Australia Dark Fiber Network Market Size, Share & Trends Analysis Report By Fiber Type (Single Mode, Multi-mode), By Network Type (Metro, Long-haul), By Application (BFSI, Military & Aerospace), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-073-5

- Number of Pages: 115

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Technology

Report Overview

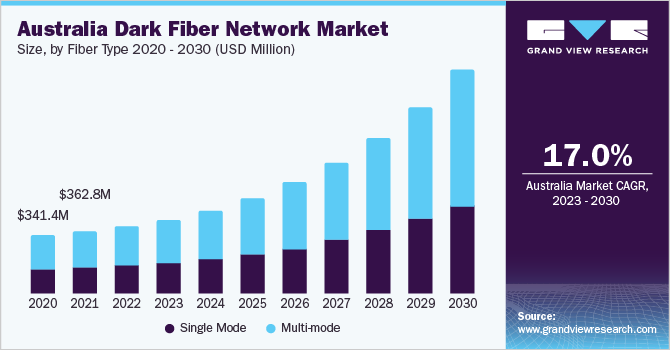

TheAustralia dark fiber network market sizewas valued atUSD 390.9 million in 2022and is expected to grow at a compound annual growth rate (CAGR) of 17.0% from 2023 to 2030. A dark fiber or unlit fiber network is a network of unused optical fiber laid underground. Dark fiber is predominantly used in telecom and network communications, and there are thousands of dark fiber cables across Australia. The growth of the Australian dark fiber network market can be attributed to the benefits of dark fiber networks, such as network speed, autonomy over the network, scalability & flexibility, predictable cost, increasing bandwidth, increased efficiency & performance, and enhanced security.

One of the significant benefitsdark fiber networks提供我ts flexibility. Dark fiber can be subdivided into a multitude of wavelengths, which enables the transmission of multiple data streams along various light wavelengths. This makes dark fiber a flexible and more economical option for businesses because businesses with smaller needs can lease a single wavelength. In contrast, larger companies can opt for leasing entire fiber strands. Businesses can lease dark fiber networks according to their needs and upgrade their network to accommodate their rapidly scaling business needs. With digitization and rapid technological innovations, businesses are growing rapidly, which can lead to insufficient bandwidth for businesses.

Bandwidth being at capacity can prevent businesses from running efficiently and effectively and can slow down their business process. Increasing the bandwidth from internet providers would take more time and can cost more. While if the business has dark fiber, it can instantaneously boost network capacity and speed by making a simple upgrade to the dark fiber powering equipment. The easy scalability that dark fiber networks offer businesses is contributing to themarket share. Traditional commercial internet services are built to stop at many stops and serve multiple businesses. While private dark fiber networks are dedicated to specific businesses, ensuring they are the most direct and, therefore, the most efficient.

This enhances the speed and offers businesses larger control over their networks, ultimately reducing downtimes and driving the demand for dark fiber networks from businesses. Key market players are launching new solutions to fulfill Australia's growing demand for dark fiber networks. For instance, in February 2021, Telstra Corporation Limited announced the launch of Telstra InfraCo's Dark Fiber, with over 250 pre-defined paths in six state capitals connected to 68 metro data centers. Such launches are boosting the market growth.Operational complexities remain a hindrance to industry's growth. First and foremost, although there is a large network of dark fiber throughout Australia, not all cities or towns have dark fiber capabilities.

This makes dark fiber availability an issue for businesses. In addition, building private network infrastructure comes at very high costs for companies, and its regular maintenance and repair can be inconvenient. Especially for businesses that own dark fiber networks, in times of significant or necessary repairs, the price can be exorbitant, and the burden of payment will entirely fall on the business's shoulders. However, key market players are investing heavily to make dark fiber networks more accessible, affordable, and easy to repair, which is anticipated to decline the impact of the above-mentioned challenges over the forecast period.

COVID-19 Impact Analysis

The COVID-19 pandemic had a varied impact on the market. On one hand, the outbreak caused widespread disruptions in the global supply chain, resulting in construction and installation delays for dark fiber networks. In addition, travel restrictions and other pandemic-related disruptions increased prices and had a negative effect on the market. However, the pandemic also brought about a surge in demand for bandwidth, as many people began working and studying from home, and businesses increasingly relied on digital communication tools to stay connected. This increaseddemand put pressure on internet service providers, creating opportunities for dark fiber providers to meet the growing needs of consumers and businesses alike. Looking ahead, the demand for high-speed internet is expected to continue, as the supply chain disruptions that occurred during the pandemic have declined, creating significant growth opportunities for the market.

Fiber Type Insights

The multi-mode segment dominated the market in 2022 and accounted for a revenue share of more than 57.0%. Multi-mode dark fibers are frequently utilized for applications that entail shorter distances, such as data center interconnections, Local Area Networks (LANs), and campus networks. The upsurge in adopting cloud computing, big data analytics, andInternet of Things(IoT) technologies, which necessitate high-speed data communication and real-time processing capabilities, is projected to drive the demand for multi-mode dark fibers. Furthermore, implementing government initiatives to offer high-speed internet connectivity to homes and businesses across the country is expected to boost the segment growth.

The single-mode segment is anticipated to register significant growth over the forecast period. The segment's growth can be attributed to the increasing demand for single-mode dark fibers for high-speed, long-range data communications, which is indispensable for numerous applications, such as telecommunications, data centers, and cloud computing. Moreover, various establishments' anticipated proliferation of investments in dark fiber networks is projected to bolster the development of both single-mode and multi-mode segments.

Network Type Insights

The metro segment dominated the market in 2022 and accounted for a revenue share of more than 56.0%. The segment's growth can be attributed to businesses and organizations' growing demand for dark fibers in metropolitan areas. Australian organizations increasingly adopt dark fiber to enhance their operations and promote innovation within their businesses. Furthermore, the continued growth of digital technologies is expected to drive the demand for metro dark fiber networks over the forecast period. In September 2020, 5G Networks Pty. Ltd., a telecommunications carrier, announced the launch of a dark fiber offering on top of its existing metro fiber networks. Such initiatives by key telecom operators in Australia are anticipated to further propel the market growth over the forecast period.

The long-haul segment is anticipated to register the fastest growth over the forecast period. With the growing popularity of cloud-based services and other data-intensive applications, the need for high-capacity long-haul dark fiber networks is becoming increasingly critical. In addition, telecom companies in Australia are entering into strategic partnerships to develop long-distance fiber networks. For instance, in August 2022, Telstra InfraCo, an Australian telecom company, announced that it had partnered with Fulton Hogan, a New Zealand-based infrastructure construction company, and Ventia Services Group, an essential services provider in Australia and New Zealand. This partnership aims to design and construct fiber optic routes in South Australia. Such initiatives are anticipated to propel the long-haul segment's growth over the forecast period.

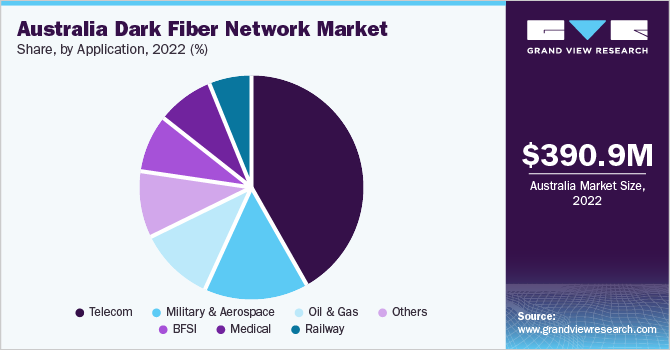

Application Insights

2022年电信部门主导市场nd accounted for a revenue share of over 41.0%. Telecom operators increasingly use dark fibers to expand and improve their network infrastructure. With the growing demand for high-speed connectivity, telecom operators are investing in building and expanding their dark fiber networks to provide their customers with faster and more reliable services. Dark fibers offer telecom operators greater control over their network infrastructure and ensure customers have more dedicated and secure connectivity. The use of dark fibers enables telecom operators to offer faster, more secure, and more reliable network connectivity to their customers, driving the adoption of dark fiber networks in the telecom segment.

The BFSI segment is anticipated to register significant growth over the forecast period. The BFSI sector deals with sensitive information and confidential financial data regularly. This makes the BFSI industry vulnerable to information theft, third-party intrusions, and cyberattacks. Considering the need for sophisticated and security-driven networking infrastructure, the BFSI industry is adopting dark fiber networks. Dark fiber networks can offer more reliable, secure networking infrastructure and greater control over their network. In addition, the demand for dark fiber in the BFSI sector is influenced by various factors, such as the growth of the financial industry and increasing data storage and transmission needs, driving the segment’s growth over the forecast period.

Key Companies & Market Share Insights

The Australian dark fiber network market can be described as a consolidated market. The rapid digitization of businesses across industries creates significant demand for robust network infrastructure and high-speed network connectivity. The vendors operating in the Australian dark fiber network market are leveraging this opportunity and are engaging in strategic initiatives such as mergers & acquisitions, partnerships, geographical expansions, and product launches to cater to the increasing demand in the market.Key vendors in the market are engaging in strategic partnerships and acquisitions.

For instance, in April 2023, a conglomerate led by funds managed by Australian Retirement Trust (ART), a managed client of UBS AssetManagement, and H.R.L. Morrison & Co., announced the completion of the acquisition of a leading fiber infrastructure provider, Fiber Light. Following this acquisition, FiberLight envisages investing in building and expanding its current lit and dark fiber optical networks. The acquisition is anticipated to help FiberLight to expand its dark fiber network. Such initiatives are anticipated to further harness the market growth over the forecast period. Some of the prominent players in the Australia dark fiber network market include:

Telstra Corporation Ltd.

Singtel Optus Pty. Ltd.

Vocus Group

Superloop Ltd.

NexGen Networks

TPG Telecom Ltd.

Opticomm Pty. Ltd.

Swoop Telecommunications Pty. Ltd.

技术服务企业精神。有限公司

Megaport.com

Australia Dark Fiber Network Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 428.3 million |

Revenue forecast in 2030 |

USD 1,285.5 million |

Growth rate |

CAGR of 17.0% from 2023 to 2030 |

Base year of estimation |

2022 |

Historical data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

报告覆盖 |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

Segments covered |

Fiber type, network type, application |

Country scope |

Australia |

Key companies profiled |

Telstra Corp.Ltd.; Singtel Optus Pty. Ltd.; Vocus Group; Superloop Ltd.; NexGen Networks; TPG Telecom Ltd.; Opticomm Pty. Ltd.; Swoop Telecommunications Pty. Ltd.; Spirit Technology Services Pty. Ltd.; Megaport.com |

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Australia Dark Fiber Network MarketReport Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the Australia dark fiber network market based on fiber type, network type, and application:

Fiber Type Outlook (Revenue, USD Million, 2017 - 2030)

Single Mode

Multi-mode

Network Type Outlook (Revenue, USD Million, 2017 - 2030)

Metro

Long-haul

Application Outlook (Revenue, USD Million, 2017 - 2030)

Telecom

Oil & Gas

Military & Aerospace

BFSI

Medical

Railway

Others (manufacturing, energy & utilities, government, media & entertainment)

Frequently Asked Questions About This Report

b.The Australia dark fiber network market size was estimated at USD 390.9 million in 2022 and is expected to reach USD 428.3 million in 2023.

b.The Australia dark fiber network market is expected to grow at a compound annual growth rate of 17.0% from 2023 to 2030 to reach USD 1,285.5 million by 2030.

b.The telecom segment dominated the market in 2022. Dark fibers offer telecom operators greater control over their network infrastructure and ensure customers have more dedicated and secure connectivity. The use of dark fibers enables telecom operators to offer faster, more secure, and more reliable network connectivity to their customers, driving the adoption of dark fiber networks among the telecom segment.

b.Some key players operating in the Australia dark fiber network market include Singtel Optus Pty Limited, Vocus Group, Superloop Limited, TPG Telecom Limited, Swoop Telecommunications Pty Ltd, Megaport Limited, Telstra Corporation Limited, Nexthop Pty Ltd, Ausconnex, and Aussie Broadband Limited.

b.The growth of the Australian dark fiber network market can be attributed to the benefits of dark fiber networks such as network speed, autonomy over the network, scalability & flexibility, predictable cost, increasing bandwidth, increased efficiency & performance, and enhanced security, among others.