Electric Vehicle Aftermarket Industry Size, Share & Trends Analysis Report By Replacement Parts, By Propulsion Type, By Vehicle Type, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-108-9

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Technology

Report Overview

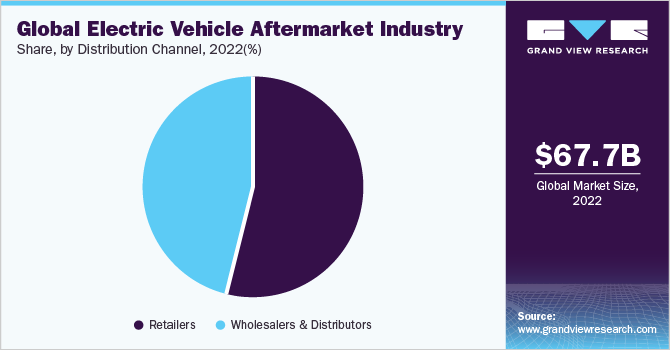

The globalelectric vehicle aftermarket industry sizewas estimated atUSD 67.74 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 21.1% from 2023 to 2030. The growth of the global electric vehicle (EV)s aftermarket can be attributed to the increasing adoption ofelectric vehicles, the need for battery replacements and upgrades, innovative charging solutions, customization demands, specialized maintenance and repair services, the trend of converting conventional vehicles to electric, and the influence of government policies and incentives. As the electric vehicle market continues to evolve and mature, the aftermarket industry will play a crucial role in meeting the demands and preferences of EV owners.

The ongoing shift toward electric vehicles is one of the primary drivers of the aftermarket's growth. As more consumers and businesses switch to electric vehicles, the demand for aftermarket products and services will naturally rise. For example, companies like Tesla. Inc., Nissan Motor Co. Ltd., and Chevrolet have experienced significant sales of their electric models, and as these vehicles age, the need for replacement parts and maintenance services will increase. For instance, according to the International Energy Agency based in France, electric car sales have been expanding steadily worldwide, with 2 million sales in the first quarter of 2022, an increase of 75% from the same period in 2021.

Battery technology is continuously improving, leading to longer-lasting and more efficient batteries for electric vehicles. However, even with these advancements, batteries will eventually need replacement or refurbishment, presenting opportunities for the aftermarket. The lithium-ion batteries used in electric vehicles have a limited lifespan and will need replacement over time. As the first generation of electric vehicles reaches the end of their battery life, there will be a surge in demand for aftermarket battery replacements and upgrades. This creates a market for companies specializing in battery refurbishment or offering improved battery technology, such as higher capacity and faster charging.

全球各国政府实施波尔icies to promote electric vehicle adoption. These policies may include subsidies for EV purchases, tax credits, or even mandates for reducing the sale of new internal combustion engine vehicles. As these policies encourage more people to choose electric vehicles, the aftermarket industry will likely see increased demand for EV-related products and services. For instance, the tax incentive program in Norway provides zero-emission vehicles (ZEVs) with a number of benefits, such as remission from registration tax, VAT, and motor fuel taxes, as well as a 50% reduction in road charges, ferry fees, and parking costs. The results of EV-friendly actions are clear to see. In 2021, over two-thirds of all new passenger cars sold nationwide were electric.

Replacement Parts Insights

The other segment dominated the market with a revenue share of 43.5% in 2022. The segment includes the motor, charging infrastructure, and other EV-specific parts and components such as electric drivetrains, regenerative braking systems, electric motors, and power electronics. Electric vehicles have different mechanical and electrical systems than traditional combustion engine vehicles, so there was a growing need for EV-specific aftermarket parts. Moreover,with the growing number of electric vehicles on the road, there was an increasing demand for specialized maintenance and repair services tailored to EVs. Aftermarket service providers offered diagnostics, battery health checks, software updates, and other maintenance services specific to electric vehicles.

The battery segment is expected to grow with the fastest CAGR of 25.1% from 2023 to 2030. Electric vehicle batteries were among the most critical components driving the growth of the aftermarket. As the adoption of electric vehicles increased, there was a corresponding demand for battery replacements, upgrades, and refurbishment services. Additionally, advancements in battery technology, such as higher energy density and faster charging capabilities, were expected to lead to improved aftermarket battery offerings. Moreover, there was an increased demand for aftermarket charging accessories. This included portable charging solutions, upgraded charging cables, wireless charging options, and adapters to access global charging networks.

Propulsion Type乐鱼APP二维码

The battery electric vehicles (BEVs) segment dominated the market with a revenue share of 37.2% in 2022. Battery electric vehicles, which rely solely on electric batteries for propulsion, were experiencing significant growth in the aftermarket. As BEV adoption increased, there was a corresponding rise in demand for aftermarket battery replacements, upgrades, and maintenance services. Additionally, aftermarket companies offered various accessories and components specific to BEVs, such as charging solutions, battery management systems, and performance upgrades.

The development of more efficient and durable fuel cell technology contributed to the growth of Fuel Cell Electric Vehicles (FCEVs). As the technology improved, FCEV became more reliable, with longer driving ranges and quicker refueling times, addressing some of the initial challenges faced by early adopters. Moreover, FCEVs found applications in commercial sectors, particularly in public transportation and commercial fleets. Cities and regions committed to sustainability and zero-emission transportation were considering FCEVs for their bus fleets and other public transport options.

Vehicle Type Insights

The passenger cars segment led the market with a revenue share of 71.0% in 2022. The adoption of electric passenger cars was steadily increasing due to growing awareness of environmental concerns, government incentives, and improvements in charging infrastructure. As more electric cars entered the market, the demand for aftermarket products and services specific to these vehicles grew. Electric passenger cars rely heavily on software and connectivity features. Aftermarket companies offered software updates, infotainment system enhancements, and connectivity solutions to improve the driving experience and access the latest technological advancements.

Electric commercial vehicles (eCVs) include electric buses, delivery vans, trucks, and other commercial fleet vehicles that have been electrified.Many governments and local authorities have been actively promoting the adoption of electric commercial vehicles as part of their efforts to reduce greenhouse gas emissions and improve air quality. Government incentives, subsidies, and grants for electric commercial vehicle purchases or fleet electrification have encouraged businesses to invest in eCVs. Moreover, electric commercial vehicles offer lower operating costs than traditional internal combustion engines. Reduced fuel and maintenance expenses make eCVs an attractive choice for commercial fleet operators, leading to increased demand in the aftermarket.

Distribution Channel Insights

The retailers segment dominated the market with a revenue share of 55.5% in 2022. Traditional automotive retailers, including authorized dealerships and independent automotive stores, have recognized the growing demand for electric vehicle aftermarket products and services. Theyare expanding their offerings to include electric vehicle accessories, charging solutions, and maintenance services specific to electric vehicles. Moreover, specialty stores that cater exclusively to electric vehicles and sustainable mobility have emerged to meet the unique needs of electric vehicle owners. These stores offer a wide range of aftermarket products, including charging accessories, batteries, and performance upgrades, providing a one-stop shop for electric vehicle enthusiasts.

The rising adoption of electric vehicles has led to an increased demand for aftermarket products and accessories tailored to electric cars. Wholesalers and distributors have responded to this demand by expanding their product offerings and providing various electric vehicle aftermarket solutions to retailers and specialty stores. As electric vehicles become more mainstream, wholesalers and distributors focus on penetrating the electric vehicle aftermarket to capture a growing market share. They are actively establishing partnerships with aftermarket manufacturers and connecting with retailers to ensure the availability of electric vehicle aftermarket products across different regions.

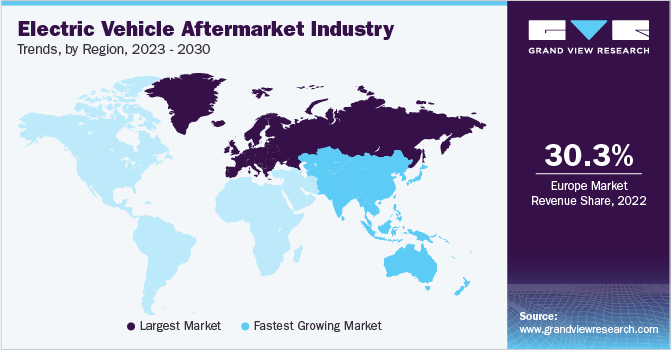

Regional Insights

Europe dominated the market with a revenue share of 30.3% in 2022. Europe was actively investing in expanding its electric vehicle charging infrastructure. As charging stations became more accessible and widespread, electric vehicles' overall appeal and convenience increased, further driving demand for aftermarket products like charging accessories and solutions. Moreover, the European electric vehicle aftermarket offered a wide range of products and services to cater to the diverse needs of electric vehicle owners. These included charging solutions, battery management systems, performance upgrades, customizations, and specialized maintenance services.

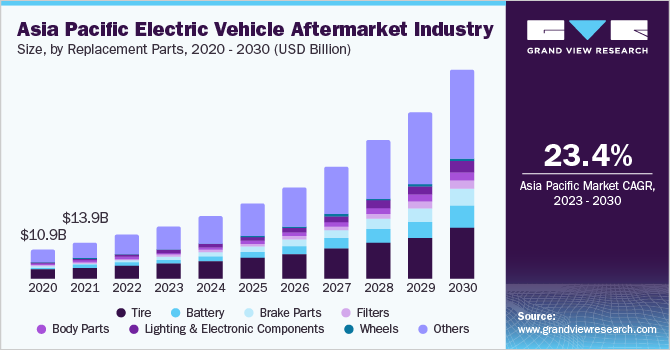

亚太地区预计将增长fastest CAGR of 23.4% from 2023 to 2030. The region, home to some of the world's most populous and rapidly growing cities, faced significant environmental challenges due to air pollution and carbon emissions. As a result, a growing emphasis on sustainable transportation led to increased interest in electric vehicles and the aftermarket products and services that support them. Furthermore, governments and private companies in the region were investing heavily in expanding electric vehicle charging infrastructure. The development of a robust and widespread charging network made electric vehicles more practical and appealing to consumers, driving the demand for charging-related aftermarket solutions.

Key Companies & Market Share Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is developing new products and collaborating among the key players. Some prominent players in the global electric vehicle aftermarket industry include:

3M

ABB Ltd.

EVBox Group

ChargePoint Inc.

Webasto SE

Siemens AG

Bosch Automotive Sevrice Solution Inc.

Delphi Technologies

Schneider Electric SE

ClipperCreek, Inc

AeroVironment, Inc

Continental AG

Denso Corporation

Robert Bosch GmbH.

Electric Vehicle Aftermarket Industry Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 80.56 billion |

Revenue forecast in 2030 |

USD 308.41 billion |

Growth rate |

CAGR of 21.1% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion, and CAGR from 2023 to 2030 |

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

Segments covered |

Replacement parts, propulsion type, vehicle type, distribution channel, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; KSA; UAE; South Africa; Brazil |

Key companies profiled |

3米;ABB有限公司;EVBox组;充点Inc .);Webasto SE; Siemens AG; Bosch Automotive Service Solutions Inc.; Delphi Technologies; Schneider Electric SE; ClipperCreek, Inc.; AeroVironment, Inc.; Continental AG; Denso Corporation; Robert Bosch GmbH |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope. |

GlobalElectric Vehicle Aftermarket IndustryReport Segmentation

This report forecasts revenue growth on global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global electric vehicle aftermarket industry report based on replacement parts, propulsion type, vehicle type, distribution channel, and region:

Replacement Parts Outlook (Revenue, USD Million, 2017 - 2030)

Tire

Battery

Brake Parts

Filters

Body Parts

Lighting And Electronic Components

Wheels

Others

Propulsion Type Outlook (Revenue, USD Million, 2017 - 2030)

Battery Electric Vehicles

Hybrid Electric Vehicles

Fuel Cell Electric Vehicles

Plug-in Hybrid Electric Vehicles

Vehicle Type Outlook (Revenue, USD Million, 2017 - 2030)

Passenger Cars

Commercial Vehicles

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

Retailers

Wholesalers & Distributors

Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Asia Pacific

China

India

Japan

South Korea

Australia

拉丁美洲

Brazil

Mexico

Middle East and Africa

Saudi Arabia (KSA)

UAE

South Africa

Frequently Asked Questions About This Report

b.The global electric vehicle aftermarket industry size was estimated at USD 67.74 billion in 2022 and is expected to reach USD 80.56 billion in 2023.

b.The global electric vehicle aftermarket industry is expected to grow at a compound annual growth rate of 21.1% from 2023 to 2030 to reach USD 308.41 billion by 2030.

b.Europe dominated the electric vehicle aftermarket industry with a share of 30.31% in 2022. This is because the region is actively investing in expanding its electric vehicle charging infrastructure and offering a wide range of products and services to cater to the diverse needs of electric vehicle owners

b.Some key players operating in the electric vehicle aftermarket industry include 3M, ABB Ltd., EVBox Group, ChargePoint Inc., Webasto SE, Siemens AG, Bosch Automotive Sevrice Solution Inc., Delphi Technologies, and Schneider Electric SE.

b.The global electric vehicle aftermarket industry growth can be attributed to the increasing adoption of electric vehicles, the need for battery replacements and upgrades, customization demands, specialized maintenance and repair services, the trend of converting conventional vehicles to electric, and the influence of government policies and incentives.