Arteriovenous Fistula Devices Market Size, Share & Trends Analysis Report By Type (AVF Creation Devices, AVF Monitoring Devices, AVF Maintenance Devices), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-099-5

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

The globalarteriovenous fistula devices market sizewas estimated atUSD 312.7 million in 2022and is expected to grow at a compound annual growth rate (CAGR) of 7.6% from 2023 to 2030. The market is expected to experience growth due to several factors, including the increasing prevalence ofEnd-stage Renal Disease(ESRD) and the subsequent rise in the number of patients requiring hemodialysis.The National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) reports that approximately 786,000 individuals in the U.S. are living with ESRD or Ed-stage Kidney Disease (ESKD). Among these, 71% are undergoing dialysis treatment, while the remaining 29% have received kidney transplants.

Arteriovenous fistula (AVF) occur when an artery and a vein directly connect, causing abnormal blood flow. These connections can be surgically created for individuals who require dialysis treatment. AVFs serve as a long-term access point for hemodialysis in people with ESRD. By enabling a higher blood flow rate, AVFs make it easier to perform dialysis and remove waste products from the body.

AVF devices are considered the preferred option for vascular access due to their durability, lower risk of infection, and superior long-term outcomes compared to alternatives like catheters or arteriovenous grafts. These devices are crucial in establishing vascular access for ESRD patients and facilitating efficient and effective hemodialysis treatments. For instance, hemodialysis is the most widely used method of kidney replacement therapy worldwide, accounting for approximately 69% of all kidney replacement therapy and 89% of all dialysis procedures.

In addition, as per the CDC, Chronic Kidney Disease (CKD) is more prevalent among individuals aged 65 years or older, with a rate of 38%. In comparison, the incidence of CKD is lower in people aged 45-64 years (12%) and even lower in those aged 18-44 years (6%). This data indicates that CKD is more commonly found in the aging population, so there is an increased demand for AVF devices. The expanding dialysis patient population, particularly among older individuals, underscores the growing need for efficient and effective vascular access through AVFs.

Furthermore, key players in the AVF device market are actively undertaking strategic initiatives to drive market expansion. For instance, in January 2023, Alucent Biomedical Inc. was dedicated to developing and commercializing innovative AlucentNVS technology for vascular disease treatment. The company announced the commencement of its ACTIVATE AVF study, which aims to evaluate the safety and feasibility of AlucentNVS for Arteriovenous Fistula (AVF) in individuals with ESRD.

The AlucentNVS therapy is specifically designed to expedite and enhance the physiological and functional maturation of AVF devices. If proven effective, this therapy could enable more patients to access regular and life-saving dialysis treatments at an earlier stage and with greater reliability. These technological advancements are crucial in driving market growth by enhancing patient outcomes and reducing complications associated with AVF procedures. As a result, the demand for innovative AVF devices is fueled, creating a positive market trend.

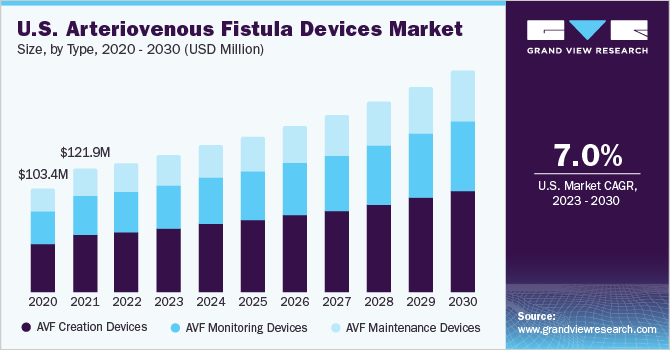

Type Insights

The AVF creation devices segment accounted for the largest revenue share of 46.97% in 2022. The increasing prevalence of ESRD and the growing number of individuals requiring dialysis treatment have created a higher demand for AVF procedures. AVF creation devices are crucial in meeting the growing demand for dialysis treatment by enabling effective vascular access, improving patient care, and enhancing the quality of life.

Key players have introduced advanced products that expedite the AVF procedure, driving the market’s growth. These innovative solutions are carefully designed to simplify and optimize AVF creation, leading to improved success rates and overall industry expansion. For instance, Medtronic's Ellipsys Vascular Access System can increase the number of clinicians performing vascular access procedures. This advancement can enhance patient care by reducing the time required for fistula formation and reducing complications associated with temporarycatheteraccess.

The AVF monitoring device segment is expected to grow significantly over the forecast period. The AVF monitoring devices play a significant role in monitoring and assessing the function and health of arteriovenous fistulas used in hemodialysis. Moreover, as the number of individuals with AVFs continues to rise, effective monitoring devices become crucial to ensure proper functioning and early detection of complications.

Several innovative products have been introduced in the AVF monitoring device segment to meet these demands. This factor is anticipated to drive the growth of the market over the forecast period. For example, the Transonic Hemodialysis Monitor system is a notable product that offers non-invasive blood flow and access to recirculation measurements, providing clinicians with valuable information for optimizing AVF function.

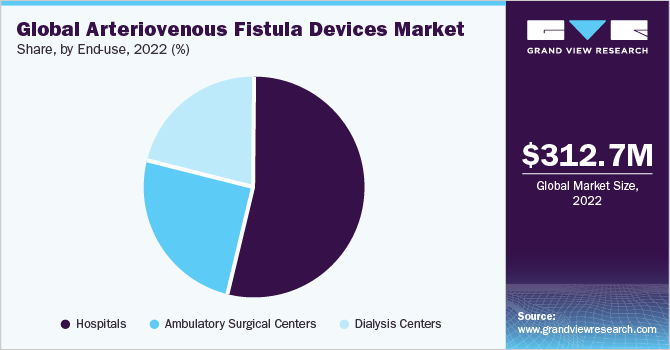

End-use Insights

The hospital's segment accounted for the largest revenue share of 54.20% in 2022. The hospital segment plays a crucial role in driving the growth of the AVF devices market, particularly in the context of hemodialysis treatments. In the U.S., Medicare and most other health plans typically cover three weekly hemodialysis treatments. This coverage ensures that hospitals can perform many hemodialysis procedures, often requiring AVF procedures. The increasing demand for hemodialysis treatments, supported by insurance coverage, leads to a higher hospital need for AVF devices. As a result, the hospital segment is a key driver in fueling the market growth of AVF Devices.

The ambulatory surgical center segment is expected to experience substantial growth over the forecast period. These centers provide outpatient surgical services, including AVF procedures, which offer a convenient and cost-effective alternative to hospitals. The demand for AVF creation and monitoring has risen, and ASCs have emerged as a viable option for performing these procedures. ASCs align with the shift towards value-based healthcare and cost containment, as they deliver high-quality care at a lower cost than hospitals. In addition, advancements in AVF device technologies, such as minimally invasive techniques and improved success rates, have made AVF procedures more feasible in ambulatory surgical centers.

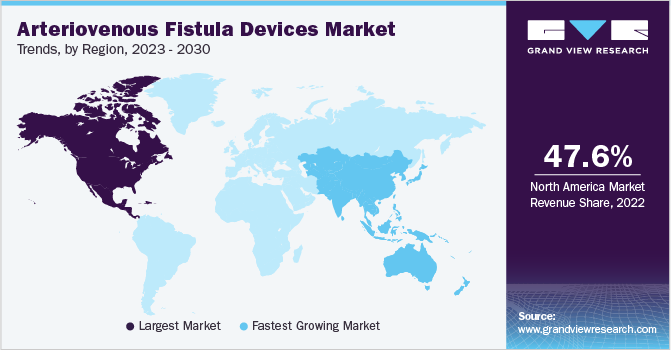

Regional Insights

North America accounted for the largest revenue share of 47.59% in 2022. North America has a significant burden of kidney disease, and AVF devices play a crucial role in providing vascular access for hemodialysis. The rising demand for AVF procedures and the emphasis on improving patient outcomes contribute to the growth of the regional market.

据美国肾脏基金公司,公关evalence of kidney disease is rapidly increasing, posing a concerning trend. For instance, kidney disease affects more than 15% of American adults, which is equivalent to more than one in seven individuals. In total, there are approximately 37 million Americans who are affected by kidney disease. Moreover, the presence of key players and favorable healthcare policies also contribute to the growth of the AVF devices market in North America.

The Asia Pacific region is expected to witness significant growth during the forecast period. This growth is attributed to the increasing prevalence of ESRD and the rising number of individuals requiring hemodialysis treatment. The region has witnessed a significant rise in kidney disease cases, creating a demand for AVF procedures and devices.

In addition, the growing healthcare infrastructure, and investments in advanced medical technologies, including AVF devices, have improved access to these procedures. Moreover, the focus on enhancing patient outcomes and healthcare quality, along with the presence of key market players and research and development activities, further contribute to the growth of the AVF devices market in the region.

Key Companies & Market Share Insights

Key players are introducing advanced products at affordable prices to increase their market share and implementing strategic initiatives, such as acquisitions, mergers, and collaborations, to maximize their market dominance.

For instance, in May 2020, APERTO, a leading medtech company, received regulatory approval for the Chinese market. This achievement is noteworthy as APERTO becomes the first high-pressure Drug-coated Balloon (DCB) in China specifically designed for treating obstructive lesions in native arterio-venous dialysis fistulae. Some prominent players in the global arteriovenous fistula (AVF) devices market include:

Medtronic

BD

Teleflex Incorporated

Fresenius Medical Care AG & Co. KGaA.

B. Braun SE

Polymedicure

NxStage Medical, Inc.

Laminate Medical Technologies

Arteriovenous Fistula Devices Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 333.1 million |

Revenue forecast in 2030 |

USD 556.6 million |

Growth rate |

CAGR of 7.6% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Type, end-use, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

Key companies profiled |

Medtronic, BD; Teleflex Incorporated; Fresenius Medical Care AG & Co. KGaA.; B. Braun SE; Polymedicure; NxStage Medical, Inc.; Laminate Medical Technologies |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

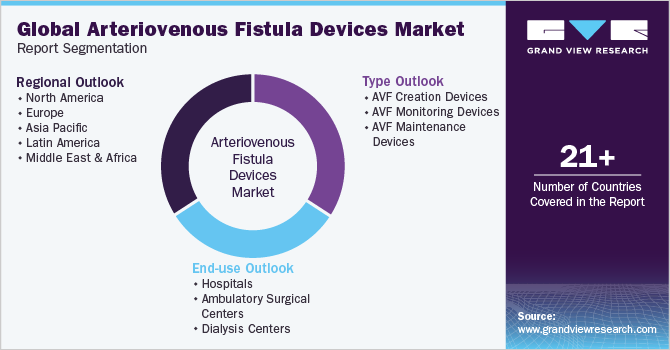

Global Arteriovenous Fistula Devices Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global arteriovenous fistula (AVF) devices market report based on type, end-use, and region:

Type Outlook (Revenue, USD Million, 2018 - 2030)

AVF Creation Devices

Surgical Instruments

Vascular Grafts

Angioplasty Balloons

Others

AVF Monitoring Devices

Doppler Ultrasound

Pressure Monitoring Systems

Others

AVF Maintenance Devices

Central Venous Catheters

Stents

Others

End-use Outlook (Revenue, USD Million, 2018 - 2030)

Hospitals

Ambulatory Surgical Centers

Dialysis Centers

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Italy

Spain

Denmark

Sweden

Norway

亚洲Pacific

Japan

China

India

South Korea

Australia

Thailand

拉丁美洲

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

UAE

Kuwait

Frequently Asked Questions About This Report

b.The global arteriovenous (AV) fistulas devices market size was estimated at USD 312.7 million in 2022 and is expected to reach USD 333.1 million in 2023.

b.The global arteriovenous fistula devices market is expected to grow at a compound annual growth rate of 7.6% from 2023 to 2030 to reach USD 556.6 million by 2030.

b.2022年,北美的主要份额47.59%. in the AV fistulas devices market. This significant market share is primarily attributed to the increasing prevalence of end-stage renal disease (ESRD) in the region has led to a higher demand for dialysis treatment, creating a need for effective AVF devices.

b.Some key players operating in the arteriovenous fistula devices market include Medtronic, BD, Teleflex Incorporated, Fresenius Medical Care AG & Co. KGaA., B. Braun SE, Polymedicure, NxStage Medical, Inc., Laminate Medical Technologies,

b.The market for arteriovenous fistula devices is driven by several factors, including the rising prevalence of end-stage renal disease (ESRD) necessitating hemodialysis, where AVFs are created to provide reliable vascular access for dialysis treatments. In addition, advancements in minimally invasive procedures, such as endovascular techniques and embolization, have fueled the demand for AVF devices.