Contrast Enhanced Ultrasound Market Size, Share & Trends Analysis Report By Product (Equipment, Contrast Agents), By Type (Non-targeted, Targeted), By End-use (Hospitals, Clinics), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-141-1

- Number of Pages: 85

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry:Healthcare

Report Overview

The global contrast enhanced ultrasound market size was valued at USD 1.8 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 4.0% from 2021 to 2028. Key factor attributing to the market growth include the introduction of affordable contrast agents, increasing ultrasound procedural volume, and contrast imaging modes becoming an integral feature of ultrasound systems. Furthermore, contrast enhanced ultrasound (CEUS) is more cost-efficient, radiation-free, and patient-friendly than other technologies. This is also expected to propel the market growth. The importance of integrating CEUS technology in Point-of-Care (PoC) diagnostics has been a key takeaway in the fight against COVID-19.

This has contributed to growing adoption of contrast-enhanced ultrasound, owing to the advantage it provides in early diagnosis of COVID-19-related pneumonia. A sudden increase in the number of lung ultrasonography procedures performed has increased the demand for this process. The rising incidence of cardiovascular and gastrointestinal diseases is expected to boost the demand further.

对比增强超声pre之一ferred grading systems for assessment of lung deterioration in COVID-19 patients. In addition, these devices played an important role as a bedside imaging tool to measure perfusion impairment in lung, kidney, and brain of pediatric COVID-19 patients. CEUS helps identify lung damage even during asymptomatic phase of the COVID-19. Significant number of studies to assess applications of CEUS to detect the presence of microthrombi in COVID-19 patients are expected to boost the usage of these devices in the coming years.

Frequent monitoring of Left Ventricular Volume (LV) and Ejection Fraction (LVEF) is vital in determining the timing & type of treatment offered to a patient with Cardiovascular Disorders (CVDs) because of increasing patient referrals for CEUS procedures. Despite the advent of advanced ultrasound imaging techniques, like harmonic imaging, the LV and LVEF values in patients are often underestimated due to their poor endocardial border delineation. Thus, the increasing demand for sensitive and accurate diagnostic tools in the quantitative assessment of ventricular volume in cardiac patients is expected to boost the market growth.

心血管病患病率的增加,肝脏病变,kidney lesions, gastrointestinal diseases, and vascular diseases globally is anticipated to boost the demand for CEUS services as these are major areas of clinical application of contrast-enhanced ultrasound systems. According to the WHO, globally, CVDs are the leading cause of death. Around 17.9 million people die each year worldwide due to CVDs. The incidence of CVD is increasing each year with a rising prevalence of behavioral risk factors, such as consumption of alcohol ortobacco, lack of physical activity, and an unhealthy diet.

Product Insights

In 2020, the equipment segment dominated the product segment with a market share of 72.6%. The introduction of advanced ultrasound units with transducer technology and nonlinear imaging techniques has simplified the workflow of CEUS, thereby fueling the market growth. The ultrasound scanner manufacturers are more inclined to provide comprehensive solutions for ultrasound imaging in a single system to increase product usability and improve the diagnostic experience.

Contrast-enhanced ultrasound imaging is an emerging technology and has recently been approved for several new indications as it is being deployed in all upcoming ultrasound technologies. For instance, in December 2019, Mindray launched an innovative ultrasound system, DC-90 ultrasound with an inbuilt contrast-enhanced ultrasound mode. Additionally, increasing investment by drug companies, academic centers, and ultrasound manufacturers to develop contrast imaging-specific ultrasound modalities & contrast agents are expected to fuel segment growth over the forecast period.

Type Insights

In 2020, the non-targeted type segment dominated the CEUS market with a revenue share of over 73%. It is the most common method of the CEUS imaging technique. All the approved ultrasound contrast agents are of a non-targeted type. They are typically used to enhance diagnostic sensitivity, determination of the blood volume and flow in interest, and differentiate between malignant and benign liver tumors. Non-targeted contrast agents held the largest market share in 2020 because most of the commercially available products are of this type.

They are commonly used to assess vascularity in a target lesion (liver/kidney) and measure organ perfusion. The increasing prevalence of chronic illnesses, such as liver cirrhosis, cancer, and CVDs, is the key factor expected to propel market growth. According to the 2019 National Survey on Drug Use and Health (NSDUH), 14.1 million adult population in the U.S. had alcohol use disorder. As excessive consumption of alcohol is one of the primary causes of liver cirrhosis. The changing global demographics of alcohol consumption are anticipated to positively influence the demand for ultrasound contrast imaging services.

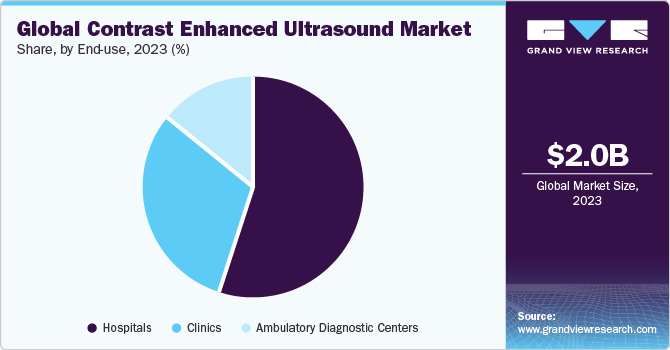

End-use Insights

The hospitals segment dominated the market and accounted for the largest revenue share of more than 58% in 2020. The increasing number of emergency visits with medical conditions, such as abdominal pain, abdominal/thoracic trauma, and cardiac complications, has led to the rising demand for CEUS in hospitals. The presence of large patient pool and installed base of advanced ultrasound equipment has contributed to the hospital segment’s largest revenue share.

There are numerous contraindications associated with the use of contrast agents. For instance, intra-arterial injection of contrast agents can lead to serious complications in patients. However, the availability of specialist doctors and technicians in hospitals possessing skills in handling equipment & contrast agent is anticipated to fuel segment growth over the forecast years.

Regional Insights

North America accounted for the largest market share of over 24% in 2020. CEUS imaging has been used in cardiac and abdominal imaging over the years in North America, but with its recent approval for the characterization of liver lesions, it is gaining increased attention. In addition, the execution of several education and training programs for sonologists and radiologists pertaining to the diagnostic and therapeutic use of CEUS in the region is anticipated to propel market growth.

The U.S. has well-established medical codes, payment processes, and coverage policies for ultrasound services in hospitals, clinics, & ambulatory centers. In addition, reimbursements are provided for use of ultrasounds by general practitioners and family physicians at their offices. This has contributed to a rise in the number of ultrasound procedures in the U.S. Rising incidence of CVDs and Inflammatory Bowel Diseases (IBD) is expected to boost the demand for contrast-enhanced ultrasound in the country.

Asia Pacific is anticipated to witness the fastest CAGR over the forecast period owing to the increasing healthcare expenditure, especially in countries, such as India and China. Moreover, the lack of well-organized reimbursement policies coupled with price-sensitive population in emerging economies is expected to boost the demand for cost-effective procedures, such as contrast-enhanced ultrasound imaging. A growing number of government initiatives to improve healthcare infrastructure in the region is also anticipated to augment the market growth.

Key Companies & Market Share Insights

The key players are adopting various business strategies, such as mergers & acquisitions, product launches, joint ventures, and partnerships, to strengthen their presence in the global market. For instance, in March 2020, GE Healthcare and Daiichi Sankyo formed an agreement wherein Daiichi Sankyo will return the exclusive marketing & development rights in Japan for four approved diagnostic imaging agents to GE Healthcare and transfer the marketing authorization rights in Japan to GE Healthcare Pharma. Some of the prominent players in the global contrast enhanced ultrasound market include:

Lantheus Medical Imaging, Inc.

General Electric

Bracco Diagnostic

Siemens Healthcare GmbH

nanoPET Pharma GmbH

ESAOTE SPA

Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Contrast Enhanced Ultrasound Market Report Scope

Report Attribute |

Details |

Market size value in 2021 |

USD 2.06 billion |

Revenue forecast in 2028 |

USD 2.71 billion |

Growth rate |

CAGR of 4.0% from 2021 to 2028 |

Base year for estimation |

2020 |

Historical data |

2016 - 2019 |

Forecast period |

2021 - 2028 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, type, end-use, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; India; Japan; China; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE |

Key companies profiled |

Lantheus Medical Imaging, Inc.; Bracco Diagnostic, Inc.; General Electric; Siemens Healthcare GmbH; nanoPET Pharma GmbH; ESAOTE SPA; Shenzhen Mindray Bio-Medical Electronics Co., Ltd. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

这份报告预测收入增长在全球、再保险gional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global contrast enhanced ultrasound market report on the basis of product, type, end-use, and region:

Product Outlook (Revenue, USD Million, 2016 - 2028)

Equipment

Contrast Agent

Type Outlook (Revenue, USD Million, 2016 - 2028)

Non-targeted

Targeted

End-use Outlook (Revenue, USD Million, 2016 - 2028)

Hospitals

Clinics

Ambulatory Diagnostic Centers

Regional Outlook (Revenue, USD Million, 2016 - 2028)

North America

U.S.

Canada

Europe

Germany

U.K.

France

Italy

Spain

Asia Pacific

China

Japan

India

Thailand

South Korea

拉丁美洲

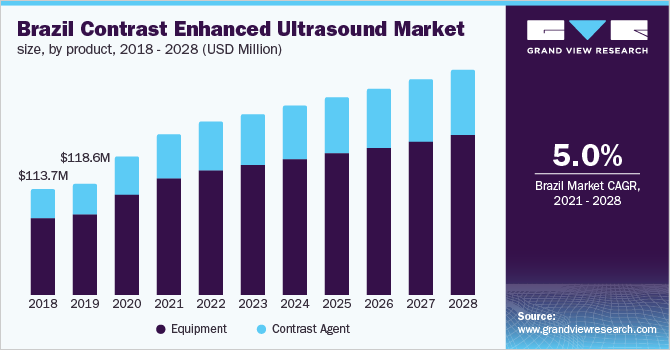

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

UAE

Frequently Asked Questions About This Report

b.The global contrast enhanced ultrasound market size was estimated at USD 1.8 billion in 2020 and is expected to reach USD 2.06 billion in 2021.

b.The global contrast enhanced ultrasound market is expected to grow at a compound annual growth rate of 4.0% from 2021 to 2028 to reach USD 2.71 billion by 2028.

b.North America dominated the contrast enhanced ultrasound market with a share of 24.6% in 2020. This is attributable to the approval of ultrasound contrast agents for newer indications and the presence of aggressive training and educational programs related to contrast-enhanced ultrasound practice.

b.Some key players operating in the contrast enhanced ultrasound market include Lantheus Medical Imaging, Inc.; Bracco Diagnostic Inc., General Electric., Siemens Healthcare GmbH, nanoPET Pharma GmbH, ESAOTE SPA, and Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

b.Key factors that are driving the contrast enhanced ultrasound market growth include the Introduction of affordable contrast agents, increasing ultrasound procedural volume, and contrast imaging modes becoming an integral feature of ultrasound systems.