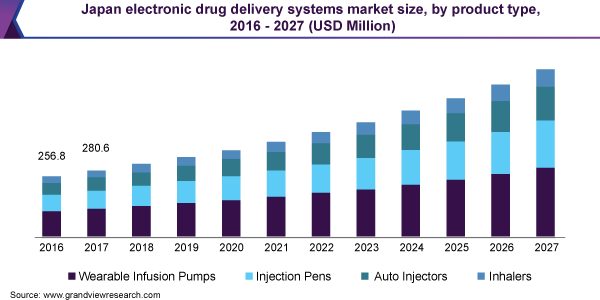

Electronic Drug Delivery Systems Market Size, Share & Trends Analysis Report by Product Type (Auto Injectors, Injection Pens), By Application (Diabetes, CVDs), By Distribution Channel, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-533-5

- Number of Pages: 138

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry:Healthcare

Report Overview

The global electronic drug delivery systems market size was valued at USD 7.8 billion in 2019 and is projected to grow at a compound annual growth rate (CAGR) of 8.9% from 2020 to 2027. The major factors driving the market include increasing prevalence of chronic diseases, such as diabetes, asthma, and cardiovascular disease (CVDs), and technological advancements in the development of smart drug delivery systems. Electronic drug delivery systems are portable devices that offer convenient options to patients, such as easy drug administration, dose accuracy, short administration time, and improved patient adherence. The launch of technologically advanced minimally invasive drug delivery systems has enabled patients with chronic disease to self-administer their regular doses, thereby minimizing hospital visits and related costs.

In February 2020, Safe’n’Spray, an electronic nasal spray device developed by Nemera’s was awarded for the best innovation at Pharmapack. The device is equipped with features, such as overdosing prevention of potent drugs and fingerprint identification allowing child-resistance and security. However, most of these devices are currently available at a high price range. Thus, limiting its target customers. This is expected to have a mild restraining impact on market growth, especially in developing countries with price-sensitive customers.

Improving medication adherence provides a significant opportunity for the market players to capture larger market share, as more than 50% of patients suffering from chronic diseases discontinue medications within a year. Moreover, connected drug delivery systems facilitate treatment programs, reduce healthcare costs arising due to non-adherence, and provide favorable reimbursement as the companies are largely focused on outcome-based models.

Thus, biopharma companies can adopt several strategies to enhance patient adherence rates to generate significant revenue. According to the International Diabetes Federation (IDF), the number of diagnosed patients is expected to escalate from 463 million in 2019 to 700 million by 2045. The IDF further stated that an estimated 374 million people are at high risk of developing type 2 diabetes.

According to the World Health Organization (WHO) fact sheet, 2017, CVDs are the leading cause of death, where around 17.9 million deaths were reported from the disease globally in 2016. Easy availability of advanced products and increasing awareness about the same are the factors expected to ensure the swift growth of the electronic drug delivery systems market over the forecast period.

Product Type Insight

Wearable infusion pumps accounted for the largest market share of more than 41% in 2019. The segment will retain its leading position throughout the forecast period as these pumps are widely used for diabetes management. Injection pen segment is likely to register the fastest CAGR from 2020 to 20274. The approval for injection pens indicated to treat diabetes, offering a portable and convenient option is expected to increase the market share of the segment over the forecast period.

In January 2020, Bigfoot Biomedical received a USD 45 million grant for conducting late-stage clinical trials of its insulin management product-a connected insulin pen. The company has also partnered with Abbott Laboratories to gain access to Abbott’s FreeStyle Libre glucose sensing technology.

Distribution Channel Insight

Retail pharmacies was the leading segment in 2019 and accounted for the market share of 45.8%. This can be attributed to factors, such as increasing patient awareness and focus on positive medical outcomes.

However, the online pharmacies segment is expected to showcase the fastest CAGR from 2020 to 2027 due to various discount offers granted by the developers via the bulk purchase of the essential drug delivery devices. In addition, cost-effectiveness is a vital factor as the medications need to be frequently administered, thus providing an economic module for the patients in developing countries.

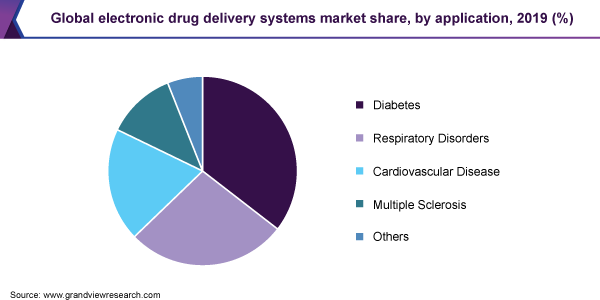

Application Insight

The diabetes segment accounted for the maximum market share of over 35% in 2019 and is projected to continue its dominance throughout the forecast years. This growth is attributed to the factors, such as rising adoption of smartphone apps, easy availability of devices likeinsulin pumpsandinjection pensby major market players for type 1 and 2 diabetes management, and increasing penetration of digital platforms enabling better patient outcomes.

In June 2018, the U.S. FDA granted Insulet Corporation approval for its Omnipod DASH Insulin Management System for diabetes management. In February 2019, Tandem Diabetes Care received FDA approval mark for t: slim X2 insulin pump with interoperable technology for children and adults for diabetes management.

Regional Insights

North America dominated the market in 2019 and accounted for a market share of 44.2% owing to extensive use of electronic drug delivery systems for various chronic conditions, such as Multiple Sclerosis (MS) and Parkinson’s disease.

According to the study conducted by the National Multiple Sclerosis Society, in U.S., about 913,925 people have multiple sclerosis. The MS Discovery Forum further stated that around 200 new cases are diagnosed in U.S. per week.

Major manufacturers are focused on developing innovative solutions to cater to the unmet medical needs for patients suffering from chronic diseases. For instance, in 2015, Unilife Corporation, a U.S.-based injectable drug delivery company launched Imperium, a prefilled wearable insulin pump of instant patch pumps for insulin.

亚洲的奶嘴fic regional market is expected to register the fastest CAGR over the forecast period. The high growth rate in the region is primarily attributed to the rise in diabetic patients and the high demand for advanced healthcare services. According to the International Diabetes Federation, about 60% of diabetic patients live in Asia, with China and India. IDF further states that Western Pacific region, which includes majorly China, Japan, Malaysia, Australia, and Indonesia, is among the world’s most populous regions. This region has around 138.2 million people with diabetes, and the number is estimated to escalate to 201.8 million by 2035.

Key Companies & Market Share Insights

New product launch, co-development collaborations, and product innovation are the major strategies adopted by the market players to retain their market share. For example, in October 2018, Novo Nordisk announced the global launch of the two connected insulin pens NovoPen 6 and NovoPen Echo Plus. The company also formed a deal with Flex Digital Health for using Flex’s BrightInsight IoT platform. The platform enables innovation focused on improving patient outcomes. Some of the prominent players in the electronic drug delivery systems market include:

Bayer AG

Gerresheimer AG

Medtronic PLC

Elcam Medical Group

Novo Nordisk

Insulet Corp.

Becton, Dickinson and Company

Sanofi S.A.

Unilife Corp.

Electronic Drug Delivery Systems Market Report Scope

Report Attribute |

Details |

Market size value in 2020 |

USD 8.5 billion |

Revenue forecast in 2027 |

USD 15.4 billion |

Growth Rate |

CAGR of 8.8% from 2020 to 2027 |

Base year for estimation |

2019 |

Historical data |

2016 - 2018 |

Forecast period |

2020 - 2027 |

Quantitative units |

Revenue in USD million and CAGR from 2020 to 2027 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product Type, application, distribution channel, region |

Regional scope |

北美;欧洲;亚洲的奶嘴fic; Latin America; MEA |

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Russia; Japan; China; India; Thailand; South Korea; Malaysia; Brazil; Mexico; Argentina; Columbia; South Africa; Saudi Arabia; UAE; Qatar |

Key companies profiled |

Bayer AG; Gerresheimer AG; Medtronic PLC; Elcam Medical Group; Novo Nordisk; Insulet Corp.; Becton, Dickinson and Company; Sanofi S.A.; Unilife Corp. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global electronic drug delivery systems market report based on product type, application, distribution channel, and region:

产品类型Outlook (Revenue, USD Million, 2016 - 2027)

Wearable Infusion Pumps

Auto Injectors

Injection Pens

Inhalers

Application Outlook (Revenue, USD Million, 2016 - 2027)

Diabetes

Cardiovascular Disease

Respiratory Disorders

Multiple Sclerosis

Others

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2027)

Hospital Pharmacies

零售药店

Online Pharmacies

Regional Outlook (Revenue, USD Million, 2016 - 2027)

North America

U.S.

Canada

Europe

U.K.

Germany

France

Italy

Spain

Russia

亚洲的奶嘴fic

Japan

China

India

Thailand

Malaysia

South Korea

Latin America

Brazil

Mexico

Argentina

Colombia

Middle East & Africa

South Africa

Saudi Arabia

UAE

Qatar

Frequently Asked Questions About This Report

b.The global electronic drug delivery systems market size was estimated at USD 7.8 billion in 2019 and is expected to reach USD 8.5 billion in 2020.

b.The global electronic drug delivery systems market is expected to grow at a compound annual growth rate of 8.9% from 2020 to 2027 to reach USD 15.4 billion by 2027.

b.The diabetes segment dominated the electronic drug delivery systems market with a share of 35.7% in 2019. This is attributable to factors such as high availability of electronic drug delivery devices such as insulin pumps and injection pens by major market players for type 1 and 2 diabetes management, rising adoption of smartphone apps, and increasing penetration of digital platforms.

b.Some key players operating in the electronic drug delivery systems market include Bayer AG; Gerresheimer AG; Medtronic Plc; Elcam Medical Group; Novo Nordisk; Insulet Corporation; Becton, Dickinson and Company; Sanofi S.A.; and Unilife Corporation.

b.Key factors that are driving the electronic drug delivery systems market growth include increasing prevalence of chronic diseases such as diabetes, asthma and cardiovascular disease and technological advancements in development of smart drug delivery systems.