Data Center Construction Market Size, Share & Trends Analysis Report By IT Infrastructure, By Power Distribution & Cooling Infrastructure, By Miscellaneous Expenses, By Tier Type, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-585-4

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Technology

Report Overview

The global data center construction market size was valued at USD 213.53 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.4% from 2023 to 2030. The construction process essentially refers to activities involved in the planning, designing, and construction of a facility. The market of data center costs comprises IT infrastructure, several miscellaneous expenses, and power distribution and cooling solutions. The increase in data consumption and the enterprise demand forcloud computingis the factor driving the growth of the data center construction market. The gradual resumption of the construction of various data center facilities, which was suspended temporarily as part of the lockdowns implemented in various parts of the world following the outbreak of COVID-19, and the commencement of new IT projects are antic to revive the market for data center construction in 2021. Meanwhile, the market is also anticipated to witness continuous investments in the construction of hyperscale facilities, which houses IT infrastructure, cooling equipment, and power equipment.

Public cloud providers, such as Facebook; Google, and Amazon.com, Inc. are anticipated to continue investing in upgrading their existing infrastructure, thereby creating growth opportunities for the data center construction market. The Asia Pacific IT infrastructure market witnessed significant growth during fiscal 2022. This growth can be attributed to the upsurge in the sales of networking equipment, including switches and routers. Companies, such as Huawei Technologies Co. Ltd., Dell Inc, and Hewlett Packard Enterprise Development LP, played a decisive role in the growth of the market in the region. The launch of new products by these companies in the servers and networking space has contributed to the growth of the IT infrastructure segment across the Asia Pacific.

The establishment of multi-tenant or colocation facilities is anticipated to be the factor driving the data center construction market over the forecast period. Incumbents of various industries and vertical industries are shifting to cloud computing. This factor drives the demand for colocation services. Additionally, the cost benefits associated with outsourcing storage requirements are anticipated to boost the multi-tenant facilities.

数据中心外包将佤邦的主要趋势tch out albeit the growth is predicted to be relatively slower during 2020 owing to the outbreak of COVID-19. Market players are focusing on mergers, partnerships, and acquisitions to enhance their service offerings and brand value, creating a favorable environment for the data center construction market.

IT Infrastructure Insights

The server segment dominated the market for data center construction and accounted for the largest revenue share of 50.7% in 2022. The segment is expected to register a healthy growth rate of 7.4% over the forecast period. The growing preference for adopting emerging technologies, such asartificial intelligence(AI) andedge computing, which is driving the demand for high-computing servers, is expected to pave the way for the growth of the segment. Besides, the hyperscale data center providers look to leverage government initiatives worldwide, such as AI for Earth campaign, which is expected to favor servers’ market growth over the forecast period.

IT infrastructure accounts for more than 80% of the overall industry revenue. The industry is heavily influenced by the rise and fall in demand for server, storage, and networking equipment to cater to computing needs across different verticals. The IT equipment demand was driven by the growing need for high computing capacity and memory storage to enable big data analytics and AI-driven applications.

Power Distribution & Cooling Infrastructure Insights

The cooling segment dominated the market for data center construction and accounted for the largest revenue share of 64.5% in 2022. The high market share can be attributed to the need for efficient cooling equipment to maintain optimum temperature and humidity levels across the data centers. IT infrastructure in data centers generates enormous amounts of heat as data centers are operational 24 hours a day and 365 days a year.

This necessitates maintaining an optimum environment to ensure the efficient functioning of the IT equipment. Hence, cooling systems are installed in data centers to manage the excessive heat generated by the processors, servers, and other IT equipment. Cooling systems also maintain appropriate humidity levels and protect the IT and electronic components from corrosion. An ideal working environment ensures the efficient working of data centers and mitigates the risks of potential downtime and data loss.

Miscellaneous Expenses Insights

The miscellaneous expenses segment is expected to witness a CAGR of 4.5% over the forecast period. Miscellaneous expenses account for the security infrastructure costs, property costs, and building and shell construction costs, among other costs. The security costs include physical security and digital security of the data center. The growing instances of cybercrime and data breaches are prompting service providers to invest aggressively in highly sophisticated security solutions.

There are several fixed costs included in miscellaneous expenses, which appreciate minimally over time, which is the reason behind the relatively slower growth of the segment. The property costs include land costs, property purchase costs, consultancy fees, and brokerage fees. These costs rely on macroeconomic factors that can change according to the market situation. The property costs are anticipated to exhibit a CAGR of between 0.1% - 2%, which is therefore expected to culminate into a slower growth rate for the segment over the forecast period.

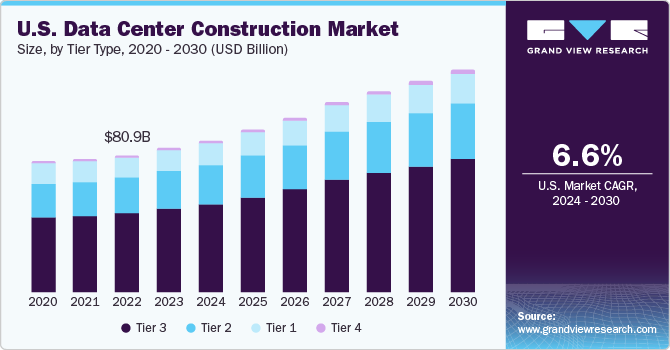

Tier Type Insights

The tier 3 segment dominated the market for data center construction and accounted for the largest revenue share of 51.3% in 2022. The high market share can be attributed to the increased redundancy across data centers. The rising need for high-performance computing and increased storage capacity is another factor why the tier 3 segment has dominated the market for data center construction. Tier 3 standard is popular among media providers, such as Netflix and Facebook, as well as for the incumbents of the financial and service industries.

Moreover, the design of tier 3 facilities offers a power backup and improvements in cooling efficiency by optimizing airflow through the architecture. It also facilitates a balanced workload across servers by continuously monitoring and distributing high-intensity workloads uniformly. These factors have encouraged colocation service providers, telecommunications service providers, social networking giants, and e-commerce companies to invest in the construction of tier 3 facilities.

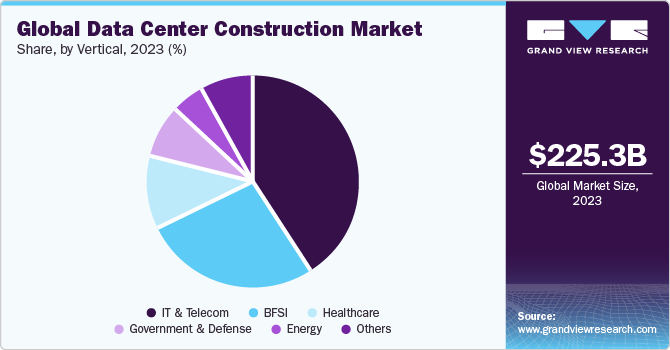

End-use Insights

The IT and telecom segment dominated the market for data center construction and accounted for the highest share of 40.4% in 2022 as a result of the proliferation of smartphones and the rise in the number of active internet users globally. The continued rollout of 5G networks also allowed the segment to dominate the market in 2022 and the trend is expected to continue over the forecast period. The continued adoption ofnetwork function virtualization(NFV) and software-defined networks (SDN) as applications to support OTT Platforms, M2M communication, andonline gamingis also expected to fuel the growth of the segment and subsequently drive the investments in this space over the forecast period.

The adoption of cloud computing,internet of things(IoT), AI, and intelligent computing across several industries and industry verticals is gaining traction. Developing nations have been investing in data center facilities as part of the efforts to digitize the economy. These facilities have particularly witnessed high deployment across industries, such as BFSI, manufacturing, healthcare, and energy, among others. For instance, Huawei Technologies Co., Ltd.’s SDN-based data center has been adopted by The Industrial and Commercial Bank of China to help share multiple services on a single set of network hardware and facilitate maximum resource utilization to launch its services faster.

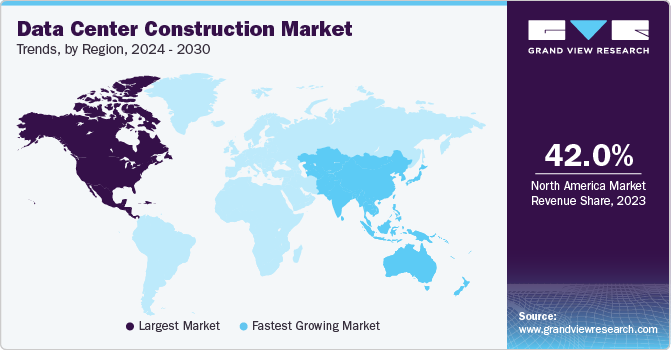

Regional Insights

North America dominated the market for data center construction and accounted for the largest revenue share of over 40.0% in 2022, followed by Asia Pacific. The high revenue share of North America can be attributed to aggressive investments in hyperscale projects. The U.S. happens to be a developed economy and already exhibits an established, sophisticated network infrastructure. Additionally, it is home to major cloud service providers, such as Amazon.com, Inc.; Google; and Facebook. Such companies are investing in the construction of mega facilities for additional processing capabilities and data storage. Hence, this opens new growth opportunities for the data center construction market.

在亚太地区,市场数据中心若干uction is expected to register the fastest growth over the forecast period, with China and India contributing significantly to the regional data center construction market. The growth can be attributed to continuous investments by cloud service providers and hyperscale’s.

Key Companies & Market Share Insights

良好的政府措施,以减少障碍s on IT companies to operate across borders are yielding positive results for the network infrastructure ecosystem. As a result, companies have been investing aggressively in emerging economies in Latin America, MEA, and other regions to expand their business. Several market players are collaborating with their clients to introduce new techniques for making the data centers more efficient and advanced. For instance, Nortek Air Solutions, a manufacturer of commercial HVAC systems, and Facebook have co-developed a new technology for cooling. The new technology called State Point Liquid Cooling provides direct evaporative cooling using outside air, thereby making the facility water-efficient and energy-efficient. Some of the prominent players in the global data center construction market include:

Acer Inc.

Cisco Systems, Inc.

Dell Inc.

Fujitsu

Hewlett Packard Enterprise Development LP

Huawei Technologies Co., Ltd.

IBM

Lenovo

Oracle

Inspur

Ascenty

ABB

Hitachi, Ltd.

Equinix, Inc.

Gensler

Schneider Electric

HostDime Global Corp.

IPXON Networks

KIO Networks

Vertiv Group Corp.

Data Center Construction Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 225.33 billion |

Revenue forecast in 2030 |

USD 371.87 billion |

Growth rate |

CAGR of 7.4% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

Segments Covered |

IT infrastructure, power distribution & cooling infrastructure, miscellaneous expenses, tier type, end-use, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa. |

Key Companies Profiled |

Acer Inc.; Cisco Systems; Inc.; Dell Inc.; Fujitsu; Hewlett Packard Enterprise Development LP; Huawei Technologies Co.; Ltd.; IBM; Lenovo; Oracle; Inspur; Ascenty; ABB; Hitachi; Ltd.; Equinix; Inc.; Gensler; Schneider Electric; HostDime Global Corp.; IPXON Networks; KIO Networks; Vertiv Group Corp. |

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options. |

GlobalData Center Construction MarketSegmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 - 2030. For this study, Grand View Research has segmented the global data center construction market report based on IT infrastructure, power distribution and cooling infrastructure, miscellaneous expenses, tier type, end-use, and region:

IT Infrastructure Outlook (Revenue, USD Billion, 2018 - 2030)

Networking Equipment

Server

Storage

Power Distribution & Cooling Infrastructure Outlook (Revenue; USD Billion; 2018 - 2030)

Power Distribution

Cooling

Miscellaneous Expenses Outlook (Revenue; USD Billion; 2018 - 2030)

Miscellaneous Expenses

Tier Type Outlook (Revenue; USD Billion; 2018 - 2030)

Tier 1

Tier 2

Tier 3

End-Use Outlook (Revenue; USD Billion; 2018 - 2030)

IT & Telecom

BFSI

Government & Defense

Healthcare

Energy

Others

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

North America

U.S.

Canada

Europe

U.K.

Germany

France

Italy

Spain

Asia Pacific

China

India

Japan

Australia

South Korea

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

UAE

Saudi Arabia

South Africa

Frequently Asked Questions About This Report

b.The global data center construction market size was estimated at USD 213.53 billion in 2022 and is expected to reach USD 225.33 billion in 2023.

b.The global data center construction market is expected to grow at a compound annual growth rate of 7.4% from 2023 to 2030 to reach USD 371.87 billion by 2030.

b.北美地区占据了数据中心有限公司nstruction market with a share of 40.05% in 2022. This is attributable to investments made for mega data center projects.

b.Some key players operating in the data center construction market include AECOM, DPR Construction, Equinix, Inc., Fluor Corporation, Gensler, and Holding Construction Group LLC.

b.Key factors that are driving the data center construction market growth include increasing internet usage, high adoption of cloud computing, and rising investment in hyperscale data centers.