Europe Custom Procedure Kits Market Size, Share & Trends Analysis Report By Product (Disposable, Reusable), By Procedure (Orthopedic, Thoracic), By End-use (ASCs, Clinics, Hospitals), By Country, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-340-9

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry:Healthcare

Report Overview

欧洲自定义程序包市场规模是v乐鱼体育手机网站入口alued at USD 1.2 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 12.8% from 2021 to 2028. Increased emphasis on infection control measures, benefits of customization, favorable government rules for prevention and control of Healthcare-Associated Infections (HAIs) in Europe are driving the market growth. Obesity therapies are in high demand in Europe due to rising cases of obesity and related health issues. According to Cancer Research U.K., in 2018, 63% of the U.K. population was overweight or obese. Ireland is expected to lead the way, with virtually all adults getting overweight in the next 15 years. According to the WHO estimates, by 2030, 89% of Irish men and 85% of Irish women will be overweight. The substantial rise in the number of obese people in Europe is expected to have a major impact on the overall market growth.

The healthcare systems around the world struggled with the impact of COVID-19, many countries chose to halt all non-emergency treatments to free up resources to treat COVID-19 patients. In the early days of the pandemic, several European hospitals postponed procedures and treatments to reduce infection rates among patients and save resources to treat COVID-19 patients. During the pandemic, the Académies de Médecine et de Chirurgie in France estimated that about 1.1 million non-urgent surgical procedures were postponed.

According to the Health Act of 2006, all healthcare practitioners should follow a code of practice to prevent and control Healthcare-Acquired Illnesses (HCAIs). Hence, the adoption of custom procedure kits is encouraged in everyday practice. The U.K. government formed a Trust Infection Control Committee, which enforced strict standards for maintaining sterility in Operating Rooms (ORs). The use of cleaned, prepared kits can help prevent nosocomial and iatrogenic infections. It can further reduce the risk of infection by eliminating the need to handle linen and other OR supplies.

European standard prEN 13795-1 includes surgical gowns and drapes. This specification contains infection control components of reusable and single-use draperies and garments in the form of essential qualities. It is mandatory to fulfill the required standards when new products are introduced, as well as when reused products are reprocessed. This is a significant driver for CPT since all of the components have been pre-sterilized and bundled with single-use goods for that specific treatment or surgery.

Reusable surgical tools, such as scalpels, forceps, retractors, and other devices, are classified as class I under the current Medical Device Directive, with no involvement of a Notified Body (NB). The manufacturers of procedure packs must adhere to the Medical Device Directive (MDD - Article 12), which requires them to verify the mutual compatibility of these devices. The packaged procedure trays are also required to provide relevant information regarding its usage.

Product Insights

Based on product, the disposable segment led the market in 2020 and accounted for the highest revenue share of more than 57%. Disposable products include patient drapes, surgical staff attire, and surgical dressings. According to a European study, disposable surgical clothing is more resistant to microbial penetration than reusable textiles. Disposable textiles keep employees safe and help prevent the spread of germs and bacteria. Single-use items are manufactured in a sterile environment and are packed in PE bags, which reduces the risk of exposure to bacteria and pathogens.

The reusable segment is anticipated to register the fastest CAGR over the forecast period. Reusable products are intended to be reprocessed and reused. For example, some drapes and gowns are made from cotton and poly cotton. Chemically modified poly cotton is used in newer high-tech reusable items, along with an extra membrane to provide a better barrier. However, there are no reusable alternatives to many of the single-use materials used in process trays, which may limit the segment growth to some extent.

Procedure Insights

骨科领域最大的收入sh举行are of 19.8% of the overall market in 2020. An increase in the geriatric population and a rise in the cases of spinal cord injuries are among the key factors responsible for the segment growth. The segment is also benefited from a rise in the number of osteoporosis operations performed across the region. According to the NHS, osteoporosis affects over 3 million individuals in the U.K., with over 50,000 people receiving hospital treatment each year for fragility fractures caused by the disease.

The segment of the thoracic procedure is anticipated to witness the fastest CAGR of 16.1% over the forecast period. It includes removal of parts of the lung affected with cancer, lung transplant, and heart transplant. Special instruments are inserted through a tiny incision in the chest during minimally invasive operations. In the case of open surgery, there is a considerable risk of infection, which has boosted the demand for high-quality medical equipment and consumables, including procedure trays.

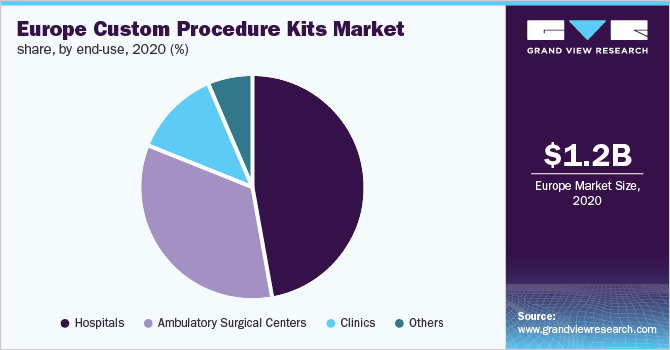

End-use Insights

Based on end-use, the hospitals segment led the market in 2020 and accounted for the maximum revenue share of 47.4% of the total market. Custom Procedure Trays & Packs (CPTPs) offer hospitals off-the-shelf convenience, cheaper prices, and more efficient operating rooms with shorter turnaround times between procedures. Furthermore, these products facilitate inventory reduction, storage, and delivery schedules. The kits are ideal for hospitals since they assure adherence to safety rules as well as the prevention of nosocomial and iatrogenic infections in the operating area. However, more hospitals are actively involved in reducing the impact of operating rooms on the environment. In the coming years, reusable and reprocess able kits would take precedence over single-use or disposable sets.

TheAmbulatory Surgical Centers(ASCs) segment is anticipated to witness the fastest growth rate over the forecast period. The centers are 45 to 60% less expensive than hospitals, which saves huge costs to insurers, patients, and taxpayers. The Department of Health and Human Services estimates that if all qualifying surgeries were performed at an ASC, taxpayers would save USD 15 billion and Medicare patients would save USD 3 billion.

Country Insights

Germany led the Europe market in 2020 and accounted for the largest market share of 20.1%. The region is also expected to grow at a significant rate during the forecast period. This is due to the highest number of surgical procedures performed, growth in the geriatric population, and increased cases of obesity in Germany. According to the 2019 report from the Organization for Economic Co-operation and Development (OECD), one in every four adults in Germany is obese.

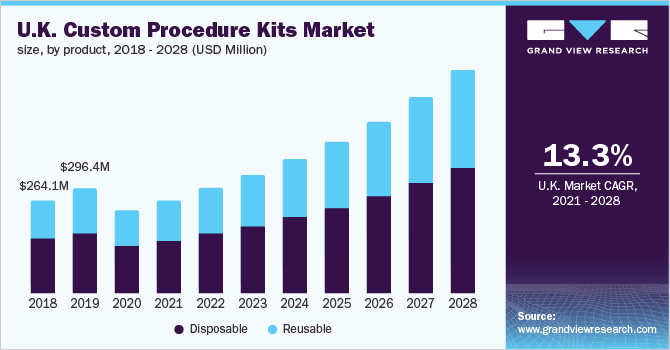

For instance, it is estimated that the elderly population (aged 65 years or above) will increase from 17 million in 2012 to 23 million in 2050. The U.K. is anticipated to register the fastest growth rate of13.3% over the forecast period. High per capita income, a well-established healthcare system, easy access to care facilities, the availability of professionals &advanced devices, and favorable reimbursement rules are the key factors that contribute to the growth of the U.K. market.

Key Companies & Market Share Insights

Key players are considering a range of strategic activities, such as new partnership agreements, collaborations, mergers, acquisitions, and geographic expansions, to strengthen their industry position and enhance their product portfolio. For instance, in April 2021, Medtronic received FDA Breakthrough Designation for the Emprint Ablation Catheter Kit. Some of the prominent players in the Europe custom procedure kits market are:

Mölnlycke Health Care

Medline Industries, Inc.

Medtronic

Cardinal Health

Teleflex Incorporated

Owens & Minor, Inc.

McKesson Corp.

Smith’s Medical

Ethicon

DePuy Synthes

Santex S.p.A.

One Med

Medica Europe BV

Europe Custom Procedure Kits MarketReport Scope

Report Attribute |

Details |

Market Size value in 2021 |

USD 1.4 billion |

Revenue forecast in 2028 |

USD 3.2 billion |

Growth rate |

CAGR of 12.8% from 2021 to 2028 |

Base year for estimation |

2020 |

Historical data |

2016 - 2019 |

Forecast period |

2021 - 2028 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, procedure, end-use, region |

Regional scope |

Europe |

Country scope |

U.K.; Germany; France; Italy; Spain; Portugal; Belgium; The Netherlands; Rest of EU |

Key companies profiled |

Mölnlycke Health Care; Medline Industries, Inc.; Medtronic; Cardinal Health; Teleflex, Inc.; Owens & Minor, Inc.; McKesson Corp.; Smiths Medical; Ethicon; DePuy Synthes; Santex S.p.A.; One Med; Medica Europe BV |

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented Europe custom procedure kits market report on the basis of product, procedure, end-use, and country:

Product Outlook (Revenue, USD Million, 2016 - 2028)

Disposable

Reusable

Procedure Outlook (Revenue, USD Million, 2016 - 2028)

Bariatric

Colorectal

Thoracic

Orthopedic

Ophthalmology

Neurosurgery

Cardiac Surgery

Gynecology

General Surgery

Urology

Others

End-use Outlook (Revenue, USD Million, 2016 - 2028)

Hospitals

Ambulatory Surgical Centers

Clinics

Others

Country Outlook (Revenue, USD Million, 2016 - 2028)

U.K.

Germany

France

Italy

Spain

Portugal

Belgium

The Netherlands

Rest of Europe

Frequently Asked Questions About This Report

b.The Europe custom procedure kits market size was estimated at USD 1.2 billion in 2020 and is expected to reach USD 1.4 billion in 2021.

b.The Europe custom procedure kits market is expected to grow at a compound annual growth rate of 12.8% from 2021 to 2028 to reach USD 3.2 billion by 2028.

b.The orthopedic segment dominated the Europe custom procedure kits market with a share of 19.8% in 2020. This is attributable to an increase in the geriatric population and a rise in the incidence of spinal cord injuries.

b.一些关键球员在欧洲运营的定制的公关ocedure kits market include Mölnlycke Health Care, Medline Industries, Inc, Medtronic, Cardinal Health, Teleflex Incorporated, Owens & Minor, Inc, McKesson Corporation.

b.Key factors that are driving the Europe custom procedure kits market growth include increased emphasis on infection control measures, benefits of customization, favorable government rules for prevention and control of healthcare-associated infections in Europe.