Clinical Trial Imaging Market Size, Share & Trends Analysis Report By Services (Clinical Trial Design And Consultation Services, Reading And Analytical Services), By End Use, By Application, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-2-68038-628-8

- Number of Pages: 111

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry:Healthcare

Report Overview

The global clinical trial imaging market size was estimated at USD 851.8 million in 2021and is expected to expand at a compound annual growth rate (CAGR) of 8.7% from 2022 to 2030. Mounting biotechnology and pharmaceutical industries combined with increased research and development investments for developing new drugs to treat diseases is expected to drive the market industry growth. Medical imaging plays an active role in the clinical development of novel life science products. Although the medical imaging industry is in a constant state of fluctuation, thebiotechnology和制药行业继续increase. This can be attributed to the enhanced investment in medical imaging companies and mergers and acquisitions, supported by the adoption of innovative imaging technologies to support clinical trials for medical devices.

然而,机械的高成本和本月allations, and the enormous cost of clinical trials may limit the market growth during the forecast period. Advancements in technology are bringing substantial improvements to the collection, evaluation, and submit clinical trial imaging data. Technology-enabled imaging, especially image analysis software, provides various benefits to clinical studies such as consistency, data accuracy, adaptability as well as compliance. For instance, image analysis software is used to direct and manage a reader via analysis of imaging time points.

The outbreak of COVID-19 has adversely impacted the healthcare system in most countries, leading to a disruption in medical studies, research activities, and reduced sponsorship for research involving clinical trials. The pandemic has hampered the clinical trial timeline as numerous ongoing studies were delayed and planned studies were canceled. Unfavorable changes in regulations and guidelines, supply chain disruption, recruitment challenges for clinical trials, fear of viral spread, and shutting down of most manufacturers during lockdown have also adversely impacted the market. However, the introduction of virtual imaging trials during the COVID-19 pandemic is expected to open new avenues for the adoption of these devices. The development of advanced computational models helps has helped in better assessment of CT and radiography images which are expected to help in the early diagnosis of COVID-19 in patients. The clinical trial imaging market is said to bounce back by 2022 Q2, supported by the rise in R&D activities and improvement in supply and distribution channels.

Increased use of imaging technology along with the enhanced power of computing is expected to drive the usage of imaging in clinical trials. The Quantitative Imaging Biomarkers Alliance (QIBA) protocol has come up with standardized methods and imaging procedures with uniform procedures to be implemented for attaining statistical and precise endpoints in clinical trials.

For improving image assessment and capturing, numerous technology patents have been filed. Also, patented technologies are being provided by the imaging core lab players that are expected to aid the pharmaceutical companies in minimizing development timelines. For instance, a reading tool named Assessa, by IXICO aids in improved decision-making in clinical trials for diseases associated with memories such as schizophrenia, Parkinson’s, and Alzheimer’s disease, and neurological disorders like dementia and cognitive impairment.

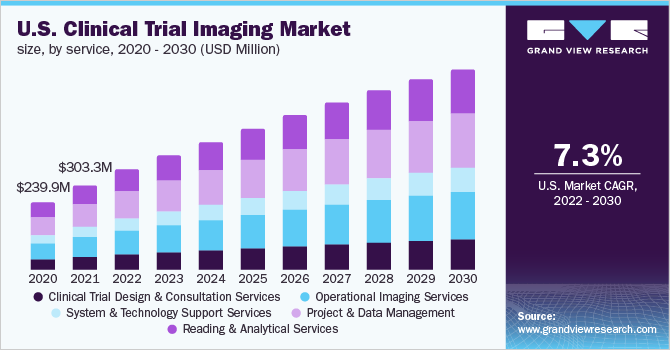

Service Insights

Project and Data Management Services dominated the market with 29.0% of the market share in 2021. Clinical trials that employ imaging typically require data management and workflow integration across several parties. These services include operational expertise & trial workflow development, tracking project, converting scans into digital images, regulatory control & quality assurance, real-time trial status report, setup & management of MRI centers, data management, and reporting & issue resolution. The U.S. government approved a cloud-based server that protects all the medical imaging records, such as annotated & base images, and secures reports from any natural disaster, and facilitates faster & easy retrieval.

Operational imaging services also held a significant share in the market. Operational imaging services include imaging modalities such asMRI,CT, ultrasound, OCT, PET, and SPECT for various therapeutic applications, such as neurology, oncology, cardiovascular diseases, gastroenterology, & musculoskeletal disorders, and medical devices to carry out theclinical trials. Imaging techniques are widely used in clinical trials to provide evidence for decision-making. The Food and Drug Administration Modernization Act (FDAMA) of 1997 allowed for imaging modalities to be used as a product development tool in medical devices or pharmaceutical clinical trials, by permitting data generated through imaging modalities to be included in regulatory submissions.

Application Insights

Nonalcoholic Steatohepatitis (NASH) is expected to grow at the fastest CAGR of 8.4% during the forecasted period. The growing burden of NASH due to the increasing prevalence of the disease is expected to drive segment growth. Studies suggest that the global prevalence of NASH is 25.24%, with the highest in the Middle East and South America and the lowest in Africa. Prevalence for the same is expected to increase to 63.0% by 2030, driving the need for its treatment. Therefore, to meet the demand, companies are focusing on enhancing clinical trial studies to assess the effectiveness of therapies used for NASH.

Cardiovascular diseases held a significant share in the market. Cardiovascular diseases are one of the leading causes of death in the U.S. According to the CDC, around 647,000 Americans die yearly from cardiovascular diseases. Therefore, to lower the risk, various clinical trials are being conducted in the field of cardiology. However, the cost of developing drugs and devices in the field of cardiology is high, which impacts the growth of clinical trials in this field. Market players, such as ICON, follow a data-driven approach to developing strategies that can cut the cost and time for trials.

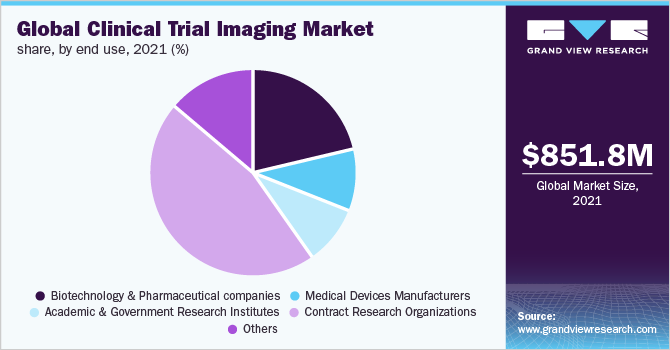

End-use Insights

The Contract Research Organizations (CROs) segment accounted for the largest share of 46.2% in 2021. This significant market share can be attributed to the snowballing cost of drug development along with the increased Research & Development activities. Additionally, mounting demand by the biotechnology and pharmaceutical companies for the outsourcing of research and development activities to reduce expenses is driving the market growth. Moreover, contract research outsourcing collaborations offer cutting-edge services. Therefore, government organizations prefer the handover of projects to the CROs.

The biotechnology and pharmaceutical segment is expected to emerge as a significantly growing segment over the forecasted period. The factor attributing to the fast growth of this segment is the need to develop new drugs and therapies to cure chronic diseases. The rise in the number of biotechnology and pharmaceutical companies is making it necessary for the manufacturers to provide the best possible medicine/drug to the end-user as competition is striking the companies. A large number of innovative drug discoveries are being done by biotechnology and pharmaceutical companies and the need for clinical trial imaging is expected to increase, ultimately fueling the market growth.

Regional Insights

北美国a dominated the global market with over 40.7% share of the global clinical trial imaging market in 2021. This can be attributed to the presence of big outsourcing companies and an increase in R&D in the region. Various factors such as the increasing geriatric population along with growing chronic diseases are anticipated to drive the market in North America. North America performs the highest number of clinical trials. In addition, most outsourcing activities are from North America. Cost is another factor contributing to the outsourcing of clinical trials to other research organizations.

The Europe clinical trial imaging market is driven by factors such as the rapidly growing geriatric population and the increasing prevalence of chronic diseases such as Parkinson’s, Huntington’s, and Alzheimer's, which are driving the adoption of the clinical trial in this region. In addition, the research laboratories are looking to reduce operational costs, which is leading to the adoption of imaging in clinical trials. Around 4,000 clinical trials of medicines are approved annually in the European Union (EU). The majority of these trials are conducted in Western European countries, but the number of clinical trials of medicines in this region is observed to be decreasing. The clinical trial imaging market in Asia Pacific is anticipated to exhibit the fastest growth during the forecast period. This can be attributed to the rapid growth of the regional population, increased R&D activity in this region, and the growing need for improved therapies.

Key Companies & Market Share Insights

Some of the key players in this market are Parexel International Corporation, Intrinsic Imaging, Bioclinica, and ICON plc. These market players are focusing on growth strategies such as mergers & acquisitions as well as signing contracts. In February 2020, ICON plc acquired MedPass International, a European medical devices CRO, reimbursement, and regulatory consultancy. This acquisition has reportedly helped in the expansion of the medical device and diagnostic research services of ICON in Europe.

In a similar context, in June 2018, Bioclinica introduced the SMART technology suite available with Medical Imaging, Interactive Response Technology (IRT), and Electronic Data Capture (EDC) to submit, manage, investigate, report & transfer medical image data compliant with universal data privacy and global requirements. Some of the prominent players in the global clinical trial imaging market include:

IXICO plc

Navitas Life Sciences

Resonance Health

ProScan Imaging

Radiant Sage LLC

Medpace

Biomedical Systems Corp

Cardiovascular Imaging Technologies

Intrinsic Imaging

BioTelemetry

ClinicalTrialImaging Market Report Scope

Report Attribute |

Details |

Market size value in 2022 |

USD 1.01 billion |

Revenue forecast in 2030 |

USD 1.97 billion |

Growth Rate |

CAGR of 8.7% from 2022 to 2030 |

Base year for estimation |

2021 |

Historical data |

2018 - 2020 |

Forecast period |

2022 - 2030 |

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

服务,应用程序,最终用途、地区 |

Regional scope |

北美国a; Europe; Asia Pacific; Latin America; MEA |

Country scope |

美国;加拿大;英国;德国;法国;意大利;西班牙;Japan; China; India; Thailand; South Korea; Brazil; Mexico; Colombia; Argentina; South Africa; Saudi Arabia; UAE |

Key companies profiled |

IXICO plc; Navitas Life Sciences; Resonance Health; ProScan Imaging; Radiant Sage LLC; Medpace; Biomedical Systems Corp; Cardiovascular Imaging Technologies; Intrinsic Imaging; BioTelemetry |

Customization scope |

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

SegmentsCovered in theReport

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global clinical trial imaging market on the basis of service, application, end-use, and region:

Service Outlook (Revenue, USD Million, 2018 - 2030)

Clinical Trial Design and Consultation Services

Reading and Analytical Services

Operational Imaging Services

Computed Tomography (CT) ScanMRI (Magnetic Resonance Imaging)

X-Ray

Ultrasound

Optical Coherence Tomography (OCT)

Others

System and Technology Support Services

Project and Data Management

Application Outlook (Revenue, USD Million, 2018 - 2030)

NASH

CKD

Diabetes

Cardiovascular Diseases

Others

End-use Outlook (Revenue,USD Million,2018 - 2030)

Biotechnology and Pharmaceutical companies

Medical Devices Manufacturers

Academic and Government Research Institutes

Contract Research Organizations (CROs)

Others

Regional Outlook (Revenue,USD Million,2018- 2030)

北美国a

U.S.

Canada

Europe

U.K.

Germany

France

Italy

Spain

Asia Pacific

India

China

Japan

Thailand

- South Korea

Latin America

Brazil

Mexico

Argentina

Colombia

Middle East & Africa

South Africa

Saudi Arabia

UAE

Frequently Asked Questions About This Report

b.The global clinical trial imaging market size was estimated at USD 851.8 million in 2021 and is expected to reach USD 1.1 billion in 2022.

b.The global clinical trial imaging market is expected to grow at a compound annual growth rate of 8.7% from 2022 to 2030 to reach USD 1.97 billion by 2030.

b.计算机断层扫描(CT)扫描服务rgest segment in 2021. The growth of the segment can be attributed to the extensive advantages CT offers such as the study of drug activity and screenings for injuries, cancer (tumors), and abnormalities inside the body.

b.Some key players operating in the clinical trial imaging market include IXICO plc, Navitas Life Sciences, Resonance Health, ProScan Imaging, Radiant Sage LLC, Medpace, Biomedical Systems Corp, Cardiovascular Imaging Technologies, Intrinsic Imaging, BioTelemetry

b.Growing pharmaceutical and biotechnology companies coupled with increasing investments in the field of R&D for developing new drugs to cure diseases is one of the key trends escalating market growth. In addition, a rising number of contract research organizations (CROs) are providing an upthrust to the clinical trial imaging market.