Containerboard Market Size, Share & Trends Analysis Report By Material (Recycled, Virgin), By End-use (Food & Beverage, Consumer Goods, Industrial), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-143-4

- 页数:98

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Advanced Materials

Containerboard Market Size & Trends

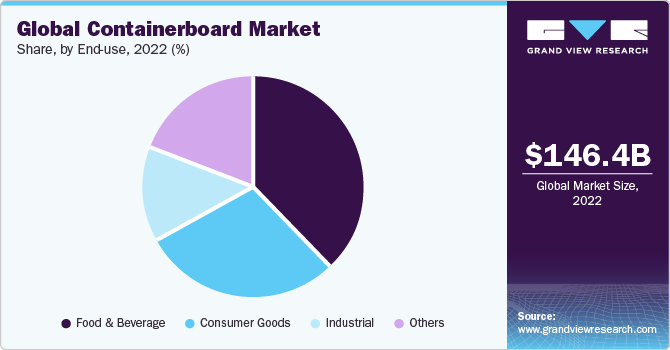

The globalcontainerboard market size was estimated at USD 146.38 billion in 2022,预计年复合增长的恶性肿瘤h rate (CAGR) of 2.8% from 2023 to 2030. The market is expected to be driven by rising demand for packaging materials that are lightweight and sustainable. Containerboard is derived from renewable resources and can be recycled after use. They possess characteristics such as strong, lightweight, and flexible. They are used in various industries such as food & beverage, consumer goods, industrial sector, agriculture, medical, and e-commerce for packaging.

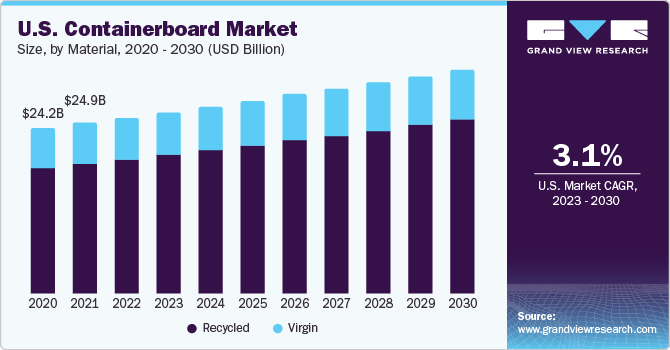

The U.S. containerboard market is expected to grow at a significant rate over the forecast period owing to the growth of end-use industries such as e-commerce, and food & beverage. For instance, the growinge-commercesector owing to the rising trend of online shopping is creating increased demand for corrugated boxes. This, in turn, is fueling the growth of the industry in the country. In addition, the rising trend of sustainable packaging is further boosting the market growth.

The formation of a containerboard with multiple layers of paper makes it highly durable and strong. The lightweight property of the containerboard helps in reducing the overall shipping cost. In addition, the ability of the product to offer protection & cushioning while transportation is further increasing its demand for transporting delicate and electronic products of industries such as food & beverage and consumer goods.

Corrugated medium and linerboard make up two basic components of the containerboard industry. The linerboard was created from virgin fiber and called a kraft liner, while the term testliner refers to a linerboard made from recycled fibers. Depending on the type of pulp utilized, the corrugated medium might be virgin, semi-chemical, or recycled. The creation of containerboard uses more than 50% of the recovered fiber that is used to makepaper & paperboard, according to the American Forest and Paper Association.

High-quality graphic printing is possible on containerboard, thereby, making it an ideal option for packaging used for marketing and branding purposes. Furthermore, it is anticipated that further technological developments in the field of digital printing will lead to a number of possible business opportunities for the market players. In addition, it is projected that the expanding demand for high-volume liners and post-print products coupled with the growing use of advanced processes is further expected to expand the market potential over the coming years.

The value chain of the market consists of raw material suppliers, manufacturers, distributors, and end-users. The strength of the product highly depends upon the quality of the raw material used. Major raw material required for the production of containerboard includes recycled paper and wood fiber. Furthermore, the value is added at the time of the production process by applying the coating and treating the product as per customers' requirements. After that, the containerboard is used for the manufacturing of different packaging products such as cartons and corrugated boxes.

The government's strict limitations on the utilization of natural resources are the main factor contributing to the market expansion. Virgin wood fiber must be used in the production of virgin containerboards, adding to the environmental load. These boards' production uses up natural resources and creates hazardous greenhouse gasses, which raises the final prices. In addition, the government's restrictions on tree-cutting are also expected to limit the market growth.

End-use Insights

Based on end-use, the food & beverage segment dominated the market with a revenue share of 37.6% in 2022 and is further expected to grow at a significant rate over the forecast period. This growth can be attributed to factors such as increasing demand for sustainable, durable, and cost-efficient packaging solutions in the food & beverage sector.

The food and beverage industry utilizes corrugated boxes produced from containerboards for storage and transportation on account of qualities including toughness, vibration & stacking resistance, and resistance to crushing. In addition, the following properties further help in decreasing the overall cost of packing and shipping.

The consumer goods segment is expected to grow at a significant rate over the forecast period. Growing purchasing power, high living standards, and rapid urbanization in several developed as well as developing countries are expected to drive the consumer goods sector, thereby driving the product demand in the coming years.

Packaging play’s crucial role in creating a brand image and changing consumer perception regarding a consumer goods brand. The appearance and appeal of a product can be increased thus making it different from competitors in the market with the use of branded and well-designed packaging made of containerboard. Therefore, rising competition in the consumer goods industry is expected to increase the demand for containerboard for branding.

Material Insights

The recycled material segment dominated the market with a revenue share of 76.3% in 2022. The segment is further expected to grow at a significant rate over the forecast period on account of rising environmental concerns that are influencing the use of sustainable materials for packaging.

Recycled fiber has the ability to be recycled 6-7 times while delivering durable results every time, thereby, helping in reducing wastage. Furthermore, recycled materials are highly preferred as they are considered to be cost-effective and at the same time comply with various government standards & regulations related to sustainability.

The virgin material segment is expected to grow at a CAGR of 2.4% over the forecast period. Wood fibers from recently cut trees are the main source of virgin material used to make containerboard. These wood fibers are used to make pulp, the primary component in containerboard production. Furthermore, the ability of virgin materials to offer consistent durability, strength, and printability is expected to drive the segment growth.

Virgin containerboards are ideal for packaging delicate and heavy objects on account of their excellent stacking strength and ability to handle heavy weights. However, the growing concerns among the government and consumers regarding the depletion of natural resources are anticipated to restrict the use of virgin materials for containerboard production.

Regional Insights

Asia Pacific region dominated the market in 2022 and is further expected to grow at the fastest CAGR over the forecast period. The robust presence of several end-use industries such as food & beverage, consumer goods, and agriculture is contributing to the increased demand for containerboard in the region. Furthermore, rising consumer spending, rapid urbanization, industrial trade, and production in countries such as India and China are further boosting the demand for packaging materials.

Sectors such as retail and e-commerce have also witnessed significant growth in the region over the past years. This has resulted in increased competition among market players which in turn is fueling the demand for functional, durable, cost-effective, and attractive packaging solutions. In addition, the rising use of sustainable materials in the region is further expected to fuel the market growth.

The North America region accounted for the revenue share of 22.0% in 2022. The presence of environmental concerns among consumers from North America has promoted the use of sustainable products for packaging. Containerboard provides lightweight and durable packaging along with an appealing display of the products. This has resulted in increased use of containerboard by end-use industries in the region.

In North America, the U.S. is the largest consumer of containerboards on account of a growing trend of food deliveries and packaged food in the country. In addition, the inclination of the population towards eco-friendly products in the country is further fueling the market growth.

Key Companies & Market Share Insights

The key players operating in the market include International Paper; Oji Fibre Solutions (NZ) Ltd; Nine Dragons Paper (Holdings) Limited; Smurfit Kappa Group; and Mondi Limited. The manufacturers have significantly invested in research & development (R&D) activities to produce recyclable and waterproof containerboards.

In 2022, WestRock Company announced its plan to construct a corrugated box production facility in Washington, U.S. The new plant will help the company to cater to increasing the demand for corrugated boxes in the Pacific Northwest. Therefore, the increasing production of corrugated boxes will result in rising demand for containerboards.

Key Containerboard Companies:

- International Paper

- Oji Fibre Solutions (NZ) Ltd

- Nine Dragons Paper (Holdings) Limited

- Smurfit Kappa Group

- Mondi Limited.

- WestRock Company

- Sappi Ltd

- Cascades Inc.

- Stora Enso Oyj

- Georgia-Pacific LLC

Containerboard Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 153.22 billion |

Revenue forecast in 2030 |

USD 185.89 billion |

Growth rate |

CAGR of 2.8% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Material, end-use, region |

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Asia Pacific; India; China; Japan; South Korea; Brazil |

Key companies profiled |

International Paper; Oji Fibre Solutions (NZ) Ltd; Nine Dragons Paper (Holdings) Limited; Smurfit Kappa Group; Mondi Limited.; WestRock Company; Sappi Ltd; Cascades Inc.; Stora Enso Oyj; Georgia-Pacific LLC |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Containerboard Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global containerboard market report based on material, end-use, and region:

Material Outlook (Revenue, USD Billion, 2018 - 2030)

Recycled

Virgin

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

Food & Beverage

Consumer Goods

Industrial

Others

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

UK

France

Italy

Asia Pacific

India

China

Japan

South Korea

Central & South America

Brazil

Middle East & Africa

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."