欧洲石灰岩市场规模、分享和趋势分析乐鱼体育手机网站入口sis Report By End-use (Construction, Iron & Steel, Agriculture, Chemical), By Country, And Segment Forecasts 2023 - 2030

- Report ID: GVR-4-68040-124-1

- Number of Pages: 76

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Advanced Materials

Report Overview

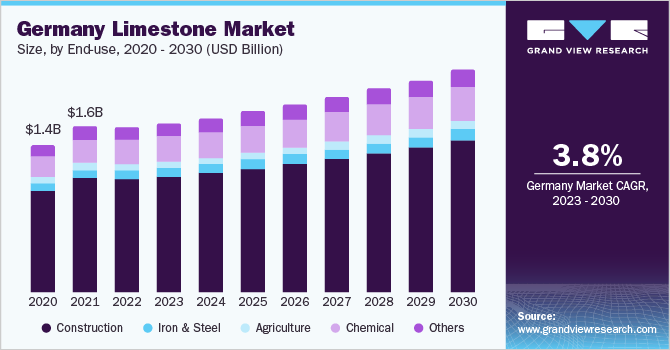

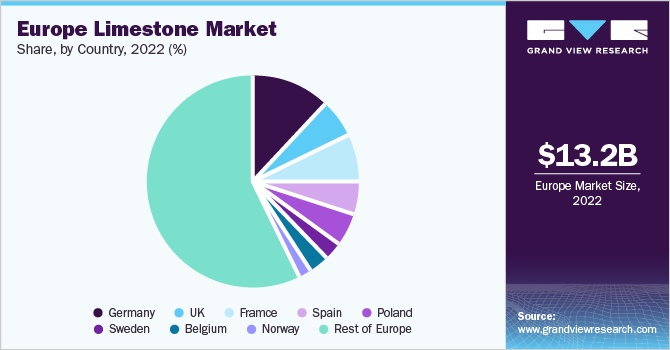

TheEurope limestone market sizewas valued atUSD 13.22 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030. The growth is expected to be favorably impacted by the usage of fertilizers in agriculture to feed the growing population. In addition, the popularity of green buildings in line with green energy initiatives adopted by governments worldwide is another prominent driver. Governments across the world have been pushing toward alignment with decarbonization goals, in line with the 2021 Paris Agreement. This has accelerated the popularity and construction of aesthetically pleasing buildings with construction materials having a low carbon footprint.

Germany is one of the largest cement producers in the world. Within the European Union, it is also the largest cement market. Currently, cement companies are actively moving towards fulfilling their CO2 emission reduction targets by investing in new technology. Few acquisitions took place in the industry in 2022. For instance, in October 2022, Ireland-based CRH decided to sell its subsidiaries Opterra Zement and Opterra Beton to Germany-based Thomas Gruppe as part of the latter’s competitive strategy.

While demand in 2022 was muted due to the Russia-Ukraine crisis and high energy costs, it is expected to improve in 2023 and beyond. The expansion of residential and non-residential construction sectors is projected to remain a key growth factor for the limestone demand. Economic growth factors such as industrial production and significant public investment are also anticipated to create a positive impact on the non-residential construction sector.

市场的增长,然而,面临obstruction from the stringent laws & regulations towards the mining sector, which hinders the production and supply in the market. The limestone extraction process severely impacts the environment as mining and further processing lead to air, soil, and water pollution; depletion of natural flora and fauna; degradation of agricultural land, and changes in landscapes. denudation of forests.

End-use Insights

The construction segment held the largest revenue share of over 74.0% in 2022 of the overall market, and this trend is anticipated to continue over the forecast period. Limestone is used for manufacturing cement, construction aggregate, tiles, mortar & plaster, and other building materials. Construction and infrastructure needs are high in European countries mainly due to the ambitious policy agenda of the European Union since 2008, wherein they have set targets for improvement in energy efficiency, increase in renewable energy, and reduction in greenhouse gas emissions.

Agriculture is another growing segment for the market, where the product is used to neutralize acids in the soil for optimum soil conditions to foster crop growth. Rising agriculture production and agri-food exports in Europe are projected to drive the demand for limestone in agricultural applications. For instance, agri-food exports in the European Union reached EUR 229,428 million (USD 253,904.5 million) in 2022 compared to EUR 198,141 million (USD 219,279.7 million) in 2021, with a y-o-y increase of 15.8%.

Further, limestone is also used to produce GCC and PCC, which are used in a wide range of applications including paper, paints & coatings, plastics, and adhesives & sealants. The European paper industry has been witnessing steady growth over the past few years owing to the increasing sustainability trend in packaging. For instance, food & beverage companies are increasingly usingpaper packaging. This is expected to drive paper industry, thereby boosting the demand for calcium carbonate over the coming years.

Country Insights

France accounted for a revenue share of about 7.0% in 2022, of the European limestone market. The growth of the construction industry rose by 2.1% as compared to 2021. Expanding demographics in France primarily contributed to a surge in residential construction activities. Increasing investments in residential construction are expected to drive the consumption of cement and aggregates, and consequently limestone, over the forecast period.

UK is another significant market in the region, where the agriculture segment is witnessing growth on account of growing need for fertilizers. In February 2023, the UK government raised payments to farmers to incentivize their efforts in conserving and enriching nature while promoting sustainable food production. Such initiatives are expected to increase sustainable farming in the coming years, and eventually aid the need for limestone over the forecast period.

Spain is likely to boost its demand for cement in the coming years to upgrade its national infrastructure. In February 2023, the government of Spain guaranteed EUR 100 million (USD 110.3 million) to the World Bank project for repairing and redeveloping healthcare infrastructure. This in turn is expected to boost the demand for limestone during the forecast period.

Key Companies & Market Share Insights

The market is highly competitive owing to the presence of various well-established players who have been carrying out both capacity expansions and market expansions for increasing their reach, better product offerings and remain competitive. For instance, in September 2022, CEMEX was granted approval for an expansion of its quarry license at the Serreta Larga quarry in Spain. The company can now supply limestone at a rate of 520,000 tons per annum for an extended period of 30 years.

Players have also been investing in R&D and adopting new technology for achieving carbon neutrality. For instance, in February 2023, Holcim launched Europe’s first low-carbon calcined clay cement operation in France, which reduces carbon emissions by 50% and helps deliver 500,000 tons of cement annually. This is anticipated to generate demand for limestone mining and generate demand for Portland limestone cement in the region. Some of the prominent players in the Europe limestone market include:

Nordkalk

CARMEUSE

Graymont

Lhoist

Sibelco

Ognyanovo-K

WIG Wietersdorfer Holding GmbH

Franzefoss Minerals

Kalkfabrik Netstal AG

CARRIÈRES DU HAINAUT

Europe Limestone MarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

137.8亿美元 |

Revenue forecast in 2030 |

USD 19.42 billion |

Growth rate |

CAGR of 4.9% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million, volume in kilotons, and CAGR from 2023 to 2030 |

Report coverage |

Revenue & volume forecast, competitive landscape, growth factors, company profiles, and trends |

Segments covered |

End-use, country |

Regional scope |

Europe |

Country scope |

Germany; U.K.; Ireland; Sweden; Norway; France; Finland; Estonia; Lithuania; Latvia; Czechia; Poland; Belgium; Spain |

Key companies profiled |

Nordkalk; CARMEUSE; Graymont; Lhoist; Sibelco; Ognyanovo-K; WIG Wietersdorfer Holding GmbH; Franzefoss Minerals; Kalkfabrik Netstal AG; CARRIÈRES DU HAINAUT |

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Europe Limestone Market Report Segmentation

This report forecasts revenue and volume growth at the country level and provides an analysis of the latest industry trends and opportunities in each end use segment from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Europe limestone market report on the basis of end-use and country:

End-use Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

Construction

Iron & Steel

Agriculture

Chemical

Others

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

Europe

Germany

UK

Ireland

Sweden

Norway

France

Finland

Estonia

Lithuania

Latvia

Czechia

Poland

Belgium

Spain

Frequently Asked Questions About This Report

b.Some of the key players operating in the Europe limestone market are Nordkalk, CARMEUSE, Graymont, Lhoist, Sibelco, Ognyanovo-K, WIG Wietersdorfer Holding GmbH, Franzefoss Minerals, Kalkfabrik Netstal AG, CARRIÈRES DU HAINAUT among others.

b.Growth of the construction industry and increasing utilization of fertilizers are anticipated to drive the growth of the Europe limestone market over the forecast period.

b.The Europe limestone market was estimated at USD 13.22 billion in 2022 and is expected to reach USD 13.78 billion in 2023.

b.The Europe limestone market is expected to grow at a compound annual growth rate of 4.9% from 2023 to 2030 to reach USD 19.42 billion by 2030.

b.Construction was the key end-use segment of the Europe limestone market, with a revenue share of over 74.0% in 2022.