Board Insulation Market Size, Share & Trends Analysis Report By Application (Building & Construction, Transportation, Industrial,), By Region (North America, Europe, APAC, CSA, MEA), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-117-2

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry:Advanced Materials

Report Overview

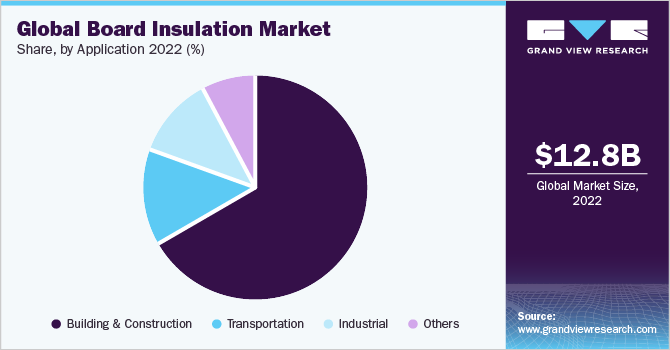

The globalboard insulation market sizewas estimated atUSD 12.8 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 3.6% from 2023 to 2030. This growth can be attributed to the increased focus on energy efficiency and the growing demand for sustainable building materials across the globe. As the cost of energy increases, there is a growing demand for insulation materials that aid in reducing energy consumption. Board insulation is a highly effective way to insulate buildings and this trend is expected to grow at a significant pace during the forecast period.

刚性板绝缘在insu高效lating buildings to curb the energy requirements for heating and cooling. It is effectively easy to install, and the operating cost makes it an ideal choice for most of the building contractors. This is particularly important in cold climates, where it is important to minimize heat loss. As a result, the demand for boards from the building & construction industry is expected to increase during the forecast period.

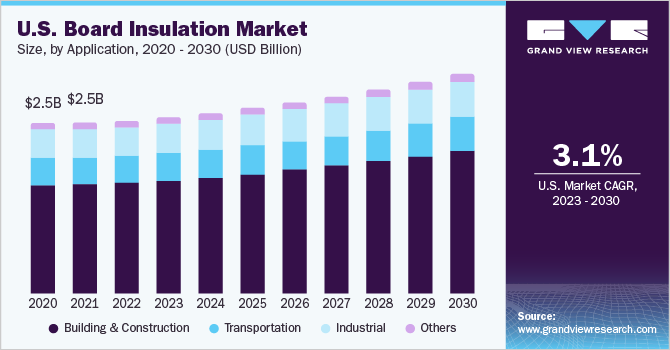

The U.S. is a key market for board insulation in North America. Board insulation is used on equipment,chillers, vessels, acoustical wall panels and heat and air conditioning ducts, hot and cold equipment, specialized ceiling applications, and power and process equipment. The material used in board insulation generally differs depending on the temperature range of the application. Mineral wool board insulation is mostly used for industrial application due to the low shrinkage it exhibits at high temperatures, in order to prevent the formation of gaps at joints to prevent thermal leaks. The construction industry focuses on sustainability which has influenced the board insulation market. Environmentally friendly insulation materials such as EPS, which is recyclable and manufactured from recycled content have gained popularity in the U.S. building & construction industry. An increase in demand for such materials from an ever-growing construction industry will boost the market throughout the forecast period.

Manufacturers of board insulation have partnerships with merchants and distributors to ensure the timely supply of boards. Some of the major manufacturers are involved in offering new product launches to increase their market share. Strategic partnerships as well as collaborations, are some of the strategies adopted by major manufacturers to gain competitive advantages.

Application Insights

The building & construction segment led the market and accounted for the largest share of 66.8% in 2022. Boards are commonly used in exterior and interior wall applications. Insulating exterior walls helps improve thermal efficiency, reduces energy consumption, and enhances comfort in buildings. Interior wall insulation is used for soundproofing and controlling temperature fluctuations. Besides, it is extensively used for roof applications, providing thermal resistance and protecting buildings from heat gain and loss. It reduces energy consumption while ensuring occupant comfort. As the construction industry prioritizes energy efficiency, sustainability, and occupant comfort, the demand for board insulation is expected to grow across various applications in the building sector.

The transportation and industrial application together accounted for 25.5% of the market share globally. In automotive insulation, boards are used to reduce noise, vibration, and harshness levels inside the vehicle. The board helps to create a quieter and more comfortable interior environment for passengers. Besides, in refrigerated transport such as trucks and containers, it is extensively used on interior walls to maintain a stable temperature, ensuring the safe transportation of perishable goods with the intent of reducing energy consumption. The transportation industry seeks to improve energy efficiency and passenger comfort, and the demand for the boards is expected to grow during the forecast period.

The building & construction segment is expected to grow at the highest CAGR of 3.8% in terms of revenue over the forecast period. Insulating foundation walls and slabs with boards helps prevent heat loss from the building’s foundation and reduces moisture-related issues, ensuring no mold growth and condensation. Particularly, in areas like basements and crawl spaces, it provides thermal comfort and helps prevent heat loss through the floor. The construction industry is growing globally as there is a huge demand for housing on account of the increase in nuclear families and growing urbanization across the globe. There is a huge demand for insulating materials that offer unique benefits and characteristics, making boards suitable for specific applications based on the project’s requirements and building regulations. This, in turn, will boost the market during the forecast period.

Board insulation is widely used in various industrial applications including process equipment, boilers & furnaces, industrial ovens, andcold storage&制冷提供声学和热sulation. It also reduces the risk of fire hazards and increases energy efficiency. Industries like petrochemicals, oil & gas, and chemical manufacturing are striving to include building materials that aid in energy efficiency, protect personnel from hot surfaces, and reduce operating costs. This increase in demand for insulating materials will boost the consumption of boards in the coming few years.

Regional Insights

Asia Pacific has dominated the board insulation market accounting for 40% of the market share in 2022. The growth of the market in this region can be attributed to its economic growth, increased energy prices, and building regulations. Different countries in the region have varying building codes and regulations that dictate the minimum requirements for thermal insulation in buildings. These regulations have mandated all construction contractors to implement insulating materials in the construction industry. Additionally, rapid urbanization and industrialization have led to a surge in construction activities, thereby driving the demand for board insulation in this region. Increasing awareness of environmental sustainability has led to a preference for eco-friendly and recyclable materials. Common types of board insulation used in this region includes EPS (extruded polystyrene, and PUR (polyurethane). These materials are eco-friendly and are used in building and construction materials widely. Demand for these materials as thermal insulation is increasing due to the ESG factors which is driving the demand for the overall market in this region.

The insulating material is widely used in various construction and industrial application to enhance energy efficiency and reduce heat transfer. The continent’s vast and diverse climate zones, including cold and hot regions, drive the demand for effective thermal insulating material, thereby driving the demand for insulating boards in this region. Besides, different regions in North America have varying building codes and regulations that specify minimum requirements for insulation materials in the buildings. Compliance with these standards ensures energy-efficient and safe construction practices.

In Europe, the board insulation market is expected to grow at a CAGR of 2.7% over the forecast period. The construction industry in the region is experiencing technological advancements, with a focus on sustainability which has led to an increase in demand for sustainable thermal material for buildings. European construction practices increasingly prioritize sustainable and eco-friendly insulation materials to align with climate goals. The demand for boards has been steadily increasing across Europe due to the construction of new buildings and the renovation of existing ones. This demand is expected to grow at a significant pace during the forecast period.

Key Companies & Market Share Insights

The board insulation market exhibits high competition owing to the presence of established players in this industry. The competitors in the industry opt for various strategies such as product portfolio expansion, partnerships, and collaborations in order to gain market share in the industry.

关键球员在市场上也从事复位arch and development to increase the usage of sustainable materials to manufacture board insulations, resulting in high competition and creating barriers to the entry of new players. A few major manufacturers, such as BASF SE, Saint-Gobain, and Huntsman Corporation are vertically integrated. It helps them to ensure the easy availability of raw materials and reduces their dependence on suppliers. This also lowers the overall production cost of paper, thereby increasing the profit margins of manufacturers. Some prominent players in the global board insulation market include:

Owens Corning

Rockwell International

Saint-Gobain

Knauf Insulation

Llyod insulations India Ltd

Polybond insulation Pvt Ltd

Industrial insulation

BASF SE

Huntsman Corporation

Mitsui Chemicals, inc.

Rogers Corporation

Duna.

Board InsulationMarket Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 13.15 billion |

Revenue forecast in 2030 |

USD 16.88 billion |

Growth Rate |

CAGR of 3.6% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2022 |

Forecast period |

2023 - 2030 |

Quantitative units |

Volume in Kilotons and Revenue in USD Million, and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

Segments covered |

Application, region |

Region scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil |

Key companies profiled |

Owens Corning; Rockwell International; Saint-Gobain; Knauf Insulation; Llyod insualtions India Ltd; Polybond insulation Pvt Ltd; Industrial insulation; BASF SE; Huntsman Corporation; Mitsui Chemicals, Inc.; Rogers Corporation; Duna |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Board Insulation Market Report Segmentation

This report forecasts revenue growth at the regional and country level and provides an analysis of the industry trends in each of the sub-segments from 2023 to 2030. For this study, Grand View Research has segmented the global board insulation market based on application and region.

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

Building & Construction

Transportation

Industrial

Others

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

Asia Pacific

China

India

Japan

South Korea

Central & South America

Brazil

Middle East & Africa

Frequently Asked Questions About This Report

b.The global board insulation market size was estimated at USD 12.8 billion in 2022 and is expected to reach USD 13.15 billion in 2023.

b.The global board insulation market is expected to grow at a compound annual growth rate, a CAGR of 3.6% from 2023 to 2030, to reach USD 16.88 billion by 2030.

b.The building & construction segment of Board insulation market accounted for the largest revenue share of 66.8% in 2022.

b.Some key players operating in the Board insulation market include Owens Corning, Rockwell International,Saint-Gobain, Knauf Insulation, Llyod insualtions India Ltd, Polybond insulation Pvt Ltd, Industrial insulation, BASF SE, Huntsman Corporation, Mitsui Chemicals, Inc., Rogers Corporation, and Duna.

b.Key factors that are driving the market growth include the rising demand of Board insulation in construction & building and transportation application.