马数字病人监护设备rket Size, Share & Trends Analysis Report By Type (Wireless Sensor Technology, mHealth, Telehealth, Wearable Devices, Remote Patient Monitoring), By Product, By Region, And Segment Forecasts, 2021 - 2028

- Report ID: 978-1-68038-767-4

- Number of Pages: 141

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry:Healthcare

Report Overview

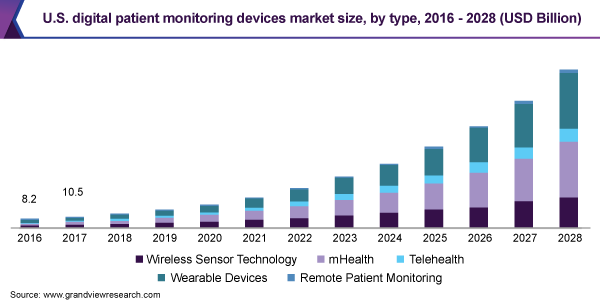

The global digital patient monitoring devices market size was estimated at USD 62.6 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 23.5% from 2021 to 2028. Rising demand for continuous monitoring devices and increasing prevalence of chronic diseases such as diabetes, hypertension, cardiovascular diseases, and others are factors propelling the growth of the market.

In recent years, the adoption of sensor-based wearable devices such as continuous glucose monitors, ECG, and others is increasing among patients as well as healthcare providers. These devices can track the patient’s vital signs on a real-time basis which can then be transmitted to their doctors electronically and can also be integrated with the EHR. This allows the providers to continuously monitor the patient eliminating the need for frequent hospital visits. The rising demand for wearable devices has encouraged key players to carry intensive research and launch innovative products in the market for digital patient monitoring devices. For example, in March 2020, Somatix, Inc. announced the launch of an AI-powered continuousremote patient monitoring system. The introduction of similar innovative products is anticipated to augment the digital patient monitoring device market growth.

Incorporating digital patient monitoring systems can help in significant cost savings, thereby reducing the overall healthcare cost. Many countries across the globe are dealing with the economic burden of chronic diseases. According to the Centers for Disease Control and Prevention, heart disease and stroke costs around USD 214 billion to the U.S. healthcare system every year. With the use of digital patient monitoring systems, people at risk can be monitored remotely, thus preventing hospitalization and reducing healthcare costs. This is likely to favor the growth of the market for digital patient monitoring devices in the coming years.

COVID19 digital patient monitoring devices market impact: 32% growth from 2019 to 2020

Pandemic Impact |

Post COVID Outlook |

The digital patient monitoring devices market witnessed an increment of over 32% from 2019 to 2020, as per the earlier projection the market was expected to be nearly USD 60 billion in 2020 |

In 2021 the market will continue to witness growth as the risk of infection is pertains. |

The emergence of the pandemic increased demand for vital signs monitors, such as respiration rate, pulse rate, and temperature can serve as an effective infection-detection system for people infected with the virus. |

The demand for mhealth and wearable devices is anticipated to grow as the pandemic greatly contributed to an increase in the general population’s desire to maintain fitness |

The COVID-19 pandemic brought a digital revolution in the healthcare industry by increasing the demand for wearable devices,mHealth apps, and telehealth by multiple folds. To control the spread of infection and patient volumes, hospitals were forced to shut down their OPDs and shift to digital health. According to a survey conducted by VivaLNK, a connected healthcare solution provider, 55% of the respondents were using or planning to use Remote Patient Monitoring (RPM) for COVID-19 patients.

许多国家的政府已经开始拥抱她cing digital health tools after realizing their potential. For instance, in April 2020, the Federal Communications Commission started a COVID-19 relief program which provided USD 200 million to equip hospitals with telehealth technology. This has opened new opportunities for the market players and start-up companies to develop innovative solutions. For example, in May 2020, VitalConnect, Inc. received Emergency Use Authorization from the USFDA for its cardiac monitoring device VitalPatch for use in COVID-19 patients.

Type Insights

The wearable devices segment dominated the market for digital patient monitoring devices and accounted for the largest revenue share of 30.4% in 2020. Increasing adoption of connected devices and rising end-user preference for sophisticated gadgets are factors attributable to the prominent share of the segment. The mHealth segment is projected to witness substantial growth during the forecast period. Rising internet penetration and the growing number of smartphone users are expected to drive the growth of the segment. Furthermore, the increasing number of startups entering the market for digital patient monitoring devices is fueling segment growth. For instance, in August 2020, Undermyfork, an app for tracking diabetes received funding of USD 0.4 million. The app is about to be launched in the U.S.

Product Insights

Based on product, the diagnostic monitoring devices segment dominated the market for digital patient monitoring devices and accounted for the largest revenue share of 62.5% in 2020. The increasing prevalence of diseases such as diabetes, obesity, cancer, and others and the rising geriatric population are propelling the growth of the segment. According to the International Diabetes Federation, around 463 million people are living with diabetes in 2019 and the number is projected to reach 700 million by 2045. This is likely to favor the growth of the segment.

Apart from this, increasing demand for respiratory monitors such as pulse oximeters especially among COVID-19 patients is poised to surge the therapeutic monitoring devices segment growth. Furthermore, a growing number of strategic partnerships among key manufacturers are expected to positively impact the segment. For instance, in June 2020, Abbott partnered with Tandem Diabetes Care. Under this partnership, Abbott combined its Continuous Glucose Monitoring (CGM) technology with Tandem Diabetes Care’s insulin delivery systems.

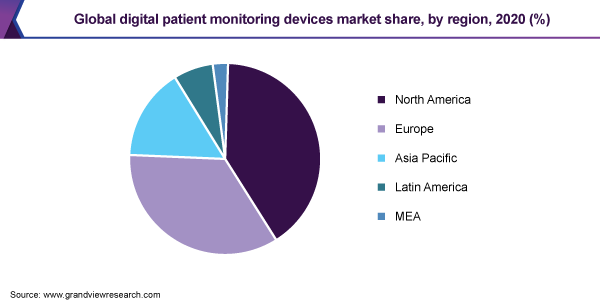

Regional Insights

North America dominated the market for digital patient monitoring devices and accounted for the largest revenue share of 41.3% in 2020. Strong government support to reduce the healthcare cost burden, technological advancements, and the launch of new products are responsible for the dominant share of the region. In July 2020, Medtronic announced 510(k) clearance from U.S. FDA approval for LINQ II insertable cardiac monitor. This coupled with rising cases of heart diseases is expected to drive the market for digital patient monitoring devices in North America.

In Europe, the market for digital patient monitoring devices is likely to propel owing to the favoring government policies formHealthand telehealth. In January 2019, NHS announced its long-term plan to make telehealth and mHealth a standard of care by 2022-23. This is expected to favor market adoption in Europe. Asia Pacific is anticipated to witness remarkable growth owing to the highest number of smartphone users in China and India and deeper internet penetration. According to India Cellular and Electronics Association, smartphone users in India are projected to increase from 500 million in 2019 to 820 million by 2022. This is likely to favor the market for digital patient monitoring devices in Asia Pacific.

Key Companies & Market Share Insights

Abbott emerged as one of the market leaders due to its strong product portfolio, update of current products as per patient needs, and wide geographical foothold. Apart from this, Koninklijke Philips N.V. held a prominent position in the market owing to the company’s strong focus on R&D. In June 2020, Koninklijke Philips N.V. launched Avalon CL Fetal and Maternal Patch and Pod, an obstetrics monitoring solution, in the U.S. Some of the prominent players in the digital patient monitoring devices market include:

GE Healthcare

AT&T

ATHENAHEALTH, INC.

Abbott

Koninklijke Philips N.V. AB

Hill-Rom Services Inc.

Medtronic

Omron Healthcare, Inc.

FitBit, Inc.

Garmin Ltd.

VitalConnect

ResMed

Siren

马数字病人监护设备rketReport Scope

Report Attribute |

Details |

Market size value in 2021 |

USD 82.4 billion |

Revenue forecast in 2028 |

USD 446.0 billion |

Growth Rate |

CAGR of 23.5% from 2021 to 2028 |

Base year for estimation |

2020 |

Historical data |

2016 - 2019 |

Forecast period |

2021 - 2028 |

Quantitative units |

Revenue in USD Million and CAGR from 2021 to 2028 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Type, product, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Country scope |

U.S.; Canada; France; Germany; Italy; Spain; U.K.; Japan; China; India; Brazil; Mexico; South Africa; Saudi Arabia |

Key companies profiled |

GE Healthcare; AT&T; ATHENAHEALTH, INC.; Abbott; Koninklijke Philips N.V. AB; Hill-Rom Services Inc.; Medtronic; Omron Healthcare, Inc.; FitBit, Inc.; Garmin Ltd.; VitalConnect; ResMed; Siren |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional and segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global digital patient monitoring devices market report on the basis of type, product, and region:

TypeOutlook (Revenue, USD Million, 2016 - 2028)

Wireless Sensor Technology

mHealth

Telehealth

Wearable Devices

Remote Patient Monitoring

Hospital Inpatient

Ambulatory Patient

Smart Home healthcare

ProductOutlook (Revenue, USD Million, 2016 - 2028)

Diagnostic Monitoring Devices

Vital Sign Monitors

Sleep Monitors

Fetal Monitors

Neuromonitors

Other Monitors

Therapeutic Monitoring Devices

Insulin Monitors

Respiratory Monitors

Other Monitors

Regional Outlook (Revenue, USD Million, 2016 - 2028)

North America

U.S.

Canada

Europe

France

Germany

Italy

Spain

U.K.

亚太地区

Japan

China

India

Latin America

Brazil

Mexico

Middle East & Africa (MEA)

South Africa

Saudi Arabia

Frequently Asked Questions About This Report

b.The global digital patient monitoring devices market size was estimated at USD 62.6 billion in 2020 and is expected to reach USD 82.4 billion in 2021.

b.The global digital patient monitoring devices market is expected to grow at a compound annual growth rate of 23.5% from 2021 to 2028 to reach USD 446.0 billion by 2028.

b.North America dominated the digital patient monitoring devices market and accounted for the largest revenue share of 41.3% in 2020.

b.Some key players operating in the digital patient monitoring devices market are Omron Corporation; Airstrip Technologies; AT&T Inc.; Athenahealth, Inc.; St. Jude Medical; Phillips Healthcare; Welch Allyn; GE Healthcare; and Zephyr Technology Corporation.

b.Key factors that are driving the digital patient monitoring devices market growth include rising attention towards fitness and a healthy lifestyle among consumers, rising prevalence of lifestyle-associated diseases, and the availability of wearable devices.

b.The wearable devices segment dominated the market for digital patient monitoring devices and accounted for the largest revenue share of 30.4% in 2020.

b.Based on product, the diagnostic monitoring devices segment dominated the market for digital patient monitoring devices and accounted for the largest revenue share of 62.5% in 2020.