Empty IV Bags Market Size, Share & Trends Analysis Report By Product (PVC, non-PVC), By Type (Single, Multi-chamber), By Region, Competitive Insights, And Segment Forecasts, 2019 - 2026

- Report ID: GVR-3-68038-494-9

- Number of Pages: 105

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry:Healthcare

Report Overview

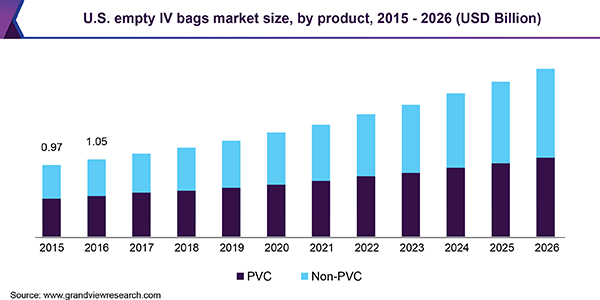

The global empty IV bags market size valued at USD 2.99 billion in 2018 and is expected to grow at a compound annual growth rate (CAGR) of 8.1% from 2019 to 2026. The demand for these bags is increasing owing to the environment-friendliness ofnon-PVC IV bags, rising government initiatives, growing prevalence of malnutrition, and increasing incidence of cancer globally.

不同国家的政府机构是扭角羚g several steps to reduce the usage of phthalate IV bags wherever possible, without compromising patient safety. For instance, Denmark introduced a national ban on Di-(2-ethylhexyl) phthalate (DEHP), Dibutyl Phthalate (DBP), Dibp Plasticizer (DIBP), and Butyl Benzyl Phthalate (BBP) under its national phthalate strategy, which was initially set for December 2013 and was later postponed to 2015. The Danish Health and Medicines Authority (DHMA) announced certain set of guidelines pertaining to usage of particular types of phthalates in medical devices. The aim of these initiatives was to ensure continued reduction in use of classified phthalates in medical devices. Similarly, in May 2006, the Federal Institute for Drugs and Medical Devices of Germany issued a recommendation for hospitals to minimize or avoid the use of DEHP containing medical devices for specific population groups, such as premature babies, infants, children, adolescents, pregnant women, and nursing mothers. The recommendation necessitates manufacturers to opt for the production of alternative products that are PVC-free and non-toxic. Such government initiatives are expected to aid growth of the market during the forecast period.

Favorable reimbursement policies in various countries are also anticipated to drive growth. The CMS in the U.S. covers various surgeries and treatment procedures that require IV bags. Similarly, various government agencies in other countries cover some part of treatment procedures, which is expected to increase sales of IV bags. Increasing prevalence of chronic conditions, such as cancer, positively impacts use of parenteral nutrition across the country.

Parenteral nutrition involves administration of vital nutrients that help in maintaining strength, energy, and hydration levels in patients suffering from a disease. According to statistics published by WHO, around 8.2 million deaths occur every year due to cancer, accounting for 13.0% of the deaths worldwide. Moreover, the proportion of cancer cases is estimated to increase by 70.0% over the next couple of decades.

越来越普遍的癌症是一种高影响rendering driver. Cancer generally results in a rise in the incidence of stomach ulcers, disturbances in normal functioning of the GI tract, and development of physical obstructions, thereby increasing the requirement for parenteral nutrition. Moreover, cancer therapies further weaken the human body and deprive it of nutrients to an extent that it may prove fatal. In addition, a common symptom associated with cancer is anorexia or unintentional weight loss, which needs to be managed parenterally.

Product Insights

On the basis of product, the market is categorized into PVC and Non-PVC IV bags. The Non-PVC IV bags segment dominated the market in 2018. On the basis of materials, the non-PVC market has been segmented into polypropylene (PP), Copolyester Ether (COPE), Ethylene-vinyl acetate (EVA), and others. The COPE segment is anticipated to witness the fastest growth over the forecast period.

COPE for empty IV bags is used in combination with other materials such as polypropylene or other polyolefin resins. It improves strength of the product and imparts more clarity. For instance, Ecdel, trademark product of the Eastman Chemical Company offers transparency, chemical resistance, and toughness. COPE can also be processed on standard injection molding, film extrusion equipment, extrusion blow molding, and profile extrusion. These elastomers are also electron beam, radiation, autoclave sterilization, and ethylene oxide stable.

Type Insights

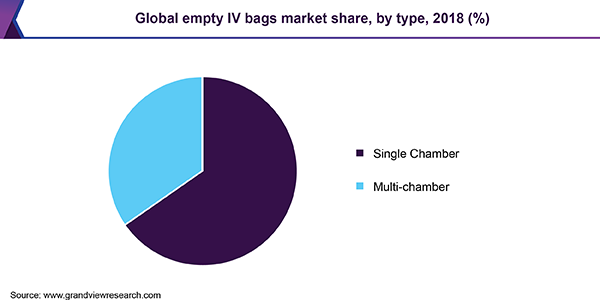

Based on type, the empty IV bags market is categorized into single and multi-chambered empty IV bags. The single chambered empty IV bags held the largest share in 2018. Single chamber bags are majorly used for common IV solutions, such as drip bags, irrigation fluids, and sterile water. Since these solutions are used at a large scale in hospitals as well as in homecare settings, the segment is expected to dominate the market over the forecast period. However, there are problems associated with plastic, such as leaching and susceptibility to puncture, that may contaminate the contents.

The multi-chambered bags are expected to witness the fastest growth over the forecast period. Their usage is anticipated to increase over the forecast period due to advancements in parenteral nutrition systems. The growing demand for customized bags has led to an increase in the number of new entrants in the market. A large number of local manufacturers in Asia Pacific region have begun offering multi-chambered IV bags that can be customized according to size, material, and a number of chambers required. Manufacturers of these bags are mostly local players. However, major players such as Baxter International, Inc. are developing products that include fixed mixtures in multi-chambered bags. Growing demand and easy availability of products at competitive prices are among the factors expected to fuel segment growth during the forecast period.

Regional Insights

North American region held the largest share in 2018 and is expected to maintain its dominance over the forecast period. The adoption of non-PVC bags in the region is high owing to rising acceptance of innovative healthcare technologies, high disease prevalence, better reimbursement policies, and increasing investments for improving healthcare infrastructure. Rising geriatric population, increasing consumption of unhealthy food, and low awareness are expected to aid growth the regional market.

Asia Pacific empty IV bags market is anticipated to witness the fastest growth over the forecast period owing to increasing healthcare expenditure, rising patient awareness, and growing need for technologically advanced & cost-efficient healthcare solutions. In addition, the demand for medical specialty bags is expected to increase due to rapidly aging population, increasing incidence of chronic diseases, and rising healthcare expenditure. As per Non-communicable diseases (NCD) burden in the South-East Asia Region Regional Action Plan and Targets, 2014 (WHO), approximately 7.9 million people die due to various NCDs in this region. It also reported that cardiovascular diseases, diabetes, and cancer are common in this region.

Key Companies & Market Share Insights

Key players are involved in adopting strategies such as mergers & acquisitions, agreements, product launch, and partnerships to strengthen their position.

For instance, in February 2017, ICU Medical, Inc. acquired the Hospira Infusion Systems (HIS) business from Pfizer, Inc. The HIS business includes IV solutions, pumps, and devices. This acquisition has helped the company enhance its infusion therapy segment, thereby increasing its global market share. Furthermore, in April 2019, Scripps Health signed an agreement with ICU Medical, Inc. to purchase the latter’s IV consumables & solutions, along with its ICU Medical MedNet IV medication safety software-based Plum 360 infusion system. This initiative was aimed at enhancing the company’s market share. Some of the prominent players in the empty IV bags market include:

Sippex IV Bag

Technoflex

Wipak Group

Baxter

B. Braun

ICU Medical, Inc.

Empty IV BagsMarketReport Scope

Report Attribute |

Details |

Market size value in 2020 |

USD 3.47 billion |

Revenue forecast in 2026 |

USD 5.57 billion |

Growth Rate |

CAGR of 8.1% from 2019 to 2026 |

Base year for estimation |

2018 |

Historical data |

2015 - 2017 |

Forecast period |

2019 - 2026 |

Quantitative units |

Revenue in USD million and CAGR from 2019 to 2026 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, type, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Netherlands; Spain; Sweden; China; Japan; Brazil; Mexico; South Africa |

Key companies profiled |

Sippex IV Bag; Technoflex; Wipak Group; Baxter; B. Braun; ICU Medical, Inc. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, & country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2015 to 2026. For the purpose of this study, Grand View Research has segmented empty IV bags market report on the basis of product, type, and region.

Product Outlook (Revenue, USD Million, 2015 - 2026)

PVC Empty IV Bags

Non-PVC Empty IV Bags

Polypropylene (PP)

Copolyester Ether (COPE)

Ethylene-vinyl acetate (EVA)

Others

Type Outlook (Revenue, USD Million, 2015 - 2026)

Single Chamber

Multi-chamber

Regional Outlook (Revenue, USD Million, 2015 - 2026)

North America

The U.S.

Canada

Europe

The U.K.

Germany

France

Italy

Netherlands

Spain

Sweden

Asia Pacific

China

Japan

拉丁美洲

Brazil

Mexico

MEA

South Africa

Frequently Asked Questions About This Report

b.The global empty IV bags market size was estimated at USD 3.22 billion in 2019 and is expected to reach USD 3.47 billion in 2020.

b.The global empty IV bags market is expected to grow at a compound annual growth rate of 8.1% from 2019 to 2026 to reach USD 5.6 billion by 2026.

b.North America dominated the empty IV bags market with a share of 47.19% in 2019. This is attributable to rising acceptance of innovative healthcare technologies, better reimbursement policies, and increasing investments for improving healthcare infrastructure.

b.Some key players operating in the empty IV bags market include Sippex IV Bag, Technoflex, Wipak Group, Baxter, B. Braun, and ICU Medical, Inc.

b.Key factors that are driving the market growth include environment-friendly nature of non-PVC IV bags, increasing government initiatives, risk of malnutrition, and increasing incidence of cancer across the globe.