Brachioplasty Market Size, Share & Trends Analysis Report By Procedure (Surgical, Non-Surgical), By End-use (Hospitals, Cosmetic Surgery Clinics), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-099-8

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

报告概述

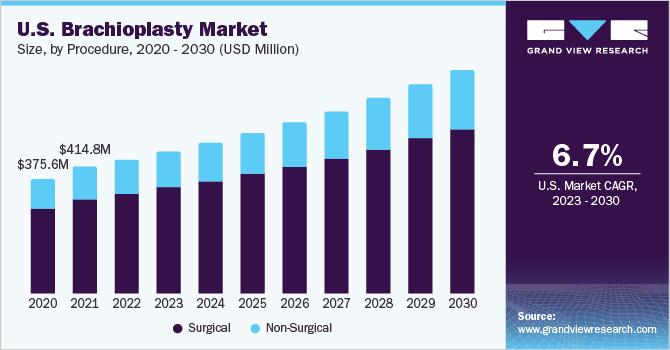

The globalbrachioplasty market sizewas estimated atUSD 1.35 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 7.1% from 2023 to 2030. Brachioplasty, also known as arm lift, is a surgical procedure to reshape the back of the upper arm by removing excess fat and remnant tissues to improve physical appearance. The market is expected to witness growth due to several factors such as increasing weight loss surgeries, the growing value of self-esteem, advancement in surgical and non-surgical techniques, the rising geriatric population, and increasing obesity rates. Four out of ten American people are obese, according to State of Obesity 2022, and obesity rates are rising both nationally and among different population groups.

The pandemic had a negative impact on the brachioplasty market. Various voluntary patient procedures were halted, and the beds were allocated to COVID-19 patients. Elective surgical cosmetic procedures were halted for 8.1 weeks in 2020, resulting in lower patient turnout. For instance, as per the American Society of Plastic Surgeons, arm lift procedures performed in the U.S. decreased by 17% in 2020 from 2019. However, due to changing customer perception levels, the market recovered from the pandemic losses. As per the American Society of Plastic Surgeons survey in 2020, 11% of respondents indicated higher adoption of cosmetic surgeries in 2021 and ahead.

The growing number of weight-loss surgeries is anticipated to propel the brachioplasty market growth. Brachioplasty is generally performed after weight-loss surgery to maintain a constant physical appearance by removing extra folds of skin and fat. For instance, in May 2023, JAMA Pediatrics stated that weight loss surgeries in adolescents grew by 20% in 2020-2021, while 24% growth was observed in adults within the same period. Furthermore, medical researchers have deemed weight loss surgeries- a safe and effective treatment. Hence, the growing acceptance of weight loss surgeries will propel the market growth during the forecast period.

此外,自尊的发展协会with physical appearance will drive market growth. According to an article published by the Journal of Education and Health Promotion in August 2022, self-esteem was negatively associated with unhealthy weight in young adults. The increasing prevalence of the geriatric population in developed countries positively aids market growth. In addition, the American Academy of Dermatology Association stated that no-severe complications were noticed in the elderly undergoing cosmetic surgeries. Body-contouring procedures such as brachioplasty had improved procedural outcomes than the younger age group owing to a better lifestyle. However, factors such as poor reimbursement policies and low awareness about the procedure impede market growth.

Procedure Insights

The surgical segment dominated the market and accounted for a revenue share of 75.20% in 2022. Surgical procedure for arm lifts involves invasive techniques to remove excess tissues and fat. The growth can be attributed to established medical literature, long-term contour maintenance, and effectivity of surgical brachioplasty procedures. Moreover, as per an NCBI article published in June 2023, upper arm lift procedures recorded a 20% increase in 2019 from 2015. Furthermore, short-scar brachioplasty is gaining immense traction due to its minimally invasive nature and reduced scar revision rates.

The non-surgical segment is estimated to witness the fastest CAGR of 7.5% during the forecast period. The growth can be attributed to the increasing technological advancements in energy-based devices to tighten the upper arm tissues and reduce cellulite.Furthermore, these devices harmoniously work with other technologies. In addition, this procedure can be used in the initial stages of skin sagging, thereby, increasing product usage.

End-use Insights

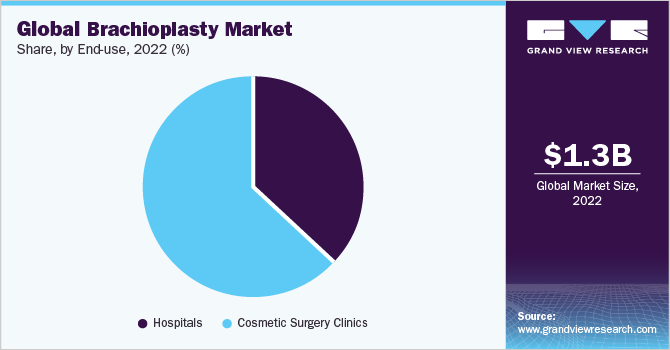

Based on end-use, the brachioplasty market is segmented into hospitals and cosmetic surgery clinics. The cosmetic surgery clinics segment accounted for the highest revenue share of 63.47% in 2022 and is also expected to grow at the fastest CAGR of 7.5% over the forecast period. The growth of the segment can be attributed to the specialized focus of the clinics on aesthetics and beauty, higher delivery of personalized care, shorter waiting times, and lower risk for sickness and infection.

Furthermore, various long-term patient trial data confirm the safety of patients in these centers. As per the American Society of Plastic Surgeons, a complication rate of under 1% wasidentified in cosmetic procedures performed outside the hospital. Moreover, growing establishments and the introduction of technologically advanced clinics will provide lucrative opportunities for the market. For instance, as per the National Institute of Health, 82% of cosmetic procedures performed in the U.S. in 2020 were handled in outpatient surgical centers.

Regional Insights

North America dominated the global brachioplasty market and accounted for a revenue share of 38.47% in 2022. The growth can be attributed to the high acceptance rate for cosmetic surgeries amongst the population, technological advancements in both surgical and non-surgical techniques, and accessibility and availability of skilled professionals. Moreover, the growing number of weight-loss surgeries in the region propels the market growth.

In recent decades, Asia’saesthetic medicine market增长非常迅速。亚太地区预计to witness the fastest CAGR of 8.1% over the forecast period. The growth can be attributed to factors such as the growing importance of physical appearance, increasing penetration of social media in lifestyle, and advancement of healthcare infrastructure. Moreover, South Korea is considered a lucrative market for brachioplasty owing to the availability of developed products and technologies. For instance, an estimated 24% of all cosmetic surgeries in the world are performed in South Korea.

Key Companies & Market Share Insights

The market is highly competitive, with a large number of manufacturers focusing on various strategic initiatives such as new product launches, geographical expansions, mergers and acquisitions, collaborations, and partnerships. For instance, in January 2023, Apyx Medical received FDA clearance for its updated Apyx One Console to be used for cosmetic surgical procedures in the U.S. Some prominent players in the global brachioplasty market include:

New York Plastic Surgical Group

Westlake Dermatology & Cosmetic Surgery

Nazarian Plastic Surgery.

Ruby Surgery & Aesthetics

Cadogan Clinics

UK Aesthetic

B. Care Medical Center

Centre For Surgery

UK Healthcare Aesthetics Center

Marroquin & Sandoval Plastic Surgery

Brachioplasty Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 1.44 billion |

Revenue forecast in 2030 |

USD 2.32 billion |

Growth rate |

CAGR of 7.1% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Procedure, end-use, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

Key companies profiled |

New York Plastic Surgical Group; Westlake Dermatology & Cosmetic Surgery; Nazarian Plastic Surgery; Ruby Surgery & Aesthetics; Cadogan Clinics; UK Aesthetics; B. Care Medical Center; Centre For Surgery; UK Healthcare Aesthetics Center; Marroquin & Sandoval Plastic Surgery |

Customization scope |

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Brachioplasty Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global brachioplasty market report based on procedure, end-use, and region:

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

Surgical

Non-Surgical

End-use Outlook (Revenue, USD Million, 2018 - 2030)

Hospitals

Cosmetic Surgery Clinics

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Italy

Spain

Sweden

Norway

Denmark

Asia Pacific

China

Japan

India

Australia

Thailand

South Korea

拉丁美洲

Brazil

Mexico

Argentina

Middle East and Africa

Saudi Arabia

South Africa

UAE

Kuwait

Frequently Asked Questions About This Report

b.The global brachioplasty market size was estimated at USD 1.35 billion in 2022 and is expected to reach USD 1.44 billion in 2023

b.The global brachioplasty market is expected to grow at a compound annual growth rate of 7.1% from 2023 to 2030 to reach USD 2.32 billion by 2030

b.North America dominated the global brachioplasty market and accounted for 38.47% of the total market share in 2022. The growth can be attributed to the high acceptance rate for cosmetic surgeries amongst the population, technological advancements in both surgical and non-surgical techniques, accessibility and availability of skilled professionals

b.Some prominent players in the brachioplasty market are- New York Plastic Surgical Group, Westlake Dermatology & Cosmetic Surgery, Nazarian Plastic Surgery, Ruby Surgery & Aesthetics, Cadogan Clinics, UK Aesthetics, B. Care Medical Center, Centre For Surgery, UK Healthcare Aesthetics Center, and Marroquin & Sandoval Plastic Surgery

b.The market is expected to witness growth due to several factors such as increasing weight loss surgeries, the growing value of self-esteem, advancement in surgical and non-surgical techniques, rising geriatric population, and increasing obesity rates