Africa Generic Pharmaceutical Market Size, Share & Trends Analysis Report By Type (Simple Generics, Specialty Generics), By Route Of Administration, By Product, By Application, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-120-0

- Number of Pages: 102

- Format: Electronic (PDF)

- 历史的范围:2018 - 2021

- Industry:Healthcare

Report Overview

TheAfrica generic pharmaceutical market sizewas estimated atUSD 6.43 billion in 2022and is projected to grow at a compound annual growth rate (CAGR) of 4.32% from 2023 to 2030. The market is poised to experience significant growth opportunities driven by several factors. With a growing population and increasing healthcare needs, there is a rising demand for affordable medicines. However, limited healthcare budgets in the region have created challenges in accessing expensive branded drugs. In this context,generic pharmaceuticalshave found a favorable environment to flourish and play a crucial role in addressing the healthcare affordability challenges across Africa.

此外,潜在的大容量是一个销售key advantage of drugs in this market. The large patient population, combined with the prevalence of chronic diseases like cardiovascular disorders, diabetes, and infectious diseases, offers a substantial market for generic medicines. These drugs not only cater to the immediate healthcare demands but also contribute to making essential medications accessible to a wider population.

As the region's healthcare landscape continues to evolve, the regional generic pharmaceutical market is poised to play a pivotal role in providing cost-effective healthcare solutions and improving overall health outcomes for the population.

Some of the generic pharmaceutical companies in Africa are Aspen Holdings, Cipla South Africa, and Lupin Limited among others. These companies have increased their focus on manufacturing affordable medicines for various therapeutic areas, catering to the needs of African patients. Their commitment to providing high-quality and affordable medicines has positioned them as a trusted provider of generic drugs. They have been successful in offering cost-effective alternatives for essential medicines, such as ARVs for HIV/AIDS treatment.

Alternatively, the market also presents certain challenges. Regulatory complexities and varying compliance requirements across different regional countries can pose hurdles to market entry and expansion. Companies need to navigate these regulatory frameworks, which may involve delays and additional costs in obtaining product registrations & approvals

Type Insights

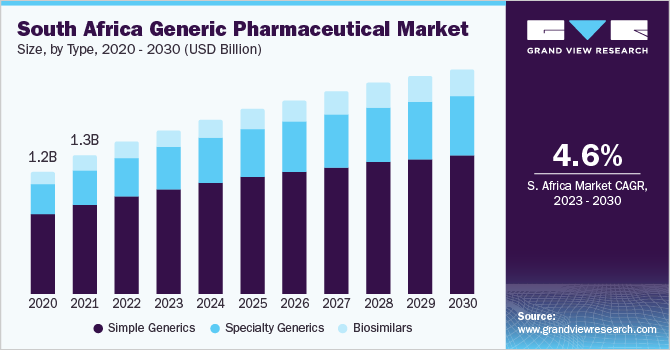

Based on type, the simple generics segment held a major market share of 64.67% in 2022 owing to safety and cost-effectiveness. The rising FDA-approved simple generics coupled with strategic initiatives by key players have led to growing sales and distribution of simple generics. For instance, in September 2020, the Africa Medical Supplies Platform and Novartis announced a new collaboration for medicines supply from the company’s pandemic response portfolio to the Caricom countries & AU member states. The company’s 15 generic and OTC medicine portfolio from the Sandoz division will be sold to the government through the Africa Medical Supplies Platform to 55 African & 15 Caricom-eligible countries.

On the other hand, biosimilars are anticipated to witness the fastest CAGR of 6.68% over the forecast period. The segment is driven by factors such as the increasing number of patients with chronic and life-threatening diseases and patent loss ofbiologicsover the coming years. Among the biosimilars, several patents drugs are likely to expire in the coming years which certainly opens up new opportunities for biosimilars and increases industry competition. In addition, fewer companies develop biosimilars, which is one of the factors for the rapid demand of the segment. In addition, improved treatment outcomes with biosimilars and increased life expectancy are likely to boost the demand within the forecast period.

Application Insights

In terms of application, the cardiovascular diseases segment held the largest revenue share of 16.84% in 2022. The prevalence of cardiovascular diseases and rising demand for medication have boosted the requirement for the market. According to the World Heart Federation, more than 1 billion people in Africa contribute to the global burden of cardiovascular disease. Therefore, this factor has led to the rise in the use of drugs for treating medical conditions associated with diseases such as blood clots, arrhythmias, coronary artery disease, high or low blood pressure, high cholesterol, heart failure, and stroke.

In addition, cancer is anticipated to witness moderate growth over the forecast period. The segment is driven by the increasing prevalence of cancer, the aging population, and the rising availability of generic medicines for cancer have fueled the segment revenue. According to WHO, in 2020, the number of new cancer cases in Africa was 1,109,209 for both sexes. The frequent cancer types occurring in the region are breast, cervix uteri, prostate, liver, and colorectum. Therefore, growing cancer incidence has led to the rapid demand for generic pharmaceuticals thereby supporting the growth of the market.

Product Insights

In terms of product, the small molecule segment held the largest revenue share of 89.46% in 2022 and is expected to maintain its dominant position throughout the forecast period. The segment is driven by key factors such as the rising number of pharmaceutical companies that are focusing on small molecule drug development pipelines with increased research and development activities. These molecules are easier to manufacture as compared to large molecules. In addition, low cost, availability, and accessibility of products to the patients drive the segment growth. This factor has led to the development of small molecule manufacturing with advanced technological capabilities.

Large molecules are anticipated to grow at a stable growth rate during the forecast period. The effectiveness of large molecules to treat various chronic illnesses such as autoimmune diseases, cancer, and genetic disorders has led to a rise in sales of products. However, due to high costs and time-consuming nature of manufacturing and frequent price volatility on the higher side may affect the segment growth.

Route of Administration Insights

Based on route of administration, the oral segment held the largest revenue share of approximately 64.65% in 2022 owing to it being the most common and easiest route of administration. In addition, its convenience, effectiveness, and safety, along with low cost drive the segment growth. In addition, the growing pipeline of oral medication, research, and development activities has boosted the market growth.

The injectable segment is anticipated to grow at the fastest CAGR of 8.0% over the forecast period owing to the increasing popularity of generic pharmaceuticals in chronic diseases such as HIV, cancer, respiratory diseases, cancer, and diabetes. For instance, in May 2023, Cipla announced the manufacturing of a generic version of the prophylaxis, long-acting cabotegravir at Benoni or Durban. The product is an affordable version of an HIV-prevention drug that will be made available in South Africa.

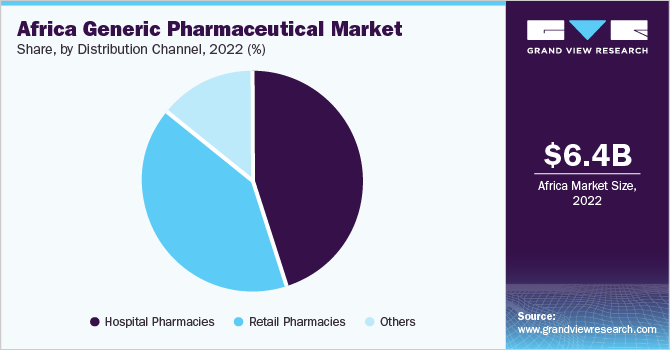

Distribution Channel Insights

In terms of distribution channels, the hospital pharmacies segment dominated the market in 2022 with the largest revenue share of over 45.20%. The growth can be attributed to several factors, such as the availability of a wide range of drugs, affordable drugs, rapid dramatic changes in demand for hospital pharmacies, and growing pharmacy competition. In addition, the presence of pharmacies within the hospitals has increased pressure on both external and internal product offerings, which have contributed to the growth.

此外,零售药店市场项目ected to witness moderate growth during the forecast period. The growing retail pharmacies through offline and online modes drive the market growth. In January 2022, mPharma raised USD 35 million to build a chain of community pharmacies across Africa. The easy accessibility, flexibility, and convenience provided by pharmacies drive the segment growth.

Regional Insights

In terms of region, South Africa dominated the market in 2022 with the largest revenue share of approximately 22.42%. The growing chronic disease burden such as cancer, CNS, and diabetes has led the increased generic medication production in the region which offers a tremendous opportunity for the companies to focus on investment and increased sales and distribution. The developing healthcare facilities, demand for generic pharmaceuticals, as well as increased local pharmaceutical production of generics, are expected to drive the demand. Furthermore, low-cost safety and high-quality drugs fuel the market growth.

Key Company & Market Share Insights

玩家操作整个非洲市场的关键for generic pharmaceuticals are adopting strategic initiatives such as new launches, mergers & acquisitions, and partnerships to increase their market share. For instance, in February 2023, Minapharm Pharmaceuticals company commenced a phase I clinical trial for its groundbreaking adalimumab biosimilar, Adessia. The outcome is expected by the end of 2023, offering significant potential for medical advancements. Furthermore, in May 2023, Cipla Inc. announced its plans to produce a generic version of a revolutionary HIV-prevention drug, long-acting cabotegravir (CAB-LA), in South Africa. This significant development marked the first time that an affordable variant of this breakthrough medication would be manufactured in South Africa. Consequently, it has the potential to provide millions of individuals at risk of HIV infection in Africa with access to a bimonthly injection that would significantly reduce their chances of contracting the virus. Some prominent players in the Africa generic pharmaceutical market include:

Abbott Laboratories

F. Hoffmann-La Roche Ltd

Novartis AG

Cipla South Africa

Aspen Holdings

Teva Pharmaceutical Industries Ltd.

Endo International plc

Viatris, Inc.

Sun Pharmaceutical Industries Ltd.

Lupin

AbbVie Inc.

Aurobindo Pharma

Sanofi

Hikma Pharmaceuticals

Dr. Reddy’s Laboratories Ltd.

Africa Generic Pharmaceutical MarketReport Scope

Report Attribute |

Details |

Revenue Forecast in 2023 |

USD 6.91 billion |

Revenue Forecast in 2030 |

USD 9.29 billion |

Growth rate |

CAGR of 4.32% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in (USD billion/million) and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Type, application, product, route of administration, distribution channel, region |

Regional Scope |

Africa; Rest of Africa & Sub-Saharan Africa |

Country scope |

Botswana; Namibia; Zimbabwe; Zambia; Tanzania; Rwanda; Ghana; Nigeria; South Africa; Angola; Mozambique; Cameroon; Senegal; Ivory Coast; Rest of Africa & Sub-Saharan Africa |

Key companies profiled |

Abbott Laboratories; F. Hoffmann-La Roche Ltd; Novartis AG; Cipla South Africa; Aspen Holdings; Teva Pharmaceutical Industries Ltd.; Endo International plc; Viatris, Inc.; Sun Pharmaceutical Industries Ltd.; Lupin; AbbVie Inc.; Aurobindo Pharma; Sanofi; Hikma Pharmaceuticals; Dr. Reddy’s Laboratories Ltd. |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Africa Generic Pharmaceutical Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Africa generic pharmaceutical market based on type, application, product, route of administration, distribution channel, and region:

Type Outlook (Revenue, USD Million, 2018 - 2030)

Simple Generics

Specialty Generics

Biosimilars

Application Outlook (Revenue, USD Million, 2018 - 2030)

Central Nervous System Disorders

Respiratory Diseases

Hormones & Related Diseases

Gastrointestinal Diseases

Cardiovascular Diseases

Infectious Diseases

Cancer

Diabetes

Others

Product Outlook (Revenue, USD Million, 2018 - 2030)

Small Molecule

Large Molecule

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

Oral

Injectable

Inhalable

Others

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

Retail Pharmacies

Hospital Pharmacies

Others

Regional Outlook (Revenue, USD Million, 2018 - 2030)

Africa

Botswana

Namibia

Zimbabwe

Zambia

Tanzania

Rwanda

Ghana

Nigeria

South Africa

Angola

Mozambique

Cameroon

Senegal

Ivory Coast

Rest Sub-Saharan Africa

Rest of Africa and Sub-Saharan Africa

常见问题关于这个报告

b.The Africa generic pharmaceutical market size was estimated at USD 6.43 billion in 2022 and is expected to reach USD 6.91 billion in 2023.

b.The Africa generic pharmaceutical market is expected to grow at a compound annual growth rate of 4.32% from 2023 to 2030 to reach USD 9.29 billion by 2030.

b.Based on type, in 2022, the simple generics segment gained a major market share of 64.7% owing to safety, effectiveness and are less expensive.

b.Some key players operating in the Africa generic pharmaceutical market include Abbott Laboratories, F. Hoffmann-La Roche Ltd, Novartis AG, Cipla South Africa, Aspen Holdings, Teva Pharmaceutical Industries Ltd. , Endo International plc , Viatris, Inc. , Sun Pharmaceutical Industries Ltd., Lupin, AbbVie Inc. , Aurobindo Pharma, Sanofi , Hikma Pharmaceuticals , Dr. Reddy’s Laboratories Ltd.

b.Key factors that are driving the market growth include region's growing population and increasing healthcare needs, which have led to rising demand for affordable medicines.