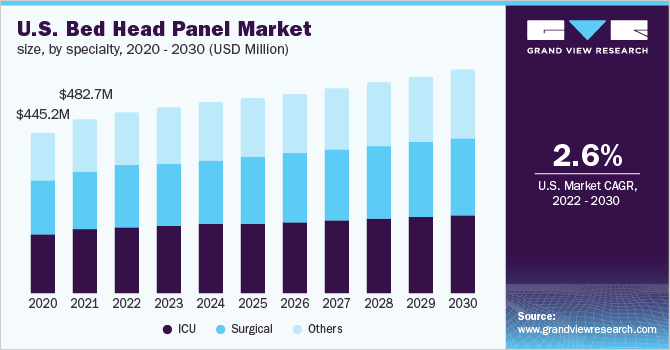

Bed Head Panel Market Size, Share & Trends Analysis Report By Specialty (ICU, Surgical), By End-use (Hospitals, Clinics), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-312-8

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry:Healthcare

Report Overview

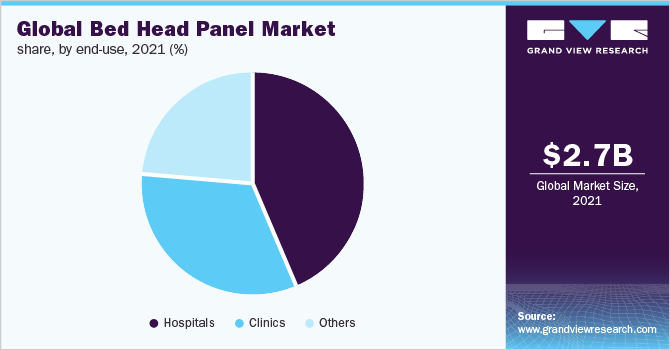

The global bed head panel market size was valued at USD 2.7 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 3.1% from 2022 to 2030. Increasing government initiatives, a rising geriatric population, and a high prevalence of chronic diseases are anticipated to drive the growth of the market during the forecast period. Furthermore, growing research and development activities to develop advanced bed head panel has been the area focus of manufacturers across the globe. This is further expected to lead the market during the forecast period. An increase in hospitalization rates as a result of the COVID -19 pandemic is an additional major factor driving the market.

Due to the significant outbreak of this infectious disease, there has been a global demand for modern healthcare services and infrastructure to treat infected patients that have never been seen before. Therefore, bed head panels, which are an important aspect of healthcare services, are in high demand around the world as a result of an increase in COVID-19 patients. The ongoing pandemic has also resulted in a rise in the number of patients with severe respiratory illnesses. Since then, oxygen levels in people with the COVID-19 have dropped, causing breathing difficulties. As a result, bed head panels with several medical gas plug aid in the delivery of oxygen to persons with respiratory problems. Therefore, the number of patients requiring critical care and advanced healthcare services during pandemics has skyrocketed. This in turn is expected to boost the growth of the market for bed head panels.

Furthermore, major companies are working on providing innovative products and comprehensive services to increase/maintain end-user confidence. For example, Hill-Rom quadrupled its manufacture of critical care products, such as ventilators, hospital beds, and vitals monitoring systems in March 2021 to help fight the COVID-19 pandemic. Such initiatives are anticipated to spur market growth. The prevalence of chronic diseases, such as urological disorders, cancer, cardiovascular disorders, neurovascular diseases, and other chronic problems, is increasing, resulting in a considerable increase in hospital admission rates. Additionally, as a result of high blood pressure, obesity, and smoking, a large percentage of the population is currently in danger of developing chronic diseases. Chronic diseases are responsible for 60% of all fatalities worldwide, according to the World Health Organization (WHO).

Furthermore, every year, 17.9 million people die as a result of cardiovascular disorders worldwide. According to the same source, cancer is the leading cause of death worldwide, accounting for nearly 1 in every 6 deaths. Therefore, increasing hospitalization, coupled with an increase in chronic illnesses, is likely to boost bead head panel installations, resulting in market growth. The need for bed head panels in various healthcare settings is likely to increase with its rising aging population, a demographic that is more susceptible to chronic illnesses such as diabetes and other lifestyle-related disorders. In addition, adults aged 65 and up are more prone to develop diabetes, heart disease, neurological disorders, cancer, and other chronic illnesses, according to the CDC. Patients with such conditions require hospital treatment, both emergency, and non-emergency.

Moreover, according to the World Health Organization, the global population of adults aged 60 and more is expected to exceed 2 billion by 2050. In addition, by 2050, 80% of the world's elderly would live in low- and middle -income countries. As a result, one of the significant impact-rendering factors for bed head panel market expansion is expected to be growing elderly population. To achieve a competitive advantage, manufacturers are creating innovative products. For instance, INMED-Karczewscy, a firm located in Poland, released the latest model of the medical gas alarm panel, during the MEDICA International Trade Fair 2019 in November. It detects irregularities in gas supply and provides an audiovisual warning. It can be hung on the wall or attached to the front of other devices. Over the forecast period, such advancements are expected to promote market growth.

Specialty Insights

ICU段主导市场,举行了largest revenue share of 39.5% in 2021. The increasing number of ICU admissions, owing to an increasing number of accidents, aging population, and increasing prevalence of life-threatening infectious diseases, are all contributing to segment growth. More than 5 million patients are hospitalized in ICUs in the U.S. each year, according to the Society of Critical Care Medicine (SCCM). Furthermore, major companies are working on providing innovative products and comprehensive services to increase/maintain end-user confidence. For instance, in August 2019, Hill-Rom acquired Breathe Technologies, Inc., a manufacturer of medical technologies that offers wearable, noninvasive ventilation technology. The company was expected to expand its product offering by incorporating wearable noninvasive ventilation technology into respiratory care products (part of the Front-Line Care division) as a result of this acquisition.

The others segment is expected to witness the fastest CAGR from 2022 to 2030. The others segment includes operation theatre, children’s wards, light duty day care and ambulatory patient beds and examination / consulting room beds, long-term care and general wards. The segment is expected to grow due to an increase in number of bariatric patients, volume of surgical procedures performed on them, and increased prevalence of preterm newborns. According to the American Society for Metabolic and Bariatric Surgery (ASMBS), 256,000 persons in the U.S. received weight loss surgery in 2019. Typically, such patients require long-term hospitalization, which increases the demand for better treatment due to bed head panels during their stay. This is projected to strengthen the segment growth rate in the coming years.

End-use Insights

The hospitals led the market and accounted for more than 43.75% share of the global revenue in 2021. The increasing rate of hospitalization due to infectious diseases such as COVID-19 and others, the growing number of well-furnished, well-equipped, and advanced infrastructure hospitals, the aging population, and the increasing prevalence of chronic diseases are expected to propel the segment. In addition, as the number of public hospitals that provide cost-effective treatment grows, so will the number of bed head panels that are installed in hospitals. Another major segment driver is a growing customer preference for hospitals that are adequately equipped.

另一段是预期的见证英足总stest growth during the forecast period. Senior homes, emergency care, and nursing institutions are some of the other end-use segments. Emergency care is rapidly growing in popularity in many nations, including the U.S. and Europe. These facilities provide effective patient care while maintaining a safe environment and providing a wide range of services. Similarly, compared to hospitals, emergency care facilities provide various benefits to patients, including faster procedure times and same-day discharge. These types of services can perform more than half of all outpatient procedures, including brain injuries, strokes, and other conditions. As these facilities are less expensive than hospitals, patients can benefit from significant cost reductions. Other segments have been quickly increasing as a result of these factors.

Regional Insights

Europe dominated the market for and accounted for the largest revenue share of 37.8% in 2021. Europe is one of the most developed regions globally, with advanced technologies and well-established infrastructure. Market growth in this region can be attributed to increase in number of road accidents and surgical procedures, presence of various key players, and introduction of technologically advanced products. According to the EU’s Annual Accident Report 2021 published by the European Road Safety Observatory, an estimated 18,800 people died in road accidents the previous year, a 17% decrease from the previous year. This means that in 2021, over 4,000 fewer people died on EU roads than in 2019.

Rapid technical improvements and the existence of significant medical device businesses, such as DRAGERWERK AG and CO. KGAA; INMED-KARCZEWSCY LLC LLP, and Precision UK Ltd., supplying bed head panels, are further contributing to market growth. For instance, in May 2018, Precision UK Ltd. was bought by Indutrade AB, a multinational technology and industrial company group with over 200 companies operating in over 30 countries. In certain domains, it creates, manufactures, and sells components, systems, and services with high technological content. Thus, Europe is expected to dominate the overall regional market during the forecast period.

In the Asia Pacific, the market is estimated to register the highest CAGR during the forecast period. The presence of a large patient pool and the growing need for technologically advanced and cost-efficient healthcare solutions are expected to present significant regional growth opportunities in the market. Moreover, increase in number of clinical trials and high R&D investments by global players to enter untapped markets in Asia Pacific owing to low-cost services are high-impact-rendering drivers of the market for bed head panel. In addition, an increase in the number of hospitalization and advancements in the clinical development framework of developing economies are a few other factors aiding market growth in the region.

Key Companies & MarketShare Insights

公司专注于实现广泛的growth strategies such as increasing product differentiation and portfolio diversification, forming strategic alliances, and expanding marketing and distribution channels, to improve their product reach and gain a competitive advantage. For instance, in December 2021, Hill-Rom was acquired by Baxter International, Inc., a global leader in medical technology. The merger brings together two leading medical technology firms with the similar goal of improving patient care and transforming healthcare globally. The firm intends to expand historical Welch Allyn and Hill-Rom products into new foreign markets, bringing the aggregate portfolio of products and services to more patients and providers worldwide, which is expected to increase bed head panel demand in the near future.

Some of the prominent players in the bed head panel market include:

Precision UK Ltd.

Baxter

Novair Medical

Amcaremed Medical

Amico Group of Companies

Drägerwerk AG & Co. KGaA

BIOLUME

BeaconMedaes

Silbermann

INMED

Bed Head Panel MarketReport Scope

Report Attribute |

Details |

Market size value in 2022 |

USD 2.9 billion |

Revenue forecast in 2030 |

USD 3.6 billion |

Growth Rate |

CAGR of 3.1% from 2022 to 2030 |

Base year for estimation |

2021 |

Historical data |

2017 - 2020 |

Forecast period |

2022 - 2030 |

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Specialty, end-use, region |

Regional scope |

北美;欧洲;亚太地区;Latin America; MEA |

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea;Brazil; Mexico; Colombia; Argentina; South Africa; Saudi Arabia; UAE |

Precision UK Ltd.; Baxter; Novair Medical; Amcaremed Medical; Amico Group of Companies; Drägerwerk AG & Co. KGaA; BIOLUME; BeaconMedaes; Silbermann; INMED |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global bed head panel market report based on specialty, end-use, and region:

Bed Head Panel Specialty Outlook (Revenue, USD Million, 2017 - 2030)

ICU

Surgical

Others

Bed Head Panel End-use Outlook (Revenue, USD Million, 2017 - 2030)

Hospitals

Clinics

Others

Bed Head Panel Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Europe

U.K.

Germany

France

Italy

Spain

Asia Pacific

Japan

China

India

Australia

South Korea

Latin America

Brazil

Mexico

Argentina

Colombia

Middle East and Africa (MEA)

South Africa

Saudi Arabia

UAE

Frequently Asked Questions About This Report

b.The global bed head panel market size was estimated at USD 2.7 billion in 2021 and is expected to reach USD 2.9 billion in 2022.

b.The global bed head panel market is expected to grow at a compound annual growth rate of 3.1% from 2022 to 2030 to reach USD 3.6 billion by 2030.

b.Europe dominated the bed head panel market with the highest share of 37.78% in 2021. This is attributable to the rising prevalence of various disorders, increasing government initiatives for investments in health care, and growing demand for quality health care in this region.

b.Some of the key players operating in the bed head panel market include Precision UK Ltd., Baxter, Novair Medical, Amcaremed Medical, Amico Group of Companies, Drägerwerk AG & Co. KGaA, BIOLUME, BeaconMedaes, Silbermann, and INMED among other players.

b.Key factors driving the bed head panel market growth include an increasing number of patients undergoing surgeries, increasing incidence of chronic medical illnesses, the impact of COVID-19, and growing cases of traumatic injuries due to accidents.