Anti-acne Cosmetics Market Size, Share & Trends Analysis Report By Product Type (Masks, Creams & Lotions), By Gender (Women, Men), By End Use (Dermatology Clinics, MedSpa), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-3-68038-139-9

- Number of Pages: 114

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry:Healthcare

Report Overview

The global anti-acne cosmetics market size was valued at USD 4.13 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 9.0% from 2022 to 2030. The negative social stigma associated with acne and the rising consumption of cosmetics by both men and women, especially from emerging economies are majorly estimated to drive the market growth. The aesthetics industry witnessed significant setbacks due to the COVID-19 pandemic. Since the majority of the cosmetic products are not a medical necessity, lockdown in several countries led to the closure of several beauty salons & med spas, dermatology clinics, and retail stores. However, the online sales of anti-acne cosmetics surged by the end of 2020 as COVID-19 restrictions were eased.

Moreover, the incidence of acne increased during the pandemic, which, in turn, accelerated the market growth. Acne is a highly prevalent skin disorder among adolescents. According to an article published by the Journal of The European Academy of Dermatology and Venereology, more than 95% of boys and nearly 85% of girls are affected by acne during their adolescence. Out of these, nearly 40% experience moderate‐to‐severe acne and nearly 50% continue to have acne in their adulthood. The high prevalence of acne, especially in the young population, is anticipated to fuel market growth. The anti-acne mask segment in the U.S is expected to grow at a significant CAGR from 2022 to 2030.

Acne patients are prone to suffer from anxiety, depression, low self-esteem, poor quality of life, and loneliness. This can be attributed to the emotional and mental associations that an individual has with his/her appearance. According to a study published in the International Journal of Women’s Dermatology, decreased self-esteem and increased embarrassment were observed in nearly 64% and about 89% of women with moderate and severe acne, respectively. These psychological issues are anticipated to prompt patients to seek cosmetic solutions to improve their appearance, thereby driving market growth. These psychological effects are also indirectly fueled by the increasing usage of social media and photo-editing apps.

COVID-19 impact: A 7.2% increase in demand was observed

Pandemic Impact |

Post COVID Outlook |

According to a study published by Clinics in Dermatology, nearly 33% of healthcare workers developed acne, dermatitis, and facial itching due to the use of an N95 face mask. |

Industry players are anticipated to focus on digital channels to capture and convert the attention of existing as well as new customers. |

Sephora’s U.S. business witnessed a nearly 30% increase in its online sales as compared to 2019 |

Retailers and brand stores are expected to offer discounts, sales, and other promotions to bring in consumers and clear inventory as these stores are witnessing relatively low (~9% to 43% ) customer traffic as compared to the pre-COVID level. |

此外,因素,如增加number of e-commerce platforms selling these products, growing internet penetration, and rapid urbanization, are estimated to boost the demand for these products among the target population, especially in developing economies. Social media is one of the biggest market influencers. The impact of social media on esthetics has been massive, especially in terms of how consumers perceive and project themselves. According to a survey conducted by Dove, nearly 82% of women believed that social media can alter existing beauty standards. Furthermore, increasing awareness regarding various products and their features is anticipated to positively impact the market growth.

Consumers are well aware of the price, advantages, and side effects of products, which helps them make well-informed purchase decisions. Despite the adverse impact of the COVID-19 pandemic on several industries, skincare product manufacturers have witnessed an increase in product sales. Cases of skin irritation, such as acne, increased during the COVID-19 period due to prolonged use of face masks. As a result of this, consumers relyon skin care products to keep their skin hydrated. An Australian skincare brand, Real-u Skincare, witnessed a boost in sales of its products amid the COVID-19 pandemic. Moreover, a key cosmetic manufacturer, L’Oréal, reported a 40% growth in its online cosmetics sale globally in 2020. Thus, lucrative opportunities lie ahead for the anti-acne cosmetic manufacturers.

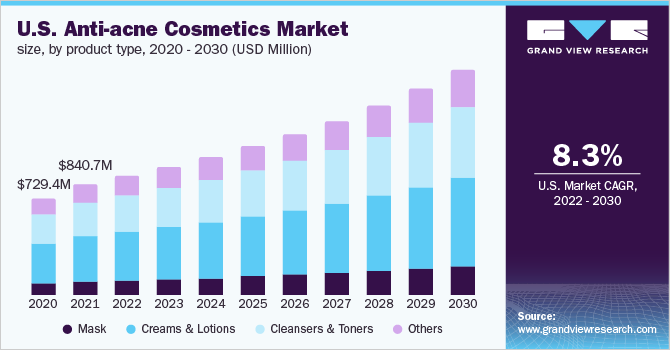

Product Type Insights

On the basis of product, the global market is divided into masks, creams & lotions, cleansers & toners, and others. The creams & lotions segment accounted for the maximum share of 40.50% of the overall revenue in 2021 owing to the high demand by both men and women as moisturizing creams and body lotions protect the skin from bacteria and skin infections, such as psoriasis and eczema. Many times, these creams and lotions are produced in medicated form. They may contain the Active Pharmaceutical Ingredient (API), vitamins like vitamin A, medications like antibiotics for acne caused due to bacterial infection, etc. The others segment includes products, such as face wash, gels, serums, and essential oils.

These products help unclog the pores and reduce inflammation, as acne is characterized by clogging and inflammation. These products are available in various types based on ingredients and their usage. The other segment is anticipated to grow at a rapid pace over the forecast period due to the compatibility of these products with various skin types and better skin absorption of these products. Serums like Salicylic acid are widely used now as it has been proven effective in unclogging blocked pores, acting as an anti-inflammatory, and also breaking down sebum, the oil found in the body responsible for acne. As per NCBI, the use of 0.5% and 2% solutions of salicylic acid for the treatment of acne vulgaris is reported to be more efficient as compared to benzoyl peroxide in reducing the total number of acne lesions.

Gender Insights

On the basis of gender, the global market has been further bifurcated into women and men. The women anti-acne cosmetics segment dominated the global market in 2021. The segment accounted for the maximum share of more than 57.5% of the overall revenue. In addition, the segment is projected to retain its dominant market position throughout the forecast period expanding at the fastest growth rate. This growth can be attributed to the high prevalence of acne among the female population across the globe. Acne is highly prevalent in women than men after adolescence since it is linked to hormone changes, such as the menstrual cycle.

According to a survey, about 62.2% of pre-menopausal women reported worsening acne during the menstrual cycle. The men anti-acne cosmetics segment also accounted for a substantial market share in 2021. The most common causes of acne in men include bacterial infection, hormonal changes, stress, poor hygiene, and drug reactions. The growing prevalence of acne in men is propelling the demand for these products with nearly 42.5% of men reporting suffering from acne in their 20s, 20.1% in their 30s, 12% in their 40s, and 7.3% in their 50s.

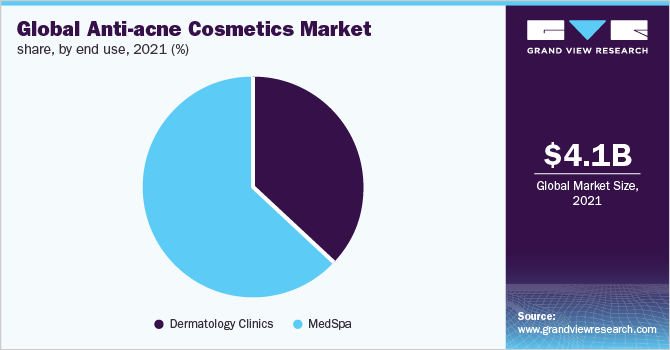

End-use Insights

On the basis of end-uses, the market is segmented into Medspa and Dermatology Clinics. The medspa segment held the highest market share of around 63.0% in 2021. The segment is also anticipated to reciprocate the highest growth over the forecast period. This is due to the fact that Medspa provides aesthetic treatments under the supervision of a licensed medical practitioner. Medspas currently use innovative, cutting-edge technology and products to provide clinical treatments that are in line with modern medicine.Currently, the millennial population is the largest target demographic for medical-grade skincare brands. According to the American Spa Association, the U.S. Medspa industry revenue has had double-digit growth since 2010, and a majority of the Medspa patients were between the ages of 35-54 years.

2018年,协会还指出,埃米尔gence of large medical spa chains, including Orange Twist, Beverly Hills Rejuvenation Centre, and Kalologie 360 are expected to further boost the market growth in the country. The number of dermatology practices is also on the rise globally due to the increasing incidence of skin cancer and lifestyle-related skin conditions, such as acne, atopic dermatitis, & hyperpigmentation. An increasing number of people in countries like the U.S., U.K., and Canada, go to skin specialists for cosmetic procedures for a more youthful appearance. These are the factors contributing to the growth of the dermatology clinic segment globally.

Regional Insights

Asia Pacific dominated the market in 2021 with a revenue share of more than 13.00% and is estimated to witness lucrative growth over the forecast period. Asia Pacific is the largest potential export market for U.S.-based products owing to over 3 billion potential consumers of anti-acne cosmetic products. A study conducted by JAMA Dermatology stated that in westernized societies, such as the U.S., acne is a universal skin disease afflicting 79 to 95% of the adolescent population. Economies, such as Australia, Japan, and South Korea, are some of the largest consumers of well-established U.S.-based products.

In addition, Vietnam, Malaysia, and Indonesia are a few other regions expected to witness the demand for these products in the forecast period. China is one of the most promising cosmetics markets in the Asia Pacific region. This can be attributed to the fascination of the Chinese population with high-end foreign brands as nearly 80% of the country’s cosmetics market is dominated by western brands. According to Cosmetic Design, skincare was one of the fastest-growing markets in the country, with maximum sales through online channels. Online sales of active skincare products for companies, such as L’Oréal (China), showed a spike in growth, which increased from 1% in 2013 to 18% in 2018.

Key Companies &Market Share Insights

兼并与收购是sustaina的关键之一ble strategies undertaken by market players. For instance, L'Oréal, is planning to undertake mergers& acquisitions in India to expand its skin and make-up portfolio to meet the country’s increasing demand for cosmetic products. In December 2020, L’Oréal announced the signing of an agreement to acquire the Japanese company, Takami Co. This company develops and markets products licensed by the skincare brand Takami, owned by Doctor Hiroshi Takami. Some of the prominent companies in the global anti-acne cosmetics market include:

PCA

Obaji

PHYTOMER

Skin Medica

Skin Better Science

Colorescience

Sente

Jan Marini Skin Research

Revision Skincare

The BeautyHealth Company

Glow Biotics LLC

Perricone MD

Anti-acne Cosmetics MarketReport Scope

Report Attribute |

Details |

Market size value in 2022 |

USD 4.46 billion |

Revenue forecast in 2030 |

|

Growth rate |

CAGR of 9.0% from 2022 to 2030 |

Base year for estimation |

2021 |

Historical data |

2018 - 2020 |

Forecast period |

2022 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product type, gender, end-use, region |

Key companies profiled |

L’Oréal Paris; MURAD LLC (UNILEVER); NEUTROGENA (Johnson & Johnson Services, Inc.); Clinique Laboratories, LLC (ESTEE LAUDER); Vichy Laboratories; PCA Skin; Obaji; Skin Medica; Skin Better Science; Colorescience; Sente; Jan Marini Skin Research; Revision Skincare; The BeautyHealth Company; Glow Biotics LLC; Perricone MD |

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; Brazil; Mexico; South Africa; Saudi Arabia |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global anti-acne cosmetics market report on the basis of product type, gender, end-use, and region:

Product Type Outlook (Revenue, USD Million,2018 - 2030)

Mask

Creams & Lotions

Cleansers & Toners

Others

Gender Outlook (Revenue, USD Million, 2018 - 2030)

Women

Men

End-use Outlook (Revenue, USD Million,2018 - 2030)

Dermatology Clinics

MedSpa

RegionalOutlook (Revenue, USD Million,2018 - 2030)

North America

U.S.

Canada

Europe

U.K.

Germany

France

Italy

Spain

Asia Pacific

Japan

China

India

Australia

Latin America

Brazil

Mexico

Middle East & Africa

South Africa

Saudi Arabia

Frequently Asked Questions About This Report

b.The global anti-acne cosmetics market size was estimated at USD 4.13 billion in 2021 and is expected to reach USD 4.46 billion in 2022.

b.The global anti-acne cosmetics market is expected to grow at a compound annual growth rate of 9.0% from 2022 to 2030 to reach USD 8.91 billion by 2030.

b.Asia Pacific dominated the anti-acne cosmetics market with a share of 39.95% in 2021. This is attributable to economies, such as Australia, Japan, and South Korea which are some of the largest consumers for well-established U.S. based products.

b.Some key players operating in the anti-acne cosmetics market include Neutrogena, Clinique, Murad, Kose, LaRochPosay, Mentholatum, L'Oréal, Proactiv, and Vichy.

b.Key factors that are driving the anti-acne cosmetics market growth include the negative social stigma associated with acne and rising consumption of cosmetics by both men and women, especially from the emerging economies.