Enterprise Mobility Management Market Size, Share & Trends Analysis Report By Solution, By Software, By Services, By Professional Services, By Deployment, By Enterprise Size, By Vertical, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-075-0

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Technology

Report Overview

The globalenterprise mobility management market sizewas evaluated atUSD 12.57 billion in 2022and is expected to grow at a CAGR of 23.8% from 2023 to 2030. Enterprise mobility management (EMM) products are witnessing growing demand across the globe owing to a significant increase in mobile devices, and shifting various end-user companies’ focus on protecting their digital infrastructure is propelling market growth. Further, advancements in cloud-based EMM solutions are creating positive outlook for the market. The rising adoption of Bring Your Own Device (BYOD) policies and the rising mobile workforce by various enterprises to enhance employees' productivity are expected to drive market growth in the forecast period.

Enterprise mobility management involves various applications such asMobile Device Management(MDM), Mobile Device Provisioning, and Mobile Application Management (MAM).Mobile security, enterprise mobility solutions, and Mobile Content Management (MCM). EMM helps organizations in maximizing the employees' productivity, control operating costs, and reduce the device downtime. EMM enables IT administrators to distribute applications to end-user devices remotely, allowing them to access all essential data. Further, it provides powerful security capabilities, such as remote data wiping and encryption to protect corporate data.

The governments of various countries, such as India, the U.K., Saudi Arabia, Brazil, and Canada, are significantly investing in cybersecurity solutions to safeguard sensitive information. These governments are funding various research projects on cybersecurity to enhance their digital infrastructure data security. For instance, in February 2023, the government of Canada announced federal funding of USD 1.9 million as a part of the Cyber Security Cooperation Program for cybersecurity projects at Université de Sherbrooke. The research projects focus on improving cybersecurity in Industry 4.0, 5G connectivity, and other wireless environments. Such as initiatives by the government will boost the growth of the market.

Increasing cyberattacks on business-critical data and personal devices force various end-use companies to adopt enterprise mobility management solutions. The market leaders are expanding their dealers and distributors to enrich their brand identity and attract potential business clients. For instance, in November 2021, Contextual Mobility Management (CMM) solutions provider TRUCE Software collaborated with mobility solution distributor 3Eye Technologies and IT solution distributor TD SYNNEX to enhance its security solution portfolio. With this collaboration, TRUCE Software automated its EMM strategy and offered advanced EMM solutions to its clients.

The lack of enterprise system integrators is expected to restrict the market growth. The organization should have integrated security systems and workflow automation to synchronize the overall security process. Further, mobile devices such aslaptopsand smartphones are required to be connected seamlessly to these complex security systems. The company failing to integrate mobile devices into their security systems may face security breaches, and loss of critical data. To overcome these issues, various market players are assisting end-user organizations by providing security infrastructure services and enabling them to secure their connected mobile devices with flexible and easy-to-use security systems.

Solution Insights

The software segment accounted for the largest market share of 64.3% in 2022. The enterprise mobility software strengthens the security of the employees’ mobile devices to protect the company’s sensitive data. This software also offers various benefits, such as controlling content access, updating content with just one click on bulk devices, and providing security against data breaches, creating positive market trends. Moreover, the advancements in EMM software and the availability of diverse EMM software portfolios are expected to drive the growth of the market.

The services segment is anticipated to expand at a CAGR of 24.7% during the forecast period. Enterprise mobility management services allow organizations to keep customer personally identifiable information (PII) and intellectual property secure and safe. These services protect mobile devices from malware attacks while providing flexibility and convenience to users when using mobile devices. Furthermore, EMM services offer various solutions, such as mobile device provisioning, enterprise mobility solutions,mobile threat defense, and mobile security, supporting the segment growth.

Software Insights

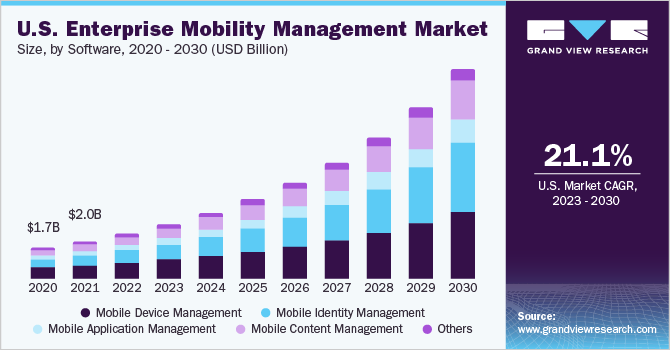

The Mobile Device Management (MDM) segment accounted for a market share of 34.9% in 2022. With an advanced MDM platform, the IT security department can manage all the organization's mobile devices, regardless of their operating system and type. MDM software consistently monitors sensitive business data and its flow within mobile devices. With MDM tools, organizations can remotely monitor, track, and troubleshoot data-related issues. Further, enterprises can easily erase device data in the event of data loss, breach, or theft.

The Mobile Identity Management (MIM) segment is expected to expand at the highest CAGR of 26.6% during the forecast period. MIM helps businesses in managing multiple usernames & passwords and provides an enriched user experience. The mobile identity management solution also allows the company to manage and control users' activity on company devices and networks. With significant technological advancements in 5G networks and rising mobile device sales, the MIM segment is anticipated to show considerable growth in the forecast period.

Services Insights

The professional services segment accounted for a market share of 56.4% in 2022. The end-user organizations across the globe are focusing on end-to-end enterprise mobility management (EMM) services to optimize their operating costs, supporting the professional services segment growth. The professional services assist the organization in implementing, maintaining, and upgrading the EMM solutions. The professional services key area includes cloud migration, deployment, advanced troubleshooting, and consulting, creating positive EMM market outlook.

The managed services segment is anticipated to expand at a CAGR of 24.1% during the forecast period. The managed services mainly include the services required by IT support to manage EMM solutions, such as daily maintenance, administration, security, network monitoring, and unified communications. One of the main benefits of managed services is that they offer 24*7 monitoring of the EMM solution and generate real-time reports for administration to assist them in making data-driven decisions. Such benefits are driving the segment growth notably.

专业的检修es Insights

The consulting segment accounted for the largest market share of 37.8% in 2022. The consulting segment is expected to grow significantly due to the shifting of various companies' focus toward customized enterprise mobility management (EMM) solutions and effective resource utilization. The consulting services offer expertise and guide businesses on the effective deployment of EMM solutions, managing the operations of cloud-based EMM solutions, and addressing the clients’ issues.

The support & maintenance segment is expected to expand at the highest CAGR of 27.0% during the forecast period. The notable growth of support & maintenance can be attributed to their ability to enhance the operational efficiency of EMM solutions. The support & maintenance includes release management, incident & problem management, ensuring business continuity, and configuration management. With enhanced support & maintenance services, the market players can reduce their service costs, and increase customer satisfaction, supporting the segment growth.

Deployment Insights

The cloud segment accounted for the largest market share of 55.1% in 2022. The cloud segment is witnessing significant growth owing to its various benefits, such as centralized data security and enhanced flexibility in various EMM operations, such as mobile device security, mobile device provisioning, and mobile application management. Cloud deployment helps end-user companies in eliminating the expenses incurred on dedicated hardware and software. Moreover, cloud-based enterprise mobility management solutions can equally facilitate automatic data backups and secure data storage. As a result, data is never compromised, even if there is any issue on the user side, and the system can resume operations automatically.

The on-premise segment is anticipated to expand at a CAGR of 22.0% during the forecast period. The on-premise segment provides business owners total control over the system, including security, upgrades, and maintenance, supporting the industry trend. Further, on-premise deployments are equipped with advanced security features which assist organizations in complying with various government regulations. It gives organizations more control over sensitive data and assists with compliance. However, the proliferation of cloud-based EMM solutions and their low operating costs is expected to hamper the growth of the on-premise segment in the forecast period.

Enterprise Size Insights

The large enterprises' segment accounted for the largest market share of 52.5% in 2022. Large enterprises face various risks, such as hacking and data breaches that come with the increasing use of advanced technologies. Large enterprises must strengthen the security of their mobile devices to avoid any significant data and financial losses due to cyber-attacks. With the increase in work from home policy adoption, the use of personal devices and anonymous networks poses a security threat to large enterprises. Due to this, the demand for EMM solutions is expected to increase in the forecast period in large enterprises.

The small & medium enterprises (SMEs) segment is anticipated to grow at a CAGR of 24.5% during the forecast period. The small & medium enterprises are vulnerable to cyber-attacks due to low levels of security due to budget constraints. However, the availability of low-cost enterprise mobility management solutions and significant penetration by market players is anticipated to accelerate the adoption of EMM solutions in SMEs in the forecast period.

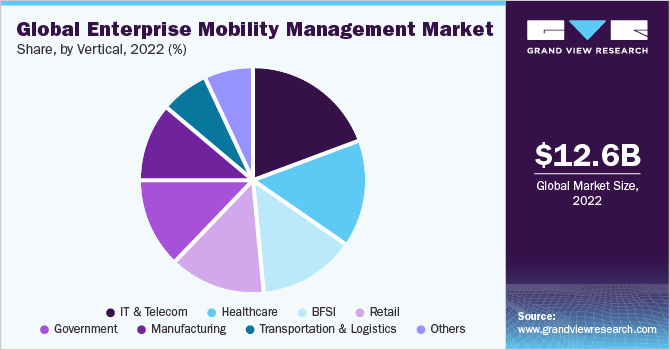

Vertical Insights

The IT & telecom segment accounted for the largest market share of 19.2% in 2022. The significant advancements inwireless infrastructureand IT modernization are boosting the enterprise mobility management solutions adoption in the IT & telecom industry. The increasing usage of endpoint devices coupled with the rising number of private unsecured network connections is creating a potential environment for cyber-attacks. As such, IT & telecom companies focus on implementing EMM solutions, contributing to enterprise mobility solution market growth.

The retail segment is anticipated to expand at the highest CAGR of 28.0% during the forecast period. The penetration ofe-commercecompanies and the significant rise in online shopping activities are propelling the demand for enterprise mobility management solutions in the retail industry. The growth in retail mobile devices such as kiosks andPOS terminalsis forcing retailers to improve the digital security of these devices to protect critical business data, supporting segment growth.

Regional Insights

北美的主要份额的36.9%target market in 2022. The availability of key market players such as Cisco Systems, Inc., IBM Corporation, & Microsoft Corporation and increasing public and private investment in cybersecurity solutions are driving the growth of the North America EMM market. The supportive government initiatives to strengthen digital security and protect sensitive data are creating robust market opportunities for the EMM market. For instance, in March 2023, the Government of the U.S. announced a new cybersecurity strategy to strengthen its cyber defenses to control the rising digital crimes and hacking in the U.S. With this program, the government will improve its collaboration with market players and invest in cybersecurity projects across the country.

Asia Pacific is anticipated to grow as the fastest-developing regional market at a CAGR of 26.1%. Significant digitalization and rising penetration of mobile devices are expected to drive the growth of the Asia Pacific enterprise mobility management market. Further, the increasing number of SMEs and their emphasis on BYOD policies are propelling the sales of EMM solutions in the regions. The governments of various countries, such as India, South Korea, China, and Australia, are digitalizing the overall infrastructure, which is expected to create robust opportunities for the EMM market in the forecast period in the region.

Key Companies & Market Share Insights

The key players operating in the market include Cisco Systems; SAP SE; Broadcom, Inc.; Vmware, Inc.; Ivanti; Sophos; and Blackberry to broaden their product offering, companies utilize a variety of inorganic growth tactics, such as partnerships, regular mergers, and acquisitions. In February 2022, IBM Corporation announced a multi-million-dollar investment to expand its capabilities and resources in cyber security and prepare organizations for dealing with the growing threat of cyberattacks across Asia Pacific. This will assist the company in improving its product portfolio for various solutions such as EMM, MTD, MIM, and MCM. Prominent players dominating the global enterprise mobility management market include:

Cisco Systems, Inc.

SAP SE

Broadcom, Inc.

AppTec GmbH

VMware, Inc.

Citrix Systems

Ivanti

IBM Corporation

Microsoft Corporation

Micro Focus

Zoho Corporation Pvt. Ltd.

Matrix42

Sophos

Blackberry

Esper

Enterprise Mobility ManagementMarket Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 15.48 billion |

Revenue forecast in 2030 |

USD 69.12 billion |

Growth rate |

CAGR of 23.8% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD billion, and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

Segments covered |

Solution, software, services, professional services, deployment, enterprise size, vertical, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

Key companies profiled |

Cisco Systems; SAP SE; Broadcom, Inc.; AppTec GmbH; IBM Corporation; Microsoft Corporation; VMware; Citrix Systems; Ivanti; Micro Focus; Zoho Corporation Pvt. Ltd; Matrix42; Sophos; Blackberry; Esper |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Enterprise Mobility Management Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global enterprise mobility management market report based on solution, software, services, professional services, deployment, enterprise size, vertical, and region:

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

Software

Services

Software Outlook (Revenue, USD Billion, 2018 - 2030)

Mobile Device Management

Mobile Identity Management

Mobile Content Management

Mobile Application Management

Others ( Mobile Expense Management, Identity and Access Management)

Services Outlook (Revenue, USD Billion, 2018 - 2030)

专业的检修es

Managed Services

专业的检修es Outlook (Revenue, USD Billion, 2018 - 2030)

Consulting

Integration

Support and Maintenance

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

Cloud

On-premise

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

Small and Medium-sized Enterprises

Large Enterprises

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

BFSI

IT and Telecom

Retail

Healthcare

Transportation and Logistics

Manufacturing

Government

Others (Aerospace & Defense, Education)

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

North America

U.S.

Canada

Europe

Germany

U.K.

France

Italy

Spain

Asia Pacific

China

India

Japan

South Korea

Australia

拉丁美洲

Brazil

Mexico

Argentina

Middle East & Africa

U.A.E

Saudi Arabia

South Africa

Frequently Asked Questions About This Report

b.The global Enterprise Mobility Management market size was estimated at USD 12.57 billion in 2022 and is expected to reach USD 15.48 billion by 2023.

b.The global Enterprise Mobility Management market is expected to grow at a compound annual growth rate of 23.8% from 2023 to 2030 to reach USD 69.12 billion by 2030.

b.在企业运营的关键球员Mobility Management market include Cisco Systems, Inc., SAP SE, Broadcom, Inc., AppTec GmbH, VMware, Inc., Citrix Systems, Ivanti, IBM Corporation, Microsoft Corporation, Micro Focus, Zoho Corporation Pvt Ltd., Matrix42, Sophos, Blackberry, and Esper.

b.Key factors that are driving the Enterprise Mobility Management market growth include the proliferation of mobile devices and the rising trend of work-from policies led by the COVID-19 pandemic. Further, the end-user companies shifting focus on remote working to improve employees’ productivity is creating a favorable environment for the enterprise mobility management market.

b.Software dominated the Enterprise Mobility Management market with a share of 64.3% in 2022. This is attributable to various benefits offered by software such as controlling content access, updating content in just one click on bulk devices, and providing security against data breaches, creating positive market trends.