the growing adoption of spy cameras by law enforcement agencies also bode well for the growth of the cameras segment. Continued adoption of the latest technologies, such as IoT, big data, AI, and deep learning in video surveillance systems are also expected to open new opportunities for the vendors operating in the market.

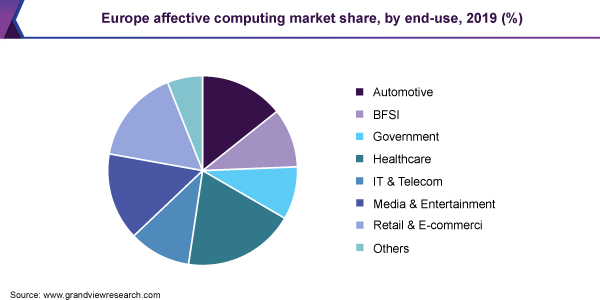

End-use Insights

The healthcare segment dominated the market in 2019 and accounted for a revenue share of nearly 18%. Healthcare companies are focusing on innovations majorly focusing on advanced patient monitoring tools typically based on facial recognition techniques to monitor the patients. For instance, Empatica, one of the prominent companies in the healthcare industry, offers wearable affective computing devices for healthcare applications. The emotions of patients are interpreted through facial, speech, and body gestures to track their condition in real-time. Medical systems may also be equipped with voice and empathic assistants to annul negative emotions that can have adverse effects on human health and uplift the mood of the patients. The growing adoption of affective computing solutions in healthcare applications is anticipated to fuel the growth of the market.

The automotive segment is expected to witness significant growth over the forecast period as the industry incumbents aggressively adopt innovative methods to implement next-generation mobility. As such, the development of biometric applications, such as driver monitoring for autonomous driving and voice/gesture recognition for driver control, shows no signs of abating. For instance, in January 2019, Aptiv plc partnered with Affectiva to commercialize innovative multimodal interior sensing solutions for fleet and OEM customers and enhance the mobility experience for future vehicles. The growing emphasis on improved vehicle safety & security and the rising adoption of advanced technologies, such as AI and cloud connectivity, in automobiles are also expected to be crucial for the growth of the market over the forecast period.

Regional Insights

在2019年和acc北美主导市场ounted for a revenue share of over 30%. North America is home to some of the highly active research organizations involved in developing technically advanced computing devices. The region is also among the leading adopters of next-gen and AI-based technologies on an extensive scale and has been continuously improving the infrastructure with AI to ensure a mature infrastructure ideal for the deployment of affective computing. The increasing adoption of robotics in the region is another factor playing a decisive role in driving the growth of the regional market. The region is also home to technologically advanced and established organizations as well as startups, such as GestureTek, Kairos, Affectiva, and Eyeris, which are offering affective computing solutions in line with the evolving needs of the customers.

Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period owing to the increasing adoption of the latest technologies across the region. Asia Pacific is home to emerging economies, such as India and China. Moreover, several countries in the region are pursuing various initiatives for the electronic ID generation of their respective citizens. For instance, initiatives, such as the UIDAI project in India and the e-KTP project in Indonesia, are opening new opportunities for the adoption of affective computing in the region. On the other hand, the growing popularity of smartwatches and smart wearable devices in China is motivating major market players to strengthen their footprint in the Asia Pacific. Affective computing is being extensively used by law enforcement agencies for investigation purposes. For instance, in April 2018, Indian police used face recognition technology in the capital city of New Delhi to detect children who had been kidnapped or lost.

Key Companies & Market Share Insights

The technology and software industry is highly fragmented with several players holding a significant market share. Key market players include Affectiva, Cognitec Systems GmbH, Intel Corporation, IBM, and Microsoft Corporation, among others. All these market players are investing aggressively in research & development activities to drive organic growth and increase their market share. These players are also engaging actively in new product development to strengthen and expand their existing product and service portfolios and acquire new customers to validate the technology. Companies are putting a strong emphasis on mergers & acquisitions and strategic partnerships to develop technologically advanced products and gain a competitive edge over their rivals. For instance, in May 2020, Microsoft and Sony Semiconductor Solutions partnered to create smart camera solutions that make AI-powered video analytics and smart cameras easier to deploy and access for their common customers. The partnership envisages the two companies implanting Microsoft Azure AI capabilities on Sony Semiconductor Solution’s intelligent vision sensor IMX500 to obtain useful information from images clicked using smart cameras and other devices. Some of the prominent players in the affective computing market include:

Affectiva

Elliptic Laboratories A/S

Cognitec Systems GmbH

Eyesight Technologies Ltd.

Intel Corporation

IBM

Microsoft Corporation

Kairos AR, Inc.

Qualcomm Technologies, Inc.

Google

Affective Computing Market Report Scope

Report Attribute |

Details |

Market size value in 2020 |

USD 26.17 billion |

Revenue forecast in 2027 |

USD 192.45 billion |

Growth Rate |

CAGR of 33.0% from 2020 to 2027 |

Base year for estimation |

2019 |

Historical data |

2016 - 2018 |

Forecast period |

2020 - 2027 |

Quantitative units |

Revenue in USD million and CAGR from 2020 to 2027 |

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

Segments covered |

Technology, software, hardware, end-use, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

The U.S.; Canada; Germany; The U.K.; China; India; Japan; Brazil |

Key companies profiled |

Affectiva; Elliptic Laboratories A/S; Cognitec Systems GmbH; Eyesight Technologies Ltd.; Intel Corporation; IBM; Microsoft Corporation; Kairos AR, Inc.; Qualcomm Technologies, Inc.; Google |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

这份报告预测全球收入增长, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global affective computing market report based on technology, software, hardware, end-use, and region:

Technology Outlook (Revenue, USD Million, 2016 - 2027)

Touch-based

Touchless

Software Outlook (Revenue, USD Million, 2016 - 2027)

Analytics Software

Enterprise Software

Facial Recognition

Gesture Recognition

Speech Recognition

Hardware Outlook (Revenue, USD Million, 2016 - 2027)

Cameras

Sensors

Storage Devices & Processors

Others

End-use Outlook (Revenue, USD Million, 2016 - 2027)

Automotive

BFSI

Government

Healthcare

IT & Telecom

Media & Entertainment

Retail & E-commerce

Others

Regional Outlook (Revenue, USD Million, 2016 - 2027)

North America

The U.S.

Canada

Europe

Germany

The U.K.

Asia Pacific

China

India

Japan

拉丁美洲

Brazil

The Middle East & Africa

Frequently Asked Questions About This Report

b.The global affective computing market size was estimated at USD 20.23 billion in 2019 and is expected to reach USD 26.17 billion in 2020.

b.The global affective computing market is expected to grow at a compound annual growth rate of 33.0% from 2020 to 2027 to reach USD 192.45 billion by 2027.

b.North America dominated the affective computing market with a share of 32.5% in 2019. North American has the presence of several prominent market players delivering advanced solutions to all the industry verticals in the regions.

b.Some key players operating in the affective computing market include Affectiva Inc., Elliptic Laboratories AS, Cognitec Systems GmbH, IBM Corp., Microsoft Corp, Eyesight Technologies, Ltd., Apple Inc., Google Inc., Intel Corporation, Qualcomm.

b.Key factors driving the affective computing market growth include rising need for socially intelligent artificial agents. Amidst the fourth industrial revolution, social robots are diligently moving from fiction to reality. Sophisticated artificial agents are becoming more ubiquitous in everyday life, due to which researchers are introducing innovative affective computing solutions for aiding assistance to human-computer interaction.