Cleanroom Robots In Healthcare Market Size, Share & Trends Analysis Report By Type (Traditional Industrial Robots, Collaborative Robots), By Component (Robotic Arms, Motors), By End Use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-915-2

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry:Healthcare

Report Overview

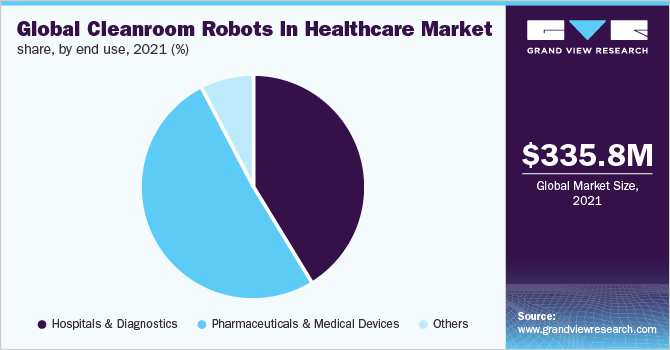

The global cleanroom robots in healthcare market size was valued at USD 335.8 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 26.4% from 2022 to 2030. The pharmaceutical andbiotechnology行业面临挑战contamination, which compromise the safety and quality of the entire process. In order to improve safety and quality, Advanced Aseptic Processing (AAP) systems have been adopted in these industries that use automation,machine learning, and robotics.

The COVID-19 pandemic has drastically impacted the world, especially hospitals due to the patient burden and risk of spreading the virus. To combat the spread of the virus amongst doctors, hospital staff, and patients, healthcare centers have been extra attentive to their contamination control protocols. Along with the HEPA filters, hospitals have been usingcleanroom technologyto contain the virus in the hospital for protection. Hospitals, pharmaceutical manufacturing companies, and biotechnology companies always rely on cleanroom technology to control contamination. However, the COVID-19 has made it more evident as cleanroom technology improves contamination control.

制药生产单位的风险contamination remains the most challenging factor for aseptic drug manufacturing. It is well known that human technicians or operators are the biggest sources of contamination in cleanrooms. Hence, the future of aseptic processing lies in the automated systems that help eliminate human intervention. Therefore, this realization is likely to contribute to the growing demand for robots in cleanrooms.

Robots provide flexibility, which is a significant advantage over traditional aseptic settings. In addition, they can be reprogrammed in case an application or container formats change. These robots are fully adaptable and require minimal investment. Robotic integration in healthcare is gaining ground currently, especially in the packaging processes for ready-to-use containers including vials,syringes, and cartridges. Robotic solutions offer pharmaceutical manufacturers a faster, cost-effective, and flexible method of filling different containers, in response to the growing demand for customized packaging, small batches, and product changeovers altogether with minimal manual intervention during the filling process.

The conventional automation processes are suited for operations with larger volumes and few changes. On the other hand, robotic automation systems designed for cleanrooms enable various types of operations in multiple container formats such as syringes and vials. In cleanroom settings, robots can perform repetitive tasks, enabling smoother operations without human intervention.

Regulatory authorities have expressed their support for automation technology to limit manual interventions. In 2021, International Society for Pharmaceutical Engineering Aseptic Conference, the FDA representatives reiterated the need to reduce the contamination risk in the drug manufacturing processes with the help of automation and robotics. The acceptance by regulatory authorities and pharmaceutical manufacturers is anticipated to drive innovations in cleanroom robotics.

Type Insights

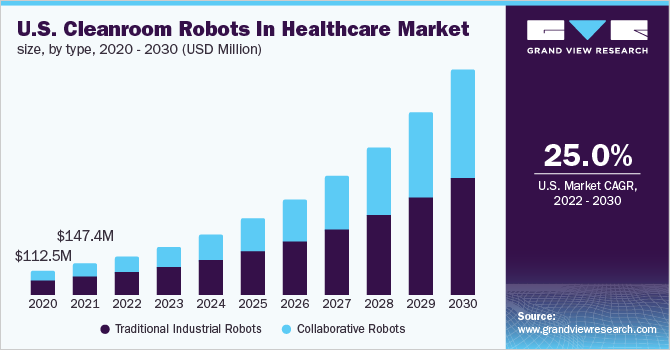

The traditional industrial robots segment dominated the market with a revenue share of over 60.0% in 2021.Industrial robotsare extensively useful in intensive production operations that require continuous movements. These robots are generally heavy and are placed in fixed positions to perform repetitive tasks. Industrial robots are designed in a way to work automatically, hence they are used in the manufacturing of drugs and medicines, wherein constant execution is the priority.

The collaborative robots segment is likely to grow at the fastest rate from 2022 to 2030. The collaborative robots are designed to work interactively with humans. They offer benefits such as rapid installation, reduced production costs, space-saving, flexibility, and improved safety in the workspace. Based on type, the market is segmented into traditional industrial robots and collaborative robots.

Component Insights

In 2021, the robotic arms segment dominated the market for cleanroom robots in healthcare and held a revenue share of over 45.0%. The armed operations of robots are the most crucial task for the working and functioning of the robots in cleanroom environments. Based on component, the market is segmented into robotic arms, drives, end effectors, controllers, power supply,sensors, motors, and others.

The motors segment is likely to register the fastest growth rate over the forecast period owing to the importance of technical components required for smooth robotic operations. The robots rely on motors for the working mechanism. These robots are independently monitored and are mainly equipped with motorized stands, which are connected to the monitor.

End-use Insights

In 2021, the pharmaceuticals and medical devices segment dominated the market for cleanroom robots in healthcare with a revenue share of over 50.0%. This is attributed to the higher adoption of robots in the cleanroom settings in the manufacturing companies due to the contamination control benefits. Based on end-use, the market is segmented into hospitals and diagnostics, pharmaceuticals and medical devices, and others.

The hospitals and diagnostics end-use segment is anticipated to grow at the fastest rate of 28.2% over the forecast period. The cleanroom robots played an instrumental role in dealing with COVID-19 patients as they were used for isolating the patients to slow down the spread of the coronavirus virus. This factor is expected to positively impact the growth of the segment in the years to come.

Regional Insights

In 2021, North America dominated the market with a revenue share of over 45.0% owing to the growing adoption of robotics and artificial intelligence-based solutions in the healthcare sector and the increasing number of market players in the region. Moreover, increased COVID-19 cases in the region and vaccination demands further boosted the demand for robots in cleanrooms.

Asia Pacific is projected to witness promising growth from 2022 to 2030. This growth can be attributed to the increase in the number of healthcare providers, high unmet needs, booming economy, and overall improving healthcare infrastructure, especially in developing countries such as China and India. In addition, the supportive government initiatives towards robotics and AI-based solutions, along with the higher adoption of robotics in the healthcare sector, is contributing to the market growth in the region.

Key Companies & Market Share Insights

The rapidly evolving robotic technology and the supportive government initiatives are further encouraging the market players to focus significantly on research and development activities to develop innovative products. Moreover, the significant growth in the number of companies offering state-of-the-art robots with updated features for usage in cleanrooms is further contributing to the growth of the cleanroom robots market in healthcare.

In the coming years, the manufacturers in the robotic technology industry are most likely to rely on collaborations, mergers, and acquisitions to strengthen their market positions. For instance, Teradyne, a test solutions provider based in the U.S., acquired Universal Robots in 2015 and Energid Technologies in 2018. In addition, the company acquired Danish MiR (Mobile Industrial Robots) in 2018. The acquisitions helped the company in widening its portfolio of advanced automation solutions. Some prominent players in the global cleanroom robots in healthcare market include:

ABB Ltd.

Denso Corporation

FANUC Corporation

Kawasaki Heavy Industries, Ltd.

Yaskawa Electric Corporation

Aerotech, Inc.

Nachi Fujikoshi Corporation

Cleanroom Robots In Healthcare Market Report Scope

Report Attribute |

Details |

Market size value in 2022 |

USD 411.3 million |

Revenue forecast in 2030 |

USD 2.69 billion |

Growth rate |

CAGR of 26.4% from 2022 to 2030 |

Base year for estimation |

2021 |

Historical data |

2017 - 2020 |

Forecast period |

2022 - 2030 |

Quantitative units |

Revenue in USD million & CAGR from 2022 to 2030 |

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors & trends |

Segments covered |

Type, component, end-use, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Russia; Japan; China; India; Australia; South Korea; Singapore; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE |

Key Companies Profiled |

ABB Ltd.; Denso Corporation; FANUC Corporation; Kawasaki Heavy Industries, Ltd.; Yaskawa Electric Corporation; Aerotech, Inc.; Nachi Fujikoshi Corporation |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global cleanroom robots in healthcare market report based on type, component, end-use, and region:

Type Outlook (Revenue, USD Million, 2017 - 2030)

Traditional Industrial Robots

Collaborative Robots

Component Outlook (Revenue, USD Million, 2017 - 2030)

Robotic Arms

End Effectors

Drives

Controllers

Sensors

Power Supply

Motors

Others

End-use Outlook (Revenue, USD Million, 2017 - 2030)

Hospitals & Diagnostics

Pharmaceuticals & Medical Devices

Others

Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Europe

U.K.

Germany

France

Italy

Spain

Russia

Asia Pacific

Japan

China

India

Australia

South Korea

Singapore

拉丁美洲

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

UAE

Frequently Asked Questions About This Report

b.The global cleanroom robots in healthcare market size was estimated at USD 335.8 million in 2021 and is expected to reach USD 411.3 million in 2022.

b.The global cleanroom robots in healthcare market is expected to grow at a compound annual growth rate of 26.4% from 2022 to 2030 to reach USD 2.69 billion by 2030.

b.The traditional industrial robots segment dominated the cleanroom robots in healthcare market with a share of 60.8% in 2021.

b.Some key players operating in the cleanroom robots in healthcare market include ABB Ltd; Denso Corporation; FANUC Corporation; and Aerotech, Inc

b.Key factors that are driving the cleanroom robots in healthcare market growth include a growing number of challenges in terms of contamination faced by pharmaceutical and biotechnology industries which compromise the safety and quality of processes.