Bakeware Market Size, Share & Trends Analysis Report By Product (Molds, Pans & Dishes), By Material (Aluminum, Carbon Steel), By End-user (Commercial, Household), By Region (Europe, Asia Pacific), And Segment Forecasts, 2023 - 2030

- 代表ort ID: GVR-4-68040-144-4

- Number of Pages: 85

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Consumer Goods

Bakeware Market Size & Trends

The globalbakeware market size was estimated at USD 3.72 billion in 2022and is expected to expand at a compound annual growth rate (CAGR) of 5.9% from 2023 to 2030. The market is driven by the increasing consumer interest in home baking and cooking, rising demand for a variety ofbakery productsthat require innovation in bakeware, coupled with rising disposable income levels in emerging economies. In addition, the market is benefiting from advancements in materials and technologies, leading to the development of durable, non-stick, and easy-to-clean bakeware products, thereby driving consumer demand. The global market is experiencing significant growth driven by rising interest in home baking, changing consumer preferences, and product innovations.

Factors contributing to this growth include the popularity of baking as a hobby, influence from cooking shows and social media, and the demand for high-quality, durable, and aesthetically appealing bakeware items. A major opportunity lies in sustainable and eco-friendly bakeware products, with innovations, such as recycled materials and personalized items, gaining traction. Integration of advanced technologies, such as smart bakeware with temperature sensors, is also driving the growth of the market. However, fluctuating raw material prices, especially aluminum andsteel, which are extensively used in bakeware production, impact overall production costs.

Diverse baking needs have led to innovation in raw materials in the market. Lurch AG, a German kitchenware manufacturer, utilizes Vectra liquid-crystalline polymer (LCP) in their bakeware production, offering excellent heat resistance, rigidity, toughness, and compliance with food safety regulations. This material enables versatile usage, transitioning seamlessly from freezer to oven, and promotes efficient baking processes due to faster heat transfer and cooling. Moreover, advanced coatings and alloys, such as the epoxy-free coating systems used by FBS Balke International GmbH & Co. KG, enhance bakeware durability, nonstick properties, and hygiene standards. The demand for such materials is witnessing growth in the market.

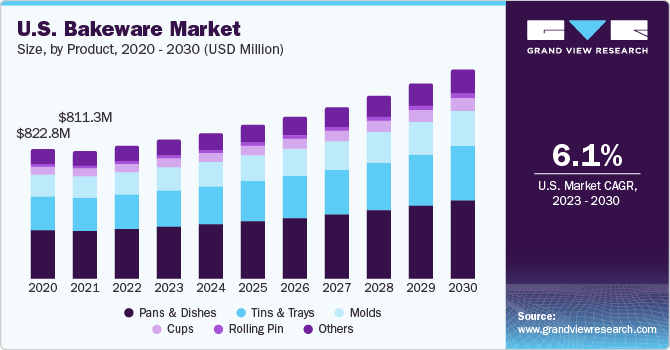

Product Insights

In 2022, the pans & dishes segment contributed to a revenue share of 38.19% and is expected to maintain its lead over the forecast period. This can be attributed to the versatile utility of pans and dishes in various cooking and baking applications. Their widespread use in different culinary traditions and the constant demand for high-quality, durable, and innovative designs contribute significantly to their demand. The availability of a variety of pan sizes and shapes allows bakers to create visually appealing baked goods, especially for special occasions. Moreover, the ongoing innovations in materials, coatings, and ergonomic designs enhance the functionality and appeal of pans and dishes.

随着消费者偏好的发展,适应性nd practicality of pans and dishes continue to drive their market share. The molds segment is anticipated to witness a CAGR of 6.9% during the forecast period. The growing trend of home baking, driven by increased leisure time and culinary experimentation, drives the demand for specialized baking molds, catering to various shapes and sizes. In addition, continuous innovations in baking mold materials, such assiliconeand non-stick coatings, enhance their usability and durability, further appealing to consumers. As baking enthusiasts seek professional-quality results and unique designs, the demand for advanced and diverse baking molds is likely to experience a consistent demand during the forecast period.

Material Insights

In 2022, the aluminum segment accounted for a revenue share of 34.03% due to the high demand for aluminum bakeware on account of its excellent heat conduction properties. It is also a cost-effective material, making bakeware affordable for consumers. Moreover, it is lightweight and can be quickly produced, especially when alloyed with metals like copper or magnesium. However, natural aluminum can react with acidic foods, altering their taste and color. To counter this, manufacturers often line aluminum bakeware with non-stick coatings, anodize it, or clad it withstainless steel, mitigating the metallic taste issue.

The carbon steel segment is projected to witness a CAGR of 6.9% during the forecast period.Carbon steeloffers excellent heat conductivity, ensuring consistent baking results and even heat distribution. In addition, it is durable and resistant to warping, making it a preferred choice for both professional bakers and home bakers. The affordability of carbon steel bakeware compared to other materials, along with its ability to withstand high temperatures, further contributes to its growing popularity. As consumers seek high-quality, durable bakeware at reasonable prices, the demand for carbon steel bakeware continues to rise, driving its revenue growth.

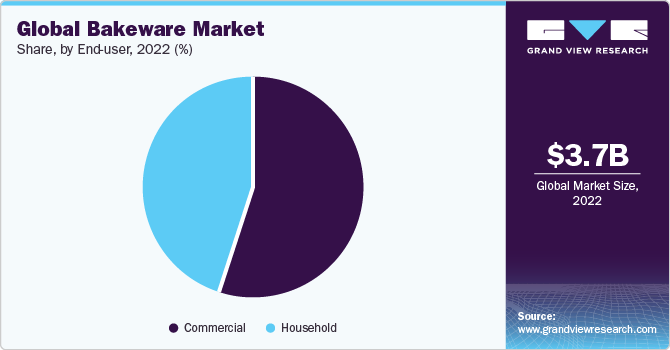

End-user Insights

In 2022, product sales in commercial applications, such as bakeries and food service establishments, accounted for a revenue share of 54.77% in the global market. There is a growing demand for energy-efficient pans aligning with the bakery industry’s sustainability goals. In response to cater to this demand from commercial bakeries, American Pan, one of the leaders in bakeware solutions, launched innovative offerings in 2023, including ePAN Designs for Bread Tins and the SMART Pan Tracking System. The energy-efficient ePAN Designs not only align with industry sustainability goals but also reduce costs, making them attractive to commercial bakeries aiming to enhance efficiency and environmental responsibility. The SMART Pan Tracking System provides valuable real-time insights, enabling bakeries to optimize operations, minimize waste, and boost productivity.

该公司还推出了锅大操作s to address challenges associated with large-scale production in commercial bakeries. The household segment is projected to witness a CAGR of 6.2% during the forecast period. The rising trend of home baking, influenced by social media, cooking shows, and the demand for homemade and healthier options, fuels the demand for a variety of bakeware products. In addition, innovations in materials, such as eco-friendly and non-stick coatings, enhance the appeal of bakeware for home cooks. The convenience of online shopping and the availability of diverse bakeware options further contribute to the steady market growth, as consumers increasingly invest in high-quality kitchen tools for their baking needs.

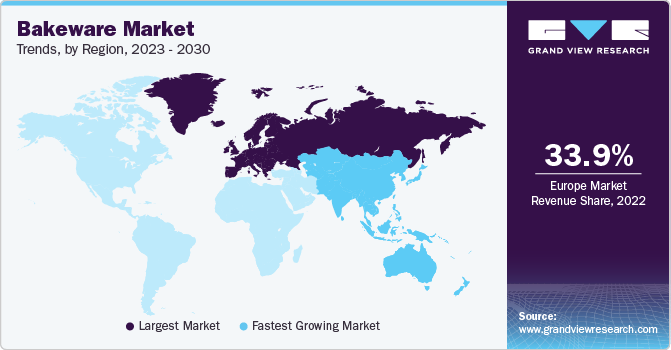

Regional Insights

In 2022, Europe accounted for a substantial 33.85% share of global bakeware sales. This is attributed to the surge in home baking, initially spurred by COVID-19 lockdowns and sustained by evolving consumer preferences. According to the International Houseware Association, there was a considerable rise in baking activities during the pandemic, which led to new companies entering the market, especially in European countries such as Germany, the UK, and France. Extended periods spent at home due to lockdowns and the post-COVID-19 era have resulted in a notable increase in home baking. This trend is driven by individuals experimenting with diverse recipes and techniques, consequently increasing the demand for bakeware products.

Revenue from bakeware in Asia Pacific is expected to witness a CAGR of 7.1% from 2023 to 2030. There is a growing demand for bakeware items such as cake molds, muffin molds, pizza pans, and bread loaf pans in Asian countries, especially post-COVID-19. The rising disposable incomes and growing urbanization rate in many Asian countries are empowering consumers to invest in kitchen products, including bakeware. In addition, the growing influence of Western culinary practices and the popularity of baking as a hobby is driving the demand for bakeware products in the region. Furthermore, the expandinge-commerceindustry and the ease of access to a wide range of bakeware products online are also driving market growth in Asia Pacific.

Key Companies & Market Share Insights

The market is moderately fragmented and characterized by the presence of key established players. Key players, such as Newell Brands Inc., WMF GmbH, and Nordic Ware, focus on diversification and sustainability, driving market competitiveness. Despite challenges, with continuous innovations and a growing global passion for baking, the future of the market appears promising. The global movement toward reducing carbon emissions and adopting eco-friendly practices has led to companies taking a significant step toward environmentally conscious bakeware production.

For instance, in February 2023, Guardini, a European bakeware brand, partnered with ArcelorMittal, Cooper Coated Coil (CCC), and coating manufacturer, ILAG to launch XBake, an eco-friendly bakeware line. Made from ArcelorMittal's XCarb green steel and featuring a PFAS-free non-stick coating, XBake was unveiled at the Ambiente fair in Frankfurt, Germany.

Key Bakeware Companies:

- Groupe SEB

- Wilton Brands LLC

- Newell Brands Inc.

- Fackelmann GmbH + Co. KG

- Nordic War

- USA Pan

- Le Creuset

- International Cookware

- Emile Henry

- Meyer Corporation U.S.

Bakeware Market代表ort Scope

代表ort Attribute |

Details |

Market size value in 2023 |

USD 3.90 billion |

Revenue forecast in 2030 |

USD 5.89 billion |

Growth rate |

CAGR of 5.9% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

代表ort coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, material, end-user, region |

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil; UAE; South Africa |

Key companies profiled |

Groupe SEB; Wilton Brands LLC; Newell Brands Inc.; Fackelmann GmbH+Co. KG; Nordic Ware; USA Pan; Le Creuset; International Cookware; Emile Henry; Meyer Corporation U.S. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

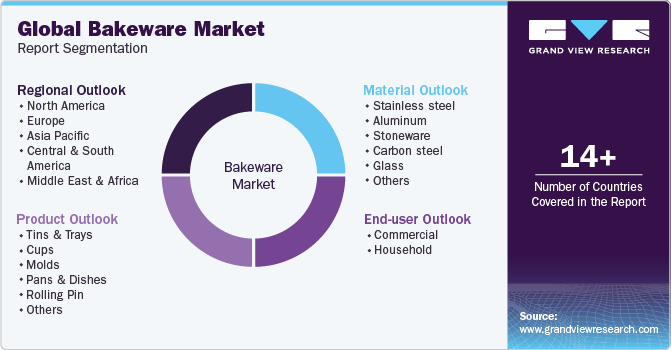

GlobalBakeware Market代表ort Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the bakeware market report on the basis of product, material, end-user, and region:

Product Outlook(Revenue, USD Million, 2017 - 2030)

Tins & Trays

Cups

Molds

Pans & Dishes

Rolling Pin

Others

Material Outlook(Revenue, USD Million, 2017 - 2030)

Stainless steel

Aluminum

Stoneware

Carbon steel

Glass

Others

End-user Outlook(Revenue, USD Million, 2017 - 2030)

Commercial

Household

Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

Asia Pacific

China

Japan

India

Australia & New Zealand

Central & South America

Brazil

Middle East & Africa

UAE

South Africa

Frequently Asked Questions About This Report

b.The global bakeware market was estimated at USD 3.72 billion in 2022 and is expected to reach USD 3.90 billion in 2023.

b.The global bakeware market is expected to grow at a compound annual growth rate of 5.9% from 2023 to 2030 to reach USD 5.89 billion by 2030.

b.Europe dominated the bakeware market with a share of more than 33% in 2022. The growth of the regional market is driven on account of the region's rich baking culture, a large number of commercial bakeries, and demand for a variety of bakery specialties requiring specific bakeware.

b.Some of the key players operating in the bakeware market include Wilton Brands LLC, Fackelmann GmbH + Co. KG, Nordic Ware, Groupe SEB, and Newell Brands Inc.

b.Key factors that are driving the bakeware market growth include a surge in the number of home bakers, growing interest in home baking as a hobby, rapid urbanization, and rising disposable income leading to increased expenditure on kitchen products including bakeware.

We are committed towards customer satisfaction, and quality service.