Antibody Contract Development & Manufacturing Organization Market Size, Share & Trends Analysis Report By Product, By Source, By Therapeutic Area (Oncology, Neurology, Cardiology), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-116-7

- Number of Pages: 175

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

The globalantibodycontract development & manufacturing organization乐鱼体育手机网站入口was valued atUSD 20.73 billion in 2022,预计年复合增长的恶性肿瘤h rate (CAGR) of 14.0% from 2023 to 2030. Rising burden of cancer worldwide, which promotes demand for advanced therapy options such as antibody therapeutics, is expected to improve the demand for antibody contract development & manufacturing organization(CDMO) services in the market. Furthermore, the growing research activities for antibodies such as monoclonal antibodies (MABs), owing to their high potential in treating cancer, are further expected to support the demand for its manufacturing in the forecasted period and, thereby, is expected to support the growth of the market.

According to WHO, cancer is one of the leading causes of death worldwide, accounting for over 10 million deaths in 2022. Lung, colon, rectum, liver, stomach, and breast cancers are among the most common types of cancer. The International Agency for Research on Cancer stated that the number of cancer cases is expected to increase in the years to come. As per its estimates, it is expected that 30.2 million cancer cases will be diagnosed by 2040 globally. This will likely improve the demand for antibodies targeted therapies for cancer treatment.

Manufacturing antibodies incurs a high cost, and there are several challenges associated with manufacturing services. This is expected to promote the demand for contract development and manufacturing of antibodies and thus support the market's growth. Moreover, the manufacturing sites require high capital investments and trained operators. Advanced design and construction of biological manufacturing premises allow for the safe manipulation of toxic drugs.

In addition, single-use components and closed systems are used to reduce microbial contamination and the use of highly toxic drug compounds to protect operators and the environment, which presents significant operational challenges. Hence,biopharmaceuticalcompanies are likely to opt for outsourcing antibody manufacturing activities to contract service providers. This is likely to support market growth over the forecast period.

The COVID-19 pandemic has indeed had a significant impact on the antibody CDMO market. Although antibody drugs have been at the forefront of research and development for potential treatments against the COVID-19 virus, the temporary halt in clinical research created a decline in the development of novel antibody therapies during the initial period of the COVID-19 pandemic. However, by the end of 2021, accelerated research and development efforts in antibody drugs led to increased investments and collaborations among pharmaceutical companies, research institutions, and governments. This resulted in a surge in clinical trials and the rapid development of potential antibody-based treatments, thus supporting the growth of contract development companies. Additionally, the global healthcare system's focus on COVID-19 has led to a temporary slowdown in other medical research and development areas. Overall, the impact of COVID-19 on the antibody drugs market has been significant, with increased demand, accelerated research, and a shift in priorities.

Furthermore, the market witnessed a considerable impact from the geopolitical war between Russia and Ukraine. Russia's invasion of Ukraine impacted millions of people in the European nation, especially around the East European region and around the world, as biopharmaceutical manufacturers faced delays in clinical trials conducted in Kyiv and other places of the war-infected economies. Since the invasion of Ukraine in February 2022, clinical trial initiation has become significantly challenging due to enormous damage to patient displacement and healthcare infrastructure. Russia and Ukraine are both large centers for clinical research activities. The geopolitical situation resulted in the underpowering of intercontinental clinical trial results with the loss of future recruitment sites for both countries.

Product Insights

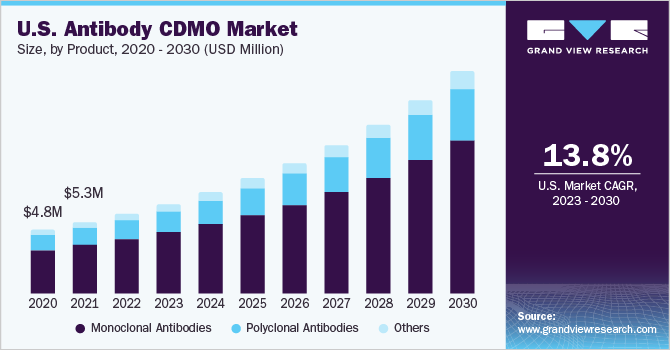

Themonoclonal antibodiessegment dominated the market and accounted for the largest revenue share of 67.6% in 2022. Monoclonal antibodies (mAbs) have emerged as a dominant product segment due to their therapeutic versatility and clinical success. These engineered antibodies have shown remarkable specificity in targeting disease-causing antigens, making them attractive candidates for treating various conditions, including cancer, autoimmune disorders, and infectious diseases. As a result, biopharmaceutical companies and investors have shown significant interest in mAb development and manufacturing. For instance, in October 2022, FUJIFILM Diosynth Biotechnologies, a CDMO for biologics, advanced therapies, and vaccines, announced an agreement with argenx to manufacture a monoclonal antibody (mAb) fragment called efgartigimod, to for the treatment of patients with severe autoimmune disease. Moreover, monoclonal antibodies have shown remarkable efficacy in treating chronic diseases. They can specifically target disease-causing molecules or cells, leading to improved patient outcomes.

Thepolyclonal antibodiessegment, on the other hand, is anticipated to register a considerable CAGR of 13.5% in the antibody contract development & manufacturing organization(CDMO) market during the forecast period of 2023 to 2030. The use of polyclonal antibodies in the CDMO market has been experiencing a noticeable increase due to their unique advantages and applications. Polyclonal antibodies offer a broader specificity, recognizing multiple epitopes on the target antigen, making them well-suited for targeting complex molecules or pathogens with high genetic variability. This characteristic can lead to enhanced sensitivity and effectiveness in specific diagnostic applications and research studies. Additionally, the rapid development process for polyclonal antibodies, requiring less time and effort compared to monoclonal antibodies, makes them a feasible and cost-effective option for certain projects, especially in response to urgent needs, such as during infectious disease outbreaks. As the market for biosimilars expands, polyclonal antibodies are also finding potential applications as alternatives to monoclonal antibodies, offering comparable therapeutic effects and potential cost savings, further contributing to their increasing use in the antibody CDMO market.

Source Insights

The mammalian segment dominated the market and accounted for the largest revenue share of 58.5% in 2022. This is majorly attributed to the use of mammalian cell lines, which minimizes the risk of rejection by human bodies in therapeutic use. Additionally, mammalian cell culture has numerous benefits, including high protein expression, improved scalability, and the ability to create biologics with human-like glycosylation patterns. As a result, the use of mammalian cell culture for producing therapeutic proteins and vaccines has grown significantly. Moreover, mammalian cells are considered most effective in producing complex biologics and proteins due to their proper folding and post-translational abilities. This has increased the demand for mammalian cell culture in pharmaceuticals and biopharmaceutical companies. For instance, in January 2023, Ginkgo Bioworks announced the opening of Bioworks7, the latest expansion of its biological engineering foundry. The company increased its capabilities and capacity to serve its partners in the spaces of biomanufacturing, cell andgene therapy, and general mammalian programming for therapeutic modalities.

Furthermore, mammalian cell expression systems are useful for producing therapeutic proteins and viral vaccinations in large quantities. They're also the preferred platform for next-generation cells and gene treatments. The ability of mammalian cells to create a wide range of high-quality therapeutic proteins makes them valuable in theCDMOindustry.

The microbial category is poised to witness a substantial CAGR of 13.7% from 2023 to 2030. Microbial expression systems, including bacteria and yeast, have been prominent in the antibody contract development & manufacturing organization(CDMO) market. These systems have gained popularity due to their cost-effectiveness, as they are relatively simple to culture and have fast growth rates, resulting in higher production yields and lower manufacturing costs compared to mammalian cell-based systems. Additionally, continuous culture using microbial cells may improve product quality, as the perfusion process produces lower antibody aggregates compared to other methods, thereby leading to higher-quality antibodies with improved efficacy and fewer side effects.

Therapeutic Area Insight

The oncology category dominated the market and accounted for the largest revenue share of 45.5% in 2022. This is attributed to increasing research and development activities pertaining to the discovery of novel anti-cancer therapeutics and a growing number of contract developers focusing on the launch of biologics in the treatment of several types of cancer, along with rising government initiatives to reduce the cost of treatment in cancer patients. For instance, in November 2021, OncoOne, and GenScript ProBio, a leading CDMO, announced the agreement for thecell line development, drug product, and drug substance manufacturing of diagnostic and therapeutic monoclonal antibodies directed for oncology targets for the treatment of cancer.

免疫介导的疾病种类,另外一些er hand, is anticipated to register a lucrative CAGR of 14.6% following the oncology segment during the forecast period. The segment is poised to witness considerable growth owing to increasing research and development activities in the field. Several biotechnology companies are focusing on the development of novel monoclonal antibody treatments for immune-mediated disorders. For instance, in February 2023, Regeneron Pharmaceuticals, Inc. announced that the U.S. Food and Drug Administration had granted the Biologics License Application (BLA) for Pozelimab, a human monoclonal antibody for the treatment of adults and children suffering from CHAPLE disease, a life-threatening and ultra-rare hereditary immune disease. Hence, due to the aforementioned factors, the immune-mediated disorders segment is anticipated to reflect lucrative growth during the forecast period in the antibody CDMO market.

End-use Insight

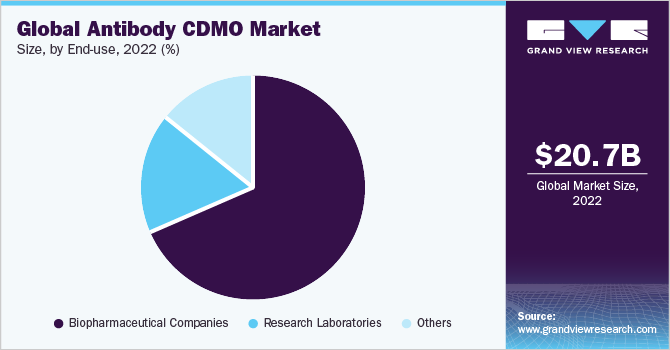

The biopharmaceutical companies’ category dominated the market and accounted for the largest revenue share of 68.5% in 2022. Biopharmaceutical companies often have research and development capabilities, including expertise in early-stage drug discovery and antibody development. However, they may need more capacity or specialized facilities required for large-scale manufacturing. Partnering with CDMOs allows them to leverage external expertise and infrastructure while focusing on their core competencies. Moreover, by partnering with CDMOs, biopharmaceutical companies can accelerate the drug development timeline and potentially reach the market faster, which is crucial in a competitive pharmaceutical landscape. Additionally, CDMOs are well-versed in regulatory requirements specific to biopharmaceutical companies. This expertise ensures that the antibodies are produced in compliance with the necessary regulations, facilitating smoother regulatory approval processes, thus supporting the segment’s lions share in 2022.

The research laboratories category, on the other hand, is anticipated to register a considerable CAGR of 13.6% during the forecast period. Research laboratories are involved in antibody research and development and require specialized CDMOs to support their efforts. CDMOs provide end-to-end services for the development and manufacturing of biologics, including antibodies, for use in a variety of therapies as well as for research and diagnostic applications. Further, research laboratories might need more infrastructure or facilities to carry out large-scale antibody production. In such cases CDMOs offer a cost-effective solution for outsourced manufacturing, avoiding significant capital investments in establishing their own manufacturing capabilities. Thus, collaborating with CDMOs allows them to access manufacturing expertise without incurring excessive costs.

Moreover, CDMOs can conduct toxicology studies to assess the safety of antibodies for use in clinical trials and beyond, which thereby benefits research laboratories from the expertise and capabilities CDMOs offer to accelerate their antibody development efforts and ensure the quality, as well as safety of products.

Regional Insight

North America dominated the market and accounted for the largest revenue share of 34.2% in 2022. North America is one of the major contributors to the global market. It is characterized by the presence of several established biopharmaceutical companies. In addition, stringent regulations regarding the quality of products and manufacturing services are anticipated to create growth opportunities for domestic contract development services in the region. Increased awareness of new therapies in the region, rising healthcare expenditure in the U.S., and a large number of commercially available antibody treatments in the region contribute to the region’s high shares. Moreover, a significant number of clinical research are conducted for antibody treatments in the U.S., which is expected to improve the demand for antibody contract manufacturing services and, thus, boost the regional market. The region also suffers from a high prevalence of cancer, which is creating a major demand for cancer-related research, further promoting market growth.

Asia Pacific is anticipated to register the fastest CAGR of 14.2% during the forecast period. Asia Pacific is one of the most attractive markets for contract development and manufacturing industry owing to the supportive regulatory landscape, especially in countries such as China and India, where the labor cost is comparatively lower than the Western economies. Furthermore, the presence of established market players and cGMP-compliant facilities in the region is also anticipated to attract more investors & fuel the market. In addition, the ease of conducting business in Asia Pacific is high due to relatively lower manufacturing costs, better tax benefits, and availability of skilled labor at lower costs than in developed economies, which supports the growth of CDMO business in Asia Pacific.

Key Companies & Market Share Insights

The major players operating across the market are focused on adopting in-organic strategic initiatives such as mergers, partnerships, acquisitions, etc. Furthermore, several players focus on developing novel therapeutics, boosting the demand for CDMO services across the antibody therapy area. Moreover, several companies are penetrating the antibody contract development & manufacturing organization space via acquisition and partnerships. For instance, in April 2022, Asahi Kasei Medical announced the expansion of its business vertical into the antibody CDMO space with the acquisition of Bionova Scientific LLC, a biologics CDMO service provider. Some prominent players in the global antibody contract development & manufacturing organizationmarket are:

Lonza

Catalent, Inc

Samsung Biologics

WuXi Biologics

AGC Biologics

AbbVie Inc.

Boehringer Ingelheim International GmbH

Charles River Laboratories

FUJIFILM Holdings Corporation

mAbxience

AntibodyContract Development & Manufacturing OrganizationMarket Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 23.37 billion |

Revenue Forecast in 2030 |

USD 58.40 billion |

Growth rate |

CAGR of 14.0% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD Million, and CAGR from 2023 to 2030 |

Report Coverage |

Revenue forecast, company share, competitive landscape, growth factors and trends |

Segments Covered |

Product, source, therapeutic area, end-use, region |

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa, Saudi Arabia; UAE; Kuwait |

Key companies profiled |

Lonza; Catalent, Inc; Samsung Biologics; WuXi Biologics; AGC Biologics; AbbVie Inc.; Boehringer Ingelheim International GmbH; Charles River Laboratories; FUJIFILM Holdings Corporation; mAbxience |

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization |

价格和购买该俱乐部ns |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Antibody CDMO Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global antibody contract development & manufacturing organizationmarket report based on product, source, therapeutic area, end-use, and region:

Product Outlook (Revenue, USD Million, 2018 - 2030)

Monoclonal Antibodies

Polyclonal Antibodies

Others

Source Outlook (Revenue, USD Million, 2018 - 2030)

Mammalian

Microbial

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

Oncology

Neurology

Cardiology

Infectious Diseases

Immune-mediated Disorders

Others

End-use Outlook (Revenue, USD Million, 2018 - 2030)

Biopharmaceutical Companies

Research Laboratories

Others

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Italy

Spain

Denmark

Sweden

Norway

Asia Pacific

Japan

China

India

Australia

South Korea

Thailand

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

UAE

Kuwait

Frequently Asked Questions About This Report

b.The global contract development & manufacturing organization market size was estimated at USD 20.73 billion in 2022 and is expected to reach USD 23.37 billion in 2023.

b.The global contract development & manufacturing organization market is expected to grow at a compound annual growth rate of 14.0% from 2023 to 2030 to reach USD 58.40 billion by 2030.

b.The oncology segment held a market share of 45.5% by therapeutic area in 2022. The growing investment in the research & development activities for cancer-based antibody therapeutics is one of the prominent factors supporting the segment's growth.

b.一些关键球员在市场运营包括Lonza, Catalent, Inc, Samsung Biologics, WuXi Biologics, AGC Biologics, and few others.

b.The increasing burden of cancer, along with the rising demand for novel anti-cancer therapeutics and increasing partnerships among CDMOs and biopharmaceutical companies to develop novel antibodies are a few of the factors supporting the market's growth.