Cuffless Blood Pressure Monitor Market Size, Share & Trends Analysis Report By Type (Wrist-based, Finger-based Monitors, Armband-based Monitors), By End-use (Hospital, Home Care), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-072-9

- Number of Pages: 180

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

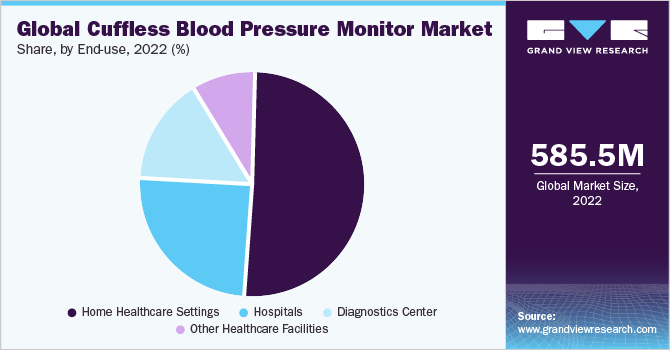

The globalcuffless blood pressure monitor market sizewas valued atUSD 585.5 million in 2022and is expected to grow at a compound annual growth rate (CAGR) of 10.9% from 2023 to 2030. The rising prevalence of hypertension and other cardiovascular diseases, coupled with the growing demand for non-invasive and continuous blood pressure monitoring, is expected to drive the market growth for cuffless blood pressure monitors. As per the WHO, high blood pressure is the leading cause of cardiovascular disorders such as strokes and heart disease, which cause 17.9 million deaths each year.

The COVID-19 pandemic has created a surge in demand for remote patient monitoring and telemedicine services. This has led to an increased interest in cuffless blood pressure monitoring devices, which can provide continuous and non-invasive monitoring of blood pressure levels without the need for a traditional blood pressure cuff.This shift towards home care devices has been driven by lockdowns in many countries and a preference for home-based healthcare settings.

As a result, major players in the market, such as Omron Healthcare, Inc., have been introducing various cuffless BP monitoring devices to cater to the needs of home care patients. For instance, in January 2021, Aktiia SA launched a 24/7 cuffless automatedblood pressure monitoringsystem that provides continuous monitoring, even during sleep.

The market for cuffless blood pressure monitoring devices is expected to grow substantially due to the rising popularity of wearablefitness trackers. These devices, such assmartwatches, fitness bands, and activity trackers, allow individuals to monitor their blood pressure, physical activity, sleep patterns, and other health metrics. According to a survey conducted by ValuePenguin in March 2022, 45% of Americans wear smartwatches regularly.

Additionally, these devices were found to be most popular with Gen Z-ers (70%), millennials (57%), and women (51%). To keep up with the demand for innovative fitness trackers, market players are investing in developing devices that monitor blood pressure and other health metrics. For instance, in February 2023, Fitbit filed a patent application with the US Patent and Trademark Office for an in-built blood pressure sensor in its smartwatches.

The usage of cuffless BP monitors is anticipated to increase significantly in the coming years because of their convenience, accuracy, and self-monitoring abilities. These monitors are expected to become more in demand in the coming years due to the increasing prevalence of heart diseases and the importance of self-monitoring blood pressure.

According to a jointly published article in 2021 by the American Heart Association and American Medical Association, self-measured BP monitoring was found to be highly effective in diagnosing hypertension and controlling blood pressure. As a result, cuffless BP monitors are expected to gain popularity as a tool for managing hypertension and monitoring blood pressure at home, with significant implications for overall health outcomes.

Technological advancements and an increase in the frequency of product launches by key market players are expected to contribute to the growth of the market. For instance, in January 2023, Valencell showcased its Cuffless Blood Pressure Monitoring device for over-the-counter use, which allows users to accurately measure their blood pressure from their fingers without a cuff or calibration.This significant update to the portfolio is expected to provide an accurate and easy way for users and medical professionals to manage hypertension.

Type Insights

wrist-based段的主要份额80.1% of the cuffless blood pressure monitor market in 2022. Wrist-based BP monitors utilize sensors and algorithms to measure blood pressure and other vital signs through the wrist. This technology has become increasingly accurate, reliable, and affordable, which has led to a significant increase in demand for these devices. The ability to track physical activity and blood pressure in real time has made wrist-based BP monitors a popular choice among fitness enthusiasts, athletes, and people with hypertension.

Furthermore, the increasing adoption of smartwatches and fitness trackers has been one of the driving factors behind the growth of wrist-based BP monitors. These devices offer a range of features, including heart rate monitoring, sleep tracking, and physical activity monitoring. For instance, OMRON Healthcare, Inc.'s HeartGuide is a clinically accurate wearable blood pressure monitor that also tracks fitness and sleep patterns.

End-use Insights

Based on end-use, the cuffless blood pressure monitor market has been further categorized into hospitals,home healthcare, diagnostics center, and other healthcare facilities. The hospital segment held a substantial revenue share of 24.67% of the market due to the increasing prevalence of hypertension, the convenience and accuracy of cuffless BP monitors, and the growing trend of adopting remote patient monitoring. These factors are significantly contributing to the adoption of these devices in hospitals.

家庭护理部分预计将见证的highest CAGR of 11.4% over the forecast period, owing to the cost-efficiency and mobility offered by cuffless BP monitors as an alternative to traditional monitoring methods. Majority of the key manufacturers are targeting the population that is looking to self-monitor its blood pressure from the convenience of their homes and is looking for devices that are effective, efficient, and economical. The fact that majority of the physicians are encouraging patients to keep a check on their cardiovascular health is expected to boost market growth.

Regional Insights

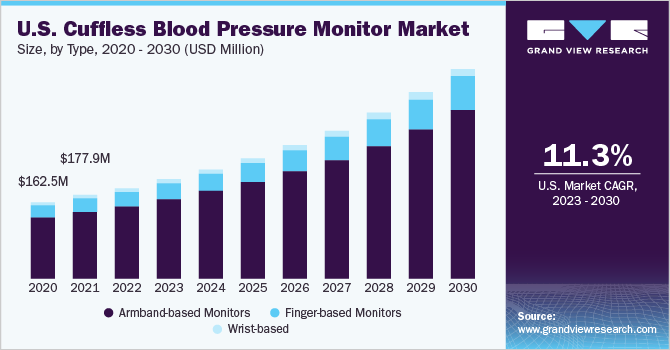

North America is anticipated to maintain its dominance in the market for cuffless BP monitors, with the region holding a 38.2% revenue share in 2022, due to the increasing prevalence of hypertension or high blood pressure in the region. According to the American Heart Association, nearly half of the adults aged 20 years and above in the U.S. have high blood pressure, which is a major risk factor for heart disease, strokes, and other health problems.

Furthermore, the increasing adoption of wearable health technology and growing awareness regarding the advantages of self-monitoring blood pressure are factors expected to contribute to the market growth over the forecast period. Moreover, the presence of major players in the region, such as Omron Healthcare, Valencell, Inc., Biobeat, and others fuels the growth of the market for cuffless BP monitors.

On the other hand, Asia Pacific is estimated to grow at the fastest rate during the forecast period, due to the increasing investment in healthcare infrastructure in recent years, particularly in emerging economies such as China and India. This investment has led to the development of advanced healthcare facilities and a growing demand for innovative medical devices and technologies, including cuffless BP monitors.

Key Companies & Market Share Insights

Market players are introducing advanced products at affordable prices to increase their market share. Key players are implementing strategic initiatives, such as mergers, acquisitions, and collaborations, to maximize their market dominance. For instance, in July 2022, Huawei launched the Watch D, its first wrist-type device for monitoring ECG and blood pressure, in the UAE. Some of the key players in the global cuffless blood pressure monitor market include:

Omron

CardiacSense

Valencell, Inc.

SOMNOmedics GmbH

Blumio

Biospectal

Aktiia

Equate Health

Fourth Frontier Technologies LLC

A&D Medical

Biobeat Technologies

CHARMCARE

Healthstats International Pte. Ltd.

LiveMetric

华为设备有限公司。

Cuffless Blood Pressure Monitor Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 637.7 million |

Revenue forecast in 2030 |

USD 1,312.5 million |

Growth rate |

CAGR of 10.9% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

Report coverage |

收入预测,公司排名、竞争局域网dscape, growth factors, and trends |

Segments covered |

Type, end-use, region |

Regional scope |

北美;欧洲;Asia Pacific; Latin America; MEA |

Country scope |

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

Key companies profiled |

Omron; CardiacSense; Valencell, Inc.; SOMNOmedics GmbH; Blumio; Aktiia; Equate Health; Fourth Frontier Technologies LLC; A&D Medical; Biobeat Technologies; Healthstats International Pte. Ltd.; Biospectal; Huawei Device Co., Ltd.; LiveMetric; CHARMCARE |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Cuffless Blood Pressure Monitor Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cuffless blood pressure monitor market report based on type, end-use, and region.

Type Outlook (Revenue, USD Million, 2018 - 2030)

Wrist-based

Finger-based Monitors

Armband-based Monitors

End-use Outlook (Revenue, USD Million, 2018 - 2030)

Home Healthcare Settings

Hospitals

Diagnostics Center

Other Healthcare Facilities

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

U.K.

Germany

France

Italy

Spain

Denmark

Sweden

Norway

Asia Pacific

Japan

China

India

South Korea

Australia

Thailand

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

UAE

Kuwait

Frequently Asked Questions About This Report

b.The global Cuffless Blood Pressure Monitors Market market size was estimated at USD 585.5 million in 2022 and is expected to reach USD 637.7 million in 2023.

b.The global Cuffless Blood Pressure Monitors market is expected to grow at a compound annual growth rate of 10.9% from 2023 to 2030 to reach USD 1.3 billion by 2030.

b.North America dominated the Cuffless Blood Pressure Monitor market with a share of 38.2% in 2022. This is attributable to rising healthcare awareness coupled with cloud-based technologies acceptance and constant research and development initiatives.

b.Some key players operating in the Cuffless Blood Pressure Monitor market include • Omron • CardiacSense • Valencell, INC. • Omron • SOMNOmedics GmbH • Blumio • Biospectal • Aktiia • EquateHealth • Valencell, INC • Fourth Frontier Technologies LLC • A&D Medical • Biobeat • CHARMCARE • Healthstats International Pte. Ltd. • LiveMetric • Huawei Device Co., Ltd. • CardiacSense

b.Key factors that are driving the Cuffless Blood Pressure Monitors market growth include the rising prevalence of hypertension and other cardiovascular diseases, coupled with the growing demand for non-invasive and continuous monitoring of blood pressure