Asia Pacific Cloud Computing Market Size, Share & Trends Analysis Report By Service (SaaS, IaaS, PaaS), By Deployment (Public, Private, Hybrid), By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-095-9

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Technology

Report Overview

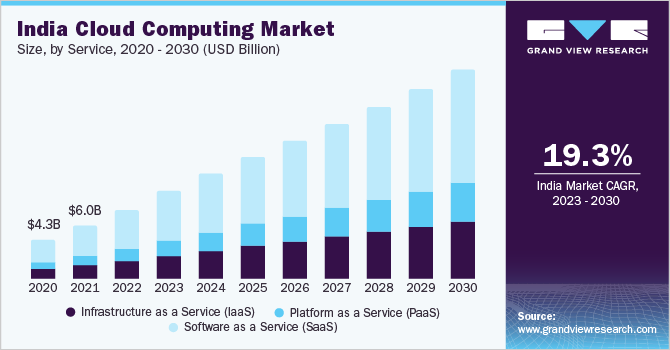

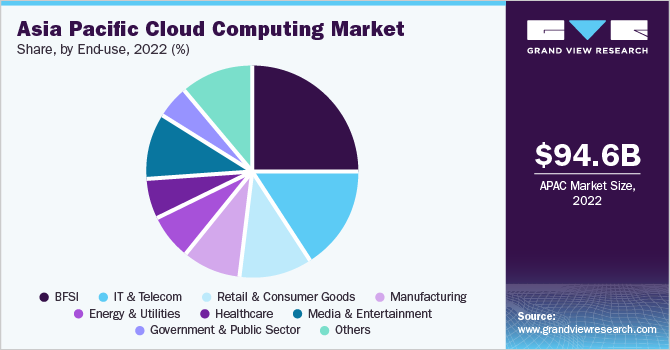

TheAsia Pacific cloud computing market sizewas estimated atUSD 94.55 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 16.6% from 2023 to 2030. The market is anticipated to grow due to various factors such as the adaptability and data security ofcloud computingand the growing demand for hybrid cloud computing among enterprises across the region, pay-as-you-go business models, and omni-cloud systems. In addition, most organizations have quickly adopted a digital-centric mode of operation to adapt to new ways of conducting business, working, and selling goods.

In Southeast Asia, cloud computing adoption is accelerating across various industry segments such as IT and Telecom, manufacturing, and BFSI. Thus, cloud providers such as Amazon Web Services, Google Cloud, and Microsoft Azure are investing in the APAC region. For instance, in March 2023, Amazon Web Services spent USD 6 billion in Malaysia to develop cloud data centers. Amazon Web Services’ total investment in Southeast Asian countries, such as Indonesia, Singapore, and Thailand, is USD 22.5 billion. Moreover, Alibaba Group Holding Limited, Microsoft Corporation, IBM Corporation, Tencent, Google LLC, and Oracle Corporation have collectively invested USD 6 billion in Malaysia to develop data centers. Furthermore, in 2021, Microsoft Corporation announced an investment of USD 1 billion over the next five years in Malaysia.

新加坡政府是引入的进步d digital platforms to increase the efficiency of financial planning and protection of personal financial information. For instance, in December 2020, the Smart Nation and Digital Government Group (SNDGG) and the Monetary Authority of Singapore (MAS) launched the Singapore Financial Data Exchange (SGFinDex), a platform designed to help Singaporeans plan their finances more effectively. Using a national digital identity and a centrally managed online consent system, it is the first public digital infrastructure in the world to provide citizens access to their financial information stored across numerous government departments and financial organizations. Singapore's leading banks, government agencies, and the Singapore Exchange Group (SGX Group) were among the original participants in SGFinDex.

Businesses outsource their business functions to cloud providers to improve efficiency. Outsourcing also provides various benefits such as lower cost, scalability, and better performance. However, there are also some risks involved in outsourcing from cloud providers. These risks involve security and confidentiality issues. Clouds are more prone to attacks as they are designed for many users, indicating many access points. As more users and devices access the cloud, the risk of fraudsters accessing the cloud infrastructure increases.

Service Insights

TheSoftware as a Service(SaaS) segment accounted for the largest market share of over 55% in 2022. SaaS eliminates the need for companies to set up and manage software on their own computers or data centers. Therefore, software license, installation, and support, as well as purchase, provisioning, and maintenance of hardware are no longer required. As business requirements evolve continuously, SaaS strives to maintain cost and functionality. Moreover, the emergence of strong local players, the proliferation of various SaaS applications, and the increase in SaaS customers across various industries are also fueling the segment’s growth. In addition, Asia Pacific countries are still developing. The primary concern is always cost-effectiveness. Vendors of SaaS solutions offer solutions with lower operational costs, driving the market growth of the segment.

The IaaS segment is anticipated to register the fastest CAGR over the forecast period. IaaS reduces the upfront investment costs as the requirement for physical data centers with continuous service and maintenance expenses no longer remains. Moreover, the emerging digitalization trends, such asArtificial Intelligence、机器学习、物联网、Kubernetes, and Multi and Hybrid cloud solutions, in the cloud infrastructure, are expected to drive the market in this segment. Furthermore, the rising demand for low-cost IT infrastructure and high-speed data connectivity across end-use industries such as IT & telecom, healthcare, retail & consumer goods, and BFSI, among others is anticipated to drive the demand for the IaaS segment.

For instance, in February 2023, Capgemini reported that telecom companies across the APAC region are expected to invest approximately USD 200 million a year on average in cloud transformation in the next five years. According to the report, technology infrastructure is expected to constitute one-third of cloud investments in the telecom industry which will include making networks more automated throughmachine learning(ML) and artificial intelligence (AI).

Deployment Insights

The private cloud deployment segment accounted for the highest market share of over 42% in 2022. Bring Your Own IP is one of the current trends found in the APAC region. For instance, in May 2023, Amazon Web Services made available Virtual Private Cloud, which supports Bring Your Own IP (Internet Protocol) in the India Region. BYOIP allows users to advertise IPv4 and IPv6 addresses on the internet using their own IPv4 and IPv6 addresses. Additionally, through AWS Direct Connect, users can access their on-premises networks via BYOIPv6. BYOIP is also available in various APAC regions such as Hong Kong, Sydney, Tokyo, and Singapore.

Hybrid cloud deployment is anticipated to register the highest CAGR over the forecast period. A hybrid implementation paradigm is gaining popularity across the public sector, BFSI, and IT & Telecom industries. Moreover, banks are usingcloud-based mobile applicationsfor customers which enable them to receive and repay loans, make budgetary and utility payments, deposit, and access international bank cards for real-time online transactions. As of January 2022, Uzbekistan had over 20 million users of remote banking services, including over 900,000 businesses. For instance, in February 2021, Malaysia Investment Development Authority (MIDA) reported that 97 percent of its organizations considered hybrid cloud as the ideal cloud service. Thus, developing countries across APAC are increasingly opting for hybrid cloud, which is expected to drive the demand for the segment.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share of over 50% in 2022. Cloud computing services are in high demand due to remote working adopted by businesses in the Asia Pacific. Moreover, the need for cloud computing services will grow as market players expand their business by offering new products in the Asia Pacific region, thereby it is anticipated to drive the segment's growth. For instance, in October 2021, Alibaba DAMO Academy, Alibaba Group's global research project, revealed a cloud-based AI-powered nowcasting platform that anticipated short-term weather patterns.

In China, the clients of Alibaba Cloud accessed the short-term AI weather forecasting platform, which provided high-resolution imagery with 1-km grid spacing and updates every ten minutes. The platform also monitored wind speed, rainfall, and extreme weather occurrences such as thunder and hailstorms. It provides significant value to weather-dependent industries such as agriculture, transportation, logistics, andrenewable energy.

Small and medium-sized enterprises (SMEs) are expected to register the fastest CAGR during the forecast period. This can be attributed to the increasing number of SMEs in developing nations such as China and India. For instance, according to a report published by Asia Pacific Economic Corporation in April 2023, SMEs constitute over 97% of businesses in APEC economies. To optimize workflows and save operational costs, SMEs are adopting cloud services.

End-use Insights

The BFSI segment accounted for the highest market share of over 20% in 2022.Increasing online banking activity has led money lenders to embrace the digital revolution, and cloud computing has played an important role in this development. Life insurance companies are adoptingdigital transformationto streamline their processes, automate operations, and offer digital services to their customers.

In May 2022, Grab Financial Group (GFG) launched GrabFin, a new platform for wealth management, lending, and digital payments. GrabFin provides simple, open, and flexible financial services to users of the Grab Financial group platform. Moreover, personalization in life insurance policies is a major trend in APAC life insurance. For instance, in August 2021, AIA Group Limited, a Hong Kong-based insurance and finance corporation, introduced the AIA Connect application to assist consumers in identifying the protection gap in their current life insurance policies through cloud computing.

The manufacturing sector is anticipated to register the highest CAGR over the forecast period. This growth can be attributed to factors such as real-time visibility and seamless data management. Manufacturers are adopting artificial intelligence, machine learning, big data analytics, and theInternet of Things(IoT) to enhance their operations and minimize downtime.

This is anticipated to drive the demand for cloud computing over the forecast period. For instance, in November 2021, Oracle Corporation introduced a smart manufacturing solution that connected shop floor data with manufacturing, maintenance, and planning systems. The solution also provided actionable insights, which allowed manufacturers to anticipate machine failures, adjust production schedules, and avoid unnecessary downtime.

Key Companies & Market Share Insights

Partnerships, strategic mergers, and acquisitions are projected to be the most efficient ways for companies to increase their technological capabilities and gain speedy access to growing markets. For instance, in March 2023, Cloud Comrade, a consultancy and managed services provider based in Singapore collaborated with Amazon Web Services (AWS) to accelerate customers' cloud transformation in ASEAN for the next three years. This may help Cloud Comrade assist businesses with a seamless and safe migration to AWS with AWS' migration and modernization services, AWS Managed Services (AMS). Therefore, Cloud Comrade will be able to adapt to the changing needs of modern enterprises and help them overcome common obstacles in cloud adoption.

In addition, improvements in product diversification, upgrades, and expansion of services would help businesses succeed in the market. For instance, in October 2022, International Business Machines Corporation introduced IBM Cloud Pak(R) for Network Automation 2.4, a cloud-native platform for disaggregating and automating communication service provider (CSP) networks. Through an open ecosystem, this solution supports the rapid onboarding of cloud-native network functions (CNFs), physical network functions (PNFs), and virtual network functions (VNFs). Some prominent players in the Asia Pacific cloud computing market include:

Alibaba Group Holding Limited

Microsoft Corporation

Amazon.com Inc.

Google LLC (Alphabet Inc.)

Cisco Systems, Inc.

Dell Inc.

Hewlett Packard Enterprise Development LP

International Business Machines Corporation

Oracle Corporation

Salesforce.com Inc.

SAP SE

Workday, Inc.

Asia Pacific Cloud Computing Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 123.89 billion |

Revenue forecast in 2030 |

USD 364.00 billion |

Growth rate |

CAGR of 16.6% from 2023 to 2030 |

The base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Service, deployment, enterprise size, end-use, region |

Country scope |

中国; Japan; India; Australia; South Korea |

Key companies profiled |

Alibaba Group Holding Limited; Microsoft Corporation; Amazon.com Inc.; Google LLC (Alphabet Inc.); Cisco Systems, Inc.; Dell Inc.; Hewlett Packard Enterprise Development LP; International Business Machines Corporation; Oracle Corporation; Salesforce.com Inc.; SAP SE; Workday, Inc. |

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Asia Pacific Cloud Computing Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific cloud computing market report based on service, deployment, enterprise size, end-use, and region:

Service Outlook (Revenue, USD Billion, 2018 - 2030)

Infrastructure as a Service (IaaS)

平台即服务(PaaS)

Software as a Service (SaaS)

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

Public

革命制度党vate

Hybrid

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

Large Enterprises

Small & Medium Enterprises

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

BFSI

IT & Telecom

Retail & Consumer Goods

Manufacturing

Energy & Utilities

Healthcare

Media & Entertainment

Government & Public Sector

Others

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

中国

Japan

India

Australia

South Korea

Frequently Asked Questions About This Report

b.The Asia Pacific cloud computing market size was estimated at USD 94.55 billion in 2022 and is expected to reach USD 123.89 billion in 2023.

b.The Asia Pacific cloud computing market is expected to grow at a compound annual growth rate of 16.6% from 2023 to 2030 to reach USD 364.00 billion by 2030.

b.The large enterprises segment accounted for the largest market share of over 50% in 2022. Cloud computing services are increasingly in high demand due to remote working adopted by businesses in the Asia Pacific.

b.Some key players operating in the Asia Pacific cloud computing market include Alibaba Group Holding Limited; Microsoft Corporation; Amazon.com Inc.; Google LLC (Alphabet Inc.); Cisco Systems, Inc.; Dell Inc.; Hewlett Packard Enterprise Development LP; International Business Machines Corporation; Oracle Corporation; Salesforce.com Inc.; SAP SE; and Workday, Inc.

b.The market is anticipated to grow by various factors, including the cloud's adaptability and data security and the growing demand for hybrid cloud among enterprises across the region, pay-as-you-go business models and omni-cloud systems.