Automated Dispensing Machines Market By Application (Outpatient, In-Patient), By End Use (Hospitals, Retail Drug Stores And Pharmacies), By Operation (Centralized Pharmacy, Decentralized Pharmacy), And Segment Forecasts To 2024

- Report ID: GVR-1-68038-181-8

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Data: 2013-2015

- Industry:Healthcare

"Growing awareness regarding benefits of pharmacy automation is one of the main factors expected to boost automated dispensing machines market over the forecast period"

The global automated dispensing machines market was valued at USD 2.9 billion in 2015 and is projected to grow at a lucrative CAGR of over 7% over the forecast period. Growing government initiatives to support healthcare institutes and pharmacists with the deployment of a technologically advanced medication dispensing system to reduce medication errors is expected to boost the usage rate during the forecast period.

According to the American Society of Health System Pharmacists, hospitals spend about 70% to 75% on their pharmacy department. Based on the estimates of the Institutes for Safety Medication Practices, over 20% of the healthcare practitioners reported adverse patient effects due to lack of proper monitoring of supply levels and inventory management. The rising death rate caused by consumption of expired drugs and rapidly growing number of patients are some of the crucial factors increasing the level of complexity in the medication distribution system.

"In-patient accounted for the largest share of automated dispensing machines market in 2015"

In-patient held a majority share of 74.4% of the application segment in 2015. The rapidly growing number of patient admissions raises the burden on pharmacy departments and also increases the chances of poor inventory management, thereby increasing the demand for automated medication dispensing system.

The outpatient segment is expected to grow at a lucrative CAGR of 8.2% due to upsurge in demand for technological advancement and reduction in the overall cost associated with inventory management. Moreover, the growing demand for real-time inventory tracking, automation in medication distribution system, and proper order management are some of the crucial factors indicating the increasing need for automated dispensing machines to minimize excess inventory and satisfy patient requirements. The increasing number of patients for home- and long-term healthcare system is one of the crucial factors anticipated to propel growth in the coming years.

"Retail drug stores and pharmacies are the fastest-growing end-use segment"

Hospitals held a majority share of 56.1% of the end-use segment in 2015. Lack of adequate pharmacy inventory management practices in hospitals is one of the factors indicating the increasing risk of medication errors. A key factor impacting market growth is the lack of pharmacists and technicians. As per the data published by the 2012 FIP Pharmacy Global Work Force Report, the sample mean density for number of pharmacists per 10,000 populations was 6.02. Lack of adequate skilled workforce and high error rate in manual dispensing are key factors driving the adoption of automated dispensing systems in the hospitals.

Retail drug stores and pharmacies are expected to grow at a lucrative CAGR of 7.8%. The increasing demand for retail drug stores and growing government initiatives to support retail drug stores and pharmacies are some of the factors indicating the need for automation to minimize the inventory holding cost and proper disposal of expired medication. Hence, the aforementioned factors are anticipated to propel growth in the coming years.

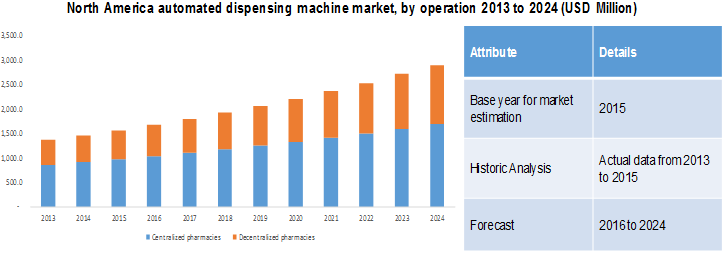

"Centralized pharmacies accounted for the largest share of automated dispensing machines market in 2015"

集中药店举行了63年的多数股权.9% of the operation segment in 2015. Centralized medication dispensing systems include manually operated unit-dose systems and stationary robotic automated systems, which dispense the drug with the help of bar code technology. The growing demand for reducing costs, ensure medication availability, and streamlined resource allocation are the factors driving the market. The decentralized pharmacy is expected to be the fastest-growing segment with a CAGR of 8.5% during the forecast period.

"North America accounted for a share of 53.8% in the industry"

In 2015, North America accounted for the maximum revenue share of 53.8%, which was followed by Europe. The U.S. is the most important sector and captured a majority share of the North American segment. The increase in the prevalence of various chronic disorders among both the pediatric and elderly population is one of the factors indicating the growing number of patients being admitted, which is thereby increasing pressure on the traditional pharmaceutical system. The awareness regarding the presently available, technologically-advanced systems gaining prominence, and lack of low-cost skilled professionals are some of the crucial factors expected to boost the market.

Asia Pacific is expected to emerge as the fastest-growing region with a CAGR of 9.1% over the forecast period. The supportive initiatives by the government and growing incidence of medication errors are expected to drive the growth of the market in the region.

"The automated dispensing machines industry is fragmented with extensive number of players in it, competing to secure a majority of market share"

Some of the key players are Aesynt Incorporated; Becton, Dickinson and Co.; Omnicell, Inc.; Script Pro LLC; Avery Weigh-Tronix, Pearson Medical Technologies, Accu-Chart Plus Healthcare System, Inc.; Baxter; and Capsa Solutions LLC. The key players differentiate themselves in terms of technology, ROI, and services.

自动配料机市场报告范围

Report Attribute |

Details |

Market size value in 2020 |

USD 4.14 billion |

Revenue forecast in 2024 |

USD 5.5 billion |

Growth Rate |

CAGR of 7% from 2016 to 2024 |

Base year for estimation |

2015 |

Historical data |

2013 - 2015 |

Forecast period |

2016 - 2024 |

Quantitative units |

Revenue in USD million and CAGR from 2016 to 2024 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Application, end use, operation, region |

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

Country scope |

U.S.; Canada; Germany; UK; Japan; China; Brazil; Mexico; South Africa |

Key companies profiled |

Aesynt Incorporated; Becton, Dickinson and Co.; Omnicell, Inc.; Script Pro LLC; Avery Weigh-Tronix; Pearson Medical Technologies; Accu-Chart Plus Healthcare System, Inc.; Baxter; Capsa Solutions LLC |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Frequently Asked Questions About This Report

b.The global Automated Dispensing Machines market size was estimated at USD 3.86 billion in 2019 and is expected to reach USD 4.14 billion in 2020.

b.The global Automated Dispensing Machines market is expected to grow at a compound annual growth rate of 7% from 2019 to 2024 to reach USD 5.5 billion by 2024.

b.In-patient segment dominated the Automated Dispensing Machines market with a share of 73.4% in 2019. This is attributable to rapidly growing number of patient admissions which raises the burden on pharmacy departments and also the chances of poor inventory management increases the demand for automated medication dispensing system.

b.Some key players operating in the Automated Dispensing Machines market include Aesynt Incorporated; Becton, Dickinson and Co.; Omnicell, Inc.; Script Pro LLC; Avery Weigh-Tronix, Pearson Medical Technologies, Accu-Chart Plus Healthcare System, Inc.; Baxter; and Capsa Solutions LLC.

b.Key factors that are driving the market growth include growing demand for automated systems, supportive initiatives by the government, increasing demand for technologically advanced medication dispensing systems and growing incidence of medication errors.