Biomarker Discovery Outsourcing Services Market Size, Share & Trends Analysis Report By Biomarker Type (Predictive, Prognostic), By Therapeutic Area (Oncology, Neurology, Autoimmune Diseases), By Phase, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-139-0

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Market Size & Trends

The globalbiomarker discovery outsourcing services market size was estimated at USD 10.81 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 21.1% from 2023 to 2030. The market is majorly driven by the advancement in personalized medicine, integration of Omics techniques, and rising adoption of emerging technologies. CRISPR-based approaches and single-cell analysis are some of the emerging technologies in biomarker discovery services. The COVID-19 pandemic significantly impacted the market by highlighting the importance of findingbiomarkersfor infectious diseases and public health. A rise in funding and interest in COVID-19-related biomarker research attributed to the situation's urgency.

The increasing demand for personalized medicine is expected to drive market growth in the coming years. For instance, in 2022, the U.S. Food and Drug Administration (FDA) approved 12 new personalized medicines. The same year, it also extended the scope of applications for numerous existing personalized treatments, authorized two novel siRNA therapies, issued recommendations for the advancement of gene and cell-based therapies, and approved the utilization of five such therapies.The move toward personalized medicine relies heavily on identifying and validatingbiomarkers. This factor is expected to drive the market growth in the forecast period.

On the other hand, the increase in the prevalence of chronic diseases such as cardiovascular diseases, cancer, diabetes, and neurodegenerative conditions are major contributing factors to the market growth. According to the American Cancer Society, in 2022, approximately 1.9 million new cancer cases and 609,360 cancer-related deaths were diagnosed in the U.S.Biomarkers play a crucial role in early diagnosis, prognosis, and monitoring of this disease, driving the demand for biomarker discovery services.

Furthermore, increasing drug development pipeline is also driving the biomarker discovery outsourcing sector. According to the NSF data, the pharmaceutical industry's development pipeline has achieved a record milestone, with more than 20,000 products currently in active development. Biomarkers are essential for drug target identification, validation, and patient stratification in clinical trials, making biomarker discovery services a crucial component of drug development.

Type Insights

Based on type, the market is divided into predictive biomarkers, prognostic biomarkers, safety biomarkers, and surrogate endpoints. The surrogate endpoints segment dominated the global market with a revenue share of over 55% in 2022. To accomplish important objectives like patient survival or disease progression,clinical trialscan take years and require significant resources.Surrogate biomarkers allow for shorter and more efficient clinical trials because they can provide early indications of treatment efficacy. Such advantages are expected to drive the segment’s growth.

The predictive biomarkers segment is anticipated to expand at the fastest CAGR of 23.1% during the forecast period. Pharmaceutical and biotechnology companies are using predictive biomarkers more frequently to identify patient populations who are most likely to respond to experimental medications. Predictive biomarkers are commercially attractive due to faster drug development and regulatory approval, which result in cost reductions and revenue generation.

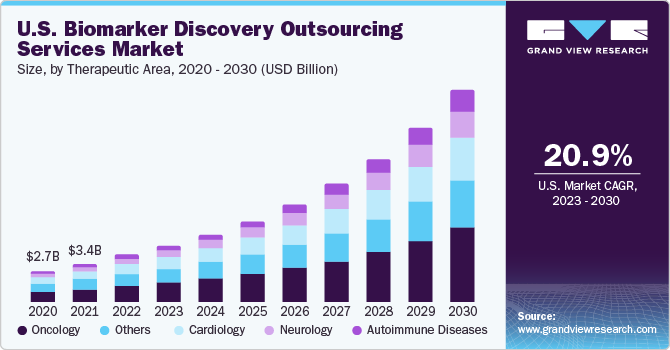

Therapeutic Area Insights

Based on therapeutic areas, the oncology segment dominated the market with a revenue share of over 34% in 2022. Worldwide, cancer is one of the leading causes of morbidity and mortality. The prevalence of various types of cancer, such as lung, breast, prostate, and colorectal cancer, has driven substantial research and investment in oncology biomarkers. Detecting genomic biomarkers, including mutations in particular genes (such as EGFR, KRAS, and BRCA), has been crucial in oncology. The ability to precisely identify these biomarkers has been made possible bynext-generation sequencingand other genomic technologies.

On the other hand, autoimmune diseases are expected to show a significant market share in the coming years. There has been an increase in autoimmune conditions worldwide, such as Type 1 diabetes, lupus, multiple sclerosis, and rheumatoid arthritis. Better diagnostic and prognostic biomarkers are required due to the increasing incidence of these diseases. Moreover, the concept ofpersonalized medicineis gaining traction in autoimmune diseases.Biomarkers are crucial for locating patient subgroups who may respond better to specific treatments or have various disease trajectories.

Discovery Phase Insights

Based on discovery phase, the market has been categorized into biomarker identification, biomarker validation, biomarker profiling, biomarker panel development, and biomarker selection. Among these, biomarker identification dominated the segment in 2022 with a market share of around 28.0%. Applications for biomarkers are numerous, ranging from the diagnosis and prognosis of diseases to the creation of new drugs and the monitoring of therapeutic regimens. Outsourcing biomarker identification can be cost-effective and time-efficient in contrast to in-house efforts. Organizations can access cutting-edge technologies and experienced teams without the need for significant capital investments.

Biomarker validation is anticipated to expand at the fastest CAGR of 22% during the forecast period. A potential biomarker's accuracy, dependability, and clinical applicability are verified through the process of "biomarker validation." The discovery of biomarkers in research settings and their application in clinical practice are covered by it. Services for biomarker validation are in high demand due to the focus on clinical translation. Moreover, regulatory bodies, such as the FDA and the European Medicines Agency (EMA), require precise validation of biomarkers for their use in diagnostics, prognostics, or treatment selection. Such factors are expected to drive market growth.

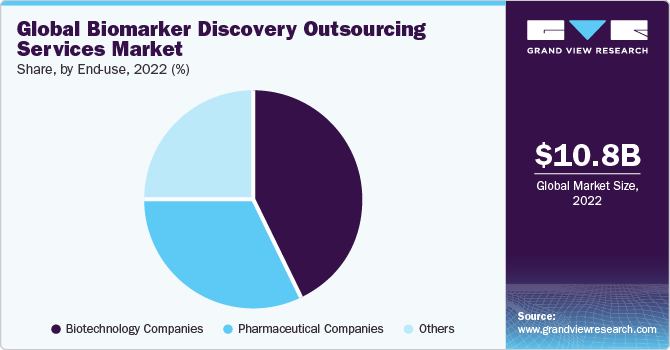

End-use Insights

The biotechnology companies dominated the global market with a revenue share of around 43% in 2022. Outsourcing allows biotechnology companies to tap into the expertise of specialized service providers, including Contract Research Organizations (CROs).Outsourcing biomarker discovery can be cost-effective compared to maintaining in-house teams, infrastructure, and equipment. Biotechnology companies can allocate resources more efficiently by focusing on their core competencies, such as drug development or therapeutic research.

Pharmaceutical companies are expected to hold a significant market share in the coming years. Pharmaceutical companies are at the forefront of drug discovery and development. Discovery of biomarkers is an important part of this process; because biomarkers are used to identify drug targets, stratify patients in clinical trials, and assess response. Companies therefore have a strong incentive to invest in biomarker discovery and use the product to gain intelligence.

Regional Insights

North America dominated the biomarker discovery outsourcing services industry with a share of 42.9% in 2022. This is attributed to its access to cutting-edge technologies, advanced healthcare infrastructure, regulatory expertise, and robust biotech industry. Moreover, the regulatory bodies in the region, such as the Canadian Food Inspection Agency (CFIA) and the U.S. Food and Drug Administration (FDA), have well-established regulatory frameworks for biomarkers in developing drugs and diagnostics.This regulatory clarity supports biomarker research and validation efforts.

亚洲Pacific is anticipated to experience maximum growth over the forecast period with a CAGR of 22.0%. Several countries in the APAC region, including China and India, are considered emerging markets for pharmaceuticals andbiotechnology. The cost-effectiveness of outsourcing biomarker discovery projects to these countries can be appealing to international pharmaceutical companies. Furthermore, introducing novel biomarkers in the market is expected to drive market growth in the coming years. For instance, in October 2022, Australia's Garvan Institute of Medical Research discovered a novel biomarker for prostate cancer, potentially improving the diagnosis and treatment of men with the aggressive form of the disease.

Key Players & Market Share Insights

Key players operating in this sector are adopting various strategic initiatives, such as partnerships, collaborations, and new service launches, to maintain their strong position in the market. For instance, in January 2022, Inotiv, Inc. and Synexa Life Sciences jointly revealed their intention to establish a partnership to expedite Inotiv's progress in developing critical biomarkers for a deeper comprehension of the safety and effectiveness of innovative biotherapeutics. This collaboration will augment the company's preclinical discovery and safety assessment services. Some prominent players in the global biomarker discovery outsourcing services market include:

Laboratory Corporation of America Holdings

Charles River Laboratories.

Eurofins Scientific

Celerion

ICON plc

Parexel International (MA) Corporation

Proteome Sciences

GHO Capital

Thermo Fisher Scientific Inc.

Evotec

Biomarker Discovery Outsourcing Services MarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 12.93 billion |

Revenue forecast in 2030 |

USD 49.32 billion |

Growth rate |

CAGR of 21.1% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

Segments covered |

Type, therapeutic area, discovery phase, end-use, region. |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Norway; Denmark; India; Japan; China; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

Key companies profiled |

Laboratory Corporation of America Holdings; Charles River Laboratories; Eurofins Scientific; Celerion; ICON plc.; Parexel International (MA) Corporation; Proteome Sciences; GHO Capital; Thermo Fisher Scientific Inc., Evotec. |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Global Biomarker Discovery Outsourcing Services Market Report Segmentation

这份报告预测全球收入增长, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biomarker discovery outsourcing services market report based on type, therapeutic area, discovery phase, end-use, and region:

Type Outlook (Revenue, USD Billion, 2018 - 2030)

Predictive biomarkers

Prognostic biomarkers

Safety biomarkers

Surrogate endpoints

Therapeutic Area Outlook (Revenue, USD Billion, 2018 - 2030)

Oncology

Neurology

Cardiology

Autoimmune Diseases

Others

Discovery Phase Outlook (Revenue, USD Billion, 2018 - 2030)

Biomarker Identification

Biomarker Validation

Biomarker Profiling

Biomarker Panel Development

Biomarker Selection

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

Pharmaceutical Companies

Biotechnology Companies

Others

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Italy

Spain

Sweden

Norway

Denmark

亚洲Pacific

Japan

China

India

South Korea

Australia

Thailand

拉丁美洲

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

UAE

Kuwait

Frequently Asked Questions About This Report

b.The global biomarker discovery outsourcing services market size was estimated at USD 10.81 billion in 2022 and is expected to reach USD 12.93 billion in 2023.

b.The global biomarker discovery outsourcing services market is expected to grow at a compound annual growth rate of 21.1% from 2023 to 2030 to reach USD 49.32 billion by 2030.

b.North America dominated the biomarker discovery outsourcing services market with a share of 42.9% in 2022. This is attributed to its access to cutting-edge technologies, advanced healthcare infrastructure, regulatory expertise, and robust biotech industry. Moreover, the regulatory bodies in the area, such as the Canadian Food Inspection Agency (CFIA) and the U.S. Food and medication Administration (FDA), have well-established regulatory frameworks for biomarkers in developing drugs and diagnostics.

b.Some key players operating in the biomarker discovery outsourcing services market include Laboratory Corporation of America Holdings, Charles River Laboratories, Eurofins Scientific, Celerion, ICON plc., Parexel International (MA) Corporation, Proteome Sciences, GHO Capital, Thermo Fisher Scientific Inc., Evotec.

b.Key factors that are driving the biomarker discovery outsourcing services market growth include the advancement of personalized medicine, the Integration of Omics Technologies, and the rising adoption of emerging technologies. Emerging technologies such as CRISPR-based approaches and single-cell analysis are some of the emerging technologies in biomarker discovery services.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."