Electric Bed Market Size, Share & Trends Analysis Report By Product (Semi-automatic, Fully Automatic), By Application (General, Intensive Care), By End Use, By Region, And Segment Forecasts, 2021 - 2027

- Report ID: GVR-4-68039-271-1

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2015 - 2019

- Industry:Healthcare

Report Overview

The global electric bed market size was valued at USD 2.40 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2021 to 2027. The increasing demand for electric bed is attributed to the rising number of hospitals in developing countries, increasing patient population, growing geriatric population, and rising adoption of technologically advanced products. The recent outbreak of COVID-19 across the globe has increased the number of patient admissions in hospitals and clinics. The electric beds are among the major requirements for aged people and patients with critical conditions. The electric beds provide several facilities, such as extra comfort and improved blood circulations, and are equipped with caregiver assistance, which is very beneficial for such patients. Therefore, this may surge the demand for the product, thereby propelling the market growth over the forecast period.

The presence of a large population pool over 60 years, which typically has a lower immunity level and is prone to neurological diseases, cardiac problems, cancer, and spinal injuries, is expected to be a high impact-rendering factor for the growth of the market over the forecast period. As per the WHO, globally, the number of people aged 65 or older is anticipated to grow from an estimated 524 million in 2010 to nearly 1.5 billion in 2050. The geriatric population is highly susceptible to diseases, such as arthritis, heart attacks, stroke, osteoporosis, and obesity. Patients suffering from such diseases may require an electric bed as they are more comfortable for them for treatment. Hence, the growing geriatric population is likely to result in the growth of the market.

全球越来越多的手术也是一个key factor expected to drive the market over the forecast period. For instance, as per the Mölnlycke Health Care AB, 70.00 million surgical procedures are performed every year in Europe. Similarly, according to the Healthcare Cost and Utilization Project (HCUP), in 2015, more than 9,942,000 surgeries were performed in the U.S. within ambulatory care settings. In the case of surgeries, an electric bed is among the essential requirement in hospitals, clinics, and ambulatory surgery centers. Therefore, such instances are expected to fuel market growth.

The growing geriatric population across the globe is also one of the prominent factors influencing the market growth. The geriatric population is more prone to various chronic conditions and chronic wounds, thereby increasing the hospital admission rate. The increasing hospital admission rate is anticipated to increase the demand for electric bed, thereby surging the market growth over the forecast period.

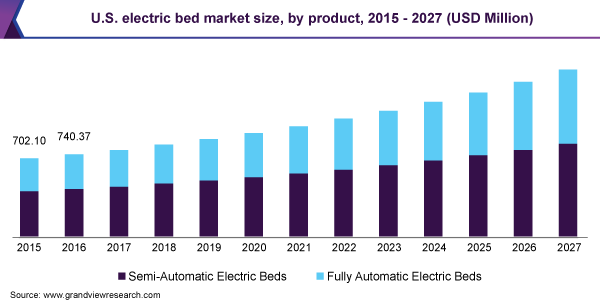

Product Insights

The semi-automatic electric bed segment held the largest share of 57.40% in 2020 and is anticipated to witness considerable growth over the forecast period. The segment growth is majorly attributed to the rising cases of cancer and surgeries of cancer patients across the globe. For instance, as per the report published by the World Health Organization in 2018, around 2.09 million cases of lung cancer, 2.09 million cases of breast cancer, and 1.80 million cases of colorectal cancer were reported globally. Therefore, such factors are anticipated to drive the demand for semi-automatic electric beds in hospitals and clinics since they are easier to handle by patients, thereby propelling the segment growth.

The fully automatic electric bed segment is anticipated to witness the fastest growth over the forecast period. The fully automatic electric bed allow improved sleep, can be handled without any assistance, and help in reducing pressure and swelling. Advantages of these beds over the semi-automatic ones are propelling the segment growth over the forecast period.

End-use Insights

The hospitals and clinics segment held the largest share of 38.00% in 2020. The increasing cases of chronic wounds and cancer and the rising number of hospital admissions are the major factors fueling the segment growth. In addition, the increasing number of surgical procedures is anticipated to positively impact the segment growth over the forecast period.

The reproductive care centers segment is anticipated to witness significant growth over the forecast period. The several advantages of the electric bed are boosting the demand for the product. The comfort and convenience offered by these beds help the patients for a comfortable delivery.

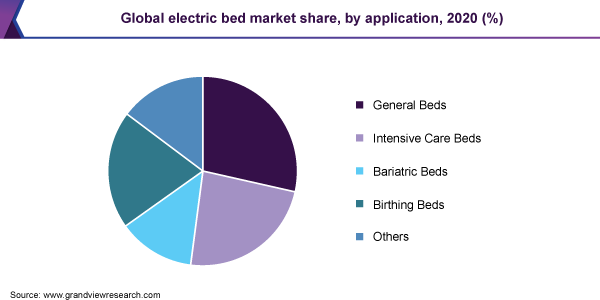

Application Insights

The general beds segment held the largest share of 28.55% in 2020. The General electric bed allows the patient to adjust lower and upper body positions and also helps to adjust the height of the bed. The increasing patient admissions due to the outbreak of COVID-19 across the globe are propelling the demand for the product. General electric bed allows better comfort to the patients, especially the aged patients, thus this factor is expected to propel the segment growth over the forecast period.

The intensive care beds segment is anticipated to witness the fastest growth over the forecast period. The rising number of accident cases and surgeries across the globe are promoting the segment growth over the forecast period. For instance, according to the Association for Safe International Road Travel (ASIRT), around 20-50 million people are injured or disabled every year. It also reported that in the U.S., more than 37,000 people die in road accidents per year and around 2.35 million are injured or disabled.

Regional Insights

North America dominated the market with a share of 45.41% in 2020. An increase in the number of surgeries and patient admissions is expected to drive the demand for electric beds in North America. Major market players in the region are undertaking initiatives to increase patient safety and comfort by offering innovations and modifications. In addition, the recent outbreak of COVID-19 is expected to boost the demand for electric bed. All these factors are anticipated to propel the market growth over the forecast period.

Asia Pacific and is expected to expand at the fastest growth rate of 7.4% over the forecast period. The presence of developing countries such as China, India, and Japan are anticipated to boost the market growth in Asia Pacific. Increasing healthcare infrastructure development in this region and rising awareness about patient safety and care are some of the factors anticipated to drive the market.

Key Companies & Market Share Insights

The companies are constantly making efforts to commercialize electric beds across the globe by emphasizing the benefits of the products and launching products with innovative features. For instance, in October 2020, Stryker launched a series of electric beds, ProCuity, which is a completely wireless hospital bed equipped with several innovative patient monitoring features. This product helps in minimizing patient falls, allows the professionals to efficiently monitor bedridden patients, and maintains the connectivity of the bed in moving positions as well.

Many key players are also implementing strategies, such as mergers with material suppliers, government investments into manufacturing, and agreements with hospitals to provide long-term supplies. Some prominent players in the global electric bed market include:

Arjo

Hill-Rom Services Inc.

Medline Industries, Inc.

PARAMOUNT BED CO., LTD.

Invacare Corporation

Stryker

Malvestio Spa

LINET

Gendron Inc.

Midmark India Pvt. Ltd.

Electric Bed Market Report Scope

Report Attribute |

Details |

Market size value in 2021 |

USD 2.55 billion |

Revenue forecast in 2027 |

USD 3.80 billion |

Growth Rate |

CAGR of 6.8% from 2021 to 2027 |

Base year for estimation |

2020 |

Historical data |

2015 - 2019 |

Forecast period |

2021 - 2027 |

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2027 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, application, end use, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; U.K.; Germany; Japan; China; Brazil; Mexico; South Africa; Saudi Arabia |

Key companies profiled |

Arjo; Hill-Rom Services Inc.; Medline Industries, Inc.; PARAMOUNT BED CO., LTD.; Invacare Corporation; Stryker; Malvestio Spa; LINET; Gendron Inc.; Midmark India Pvt. Ltd. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2015 to 2027. For the purpose of this study, Grand View Research has segmented the global electric bed market report on the basis of product, application, end use, and region:

产品或者tlook (Revenue, USD Million, 2015 - 2027)

Semi-automatic Electric Bed

Fully Automatic Electric Bed

Application Outlook (Revenue, USD Million, 2015 - 2027)

General Bed

Intensive Care Bed

Bariatric Bed

Birthing Bed

Others

End-use Outlook (Revenue, USD Million, 2015 - 2027)

Hospitals & Clinics

Reproductive Care Centers

Dentistry

Others

Regional Outlook (Revenue, USD Million, 2015 - 2027)

North America

U.S.

Canada

Europe

Germany

U.K.

Asia Pacific

Japan

China

拉丁美洲

Brazil

Mexico

Middle East & Africa

South Africa

Saudi Arabia

Frequently Asked Questions About This Report

b.The global electric bed market size was estimated at USD 2.40 billion in 2020 and is expected to reach USD 2.54 billion in 2021.

b.The global electric bed market is expected to grow at a compound annual growth rate of 6.8% from 2020 to 2027 to reach USD 3.79 billion by 2027.

b.North America dominated the electric bed market with the highest share in 2019. This is attributable to rising healthcare awareness coupled with constant research and development initiatives.

b.Some key players operating in the electric bed market include Hill-Rom Holdings, Inc., Stryker Corporation, Getinge AB, and Medline Industries, Inc.

b.Key factors driving the electric bed market growth include an increasing number of road accidents and surgeries across the globe.