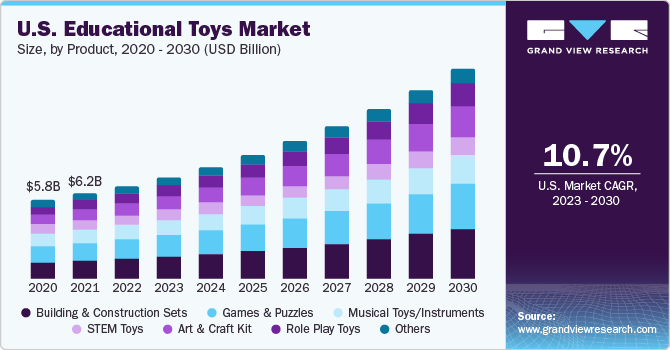

Educational Toys Market Size, Share & Trends Analysis Report By Product (Building & Construction Sets, Role Play Toys), By Age (Toddlers, Preschoolers), By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- 再保险port ID: GVR-4-68040-146-7

- Number of Pages: 85

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Consumer Goods

Educational Toys Market Size & Trends

The globaleducational toys market size was estimated at USD 47.31 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 10.2% from 2023 to 2030. The growing awareness among parents and educators regarding the significance of early childhood education is fueling the demand for educational toys. These toys play a vital role in enhancing cognitive development. The incorporation of technology into educational toys has made learning more interactive and engaging, further driving the market's expansion. Growing demand for smart educational toys has gained popularity among kids due to their interactive and technology-driven features. These toys offer engaging learning experiences by combining play with educational content, making learning fun.

市场目前正在目睹deman增加d for sustainable educational toys due to increasing awareness and concern about environmental issues among consumers, as well as a growing trend toward eco-friendly and socially responsible products. Market players have been responding to this trend by developing and promoting eco-friendly products, using sustainable materials, and implementing environmentally conscious manufacturing and distribution practices. For instance, a U.S.-based company called Mattel, Inc. constantly seeks to optimize its resource use to lessen the effects on the environment, support ethical sourcing, and promote worker health and safety throughout its supply chain. By 2030, the company aims to use only recycled, recyclable, or bio-basedplasticin all of its products and packaging, while also reducing plastic packaging by 25% per product.

The educational toys integrating science, technology, engineering, and mathematics (STEM) concepts and challenges offer children a valuable learning experience that is both entertaining and enjoyable. This surge in the production and sales of STEM-related educational toys in the market is attributed to their effectiveness. Strategy games such as chess and Settlers of Catan, involving mathematical and logical principles for planning and decision-making, promote problem-solving, critical thinking, and logical reasoning, thus fostering STEM education.

Government support for early childhood education is expected to provide a significant impetus to the market. For instance, in 2023, the Australian government allocated funds to kindergartens, offering a one-time grant of USD 5,000 to fund kindergarten services in Victoria. This grant is intended for the acquisition of educational toys and equipment, facilitating play-based learning for children during their kindergarten attendance.

Product Insights

The games & puzzles dominated the market with a revenue share of around 21% in 2022. Games and puzzles for children under 5 foster cognitive and fine motor skill development. They encourage problem-solving, boost spatial awareness, and nurture creativity, providing a well-rounded approach to early learning and development. A few of the commongames and puzzlesamong the kids include LEGO DUPLO, HABA Town Maze Magnetic Game, Ravensburger My First Puzzle Set, and more such games and puzzles.

The STEM toys are estimated to grow at a CAGR of about 12.9% in the forecast period. These toys introduce kids to the basic STEM concepts through play, promoting early interest and learning in these fields. Numerous PBS science shows funded by the NSF offer online platforms brimming with STEM-focused games and activities for children. For example, "Peep and the Big Wide World" provides resources for parents, including ideas for neighborhood safaris and STEM teaching methods. ‘Cyberchase’ offers a 3D math app and math-related downloads, while ‘SciGirls’ and "Design Squad" feature interactive games, and NOVA's ‘Topic Earth’ presents a wide array of educational videos on various topics, fostering both learning and parental involvement in STEM exploration.

Distribution Channel Insights

Based on distribution channel, the offline channel segment held a majority market share of about 65% in 2022. Specialty stores and game shops often provide an extensive range of educational toys, including rare and unique collectibles that aren't available elsewhere. Involving kids in the selection process adds to the engagement and excitement of the shopping experience. According to BookNet Canada, 80% of independent bookshops in Canada saw an increase in puzzle sales between 2019 and 2020. Additionally, 45% of bookstores saw an increase in toy and game sales.

The online channel is set to grow at a CAGR of about 18.0% over the forecast period. The online launch and accessibility of these toys are fueling demand for such products through the online distribution channel. In April 2023, SkilloToys, based in Bangalore, India, an emerging e-commerce startup, introduced an online platform dedicated to play-based learning. Their platform provides an extensive collection of educational toys, learning furniture, and games designed for children aged 0 to 8 years. Their selection encompasses wooden educational toys, Montessori toys, STEM/STEAM toys, activity kits, and educational games, all tailored to enhance various skills such as hand-eye coordination, motor skills, sensory perception, cognitive abilities, and language and numeracy skills.

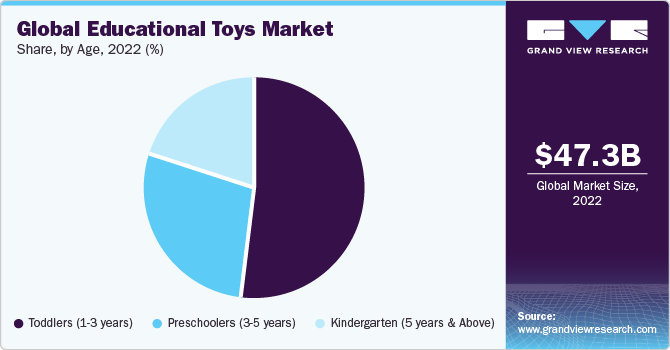

Age Insights

Based on age, the toddlers segment dominated the global market with a revenue share of approximately 52.6% in 2022. Toddlers possess an innate curiosity and eagerness to learn. Educational toys offer a structured approach to acquaint them with fundamental concepts such as shapes, colors, numbers, and letters. These toys are carefully designed to be interactive and captivating, captivating a toddler's interest and stimulating their desire to explore and discover.

The preschoolers segment is anticipated to grow at a CAGR of about 11.8% over the forecast period. Toys for preschoolers are often designed to introduce young children to a variety of subjects and basic concepts. These toys aim to make learning enjoyable and interactive, fostering early awareness of the calculation of numbers, sentences, drawings, and even more complex subjects like science and geography. They often incorporate educational content in the form of games, puzzles, books, and interactive tools, providing a foundation for ease of future learning.

再保险gional Insights

北美dominated the market with a revenue share of about 30.3% in 2022. The North American educational toy market is growing due to the rising awareness of early childhood education's significance. Parents seek toys that promote cognitive development and prepare kids for school. Furthermore, prominent market players in the region are introducing innovative and appealing educational toys for children in the market. For instance, products like the ‘Osmo-Genius Starter Kit’ blend physical and digital learning. STEM-focused toys, such as ‘LEGO Education’ sets, are also popular. These toys offer developmental benefits and are influenced by parental emphasis on educational value, contributing to market expansion.

亚太地区is expected to witness a CAGR of 11% from 2023 to 2030. This region's market holds promising prospects for growth, given that it's home to over half of the global population and boasts growing economies, particularly in countries like India and China. China especially is the largest producer and exporter of children's products & toys in the world. In a March 2023 article, The Associated Press detailed China's increased factory activity following the lockdown. The production, export, and new order indicators all increased, and the official China Federation of Logistics & Purchasing recovered to levels that indicate growing activity.

Key Companies & Market Share Insights

The market for educational toys is progressively competitive with the presence of both large- and small-scale manufacturers. Prominent players have been adopting strategies such as mergers & acquisitions, partnerships, product launches, innovation, and promotions to stay competitive in the markets.

In June 2021, Melissa & Doug, announced the launch of Timeless Toys, its new marketing campaign, aimed at reaching more parents and introducing them to its products through digital platforms including Hulu, YouTube, and Amazon.

In July 2022, Mattel collaborated with Elon Musk's SpaceX to introduce a fresh line of space-themed toys as part of its Matchbox brand. In addition, the toymaker intends to unveil SpaceX-inspired merchandise on Mattel Creations, its online platform catering to collectors seeking limited-edition items.

Key Educational Toys Companies:

- The Lego World

- Hasbro

- Ravensburger

- Melissa & Doug

- Mattel

- Spin Master

- VTech Holdings Limited

- Osmo (by Tangible Play

- Sphero, Inc.

- MindWare, Inc.

- Fat Brain Toys, LLC.

Educational ToysMarket报告范围

再保险port Attribute |

Details |

Market size value in 2023 |

USD 51.56 billion |

再保险venue forecast in 2030 |

USD 103.05 billion |

Growth rate |

CAGR of 10.2% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

再保险venue in USD million/billion and CAGR from 2023 to 2030 |

再保险port coverage |

再保险venue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, age, distribution channel, region |

再保险gional scope |

北美; Europe; Asia Pacific; South America; Middle East & Africa |

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; India; Japan; Australia & New Zealand; Brazil; South Africa; UAE |

Key companies profiled |

The Lego World; Learning Resources; Melissa & Doug; Yoto; Great Little Trading Co.; Spin Master; VTech Holdings Limited; Osmo (by Tangible Play); Sphero, Inc.; MindWare, Inc.; Fat Brain Toys, LLC. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

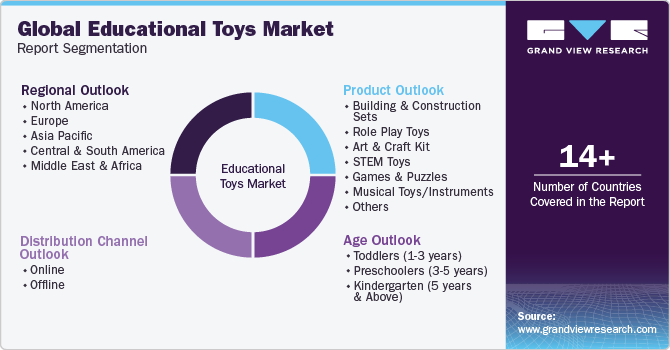

Global Educational Toys Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global educational toys market report based on product, age, distribution channel, and region:

Product Outlook (Revenue, USD Million, 2017 - 2030)

Building & Construction Sets

Role Play Toys

Art & Craft Kit

STEM Toys

Games & Puzzles

Musical Toys/Instruments

Others

Age Outlook (Revenue, USD Million, 2017 - 2030)

Toddlers (1-3 years)

Preschoolers (3-5 years)

Kindergarten (5 years & Above)

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

Online

Offline

Supermarkets & Hypermarkets

Convenience Stores

Others

再保险gional Outlook (Revenue, USD Million, 2017 - 2030)

北美

U.S.

Canada

Mexico

Europe

UK

Germany

France

Spain

Italy

亚太地区

China

India

Japan

Australia & New Zealand

Central & South America (CSA)

Brazil

Middle East & Africa (MEA)

South Africa

UAE

Frequently Asked Questions About This Report

b.Key factors that are driving the educational toys market growth include factors such as growing awareness among parents regarding the significance of early education and the incorporation of technology into educational toys making it more interactive and engaging.

b.The global educational toys market was estimated at USD 47.31 billion in 2022 and is expected to reach USD 51.56 billion in 2023.

b.The global educational toys market is expected to grow at a compound annual growth rate of 10.2% from 2023 to 2030 to reach USD 103.05 billion by 2030.

b.北美dominated the educational toys market with a share of around 30.3% in 2022. This is owing to the product launches by prominent market players in the region introducing innovative and appealing educational toys for children in the market.

b.Some of the key players operating in the educational toys market include The Lego World, Hasbro, Ravensburger, Melissa & Doug, Mattel, Spin Master, VTech Holdings Limited, Osmo (by Tangible Play), Sphero, Inc., MindWare, Inc., Fat Brain Toys, LLC.

We are committed towards customer satisfaction, and quality service.