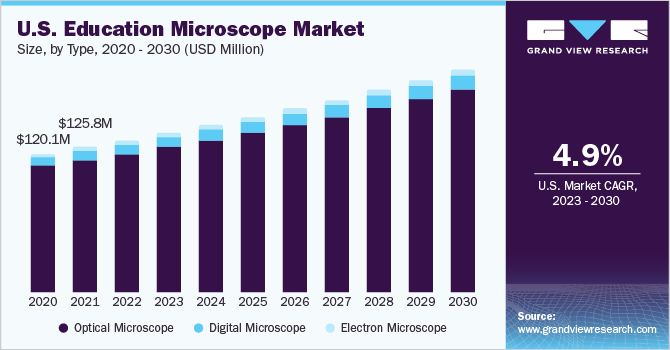

Education Microscope Market Size, Share & Trends Analysis Report By Type (Optical Microscope, Digital Microscope, Electron Microscope), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-098-8

- Number of Pages: 108

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

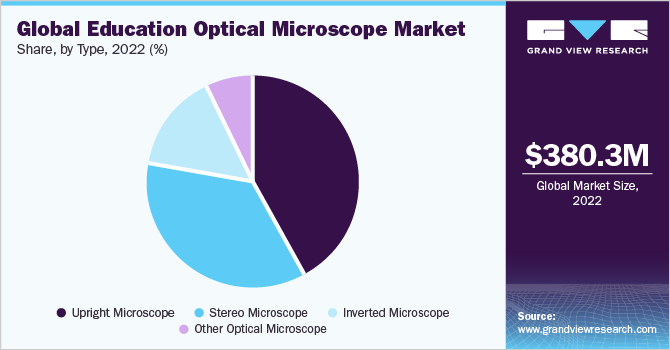

The globaleducation microscope market sizewas valued atUSD 380.3 million in 2022and is anticipated to grow at a compound annual growth rate (CAGR) of 5.29% from 2023 to 2030. The key factors driving the market growth are the growing emphasis on Science, Technology, Engineering, and Mathematics (STEM) education, the installation of advanced microscopes in academic facilities, and increasing funding by government & nongovernment organizations for installing scientific equipment in academic institutions. Moreover, the establishment of microscopy as of field of education to promote research activities contributes to the demand formicroscopes.

Educators are turning to technology to boost learning outcomes. Hence, the government and other organizations are introducing various programs to offer advanced & quality education to students. For instance, the BioEYES science education program provides classroom-based learning opportunities to increase the adoption of STEM education globally. The program is currently benefitting more than 155,000 students from 13 diverse global locations. The program was started in Philadelphia, U.S., and microscopy was the core of the program. It deployed ZEISS Stemi 305 stereo microscope for analyzing and visualizing zebrafish embryos and larvae.

Moreover, many organizations are shifting toward advanced microscopes to augment education delivery and enable students to work on high-level research. For instance, in November 2020, the College of Engineering at the University of Miami installed a newScanning Electron Microscope(SEM) and testing tools to accelerate the studies for materials characterization and application of advanced materials in various industries.

Government and nongovernment funding for educational institutions is constantly growing globally. Hence, these institutions are shifting toward advanced technologies to offer high-level instruments and resources to their students to gain a competitive advantage in the education industry. For instance, in February 2022, the Massachusetts Institute of Technology (MIT)-Nano received a grant from the U.S. National Science Foundation (NSF) to install VELION FIB-SEM, focused ion beam SEM.

Due to the COVID-19 pandemic, most countries closed academic institutions to curb the spread of the virus. This negatively impacted the installation of new educational microscopes. According to UNICEF data released in March 2021, schools for more than 168 million children were completely closed during the pandemic. Moreover, with the pandemic, academic institutions shifted toward virtual microscopes to provide quality education to the students who were attending online classes. Virtual microscopes are available online and can be simultaneously accessed by many students. This has decreased the adoption of conventional microscopes at academic institutions globally, specifically in developed countries.

Type Insights

Based on type, the market is segmented into optical microscope, digital microscope, andelectron microscope. The optical microscope segment dominated the market and accounted for the largest revenue share of 91.06% in 2022. The high share of the segment can be attributed to the lower cost and high device preference among schools. Optical microscopes have lower maintenance costs and are easy to handle. Hence, many institutions prefer installing optical microscopes, mainly in developing countries.

因此,企业引进先进的职业ducts to gain an advantage in the highly competitive market. For instance, in January 2021, ZEISS launched ZEISS Primostar 3, a new compact upright optical microscope for routine lab work and digital teaching. The microscope is designed for daily work in laboratories & classrooms for sample and tissue examination in microscopy, food, cell biology, and histology.

The digital microscope segment is expected to witness the fastest growth over the forecast period. Many institutions prefer a digital microscope as it eliminates the need for a handler. Hence, manufacturers are launching products specifically designed to cater to the growing demand from the end user. For instance, in June 2020, Nikon Corporation launched Digital Sight 1000, a microscope camera that offers digital solutions to educational/clinical institutions.

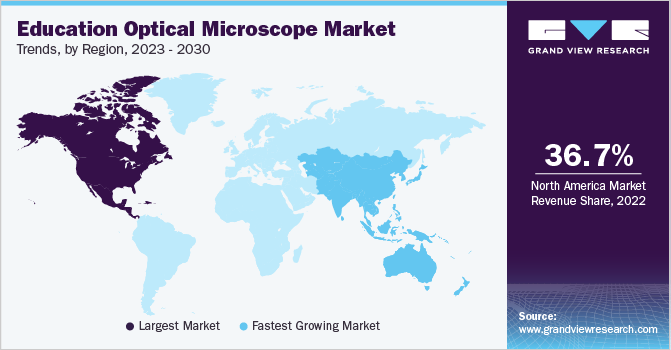

Regional Insights

北美region dominated the market and held the largest revenue share of 36.74% in 2022. The high share of the region can be attributed to the demand for high-quality scientific education and the need to equip educational institutions with suitable laboratory tools like high-level microscopes. For instance, in September 2021, the University of Arkansas’ Dale Bumpers College of Agricultural, Food and Life Sciences received USD 481,121 grant from the U.S. Department of Agriculture- National Institute of Food and Agriculture and purchased a confocal microscope for research & teaching purposes in the campus.

Asia Pacific region is expected to witness the fastest growth over the forecast period owing to increasing research in the field of nanotechnology, the growing interest of international players in investing in this region, and various government initiatives being undertaken to support STEM education. For instance, in October 2021, teachers from Ban Din Dam Laosentai School in Thailand raised funds to purchase five sets of optical microscopes to provide hands-on learning experiences to more than 400 students in the school.

Europe is expected to grow at a significant CAGR over the forecast period. Dynamic activity among research institutes resulted in the rise in the growth potential of the market in this region. The funding to provide access to advanced technologies and microscopes to research & academic facilities is growing in Europe, contributing to the growth of the market. For instance, in January 2023, NOVA School of Science and Technology received USD 2.74 million (Euro 2.5 million) funding under the ERA Chairs Actions program by the EU for the establishment of an Electronic Cryo-Microscopy (cryoEM) research group in Portugal.

Key Companies & Market Share Insights

The market is fragmented with the presence of various multinational and regional players. Integrating advanced technology in the products helps improve efficiency and reduce the time required for microscopic analysis. Product manufacturers are collaborating with academic organizations to adopt such technologies. The market has witnessed the adoption of strategies for product launches, mergers & acquisitions, and collaborations. For instance, in May 2023, Nikon Corporation launched ECLIPSE Ni-L, an upright optical microscope enabled with LED illumination for effective observation of cells and pathological specimens. Some prominent players in the global education microscope market include:

Thermo Fisher Scientific, Inc

JEOL Ltd

Bruker Corporation

ZEISS Group

Nikon Corporation

Olympus Corporation

Leica Microsystem (Danaher Corporation)

OPTIKA

AmScope

Dino-Lite

Jenoptik

Meiji Techno

Motic Microscope

National Optical

Education Microscope Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 399.9 million |

Revenue forecast in 2030 |

USD 573.9 million |

Growth rate |

CAGR of 5.29% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million, and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Type, region |

Regional scope |

北美; Europe; Asia Pacific; Latin America; Middle East & Africa |

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Mexico; Brazil; Argentina; Colombia; South Africa; Saudi Arabia; UAE; Kuwait |

Key companies profiled |

Thermo Fisher Scientific, Inc; JEOL Ltd; Bruker Corporation; ZEISS Group; Nikon Corporation; Olympus Corporation; Leica Microsystem (Danaher Corporation); OPTIKA; AmScope; Dino-Lite; Jenoptik; Meiji Techno; Motic Microscope; National Optical |

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Education Microscope Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030.For this study, Grand View Research has segmented the global education microscope market report based on type, and region:

Type Outlook (Revenue, USD Million, 2018 - 2030)

Optical Microscope

Upright Microscope

Inverted Microscope

Stereo Microscope

Other Optical Microscope

Digital Microscope

Electron Microscope

Transmission Microscope

Scanning Electron Microscope

Regional Outlook (Revenue, USD Million, 2018 - 2030)

北美

U.S.

Canada

Europe

UK

Germany

France

Italy

Spain

Norway

Denmark

Sweden

Asia Pacific

Japan

China

India

Australia

South Korea

Thailand

Latin America

Mexico

Brazil

Argentina

Colombia

Middle East & Africa (MEA)

South Africa

Saudi Arabia

UAE

Kuwait

Frequently Asked Questions About This Report

b.The global education microscope market size was estimated at USD 380.3 million in 2022 and is expected to reach USD 399.9 million in 2023.

b.The global education microscope market is expected to grow at a compound annual growth rate of 5.29% from 2023 to 2030 to reach USD 573.9 million by 2030.

b.光学microscope segment dominated the education microscopes market with a share of 91.06% in 2022 owing to the lower cost and high device preference among high schools and colleges.

b.一些关键球员在教育微指令操作cope market include Thermo Fisher Scientific, Inc; JEOL Ltd; Bruker Corporation; ZEISS Group; Nikon Corporation; Olympus Corporation; Leica Microsystem (Danaher Corporation); OPTIKA; AmScope; Dino-Lite; Jenoptik; Meiji Techno; Motic Microscopes; National Optical.

b.Key factors that are driving the education microscope market growth include increasing emphasis on STEM learning, enhanced funding for education by various government and other organizations, and adoption of advanced microscopes by the academic institutions.