Continence Care Market Size, Share & Trends Analysis Report By Product (Urinary Catheters, Urinary Bags), By Bag Usage (Sterile Bags, Non-sterile Bags), By Application (Diabetes, BPH), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-116-9

- Number of Pages: 121

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

The globalcontinence care market sizewas estimated atUSD 2.29 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 5.5% from 2023 to 2030. The growth of the market is due to various factors such as technological advancements, the rising geriatric population, and the increasing prevalence of various chronic disorders such as bladder cancer, Spina Bifida, Spinal Cord Injury, Cerebral Palsy, and others. For instance, as per the WHO in September 2022, every year, about 17 million people die from non-communicable diseases (NCDs) before they turn 70 years old. Most of these deaths, about 86%, happen in countries with lower and middle incomes.

UTIs are among the most common healthcare-associated infections. Patients are at a high risk of UTIs from long-term use of urinary bags, which can represent a significant challenge to the market. For instance, UTIs are frequently associated with Purple Urine Bag Syndrome (PUBS), while complications such as erosion, skin inflammation, and ulceration can occur from the use of two-piece systems, primarily due to the risk of leakage and larger sizes. As per the National Library of Medicine (NIH), in 2022, among the UTIs acquired in hospitals, approximately 80% of the cases were related to the use of indwellingurinary cathetersin the U.S.

项目由几个私人球员和上升nonprofit organizations to increase awareness regarding incontinence care globally are expected to improve the demand for UI products. For instance, the government of Australia has introduced the Incontinence AIDS Payment Scheme. This program supports the incontinence needs of patients experiencing persistent or serious incontinence problems. The Australian Government has also established a National Incontinence Control Program to increase bladder and bowel health awareness.

如泌尿科、理疗师,gynecologists, nurses, general practitioners, and other professional associations also actively participate in promoting incontinence awareness in all areas of care. In March 2023, Convatec Group Plc announced that they have started a new three-year collaboration with Partners in Health (PIH), an organization that helps to create equitable healthcare systems in communities, where they are needed the most. This partnership will start by making healthcare better for people in underserved areas of Mexico, Peru, and the U.S. They aim to impact 250,000 lives positively. Thus, due to such initiatives market is anticipated to boost in the near future.

Increasing adoption of minimally invasive procedures is expected to positively impact market growth over the forecast period. There has been a rise in minimally invasive surgical techniques for treating UI, such as the use of slings or mesh implants to support the urethra & bladder neck. These procedures have shorter recovery times and lower complication rates compared to traditional open surgeries. Furthermore, advancements in medical technology have contributed to the development and refinement of minimally invasive techniques. This includes the use of laparoscopic or robotic-assisted surgery, which provides surgeons with enhanced visualization and precision during the procedure.

Product Insights

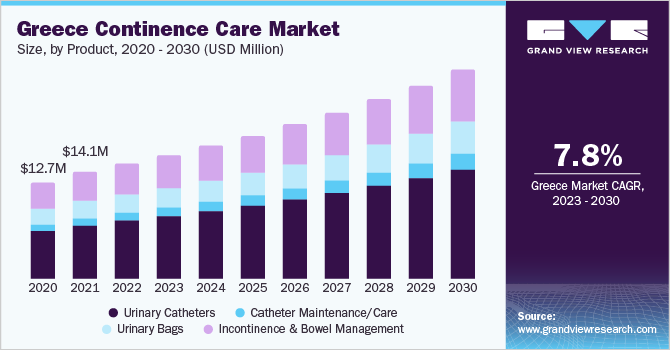

2022年,尿导管段th主导e continence care market with a revenue share of around 52.5%. The urinary catheter segment includes a wide range of products, such as intermittent catheters,Foley catheters, external catheters, and indwelling catheters, each designed to meet specific patient needs. Factors such as an aging population, rising prevalence of urinary incontinence, and increasing incidence of urological disorders contribute to the market's growth.

技术进步导致发展ment of more comfortable, infection-resistant, and user-friendly catheters, addressing concerns about patient discomfort and infection risk. As healthcare continues to evolve, the urinary catheters market remains a crucial sector, continually innovating to improve patient quality of life and overall urological care. For instance, in April 2023, The Flume Catheter Company Ltd. (TFCC) announced the launch of a study to gather real-world data on patient experiences with the new FLUME catheter. Because of these improvements in urinary catheters, the need for products to help with continence care is expected to grow in the coming years.

The catheter maintenance/care segment is expected to grow at the highest CAGR from 2023 to 2030.Cathetermaintenance is essential to remove small blood clots, tissue, and debris to reduce the frequency of changing catheters. A variety of catheter maintenance solutions, such as saline, citric acid-based products, and products like polyhexanide, which also have an antibacterial effect, are useful in catheter maintenance. Regular catheter care can reduce the chances of bacterial colonization, remove deposits, and stop debris buildup. Thus, the benefits associated with catheter maintenance are expected to boost market growth over the forecast period.

Application Insights

Based on application, the diabetes segment dominated the market with a revenue share of 25.5% in 2022. The increasing prevalence of diabetes around the world will increase the demand for continence care products in the near future. For instance, as per the International Diabetes Federation in 2021, about 537 million adults (between 20 and 79 years old) had diabetes. This means 1 out of every 10 adults has diabetes. As per the same source, by 2030, the number could go up to 643 million, and by 2045, it might reach 783 million. Control of the bladder and bowel is a common issue faced by diabetic patients. This may involve unintentional leaking, partial emptying, frequent passing of urine, or the urge to use the restroom immediately. As a result of these factors, the demand for continence care products for diabetes treatment will increase in the near future.

The spinal cord injury (SCI) segment is expected to grow at the highest CAGR from 2023 to 2030. Urinary tract infections pose a considerable issue for individuals who rely on intermittent catheters to empty their bladder. This predicament applies to those with conditions like multiple sclerosis, spinal cord injury, or spina bifida. Typically, people using intermittent catheters experience 2-3 urinary tract infections annually. These infections can lead to severe health problems, significantly affect their quality of life, and sometimes result in hospitalization, which strains local healthcare systems. Consequently, manufacturers are introducing advanced products as a solution to address these challenges. For instance, in February 2023, Coloplast introduced a new kind of catheter for men that is made to lower the chances of getting urinary tract infections. This new catheter is called Luja. Due to such advancements, the demand for continence care products will increase in the near future.

Bag Usage Insights

Based on bag usage, the sterile segment dominated the market with a revenue share of 64.9% in 2022. Sterile bags are essential for avoiding infections and other problems. Utilizing sterile bags lowers the possibility of introducing microorganisms, lowering the risk of infection. Sterile bags are considered temporary or short-term, noninvasive medical devices, which are single-use pouches for collecting urine at a hospital or home. They are immediately attached to a catheter outside the body or to a probe that is put into the urethra. They are always used with an indwelling catheter. Examples of sterile bags are Conveen Basic bedside drainage sterile bag by Coloplast and Urinary Leg Bag–Sterile by Hollister Incorporated.

Moreover, as consumers become more health-conscious and informed, they seek products that prioritize hygiene and minimize health risks. Sterile bags fulfill this demand by offering a reliable solution that promotes cleanliness and minimizes the potential for cross-contamination. This shift in consumer preference creates an avenue for manufacturers to capitalize on the demand for safer and more effective continence care products. Overall, the rising usage of sterile bags in the market represents an opportunity for companies to cater to evolving consumer expectations, comply with healthcare regulations, and ultimately contribute to improved patient well-being through enhanced infection prevention measures.

End-use Insights

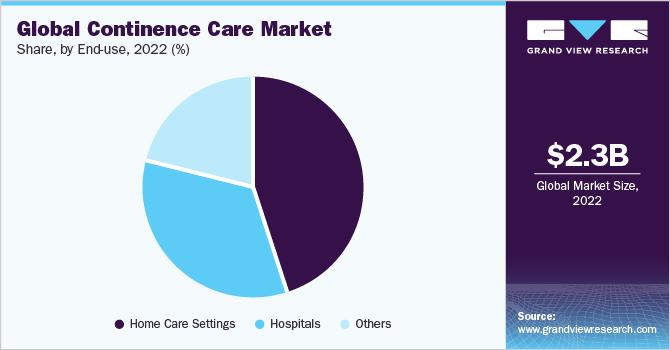

Home care settings held the largest share of 43.0% in the continence care market in 2022 and is expected to grow at the highest CAGR over the forecast period. Home care plays an important role in the management of incontinence and focuses on maintaining hygiene, managing fluids, exercising the pelvic floor muscles, adopting a healthy lifestyle, making environmental modifications, and seeking appropriate medical assistance when needed. It also promotes comfort, confidence, and overall well-being of individuals managing incontinence at home. Technological advancements have led to the development of innovative homecare products and devices for managing incontinence. Comfort, convenience, cost-effectiveness, individualized care, advancements in technology, the rising older population, and patient desire are some of the main factors influencing the demand for home care solutions for successfully treating incontinence at home.

Hospitals held the second-largest share in 2022. Hospital continence care involves controlling bladder and bowel function for patients who have difficulty controlling their urination or stool motions. This care is crucial for people who may be elderly, have particular medical conditions, or have undergone surgery that has affected their gastrointestinal or urinary systems. The increasing geriatric population is helping to propel the growth of the segment. For instance, in September 2022, according to World Population Prospects 2022, the proportion of adults 65 and older in the global population is expected to increase from 10% in 2022 to 16% in 2050.

Regional Insights

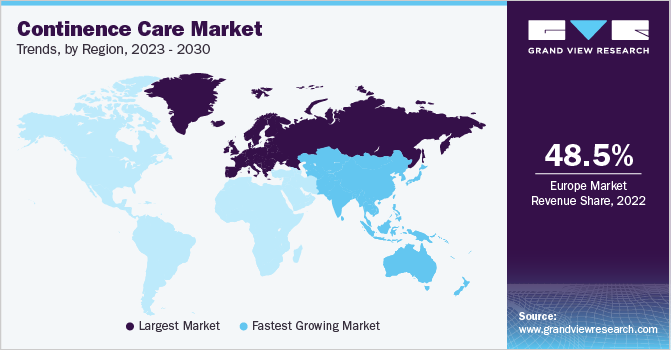

Europe dominated the continence care regional market with the largest share of around 48.5% in 2022, by revenue. The technological advancements in countries such as the UK, France, Germany, and Denmark contribute to the regional market growth. For instance, in September 2022, Convatec introduced the GentleCath range of catheters, incorporating FeelClean Technology. These catheters provide a more comfortable and less sticky user experience during intermittent catheterization. The catheters’ next-generation material is intrinsically slippery when wet, effectively reducing the risk of trauma, bleeding, and pain.

Users have reported a significant improvement in comfort, and the catheters leave minimal mess and residue. For instance, in February 2023, with the introduction of Luj, an innovative male intermittent catheter featuring 80+ micro-holes, Coloplast Corp effectively addresses UTI risk factors faced by intermittent catheter users, positively impacting their well-being and healthcare systems. Luja's Micro-hole Zone Technology ensures thorough bladder emptying, reducing the risk of bacterial growth and UTIs. The planned launch in Denmark and Finland, followed by global availability within 12 months.

亚太地区预计将增长最高的CAGR from 2023 to 2030. Increasing awareness among consumers is expected to boost demand for continence care in this region. In addition, there is a huge demand for colostomy in countries such as India, and China as many people suffer from bladder issues. Mostly geriatric population is prone to having stomas and requires ileostomy and colostomy surgeries. Thus, the increasing number of people living with bladder problems coupled with the rising geriatric population are boosting the demand for continence care products in Asia Pacific. Thus, driving the growth of the market in Asia Pacific.

Key Companies & Market Share Insights

竞争对手推出新产品ines or adding more features to their existing products to gain a larger share of the market. Major players frequently incorporate technologies that can meet specific requirements of patients, which further drives the market growth in the near future. For instance, in February 2023, Hollister Incorporated, a U.S.-based developer and manufacturer of continence care, and critical care products, is expanding its manufacturing capabilities at its Kaunas plant by investing USD 25 million in cutting-edge manufacturing technologies.

Players such as Coloplast; Convatec Inc.; and Hollister Incorporated are using various strategies to gain more market share. Strategies such as promotions and marketing are widely used by manufacturers in the market to raise awareness regarding the benefits of ostomy care and increase product availability. For instance, in October 2022, Hollister Incorporated published a study on patient support programs through the Journal of Wound Ostomy & Continence Nursing (JWOCN). This study focuses on connecting support service interactions to offer enhanced results in areas of skin health, stoma barrier leakage, and proper fit. Thus, due to such factors, the demand for continence care will increase in the near future. Some prominent players in the global continence care market include:

Coloplast Group

B. Braun SE

Hollister Incorporated

Convatec Group PLC

BD

Wellspect HealthCare

Salts Healthcare Ltd.

Welland Medical Ltd.

Continence CareMarket Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 2.40 billion |

Revenue forecast in 2030 |

USD 3.49 billion |

Growth rate |

CAGR of 5.5% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, application, bag usage, end-use, region |

Regional scope |

North America; Central Europe; Western Europe; Eastern Europe; Asia Pacific; Latin America; MEA |

Country scope |

U.S.; Canada; France with DOM-TOM; UK; Spain; Italy; Portugal; Netherlands; Ireland; Belgium; Switzerland; Denmark; Sweden; Finland; Norway; Czech Republic; Russian Federation; Poland; Austria; Romania; Slovakia; Slovenia; Serbia; Greece; Turkey; Ukraine; Australia; Japan; Malaysia; China; South Korea; Thailand; India; Brazil; Chile; Colombia; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

Key companies profiled |

Coloplast Group; B. Braun SE; Hollister Incorporated; Convatec Group PLC; BD; Wellspect HealthCare; Salts Healthcare Ltd.; Welland Medical Ltd. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Continence CareMarket Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global continence care market report based on product, application, bag usage, end-use, and region:

Product Outlook (Revenue, USD Million, 2018 - 2030)

Urinary Catheters

Intermittent Catheters

Female

Male

Intermittent Catheter Sets

Female

Male

Intermittent Catheters Dry

Indwelling Foley Catheters Silicone

2W

3W

Catheter Maintenance/Care

Urinary Bags

Pediatric Urine Bags

Night Bags > 1,5L

Sterile

Non-sterile

Bag Accessories

Leg Urine Bags < 1,5L

Sterile

Non-sterile

Incontinence And Bowel Management

Male External Catheters Silicone

Female Incontinence Device

Irrigation Pump/Transanal Irrigation

Application Outlook (Revenue, USD Million, 2018 - 2030)

Diabetes

Strokes

BPH

Alzheimer

Cerebral Palsy

Parkinson

Prostate Cancer

Spinal Cord Injury

Bladder Cancer

Multiple Sclerosis

Spina Bifida

Others

Bag Usage Outlook (Revenue, USD Million, 2018 - 2030)

Sterile Bags

Non-sterile Bags

End-use Outlook (Revenue, USD Million, 2018 - 2030)

Home Care Settings

Hospitals

Others

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

- Canada

Europe

Central Europe

Germany

Western Europe

France with DOM-TOM

UK

Spain

Italy

Portugal

Netherlands

Ireland

Belgium

Switzerland

Denmark

Sweden

Finland

Norway

Eastern Europe

Czech Republic

Russian Federation

Poland

Austria

Romania

Slovakia

Slovenia

Serbia

Greece

Turkey

Ukraine

Asia Pacific

Japan

China

India

Australia

South Korea

Thailand

Malaysia

Latin America

Brazil

Chile

Argentina

Colombia

Middle East and Africa (MEA)

South Africa

Saudi Arabia

UAE

Kuwait

Frequently Asked Questions About This Report

b.The global continence care market is expected to grow at a compound annual growth rate of 5.5% from 2023 to 2030 to reach USD 3.49 billion by 2030.

b.The global continence care market size was estimated at USD 2.29 billion in 2022 and is expected to reach USD 2.40 billion in 2023

b.Europe dominated the global continence care market with a share of 48.53% in 2022, owing to increasing number of people living with bladder problems coupled with rising geriatric population are boosting the demand for continence care products in Europe.

b.Some key players operating in the continence care market include Coloplast Group, B. Braun SE, Hollister Incorporated, Convatec Group PLC, BD, Wellspect HealthCare, Salts Healthcare Ltd., Welland Medical Ltd., Others.

b.The growth of the continence care market is due to various factors such as technological advancements, the rising geriatric population, increasing prevalence of various chronic disorders such as bladder cancer, Spina Bifida, Spinal Cord Injury, Cerebral Palsy, and others.