Asia Health Check-Ups Market Size, Share & Trends Analysis Report By Type (General Health, Preventive Health) By Test Type, By Application, By Service Provider, By End-use, By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-080-5

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

TheAsia health check-ups market sizewas valued atUSD 12.73 billion in 2022,预计年复合增长的恶性肿瘤h rate (CAGR) of 6.1% from 2023 to 2030. The market growth is attributable to the increasing prevalence of chronic diseases, growing investments from government and private organizations to detect diseases at early stages, and the adoption of digital technologies across various healthcare platforms. For instance, in March 2021, DoctorOnCall, a leading Malaysia digital healthcare platform, partnered with two key insurance companies to increase access to digital healthcare. Moreover, restrictions due to the COVID-19 pandemic have increased the adoption oftelemedicine, which fueled the demand for home-based testing and sample collection services across the region.

The increasing prevalence of life-threatening diseases is one of the key drivers for the Asia health check-up market in Asia. Most countries in Asia are facing a growing burden of non-communicable diseases such as diabetes, hypertension, and cardiovascular diseases, which are often asymptomatic in their early stages. For instance, in September 2022, WHO stated that nearly two-thirds of deaths in the South-East Asian region are attributed to cardiovascular diseases, cancer, diabetes, and other diseases. Hence, healthcare professionals recommend people to periodically use various health check-up tests to mitigate premature deaths and chronic conditions.

Government and private organizations in many countries are investing in population screening programs to detect diseases at an early stage and provide appropriate treatment. As a result, people are becoming aware of the importance of regular health check-ups, increasing market growth. For instance, in May 2023, Vietnam Social Security (VSS) stated that nearly 91.1 million people residing in Vietnam were covered by health insurance in 2022, which was 2.2 million higher than in 2021 participation. In addition, the government is continuing to take steps towards achieving universal healthcare coverage and encouraging participation in medical insurance programs.

The Asia health check up market is experiencing innovation driven by the adoption of digital technology, favorable government initiatives. For instance, in August 2022, the Health Ministry of Indonesia launched the SatuSehat platform in Jakarta, representing a significant step toward the country's medical technology transformation efforts. The platform aims to facilitate the implementation of various healthcare systems' transformation pillars, including the transformation of primary & referral services, medical financing systems, and human resources in the medical sector.

Type Insights

The general health check-up segment held the largest market share of 36.69% in 2022. A general check-up is a preventive medical service that helps people identify critical medical issues before they become serious. It comprises of various tests covering different aspects, such as general, metabolic, and cardiovascular health. In addition, the rising geriatric population and growing need for elderly screening are further supporting segment expansion. For instance, according to the International Trade Organization, by 2030, one in four individuals in Singapore will be over the age of 65 years.

The specialized health check-ups segment is expected to show the fastest growth rate during the forecast period. A specialized health check-up is a medical examination that mainly emphasizes a particular aspect of an individual's wellness. Supportive government legislation and public and private organizations' promotional activities are supporting segment growth. For instance, the Government of Malaysia provides free medical screening for Malaysians aged 40 years and above. In addition, Apollo Hospitals Enterprise Ltd offers tailored, personalized medical checkup packages in accordance with factors such as fitness, body type, and lifestyle in India.

Test Type Insights

The blood glucose test segment held the largest market share of 22.28% in the Asia health check-up market in 2022, which can be attributed to the increasing patient base of diabetes in the region. These tests are commonly used to diagnose and monitor diabetes & hyperglycemia. Moreover, these tests are used to screen for prediabetes, a condition in which the blood sugar is higher than normal but not yet high enough to be classified as diabetes. For instance, according to the article published in Elsevier B.V. in March 2022, an estimated 160 million Asians will have prediabetes by 2045. Due to the exponential growth in the diabetic population, the segment is anticipated to offer lucrative opportunities to the Asia health check-up industry players.

The tumor biomarkers segment of the market is expected to show the fastest growth rate during the forecast period. Tumor markers can be detected in urine, blood, and other bodily fluids to detect malignancies. In addition, these tests are used to assess the prognosis of cancer, track the effectiveness of cancer treatment, and spot cancer recurrence. For instance, as per Elsevier B.V. article published in February 2022, from 2015 to 2030, newer cancer cases are projected to increase by 46% from 2.2 million to 3.2 million in the Chinese adult population.

Application Insights

心血管疾病领域中最大举行t market share of 28.72% in 2022, which can be attributed to increasing disease prevalence, high mortality rates, and advancements in testing products. Smoking, alcohol abuse, decreased physical activity, unhealthy diet, and high blood pressure are anticipated to increase the burden of cardiovascular diseases in Asia. In addition, the presence of co-morbidities such as diabetes and neurological disorders worsens cardiac disorders. According to the Singapore Heart Foundation, 21 people die due to cardiovascular diseases (CVDs) in Singapore every day, and CVDs accounted for 32% of all deaths in 2021. Hence, the growing number of deaths due to CVDs is expected to increase the segment share.

Cancer segment is expected to grow at the fastest growth rate during the forecast period. The increasing prevalence rate of cancer in Asia and the inclusion ofcancer biomarkerstests in health check-up tests are major factors driving the segment growth. Many government and non-government organizations have launched cancer screening programs and regular medical check-ups to detect cancer in its early stages and understand its associated risk factors. For instance, the Health Promotion Board (HPB) and MOH of Singapore encourage people in Singapore to undergo regular medical screening and follow-up.

Service Provider Insights

Hospital-based laboratories dominated the market with a share of 58.85% in 2022. It is attributed to a large number of patient tests performed, majorly for complex and severe disease conditions that are comparatively more cost intensive. The segment is expected to maintain its dominance owing to the increasing number of hospitals integrating laboratories into their premises. Additionally, strategic partnerships of hospitals with leading medical device manufacturers provide the opportunity for hospital-based laboratories to grow. For instance, in August 2020, Singapore General Hospitals (SGH) and Philips established a digital and computational pathology center of excellence. SGH developed a fully digitized histopathology laboratory by growing the utilization of Philips IntellSite Pathology Solution, allowing the hospital to save nearly 12,000 hours annually.

Standalone laboratories segment is expected to show the fastest growth rate during the forecast period. It is owing to rising efforts to improve patient outcomes by offering diagnostic facilities at a retail level. Moreover, the ability of standalone labs to handle large volumes of diagnostic tests, health check-up service expansion, and better test results at comparatively cheaper prices is projected to propel the segment growth over the forecast period.

End-use Insights

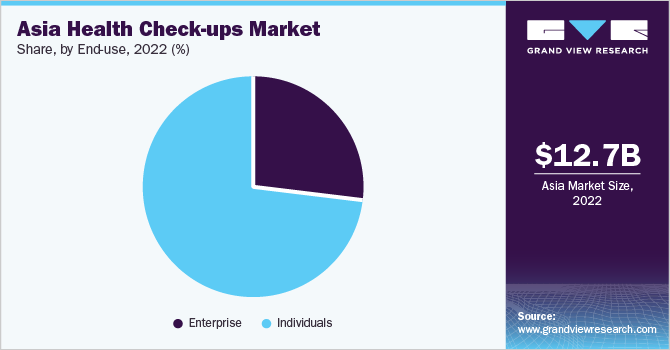

The individuals segment held the largest market share of 73.35% in 2022, it can be attributed to increasing awareness about general health check-ups among people, increasing offers related to health check-ups from market players, and government initiatives to promote routine testing services. These services typically target people interested in proactively managing their fitness and wellness. A few of the medical check-ups may be customized to specific age groups, such as young adults, middle-aged adults, or seniors. For instance, Tata 1MG provides health check-up tests in India based on disease relevance, age, elderly care, and others.

Enterprise segment of the market is expected to grow at the fastest growth rate during the forecast period. Enterprise health check-ups involve a series of evaluations and assessments arranged by companies or employers to evaluate the well-being of their employees. Moreover, supportive government legislation to promote health screening is supporting segment expansion. For instance, in September 2022, Malaysia’s MOH proposed that employers give an extra day’s leave to their staff for regular health screening.

Country Insights

China held the largest market share of Asia health check up market of 28.51% in 2022. It is attributed to a growing number of cardiovascular diseases, a dominant geriatric population, and an exponential increase in the adoption of health check-up tests. According to the National Library of Medicine report published in July 2022, nearly 330 million patients living in China suffer from cardiovascular disease. In addition, as per the United Nations report in 2021, nearly 366 million population in China is estimated to be above the age of 65 by 2050. These factors will allow the country to maintain its dominant position throughout the forecast period.

Indonesia is estimated to show the fastest growth over the forecast period. The growth of the market in the country is due to the increasing government initiatives to improve the healthcare ecosystem, growing foreign direct investments (FDI), and increasing incidence of non-communicable diseases. For instance, in May 2023, IFC and the Ministry of Health (MoH) Indonesia collaborated to launch the Indonesia Health Sector Growth Program. It aims to support the growth of the private healthcare industry and simultaneously attract FDI in the region. Due to the following collaborations and reforms, the country is anticipated to provide lucrative growth opportunities to the players in the health check-up industry.

Key Companies & Market Share Insights

The key players operating in the market are constantly focusing on introducing and changing existing technologies that enhance patient outcomes and significantly increase the effectiveness and efficiency of laboratory testing services. For Instance, in February 2023, Quest Diagnostics Incorporated entered into an agreement with Cleveland Diagnostics to increase patient access to the existing IsoPSA prostate cancer testing test. The agreement is anticipated to enhance the reach of the cancer test across 2,100 centers. Some prominent players in the Asia health check-ups market include:

Eurofins Scientific

SYNLAB International GmbH

联合国ILABS

OPKO Health, Inc. (BioReference Health, LLC.)

Sonic Healthcare Limited

ARUP Laboratories

Q2 Solutions

Laboratory Corporation of America Holdings

LalPathLabs.com.

Quest Diagnostics Incorporated

Asia Health Check-Ups Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 13.51 billion |

Revenue forecast in 2030 |

USD 20.47 billion |

Growth rate |

CAGR of 6.1% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/ billion, and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

Segments covered |

Type, test type, application, service provider, end-use, country |

Country scope |

Japan; China; India; South Korea; Thailand; Singapore; Indonesia; Malaysia; Vietnam |

Key companies profiled |

欧陆坊科学;SYNLAB国际GmbH是一家;联合国ILABS; OPKO Health, Inc. (BioReference Health; LLC.); Sonic Healthcare Limited; ARUP Laboratories; Q2 Solutions; Laboratory Corporation of America Holdings; LalPathLabs.com.; Quest Diagnostics Incorporated |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Asia Health Check-Ups Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the Asia health check-ups market report based on type, test type, application, service provider, end-use, and country:

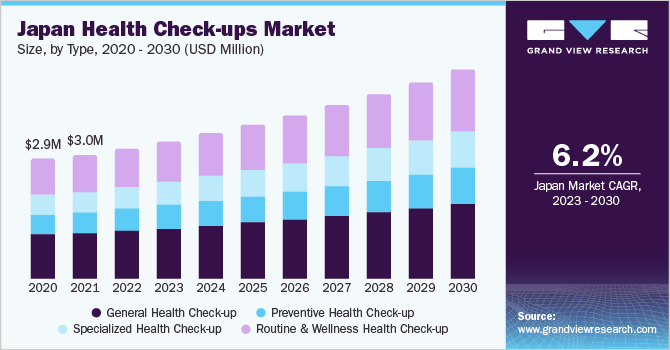

Type Outlook (Revenue, USD Million, 2018 - 2030)

General Health Check-up

Preventive Health Check-up

专业体检

Routine and Wellness Health Check-up

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

Blood Glucose Test

Kidney Function Test

Bone Profile Test

Electrolyte Test

Liver Function Test

Lipid Profile Test

Special Biochemistry

Cardiac Biomarkers

Hormones & Vitamins

Tumor Markers

Others

Application Outlook (Revenue, USD Million, 2018 - 2030)

Cardiovascular Diseases

Metabolic Disorders

Cancer

Inflammatory Conditions

Musculoskeletal Disorders

Neurological Conditions

Others

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

Hospital-Based Laboratories

Central Laboratories

Standalone Laboratories

End-use Outlook (Revenue, USD Million, 2018 - 2030)

Enterprise

Individuals

Country Outlook (Revenue, USD Million, 2018 - 2030)

Japan

China

India

South Korea

Thailand

新加坡

Indonesia

Malaysia

Vietnam

Frequently Asked Questions About This Report

b.The global Asia health check-up market size was estimated at USD 12.73 billion in 2022 and is expected to reach USD 13.51 billion in 2023.

b.The global Asia health check-up market is expected to grow at a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 20.47 billion by 2030 .

b.Cardiovascular diseases segment dominated the Asia health check-up market with a share of 28.72% in 2022. This is attributable to increasing disease prevalence, high mortality rates, and advancements in testing products.

b.Some key players operating in the Asia health check-up market include Eurofins Scientific, SYNLAB International GmbH, UNILABS, OPKO Health, Inc. (BioReference Health, LLC.) , Sonic Healthcare Limited, ARUP Laboratories, Q2 Solutions , Laboratory Corporation of America Holdings, LalPathLabs.com., Quest Diagnostics Incorporated

b.Key factors that are driving the Asia health check-up market growth include the increasing prevalence of chronic diseases, growing investments from government and private organizations to detect diseases at early stages, and the adoption of digital technologies across various healthcare platforms.