Copper Foil Market Size, Share & Trends Analysis Report By Application (Circuit Boards, Batteries, Electromagnetic Shielding), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-909-8

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry:Advanced Materials

Report Overview

The global copper foil market size was valued at USD 4.9 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 9.7% from 2020 to 2027. Increasing penetration of the internet is projected to remain an indirect growth driver for the market. Internet usage is increasing at a rapid pace in developing and developed countries, which has resulted in faster demand for mobile devices,laptops, tablets, and computers. Cheap data plans, increased availability of bandwidth, and increased awareness owing to the government programs are assisting in bridging the digital gap in emerging countries, such as India. Electronic grade Copper foil finds applications in printed circuit boards, which are used in various electronics and digital devices.

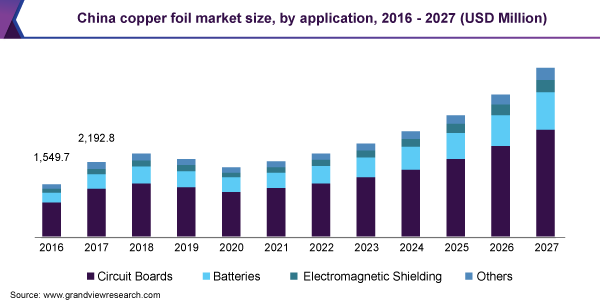

China is the world’s leading producer in the electronics market and is likely to maintain its lead over the coming years. China produces multi-layer, low-order single double PCB products in large volumes. China accounts for more than 50% of PCB production around the world. This is projected to benefit the demand for copper foil products over the coming years.

However, stricter regulations for small and medium-sized PCB producers are projected to create a critical impact on copper foil demand in the short term. The regulations enforce particular requirements on different types of applications, excluding aerospace and military applications. This is likely to strengthen the market position of leading players in China.

The strong domestic market, supportive government policies, and avenues available due to international transfer of technology are the key factors for the growth of the Chinese electronics industry. Demand from industrial electronics, consumer electronics, and electronic components is also anticipated to remain a key factor for the market growth in the country.

Application乐鱼APP二维码

Circuit boards emerged as the largest application segment and accounted for a volume share of 61.0% in 2019. Copper foil is used as an electrolytic material and is deposited on the base layer of printed circuit boards. It also has a low rate of surface oxygen and can be attached to different substrates, such as insulating materials and metals. Electronic grade copper foil finds applications in television sets, calculators,batteries, air conditioners, QA equipment, telephones, and automotive electronics.

PCB制造商使用包铜复合材料(CCL)分部d prepreg to make multi-layered PCBs. The thin layer of copper foil is used in CCL in the lamination of prepreg. These CCL products are then finally used in the end products, such as mobile communications, radio, mobiles, computers, television, and other electronics products.

The batteries application segment is projected to grow at the fastest rate of 10.7% from 2020 to 2027 in terms of both volume and revenue. Increasing demand for electric andhybrid vehiclesand energy storage is a key driver for the copper foil market. Batteries have a great potential to decarbonize transport and power systems. The deployment ofelectric vehiclesis observing a greater pace in various countries, particularly in China, the U.S., and European countries. As per the International Energy Agency, the stock of global electric vehicles reached over 5 million in 2018, increasing by 63% from 2017.

Regional乐鱼APP二维码

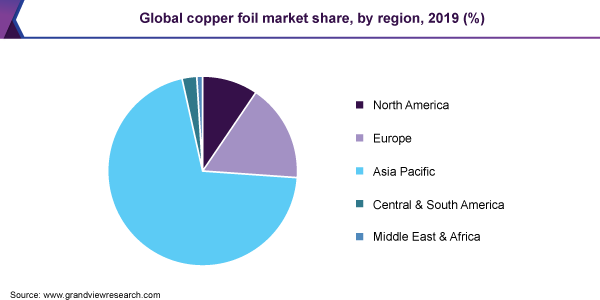

Asia Pacific held the largest volume share of over 72.0% in 2019 and is projected to maintain its position during the forecast period. Demand from China, South Korea, Japan, and India is a key factor driving the market. Asia Pacific dominates the PCB manufacturing industry, primarily owing to the incentives provided by the Chinese government. Another reason is the large manufacturing capacity for PCBs and low labor wages in China.

In terms of volume, North America is projected to grow at a rate of 9.4% over the forecast period. Growing electric vehicle penetration in the U.S. market is likely to drive the demand for copper foil products in the region. The U.S. is also characterized by the presence of leading electric vehicle manufacturers, such as Tesla, Inc. The company accounted for more than 75% of electric cars sold in 2019.

储能和电动和日益增长的需求hybrid vehicles is likely to assist in the growth of European demand. Europe holds a prominent position in the electric vehicles market. The deployment of new electric bus registrations is another promising factor for the regional market growth. As per the International Energy Agency, these registrations in Europe increased from 0.91 thousand in 2018 to 1.99 in 2019.

Key Companies & Market Share Insights

合并和收购和合资企业key strategies adopted by market players. In order to gain the largest market share, companies are likely to acquire small and medium-sized companies over the coming years. Moreover, leading players are focusing on improving their production capacity by investing in new factories. For instance, in July 2019, Dusan Corp. announced the construction of a new copper foil plant for battery applications in Hungary. This plant is projected to start in 2020 with an additional capacity of 50,000 tons for copper foil, enough for batteries of 2.2 million electric vehicles. Some of the prominent players in the copper foil market include:

SKC

Dusan Group

Chang Chun Group

Circuit Foil

LS Mtron

Furukawa Electric Co., Ltd.

Iljin materials co,. Ltd.

Nippon Denkai, Ltd.

Copper Foil Market Report Scope

Report Attribute |

Details |

Market size value in 2020 |

USD 4.5 billion |

Revenue forecast in 2027 |

USD 10.3 billion |

Growth Rate |

CAGR of 9.7% from 2020 to 2027 |

Market demand in 2020 |

597.2 kilotons |

Volume forecast in 2027 |

1260.3 kilotons |

Growth Rate |

CAGR of 9.6% from 2020 to 2027 |

Base year for estimation |

2019 |

Historical data |

2016 - 2018 |

Forecast period |

2020 - 2027 |

Quantitative Units |

Volume in kilotons, revenue in USD million and CAGR from 2020 to 2027 |

Report coverage |

Revenue and volume forecast, company share, competitive landscape, growth factors, and trends |

Segments covered |

Application, region |

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

Country scope |

The U.S.; Canada; Mexico; Germany; Russia; France; China; Japan; South Korea; Taiwan; Brazil |

Key companies profiled |

SKC; Dusan Group; Chang Chun Group; Circuit Foil; LS Mtron; Furukawa Electric Co.; Ltd.; Iljin materials co. Ltd.; Nippon Denkai, Ltd. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts volume and revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global copper foil market report based on application and region:

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

Circuit Boards

Batteries

Electromagnetic Shielding

Others

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

North America

The U.S.

Canada

Mexico

Europe

Germany

Russia

France

Asia Pacific

China

Japan

South Korea

Taiwan

Central & South America

Brazil

Middle East & Africa

Frequently Asked Questions About This Report

b.The global copper foil market size was estimated at USD 4.9 billion in 2019 and is expected to reach USD 4.5 billion in 2020.

b.The copper foil market is expected to grow at a compound annual growth rate of 9.7% from 2020 to 2027 to reach USD 10.3 billion by 2027.

b.Circuit boards dominated the copper foil market with a share of 59.6% in 2019, owing to its increasing demand from electronic components for mobiles, laptops, tablets, and computers.

b.Some of the key players operating in the copper foil market include SKC, Dusan Group, Chang Chun Group, Circuit Foil, LS Mtron, Furukawa Electric Co., Ltd., Iljin materials co. Ltd., and Nippon Denkai, Ltd.

b.The key factors that are driving the copper foil market include increasing demand for lithium-ion batteries on account of growing electric vehicle sales at global level.