Asia Pacific Multi-cancer Early Detection Market Size, Share & Trends Analysis Report By Type (Liquid Biopsy, Gene Panel, LDT ), By End-use (Hospitals, Diagnostic Laboratories), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-107-6

- Number of Pages: 102

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

TheAsia Pacific multi-cancer early detection market sizewas estimated atUSD 172.68 million in 2022and is expected to grow at a compound annual growth rate (CAGR) of 11.84% from 2023 to 2030. The multi-cancer early detection (MCED) market is witnessing growth due to the increasing healthcare reforms, improving healthcare infrastructure, a growing population, and a rising number of local companies entering the market. Thus, the usage of cancer screening tests has increased in the last few years due to growing government initiatives, such as screening for breast cancer, lung cancer, and cervical cancer for free, as well as increasing collaborations between research institutes, companies, & government, for distribution & supply of these tests.

In Asia Pacific, cancer has drawn more attention as a result of demographic shifts brought on by urbanization, aging populations, and economic expansion. A high prevalence of health risk factors, such as increasing alcohol and cigarette consumption, poor diets, and sedentary lifestyle, are contributing to the increasing prevalence of cancers. This rapidly rising burden of cancer may be beyond the current capacity of healthcare systems in several Asia Pacific countries.

Various established players are expanding into Asia Pacific, which is anticipated to positively impact the growth of the liquid biopsy market. For instance, in June 2022, MGI collaborated with MiRXES to expand the region's access to advanced spatial multi-omics research capabilities. This agreement enables expansion of the companies’ reach. Singapore and Taiwan governments offer funding and favorable regulatory support. However, low affordability, poor infrastructure, and lack of trained professionals are expected to restrain market growth.

Initiatives such as government grants to various research institutes and companies that can develop effective solutions to battle cancer are likely to boost market growth. Various companies have entered into collaborations with private universities to develop and provideliquid biopsytechniques. This includes the Strategic International Collaborative Research Program, a global collaborative research initiative. Through cooperation with a wide range of nations, this initiative aims to offer solutions to current problems facing the world today and to strengthen Japan's scientific and technological capabilities. The alliance aims to accelerate collaboration with pharmaceutical companies for the development of drug treatments for cancer and promote the adoption of liquid biopsy companion diagnostics.

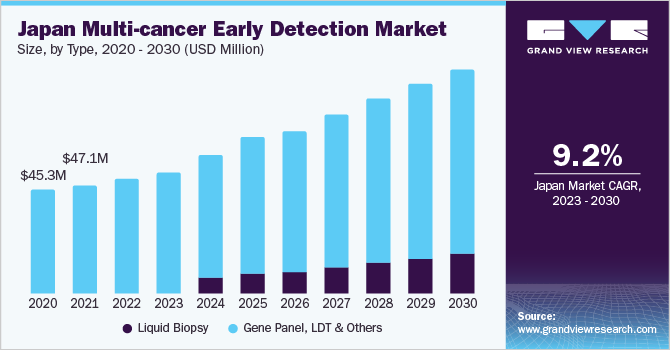

Moreover, the increase in cancer prevalence can be attributed to rapid growth in the geriatric population; Japan has a median age of 44 years, one of the highest in the world. Japan, in contrast to other Asia Pacific countries, offers country-wide cancer screening programs to combat the growing prevalence of cancer. This program offers cancer screening to over 94% of the population in the country. However, stringent policies by regulatory agencies may delay the introduction of newer technologies in the market, which may restrain market growth during the forecast period.

However, the collection of sufficient efficacy and safety data for achieving regulatory approval is expected to hamper market growth. It may be logistically difficult to conduct clinical screening studies, such as RCTs, to produce the necessary proof of the clinical efficacy and validity of MCED screening assays. Validation of cancer-specific mortality benefits across a large variety of cancer types in the intended usage population, appropriate study design, large enrollment numbers (i.e., on the order of tens of thousands of participants), extensive resourcing, and one or more decades of longitudinal follow-up are vital.

Type Insights

The gene panel, LDT, and others segment led the multi-cancer early detection market with the largest share of 100% in 2022. The segment’s dominance is attributed to the rising commercialization of tests. For the simple reason that they are generated and utilized in the same facility, Lab-developed Tests (LDTs) are launched into the market without FDA approval or any other independent regulatory assessment.

For instance, in May 2022, Guardant Health launched Shield, an LDT blood test, for the detection of early signs of colorectal cancer in the adult population aged above 45 years. Moreover, in December 2021, GRAIL finished recruiting participants for PATHFINDER, a prospective, multisite interventional study with 6,600 participants, which was carried out in accordance with a U.S. Food and Drug Administration Investigational Device Exemption application to assess the use of Galleri in clinical practice.

The liquid biopsy segment is expected to showcase the fastest CAGR over the forecast period owing to the expected launch of promising products post-FDA approval, which are currently being made available as LDTs. Liquid biopsy technology is one of the most evolving technologies in diagnostics. An increasing number of players are receiving funding from investors for the development of new tests.

For instance, in July 2022, Delfi Diagnostics, Inc. received funding of USD 225 million for the development of a high-performance and accessible MCED test. The company is working on reducing the cost of the test to make it more accessible to the masses. Liquid biopsy technologies have made remarkable progress in recent years, with a large increase in clinical application uptake.

End-use Insights

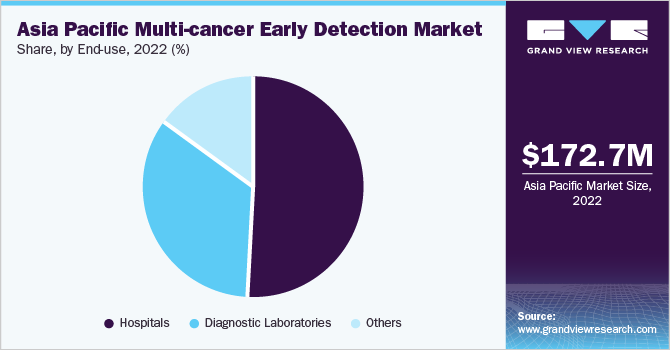

The hospitals segment held the largest revenue share of 50.55% in 2022 and is anticipated to grow at the fastest CAGR over the forecast period. Hospitals are preferred for care due to the availability of various services under one roof. Developments in hospital laboratories are crucial to address the evolving needs of patients, and more hospitals aim to provide a wide range of services within their settings.

For instance, in September 2022, Henry Ford Health was the first medical center to provide Grail’s Galleri MCED test in Michigan to increase cancer detection and improve public health. Moreover, in December 2022, Mercy Hospital in St. Louis announced that it will begin testing for cancer that is still in its development stage with Galleri test, which can be used to detect around 50 different cancers.

The diagnostic laboratories segment is expected to show a significant growth rate over the projected period owing to increased testing and availability of resources for performing tests. There has been an improved reliance of hospitals on diagnostic laboratories for evaluation and testing, which is likely to accelerate segment growth.

Moreover, regulatory authorities are undertaking initiatives to improve clinical laboratory diagnostic services to simplify the diagnosis process. For instance, in January 2021, WHO published the first Essential Diagnostics List, a catalog of tests required to diagnose common diseases. Some of the tests mentioned in this list are especially suitable for primary healthcare facilities where laboratory services are, at times, nonexistent or poorly resourced.

Key Companies & Market Share Insights

The key players operating in the market are involved in discovering, developing, and delivering actionable, early, and personalized diagnoses across the care continuum to enhance patient healthcare and save lives. For Instance, in May 2023, Lucence Health, Inc. announced the launch of its multi-cancer early detection test-LucenceINSIGHT. It can detect 10 cancers in one blood draw based on ctDNA diagnosis technology. The company aims to enhance cancer screening accessibility and efficiency in asymptomatic people. Some prominent players in the Asia Pacific multi-cancer early detection market include:

Grail, LLC (Illumina, Inc.)

Exact Sciences Corporation

AnchorDx

Guardant Health

Burning Rock Biotech Limited

GENECAST

Singlera Genomics Inc.

Laboratory for Advanced Medicine, Inc.

MiRXES Pte Ltd.

Asia Pacific Multi-cancer Early Detection MarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 184.96 million |

Revenue forecast in 2030 |

USD 404.75 million |

Growth rate |

CAGR of 11.84% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in (USD Million) and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

赛格ments covered |

Type, end-use, region |

Regional scope |

Asia Pacific |

有限公司untry scope |

Japan; China; India;Thailand; South Korea; Australia; Singapore; Taiwan; Hong Kong; Rest of APAC |

Key companies profiled |

Grail, LLC (Illumina, Inc.); Exact Sciences Corporation; AnchorDx; Guardant Health; Burning Rock Biotech Limited; GENECAST; Singlera Genomics Inc.; Laboratory for Advanced Medicine, Inc.; MiRXES Pte Ltd. |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Asia Pacific Multi-cancer Early Detection Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific multi-cancer early detection market on type, end-use, and region:

Type Outlook (Revenue, USD Million, 2018 - 2030)

液体活检

Gene Panel, LDT & Others

End-use Outlook (Revenue, USD Million, 2018 - 2030)

Hospitals

Diagnostic Laboratories

Others

Regional Outlook (Revenue, USD Million, 2018 - 2030)

Asia Pacific

Japan

China

India

Thailand

South Korea

Australia

Singapore

Taiwan

Hong Kong

Rest of APAC

Frequently Asked Questions About This Report

b.亚太multi-cancer早期检测et size was estimated at USD 172.68 million in 2022 and is expected to reach USD 184.96 million in 2023.

b.亚太multi-cancer早期检测et is expected to grow at a compound annual growth rate of 11.84% from 2023 to 2030 to reach USD 404.75 billion by 2027.

b.Japan dominated the Asia Pacific multi-cancer early detection market with a share of 28.31% in 2022. This is attributable to high government spending to curb cancer prevalence, high per capita income, and significant demand for novel products.

b.Some key players operating in the Asia Pacific multi-cancer early detection market include Guardant Health, Weigao Group, NuProbe, burning rock biotech limited, Berry Oncology, MiRXES Pte Ltd., Sysmex Inostics, Inc., Exact Sciences Corporation, Illumina, Inc., and Foundation Medicine, Inc.

b.Key drivers driving the Asia Pacific multi-cancer early detection market are the increasing prevalence of cancer, extensive R&D for the development of MCED and need to develop diagnostic options that can detect cancer at an early stage.