Anti-biofilm Wound Dressing Market Size, Share & Trends Analysis Report By Mode of Mechanism (Chemical, Physical, Biological), By Application (Acute Wounds, Chronic Wounds), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-948-7

- Number of Pages: 97

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry:Healthcare

Report Overview

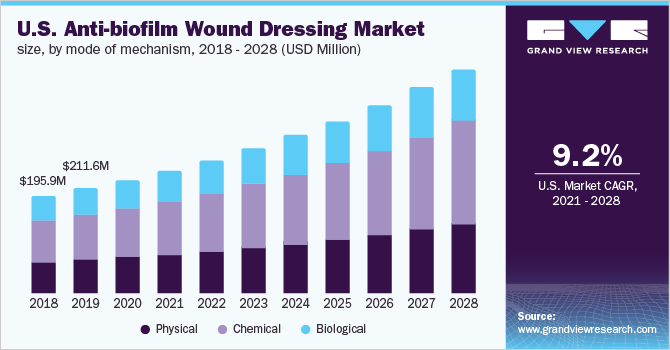

The global anti-biofilm wound dressing market size was valued at USD 606.57 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 9.2% from 2021 to 2028. The worldwide increase in the incidence of chronic diseases, such as cancer and diabetes, is fueling the market growth. Factors such as unhealthy and sedentary lifestyles, antimicrobial resistance, alcohol consumption, and smoking are contributing to the growing prevalence of non-communicable diseases. As per the studies conducted by B. Braun Melsungen AG in 2018, around 2.0% to 10.0% of diabetic people suffer from diabetic foot ulcers. In addition, as per the American College of Physicians, in 2017, the global annual incidence rate of diabetic foot ulcers is around 6.3% and the lifetime incidence rate of foot ulcers in patients suffering from diabetes ranges from 19.0%-34.0%. Since anti-biofilm wound dressing products are highly recommended for treating chronic wounds, thus this factor is expected to significantly boost the market growth.

Due to the COVID-19 outbreak, healthcare facilities such as hospitals have been exhausted with many Covid positive patients; therefore, many countries have postponed elective surgeries and other healthcare procedures for an indefinite period. Therefore, patients suffering from acute and chronic wounds must be treated at home or in outpatient clinics. Thus, demand for wound care products such as anti-biofilm wound dressing used in home settings has increased. Moreover, the demand for home healthcare among the aging population is increasing as this population group is at a higher risk of acquiring the infection and cannot visit any healthcare facilities. In addition, many patients have adopted online counseling for their health-related concerns.

According to the U.S. CDC, 6 in 10 adults are suffering from a chronic disease and 4 in 10 adults are suffering from two or more chronic diseases in the U.S. Furthermore, chronic diseases are the leading cause of disability and death and a key contributor to the country’s USD 3.5 trillion annual healthcare costs. As a result of the rising prevalence of chronic conditions, the number of surgeries being performed has increased. Wound dressing products such as silver-based wound dressing are increasingly being used to prevent surgical site infections. Most surgical wounds after cancer surgery are generally large in size and deep, producing exudate that requires regular management. Anti-biofilm wound dressing products such as silver and iodine-based wound dressings help to manage large wounds, thus reducing the risk of infection. Therefore, the rising incidence of chronic diseases is expected to boost the demand for the products, thereby propelling the market growth.

Increasing incidence of burns, trauma events, and road accidents across the globe is anticipated to drive the market. For instance, according to the WHO (2018), approximately 1,000,000 people in India suffer from severe or moderate burns every year. In addition, as per the NCBI, in 2017, countries such as Finland, the Netherlands, Bulgaria, China, Australia, and the U.K. reported a rise in the incidence of burn wounds. Furthermore, according to the American Association for the Surgery of Trauma, in 2017, around 1.2 million people died globally and road accidents account for around 3,242 deaths per day. Road accidents mostly occur in middle- or low-income countries. Biomaterials and skin substitutes are majorly used for healing all kinds of burn wounds. Thus, the rising number of accidents is expected to boost the demand for products, which is expected to lead to considerable growth in the market over the forecast period.

Furthermore, as more people are participating in sports and recreational activities, the risk of injuries is increasing. For instance, according to Stanford Children’s Health, over 3.5 million injuries are reported annually among children and teens in the U.S., and around 21% of all injuries are traumatic brain injuries. Furthermore, according to the Canadian Institute for Health Information, from 2016 to 2017, around 17,655 people were hospitalized due to sports-related injuries. Similarly, according to the American Physical Therapy Association (APTA) 2017 report, approximately 8.6 million sports injuries are reported in the U.S. each year. Thus, an increase in the incidence of injuries is anticipated to drive the demand for anti-biofilm wound dressing products, thereby aiding the market growth.

Application Insights

The acute wounds segment held the largest share of over 55.0% in 2020 owing to the rising cases of burns and trauma and the increasing number of surgeries across the globe. An acute wound is an injury to the skin that occurs unexpectedly and includes incisions, abrasions, burns, scratches, and puncture wounds. It heals at a normal rate according to the regular wound healing process. These types of wounds can take place anywhere on the body and differ from small scratches to deep wounds. The acute wounds segment is further classified into surgical or traumatic wounds and burn wounds. Treating acute wounds will depend on the severity and location of the wound. However, the primary treatment includes dressing the wound and preventing biofilm formation. Thus, the increasing number of patients suffering from acute wounds is expected to boost the market growth.

The chronic wounds segment is anticipated to witness the fastest growth over the forecast period owing to the increasing cases of chronic diseases, especially diabetes, across the globe. Chronic or non-healing wounds occur when there is no significant healing of an injury for about 4 weeks. These types of wounds progress and will heal slower than expected or will not heal at all. The symptoms of chronic wounds include increased infection and pain in the wound. This can be due to the pressure on or around the wound, exposure to bacteria or trauma, or insufficient blood and oxygen supply. It is estimated that 1%-2% of the population will suffer from a chronic wound once in their lifetime.

In the U.S., it is stated that chronic wounds affect around 6.5 million people. Moreover, the incidence of chronic wounds is expected to increase with aging and will impose a significant financial burden on society. It is estimated that more than USD 25 billion is spent by the healthcare system on treating wound-related complications every year in the U.S. In addition, as per the American Diabetes Association (ADA), more than 9-12 million people in America suffer from chronic ulcers. Thus, the increasing cases of chronic diseases, especially diabetes, and the rising geriatric population across the globe are the major drivers of the segment. These common wounds have different characteristics. There are many common types of chronic wounds. The chronic wound segment is further fragmented into diabetic foot ulcers, pressure ulcers, venous leg ulcers, and others.

Mode of Mechanism Insights

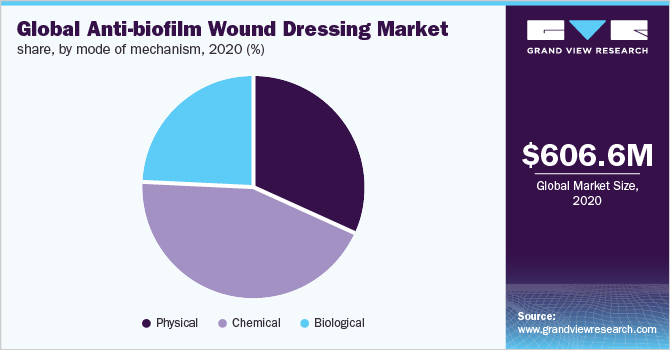

The chemical mode of mechanism segment held the largest share of over 40.0% in 2020 and is anticipated to witness the fastest growth over the forecast period owing to the rising prevalence of chronic wounds and the increasing number of surgeries across the globe. The chemical-based anti-biofilm wound dressing products allow multi-faceted action against biofilm, thereby increasing the healing rate and recovery efficiency of chronic wounds. They also reduce the biofilm burden on both chronic and acute wounds and lower the risk of acquiring recontamination with microorganisms. The chemical segment is further fragmented into ionic silver, iodine, EDTA, and others.

The presence of several players offering anti-biofilm wound dressing products with iodine and ionic silver is the major factor promoting the segment growth. In addition, researchers are taking initiatives to introduce advanced anti-biofilm wound dressing products in the market for better treatment of chronic and acute wounds. For instance, in June 2020, the National Biofilms Innovation Centre of the U.K. announced a grant of USD 28,949.03 to research and introduce new product lines related to managing, engineering, and detecting biofilms. Therefore, all these factors are anticipated to positively impact the market growth over the forecast period.

Regional Insights

North America dominated the market with a share of more than 40.0% in 2020 and is expected to witness considerable growth over the forecast period. The increasing incidence of sports injuries, rising number of road accidents, and the presence of several key players in the region are some of the factors expected to drive the market. In addition, the presence of a highly developed healthcare infrastructure and favorable reimbursement policies are expected to propel market growth over the forecast period.

Asia Pacific is anticipated to witness the fastest growth during the forecast period. The presence of developing countries such as Japan, India, and China is anticipated to fuel the market growth in this region. In addition, the growing medical tourism industry in these countries is contributing to the increasing demand for wound dressing products in this region. For instance, according to a report on Export Health Services by the Directorate-General of Commercial Intelligence and Statistics of India, in 2015-2016, India had 58,300 tourists on medical visas.

拉丁美洲is anticipated to grow at a significant rate during the forecast period. The presence of developing economies, such as Brazil and Mexico, is expected to primarily drive the market in Latin America. The availability of advanced treatment options at low cost in Latin America is making the region a preferred destination for medical tourism. In addition, the governments of Latin American countries are consistently involved in improving healthcare infrastructure. Thus, such factors are expected to fuel the growth of the market over the forecast period.

Key Companies & Market Share Insights

Companies are focusing on research and development to develop technologically advanced products to gain a competitive edge. For instance, in January 2018, Imbed Biosciences raised a fund of around USD 1.6 million intending to introduce the silver-based anti-biofilm wound dressing product, Microlyte Ag in the market, after the completion of its research on this product.

Companies are engaging in partnerships, mergers, and acquisitions, aiming to strengthen their product portfolio, expand their manufacturing capacities, and provide competitive differentiation. For instance, in April 2019, Smith & Nephew PLC announced the acquisition of Osiris Therapeutics, Inc., which specializes in regenerative medicine products. With this acquisition, the company will accelerate the development of its advanced wound management product portfolio, thereby expanding its customer pool and market reach. This initiative is anticipated to boost the growth of the company. Some prominent players in the global anti-biofilm wound dressing market include:

ConvaTec

Smith & Nephew PLC

Urgo Medical

Coloplast

3M

Anti-biofilm Wound Dressing Market Report Scope

Report Attribute |

Details |

Market size value in 2021 |

USD 657.84 million |

Revenue forecast in 2028 |

USD 1,219.85 million |

Growth Rate |

CAGR of 9.2% from 2021 to 2028 |

Base year for estimation |

2020 |

Historical data |

2016 - 2019 |

Forecast period |

2021 - 2028 |

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2028 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Mode of mechanism, application, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; U.K.; Germany; Japan; China; Brazil; Mexico; South Africa; Saudi Arabia |

Key companies profiled |

ConvaTec; Smith & Nephew PLC; Urgo Medical; Coloplast; 3M |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global anti-biofilm wound dressing market report on the basis of mode of mechanism, application, and region:

Mode of Mechanism Outlook (Revenue, USD Million, 2016 - 2028)

Physical

Manual Debridement

Pulse Electrical Field

Ultrasound Debridement

Chemical

Ionic Silver

Iodine

EDTA

Others

Biological

Dispersin B

Lactoferrin

Bacteriophage

Others

Application Outlook (Revenue, USD Million, 2016 - 2028)

Chronic Wounds

Diabetic Foot Ulcers

Pressure Ulcers

Venous Leg Ulcers

Others

Acute Wounds

Surgical & Traumatic Wounds

Burn Wounds

Regional Outlook (Revenue, USD Million, 2016 - 2028)

North America

U.S.

Canada

Europe

Germany

U.K.

Asia Pacific

Japan

China

拉丁美洲

Brazil

Mexico

Middle East & Africa

South Africa

Saudi Arabia

Frequently Asked Questions About This Report

b.The global anti-biofilm wound dressing market size was estimated at USD 606.57 million in 2020 and is expected to reach USD 657.84 million in 2021.

b.The global anti-biofilm wound dressing is expected to grow at a compound annual growth rate of 9.2% from 2021 to 2028 to reach USD 1,219.85 million by 2028.

b.North America dominated the anti-biofilm wound dressing market with the highest share of 43.4% in 2020. This is attributable to rising healthcare awareness coupled with technological advancements.

b.Some key players operating in the anti-biofilm wound dressing market include ConvaTec, Urgo Medical, Smith & Nephew, and Coloplast.

b.Key factors driving the anti-biofilm wound dressing market growth include rising demand for innovative wound care products and a rising number of surgical wounds.