大脑植入市场规模,分享& An乐鱼体育手机网站入口alysi趋势s Report By Product (Deep Brain Stimulator, Vagus Nerve Stimulator, Spinal Cord Stimulator), By Application (Chronic Pain, Parkinson's Disease, Epilepsy), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-2-68038-311-9

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry:Healthcare

Report Overview

The global brain implants market size was valued at USD 4.6 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 9.1% from 2021 to 2028. Increasing incidence of neurological conditions such as Parkinson’s disease, Alzheimer’s, and epilepsy, coupled with increasing awareness regarding brain implant benefits, and positive research outcomes are among the major factors driving the growth of the overall market.

神经障碍的患病率增加s is a high-impact rendering driver for the market. For instance, according to the WHO, neurological diseases contribute 6.3% to the global disease burden and are one of the major causes of mortality worldwide, resulting in 13.2% deaths in developed countries and 16.8% in low- and middle-income countries. This has created clinical urgency for the incorporation of long-term solutions such as spinal cord stimulators and deep brain stimulators. Moreover, the global prevalence of stress and obesity-induced depression is constantly increasing. As per the National Institute of Mental Health (NIHM), in 2016, 16.2 million adults had been through at least one major depressive episode in the U.S. Brain implants have been proved to play a crucial role in providing therapeutic solutions for depression. Thus, a rise in the prevalence of such diseases is expected to drive market growth during the forecast period.

Moreover, the growing global geriatric population and increase in the incidence of target diseases, especially Parkinson’s, epilepsy, and Alzheimer’s, as well as high unmet medical needs has increased the demand for brain implants. The growing base of the aging population is more prone to Parkinson's disease. Individuals suffering from Parkinson’s are not able to release adequate dopamine in the brain, which leads to walking problems, tremors, and stiffness, among other conditions. As per the CDC, Parkinson's disease is largely diagnosed in people over the age of 60 and it is projected that it affects 1.0% of the population over 60 to 4.0% by age 80. According to the WHO 2018 report, the population pertaining to the age group of 60 and above is expected to reach approximately 2 billion by 2050, from 900 million in 2015. Thus, the geriatric population is highly susceptible to PD, which is expected to be a key factor driving the market for brain implants.

Furthermore, the introduction of advanced technologies such asMRIsafety-enabled brain implants by Medtronic and the launch of transdermal neuromodulation technology (introduced by Neurowave Medical Technologies) is further anticipated to drive the market. In addition, technologies such as motor neuron prostheses, microelectrode arrays, andBrain Computer Interfaces(BCIs) exhibit benefits such as improved patient mobility profile. This advancement acts as a high-impact-rendering driver for the market. For instance, smart neural chips improve the wireless transmission of brain signals into fingers and hands with around 95% accuracy and this is anticipated to upsurge the demand for brain implants during the forecast period.

美国和加拿大等国家有证人ed a high prevalence rate of movement and psychiatric disorders coupled with an increasing geriatric population in the region. In addition, an increase in government funding and initiatives for raising awareness about movement disorders are expected to drive the demand for brain implants. For instance, in 2020, Parkinson’s Foundation invested USD 3.5 million to fund more than 34 research projects for Parkinson’s disease. Similarly, According to Epilepsy Canada, 0.6% of the Canadian population is affected by epilepsy. Every year, around 15,500 people learn that they have epilepsy. Moreover, approximately 2% of the population has obsessive-compulsive disorder, according to the Canadian Psychological Association. These factors are expected to boost the demand for brain implants in these countries.

Furthermore, the increasing number of research activities leading to technological breakthroughs is expected to witness lucrative growth opportunities in the market for brain implants. These include self-charging implants and memory chips that are anticipated to provide the market with growth opportunities over the forecast period. For instance, Andersen Lab has research on cognitive signals in Post Parietal Cortex (PPC) for decoding target position for motions. The signals received by the cortex are used for controlling the device. Additionally, potential benefits of these devices, such as better management of postoperative outcomes and long-term efficacy are expected to facilitate market growth over the forecast period. These key factors are anticipated to raise the demand for brain implants.

The lockdown and restrictions pertaining to preventing the spread of COVID-19 in 2020 have had a significant impact on both the patients who have scheduled surgery and those who already undergone the DBS surgery. Brain implant surgery such as DBS is an elective surgical procedure in several institutes due to which the scheduled surgeries have been put on hold. Patients were advised to continue their last optimized dose regimen and surgeries were performed when the restrictions were lifted. Thus, the outbreak of COVID-19 has resulted in low demand for brain implants, therefore restraining market growth.

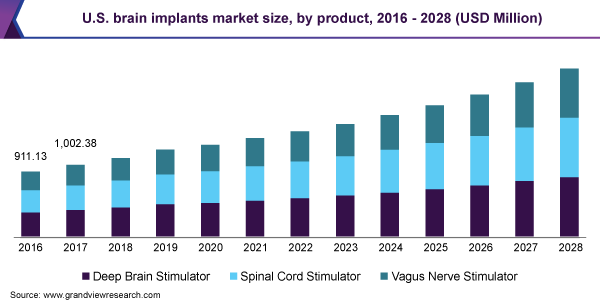

Product Insights

The deep brain stimulators segment dominated the market for brain implants and accounted for the largest revenue share of 37.0% in 2020, owing to its use in various applications in neurological disorders. The growing adoption of DBS for the treatment of various neurological disorders including obsessive-compulsive disorder, Parkinson’s diseases, dystonia, essential tremor, epilepsy, and Alzheimer’s disease is a key growth driver of this segment. In addition, growing awareness about neurological movement disorder treatment among patients is anticipated to trigger the growth of this segment.

However, the vagus nerve stimulator segment is expected to grow at the highest compound annual growth rate (CAGR) of 9.5% from 2021 to 2028, owing to applications in the treatment of various disorders such as anxiety, migraines, fibromyalgia, tinnitus, and obesity. It is mainly used to deliver electrical impulses to the vagus nerve. In addition, product launches with advanced technology are enhancing the quality of therapy. For instance, in 2017 NeuroScience company launched the first non-invasive vagus nerve stimulation therapy product called GammaCore. This is also likely to bolster market growth.

Application Insights

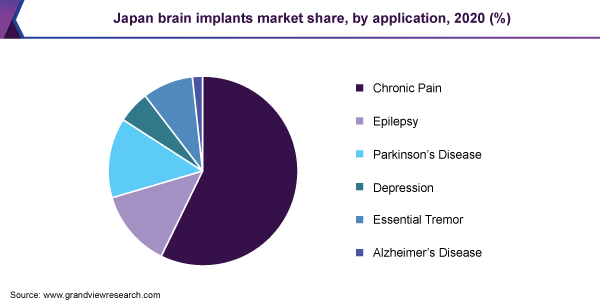

The chronic pain segment dominated the market for brain implants and accounted for the largest revenue share of 58.8% in 2020. An increase in the incidence of chronic pain has created clinical urgency for incorporating long-term solutions. For instance, as per the National Health Interview Survey, in 2016, the prevalence of chronic pain was around 20.4% in adults in the U.S. (50 million) and about 8.0% of adults in the country (19.6 million) had high-impact chronic pain. Stimulators are mainly used in cases when chronic neck or back pain has not been relieved despite surgery or other treatments. With increasing chronic pain due to conditions such as lumbar and cervical radiculitis, failed back surgery, and neuropathy, the demand for stimulators is rising. This, in turn, is anticipated to fuel the growth of the market for brain implants.

However, the Parkinson’s disease segment is expected to witness the highest CAGR of 10.1% from 2021 to 2028 owing to the increasing number of the geriatric population who are prone to conditions such as Parkinson’s and Alzheimer’s diseases. According to the UN Department of Economic and Social Affairs, currently, the global population is 7.7 billion, which is expected to increase to 9.7 billion by 2050, thus supporting segment growth during the forecast period.

Regional Insights

North America dominated the market for brain implants and accounted for the largest revenue share of 42.9% in 2020. This dominance can be attributed to factors such as an increase in the prevalence of neurological disorders, a rise in awareness about treatments, the availability of highly skilled physicians, and the presence of well-established healthcare facilities. Moreover, an increase in government funding and initiatives for raising awareness about movement disorders are expected to drive the demand for deep brain stimulation devices in the region. For instance, in 2020, Parkinson’s Foundation invested USD 3.5 million to fund more than 34 research projects for Parkinson’s disease. These factors are expected to boost the demand for brain implants in this region.

However, Asia Pacific is expected to significantly lead the market in the future from 2021 to 2028 owing to various factors such as the rising prevalence of neurodegenerative and psychiatric disorders, coupled with unmet need for effective and long-term treatment solutions, increasing affordability, and a rising number of awareness programs. Increasing initiatives being undertaken by neurosurgeons and neurology clinics to raise awareness about brain implants are expected to present significant growth opportunities for the brain implants market in this region. Moreover, high R&D investments by global market players owing to their low-cost structure are among the key drivers of the market in the region.

Key Companies & MarketShare Insights

有成本效益的发展,技术先进nced brain implants is the key focus of the companies operating in this market. Market leaders are involved in extensive research for the development of advanced brain implant technologies. Subsequently, the introduction of new products is expected to provide this market with lucrative growth opportunities. For instance, Abbott secured the U.S. FDA approval in September 2019 for its Proclaim XR recharge-free SCS system for chronic pain management. This system operates by utilizing low doses of electrical pulses that help extend the system's battery life for up to ten years.

Moreover, emerging players such as NeuroPace, Inc. and Synapse Biomedical Inc., are considered innovators for the market. Products offered by these competitors have a good price-performance proposition, competitive functionality, and are technologically advanced. These emerging companies are continuously investing in research and development activities as well as product commercialization events. For instance, in October 2017, NeuroPace, Inc. closed a USD 74 million funding round initiated by OrbiMed Advisors and KCK Groups. The funding will support the company’s ongoing efforts for rapid expansion and commercialization of its FDA-approved DBS product, the NeuroPace RNS system. Some of the prominent players in the brain implants market include:

Medtronic

Boston Scientific Corporation

St. Jude Medical (Abbott)

NeuroPace, Inc.

Nevro Corporation

Synapse Biomedical Inc.

Aleva Neurotherapeutics SA

Brain Implants MarketReport Scope

Report Attribute |

Details |

Market size value in 2021 |

USD 4.9 Billion |

Revenue forecast in 2028 |

USD 9.2 Billion |

Growth Rate |

CAGR of 9.1% from 2021 to 2028 |

Base year for estimation |

2020 |

Historical data |

2016 - 2019 |

Forecast period |

2021 - 2028 |

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2028 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, application, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Colombia; Argentina; South Africa; Saudi Arabia; UAE |

Key companies profiled |

Medtronic; St. Jude Medical (Abbott); Boston Scientific Corporation; NeuroPace, Inc. Synapse Biomedical Inc., Aleva Neurotherapeutics SA; Nevro Corporation |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global brain implants market report on the basis of product, application, and region:

Product Outlook (Revenue, USD Million, 2016 - 2028)

Deep Brain Stimulator

Spinal Cord Stimulator

Vagus Nerve Stimulator

Application Outlook (Revenue, USD Million, 2016 - 2028)

Chronic Pain

Epilepsy

Parkinson’s Disease

Depression

Essential Tremor

Alzheimer’s Disease

Regional Outlook (Revenue, USD Million, 2016 - 2028)

North America

U.S.

Canada

Europe

Germany

U.K.

France

Italy

Spain

Asia Pacific

Japan

China

India

Australia

South Korea

拉丁美洲

Brazil

Mexico

Argentina

Colombia

Middle East and Africa (MEA)

South Africa

Saudi Arabia

UAE

Frequently Asked Questions About This Report

b.The global brain implants market size was estimated at USD 4.6 billion in 2020 and is expected to reach USD 4.9 billion in 2021.

b.The global brain implants market is expected to grow at a compound annual growth rate of 9.1% from 2021 to 2028 to reach USD 9.2 billion by 2028.

b.North America dominated the brain implants market with a share of 43.36% in 2019. This is attributable to high investment in R&D activities, the domicile of a large number of prominent market players, and frequent product approvals.

b.Some of the key players operating in the brain implants market include Boston Scientific; Medtronic; Abbott (St. Jude Medical); Nevro Corporation; NeuroPace Inc.; and NDI Medical LLC.

b.Key factors that are driving the brain implants market growth include the rising incidence of neurological disorders such as Parkinson’s, Alzheimer’s, epilepsy, depression, and essential tremors.

b.The deep brain simulators segment accounted for the highest revenue share of 37% in the brain implants market in 2020.

b.The Parkinson’s disease segment is expected to witness the fastest CAGR of 10.1% from 2021 to 2028 in the brain implants market.

b.Abbott secured U.S. FDA approval in September 2019 for its Proclaim XR recharge-free SCS system for the purpose of chronic pain management.

b.Some of the recent innovations and researches include self-charging implants and memory chips, which are expected to positively develop the brain implants market in the coming years.

b.Asia Pacific is anticipated to show considerable growth in the brain implants market in the coming years, owing to an increase in the prevalence of neurological disorders, growing awareness about treatments, and the presence of well-established healthcare infrastructure.