中美洲和南美洲土工合成材料市场规模,乐鱼体育手机网站入口Share & Trends Analysis Report By Application (Road & Pavements, Rail Roads, Drainage Systems, Others), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-056-8

- Number of Pages: 198

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Advanced Materials

Report Overview

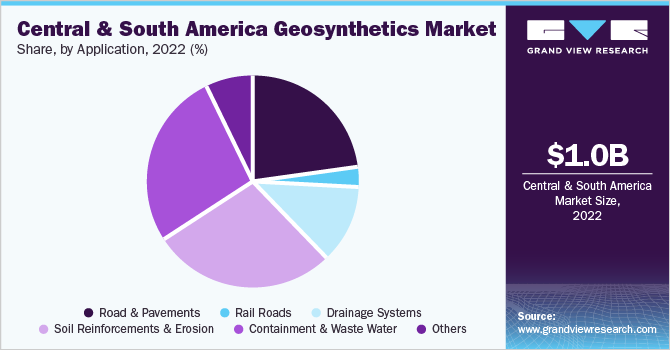

TheCentral & South America geosynthetics marketsizewas estimated atUSD 1.03 billion in 2022, growing at a compound annual growth rate (CAGR) of 6.1% from 2023 to 2030.This growth is attributed to the growing applications of geosynthetics in infrastructural applications such as the construction of railroads and roadways.

巴西是一个主要的发展中国家the Central & South American region. Some of the major industries contributing to the country’s economic growth include automobile, oil & gas, agriculture, construction, iron & steel, and machinery & equipment. The construction industry in Brazil is anticipated to witness significant growth on account of increasing efforts taken by the government to revive the economy, followed by improvement in consumer and investor confidence. In addition, the recovery of oil prices is expected to improve the ability of the government to invest in massive infrastructure construction projects, thereby augmenting the demand for geosynthetics over the forecast period for providing high tensile strength to the structures.

Rising developments in waste management, mining, transportation, and water resources in Brazil are likely to fuel the demand for geosynthetics over the forecast period. The growth in the Brazilian construction industry is likely to open new avenues for the growth of the market in the next few years. A rise in hydraulic fracturing activities and a lack of proper waste management methods in the country are likely to promote the demand for geosynthetics, especiallygeotextilesandgeomembranes, over the forecast period.

Geosynthetics are used for base reinforcement, separation, and stabilization of roads and pavements. These products also find applications in subsurface drainage systems for dewatering, road base, and structure drainage. Geotextiles are used to strengthen industrial units, car parks, and new roadways. The incorporation of geosynthetics entails sustainable development, a small volume of earthwork, low carbon footprint, and an increased rate of construction.

Increasing infrastructural activities in Central & South America are likely to boost the use of geomembranes, geogrids, and geotextiles. Water and waste management are expected to remain the promising application segments for geomembranes in the region owing to the high prevalence of the offshore oil & gas industry in Brazil, Venezuela, and Argentina. In addition, the robust mining base in Chile, Brazil, Peru, and Colombia is likely to increase the need for wastewater treatment, thereby fueling the demand for geomembranes in the forecast period.

Rising developments in waste management, mining, transportation, and water resources in Brazil are likely to fuel the demand for geosynthetics over the forecast period. The growth in the Brazilian construction industry is likely to open new avenues for the growth of the market in the next few years. A rise in hydraulic fracturing activities and a lack of proper waste management methods in the country are likely to promote the demand for geosynthetics, especially geotextiles and geomembranes, over the forecast period.

Geotextiles are susceptible to blockage by organic residues, sediments, fungi, algae, plant roots, slimes, and viscous petrochemical compounds when utilized in drainage applications. In the riding arenas, geotextile may break down due to organic riding surfaces such as bark or shredded timber and may also form impervious bio-detritus coating due to horse and pony droppings.

Geosynthetics are susceptible to being ripped off if the overlying layer above is displaced or too shallow. This ripping may permanently damage the sheet. Such problems of blocking, clogging, and ripping may require frequent changing of geotextile sheets, thus, posing a challenging factor for the growth of the market.

Application Insights

的基础上应用,土壤reinforcement & erosion segment led the market with a revenue share of 27.9% in 2022. The segment is further forecasted to grow at a compound CAGR of 6.0% till 2030. Geogrids and geotextiles are used for soil reinforcement as they prevent the intermixing of the soil and piping. In addition, they help preserve the strength of the construction aggregate.

Soil erosion is a significant problem as it leads to loss of land, slope instability, and loss in reservoir capacity due to silting. Geocells and geogrids play an essential role in shore protection and vegetative growth. The growing construction industry in Argentina and Brazil will likely increase the demand for geosynthetics in soil reinforcement soon.

铁路应用程序段是预测to expand at the fastest CAGR of 7.1% over the coming years. Geotextiles are used in railroads as they act as separators & filters and help in the transmission of water through lateral drainage. Geosynthetics are incorporated for the reinforcement of tracks for stress reduction, which ensures long-term performance.Geosyntheticsolutions are required for various applications such as track-bed separation, slope erosion control, structural drainage, embankment stabilization, tunnel drainage, and access road reinforcement in rail construction projects.

Geosynthetics are widely used in a variety of engineering applications around the world. Their adaptability and ease of construction have aided in the design and construction of several geotechnical projects. Drainage geotextiles are mainly used in the developing regions of Central & South America to improve the efficiency of drainage systems and increase their life span. In addition, the demand for geotextiles in developing economies is on the rise owing to infrastructural development, including drainage system development, which is expected to drive the market. Geotextiles provide economic and environmental benefits through the replacement of traditional drainage layers and granular filters, thereby driving the market.

Groundwater protection is a major consideration during the design of waste containment facilities. Geosynthetics are used for the protection of groundwater owing to their cost-effectiveness and easy installation with good hydraulic properties. Geosynthetic clay liner (GCL) is incorporated as base liners for preventing the migration of hazardous chemicals into the surrounding environment. Increasing the application of geomembranes and geosynthetic clay liners in the heap leaching process during mining for liquid containment and leak detection at the site is likely to drive the market in the near future.

Regional Insights

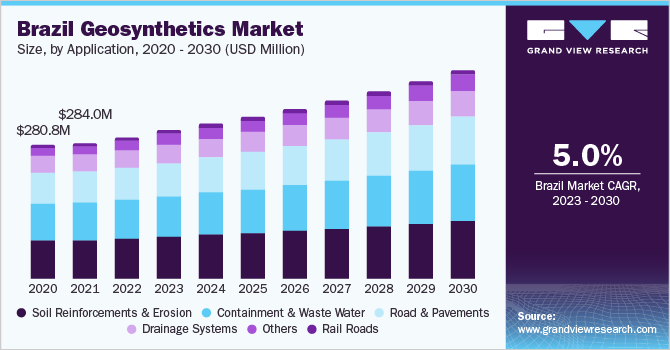

Brazil dominated the regional segment with the highest revenue share of 28.5% in 2022 and is expected to expand at a CAGR of 5.0% till 2030. Brazil is one of the major developing countries in the Central & South American region. Some of the major industries contributing to the country’s economic growth include automobile, oil & gas, agriculture, construction, iron & steel, and machinery & equipment. The construction industry in Brazil is anticipated to witness significant growth on account of increasing efforts taken by the government to revive the economy, followed by improvement in consumer and investor confidence.

In addition, the recovery of oil prices is expected to improve the ability of the government to invest in massive infrastructure construction projects, thereby augmenting the demand for geosynthetics over the forecast period for providing high tensile strength to the structures. Rising developments in waste management, mining, transportation, and water resources in Brazil are likely to fuel the demand for geosynthetics over the forecast period.

Central & South American countries such as Brazil, Peru, and Argentina have started economic revival as manufacturing net exports have returned to the pre-pandemic levels. Factors such as the influx of remittances, increasing food costs, and effective governmental assistance in terms of economic aid have helped economies improve their GDP growth. However, natural catastrophes pose an additional threat to regional development. For instance, the destruction caused by hurricanes Eta and Iota in November 2020.

Panama is expected to be the fastest-growing market for geosynthetic in the Central & South American region, with a compound annual growth of 7.1% till 2030. Increasing infrastructural activities in Central & South America are likely to augment the use of geomembranes, geogrids, and geotextiles. Water & waste management are expected to remain the promising application segments for geomembranes in the region owing to the high prevalence of the offshore oil & gas industry in Brazil, Venezuela, and Argentina. In addition, robust mining base in Chile, Brazil, Peru, and Colombia is anticipated to increase the need for wastewater treatment, thereby fueling the demand for geomembranes over the forecast period.

Key Companies & Market Share Insights

The Central & South America geosynthetic market is characterized by the presence of a large number of global and regional players leading to an intense competitive rivalry. Companies have adopted various growth strategies, such as product launches, partnerships, mergers, and agreements, to increase their market shares and enhance their product and service portfolios.

Key market players are engaged in the production of a variety of geosynthetic products, including geotextiles, geomembranes, geogrids, geonets, and geocells. Multiple investments in infrastructure developments along with increasing concerns regarding waste and water management in the region, are driving the product demand in the region. The industry participants face intense competition from international players as well as from regional players with strong distribution networks and know-how about suppliers and regulations. Some prominent players in the Central & South America geosynthetics market include:

AGRU America, Inc.

SOLMAX

HUESKER Group

Minerals Technologies Inc.

Concrete Canvas Ltd

Officine Maccaferri SpA

NAUE GmbH & Co. KG

Raven Industries, Inc.

Strata Systems, Inc.

The Best Project Material Co., Ltd. (BPM)

Central & South America Geosynthetics Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 1.09 billion |

Revenue forecast in 2030 |

USD 1.66 billion |

Growth rate |

CAGR of 6.1% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Volume in million square meters, revenue in USD Billion and CAGR from 2023 to 2030 |

Report coverage |

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Application, region |

Regional scope |

Central & South America |

Country scope |

Brazil; Argentina; Chile; Colombia; Ecuador; Peru; Panama |

Key companies profiled |

AGRU America, Inc.; SOLMAX; HUESKER Group; Minerals Technologies Inc.; Concrete Canvas Ltd; Officine Maccaferri SpA; NAUE GmbH & Co. KG; Raven Industries, Inc.; Strata Systems, Inc.; The Best Project Material Co.; Ltd. (BPM) |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Central & South America Geosynthetics Market Report Segmentation

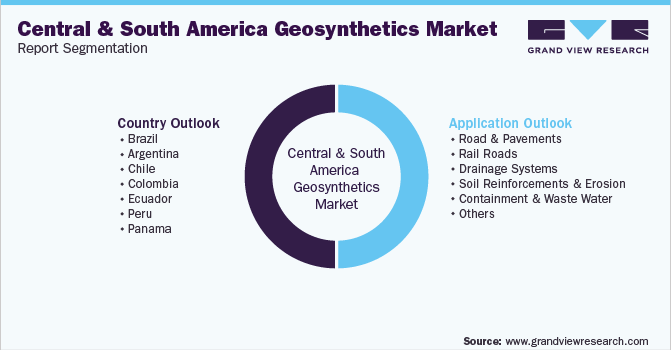

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Central & South America geosynthetics market on the basis of application and region:

Application Outlook (Volume, Million Square Meters, Revenue, USD Million; 2018 - 2030)

Road & Pavements

Rail Roads

Drainage Systems

Soil Reinforcements & Erosion

Containment & Waste Water

Others

Regional Outlook (Volume, Million Square Meters, Revenue, USD Million; 2018 - 2030)

Central & South America

Brazil

Argentina

Chile

Colombia

Ecuador

Peru

Panama

Frequently Asked Questions About This Report

b.The Central & South America geosynthetics market size was estimated at USD 1.03 billion in 2022 and is expected to reach USD 1.09 billion in 2023.

b.The Central & South America geosynthetics market is expected to grow at a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 1.66 billion by 2030.

b.The soil reinforcement & erosion application segment led the market and accounted for a revenue share of 27.9% in 2022, due to the growing soil conservation projects in various countries across Latin America.

b.Some of the key players operating in the Central & South America geosynthetics market include AGRU America, Inc., SOLMAX, HUESKER Group, Minerals Technologies Inc., Concrete Canvas Ltd, Officine Maccaferri SpA, NAUE GmbH & Co. KG, Raven Industries, Inc., Strata Systems, Inc., and The Best Project Material Co., Ltd. (BPM).

b.Increasing infrastructural development & construction activities in Central & South America is propelling the demand for geosynthetics including geomembranes, geogrids, and geotextiles in the market.