Cell And Gene Therapy Clinical Trials Market Size, Share & Trends Analysis Report By Phase (Phase I, II, III, IV), By Indication (Oncology, CNS), By Region (Asia Pacific, North America), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-409-7

- Number of Pages: 275

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry:Healthcare

Report Overview

The global cell and gene therapy clinical trials market size was valued at USD 7.3 billion in 2021 and is anticipated to exhibit a compound annual growth rate (CAGR) of 14.6% from 2022 to 2030. The market is majorly driven by an increase in R&D funding, rising patient demand for innovative therapies, growing interest in cell and gene therapies for cancer treatment, and a favorable regulatory environment. Cell and gene therapy (CGT) represents a new frontier in the fight against many deadly diseases, including rare genetic disorders and cancers. It represents the new wave of innovation in the life sciences industry. The COVID-19 pandemic reduced the number ofgene therapyclinical trials in the early 2020s as the majority of studies were focused on treating and diagnosing COVID-19.

In 2021, global data stated that the percentage of gene therapy clinical studies increased significantly as compared to previous years, as many researchers are now shifting their focus to gene therapy due to its potential in treating cancer and other rare diseases. This shift is expected to boost the market growth in the coming years. Patients can look forward to the next generation of cell & gene treatments as an alternate therapy choice or tailored medication. In addition, when compared to small-molecule drugs, these medications have a higher success rate. This is because CGT focuses on specific disease causes rather than broad targets like small-molecule treatment.

Between 2008 and 2018, CGT drugs had an R&D success rate of 11% from Phase I to launch, compared to 8.2% for small-molecule compounds. Substantial growth is happening in the size and sophistication of the companies entering the market. Many of the early movers in this market were small biotech startups. A significant interest was seen in the major biopharma firms. The majority of the large-sized pharmaceutical companies are now investing in CGT. For instance, Novartis, in December 2021, stated that it has signed an acquisition agreement with an ocular gene therapy company, Gyroscope Therapeutics.

This acquisition will strengthen Novartis’s position in ophthalmology gene therapy. Other noteworthy acquisitions include those of Kite Pharma by Gilead; Spark Therapeutics by Roche; and Celgene by Bristol-Myers Squibb. Interest in the CGT field has grown gradually since technological advancements in 2000. There were only about 20 FDA-approved Biologics License Applications (BLAs) for cell-based therapeutics in the 20 years, between 1997 and 2017. The FDA, in 2019, stated that it projects to approve 10 to 20 new BLAs for cell therapy products each year in the U.S. alone by 2025. The U.S. FDA has also improved the approval of CGT in recent years.

For instance, in May 2022, the FDA gave the third approval for CAR T Cell Therapy, developed by Penn Medicine for the treatment of relapsed or Refractory Follicular Lymphoma (FL) in adults. Such approvals are expected to increase the demand for research in CGT, thereby boosting the market growth. CGT is not only used in treating cancer but also has gained importance in treating COVID-19. The FDA approved BioCardia’s Investigational New Drug (IND) application in April 2022, allowing the company to initiate Phase I/II clinical trial of BCDA-04 in adults recovering from COVID-19-linked Acute Respiratory Distress Syndrome (ARDS). Such approvals are likely to support market growth.

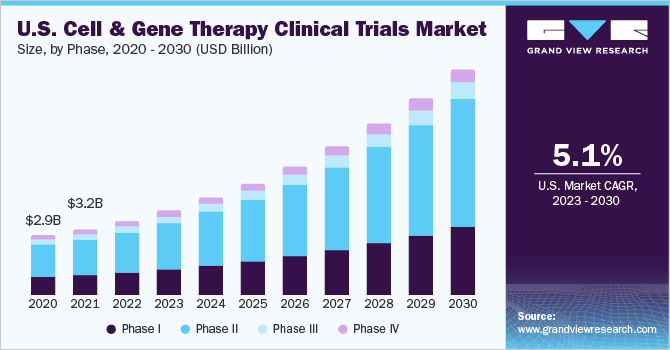

Phase Insights

On the basis of phases, the overall market has been further categorized into phase I, phase II, phase III, and phase IV. The phase II segment dominated the global market in 2021 and accounted for the largest share of more than 52.8% of the total revenue as the majority of cell and gene therapies are in this phase of the clinical trial. The segment is also expected to grow with the fastest growth over the forecast owing to increasing investments in R&D, a growing number of industry-sponsored and non-industry-sponsoredclinical trialsin phase II, and due to the complexities associated with phase II clinical trials.

Furthermore, the majority of cell and gene therapy studies are currently failing to reach later stages of studies. This further contributes to the largest share in the segment market. Phase 1 segment is expected to register a significant share in 2021. One of the main reasons for the segment’s rise is the effective translation of medicines from non-clinical projects into First-in-Human clinical trials. Though the vast majority of cell and gene therapy clinical trials are in phases I and II, the proportion of trials now in the late phase, including phase III and phase IV, is slightly improving. This is expected to enhance the market growth in the later phase of clinical studies.

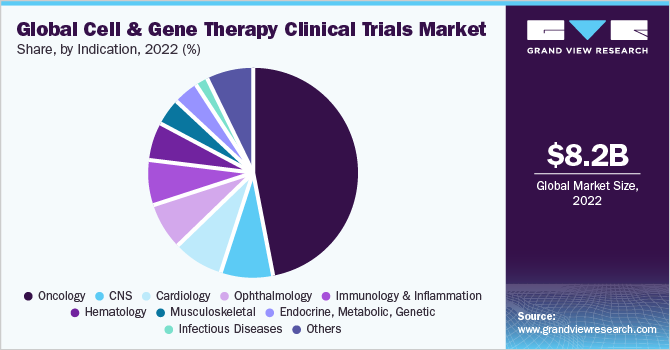

Indication Insights

On the basis of indications, the market is divided into oncology; cardiology; CNS; musculoskeletal; infectious diseases; dermatology; endocrine, metabolic, genetic; immunology & inflammation; ophthalmology; hematology; gastroenterology; and others. The oncology segment dominated the global market with a revenue share of more than 47.00% in 2021 and is anticipated to maintain its lead over the forecast period. As per the estimates of global data, in 2021, out of the total number of CGT clinical trials, the oncology segment alone consists of 1,375 ongoing trials. The investment in oncology highlights the importance of developing innovative and faster ways to deliver CGT clinical trials and addressing the challenges of scaling to commercialization.

In the early 2020s, the clinical studies for cancer were suspended owing to the spread of the COVID-19 pandemic globally. However, there has been significant growth in the clinical studies for cancer in 2021 and is expected to grow at a faster rate during the forecast period owing to the growing burden of cancer worldwide. Furthermore, the development of CAR-T cell therapies, such as Kymriah and Yescarta, as well as their success in treating hematological malignancies, has paved the way for increased investment in CGTs in oncology. Both biotech and pharmaceutical companies are investing globally in this approach to treat various types of cancer.

Regional Insights

North America accounted for the largest share of 48.3% of the global revenue in 2021 and is expected to maintain its lead during the forecast period. This is attributed to a favorable regulatory environment, especially in the U.S. The U.S. FDA has established a collaborative regulatory procedure for CGTs with early and steady engagement with the sponsor, along with special regulatory designations useful for many CGTs. In addition, the regulatory approval process in the U.S. is evolving and becoming favorable for vendors developing CGT products. The U.S. FDA is designating the orphan drug status, breakthrough designation, accelerated approvals, and RMAT designations for CGTs to expedite the approval process.

Asia Pacific is anticipated to expand at the fastest CAGR during the forecast period. A rising number ofbiotechnologyfirms in the Asia Pacific region are specializing in regenerative treatments. Moreover, with the constant growth of medical tourism centers like Thailand, Singapore, and India, the region is projected to maintain its place as the epicenter of cell research and therapy. Moreover, the recruitment for CGT clinical trials is increasing in Asia as compared to North America and Europe. This is due to the large patient pool & low trial cost; this further strengthens the Asia Pacific market.

Key Companies&Market Share Insights

The market is highly competitive, market players are undertaking numerous strategic initiatives, such as acquisitions, collaborations, and partnerships, to gain a greater market share. For instance, in January 2020, Charles River Laboratory acquired HemaCare Corp., a prominent player in the production of human-derived cellular products for the cell therapy market, for USD 380 million in cash. In April 2022, Labcorp, collaborated with, Xcell Biosciences, to support the company in developing CGTs for treating cancer, Parkinson’s, and other rare diseases.Some prominent players in the global cell and gene therapy clinical trials market include:

IQVIA

ICON Plc

Laboratory Corporation of America Holdings

Charles River Laboratories International, Inc.

PAREXEL International Corp.

Syneos Health

Medpace Holdings, Inc.

PPD Inc.

Novotech

Veristat, LLC

CellAndGene Therapy Clinical Trials Market Report Scope

Report Attribute |

Details |

Market Size value in 2022 |

USD 8.22 billion |

Revenue forecast in 2030 |

USD 24.5 billion |

Growth rate |

CAGR 14.6% from 2022 to 2030 |

Base year for estimation |

2021 |

Historical data |

2018 - 2020 |

Forecast period |

2022 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Phase, indication, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; India; Japan; China; South Korea; Australia; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE |

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

Key companies profiled |

IQVIA; ICON Plc; Laboratory Corporation of America Holdings; Charles River Laboratories International, Inc.; PAREXEL International Corp.; Syneos Health; Medpace, Holdings, Inc.; PPD Inc.; Novotech; Veristat, LLC |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cell and gene therapy clinical trials market report based on phase, indication, and region:

Phase Outlook (Revenue, USD Million, 2018 - 2030)

Phase I

Phase II

Phase III

Phase IV

Indication Outlook (Revenue, USD Million, 2018-2030)

Oncology

Cardiology

CNS

Musculoskeletal

Infectious Diseases

Dermatology

Endocrine, Metabolic, Genetic

Immunology & Inflammation

Ophthalmology

Hematology

Gastroenterology

Others

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

U.K.

Germany

France

Italy

Spain

Asia Pacific

Japan

China

India

Australia

South Korea

Latin America

Brazil

Mexico

Argentina

Colombia

Middle East & Africa

South Africa

Saudi Arabia

UAE

Frequently Asked Questions About This Report

b.The global cell & gene therapy clinical trials market size was estimated at USD 7.3 billion in 2021 and is expected to reach USD 8.2 billion in 2022.

b.The global cell & gene therapy clinical trials market is expected to grow at a compound annual growth rate of 14.6% from 2022 to 2030 to reach USD 24.5 billion by 2030.

b.The Phase II segment led the global cell & gene therapy clinical trials market and accounted for more than 52.9% in 2021.

b.The oncology segment dominated the global cell & gene therapy clinical trials market with a share of 47.0% in 2021.

b.North America dominated the cell & gene therapy clinical trials market with a share of 48.3% in 2021. The U.S. FDA has established a collaborative regulatory procedure for CGTs with early & steady engagement with the sponsor, along with special regulatory designations useful for many CGTs.

b.Some key players operating in the cell & gene therapy clinical trials market include IQVIA; ICON Plc; Laboratory Corporation of America Holdings; Charles River Laboratories International, Inc.; PAREXEL International Corporation; Syneos Health; Medpace, Holdings, Inc.; PPD Inc.; Novotech; Veristat, LLC. Market players are undertaking numerous strategic initiatives such as acquisition, collaborations, & partnership to gain market share.

b.关键因素推动了细胞和基因席拉py clinical trials market growth are an increase in R&D funding, rising patient demand for innovative therapies, growing interest in cell & gene therapies for cancer treatment as well a favorable regulatory environment.