Fertility Supplements Market Size, Share & Trends Analysis Report By Ingredient (Natural, Synthetic/Blend), By Product (Capsules, Tablets, Soft gels), By End Use, By Distribution Channel, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-136-8

- Number of Pages: 165

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry:Consumer Goods

Industry Insights

The global fertility supplements market size was estimated at USD 1.45 billion in 2018. It is anticipated to be driven by the declining fertility rates owing to the increase in the number of smokers along with the rising consumption of alcohol and caffeine. Rising geriatric population, healthcare costs, changing lifestyle, innovation in food, medical discoveries, and expectations regarding the high prices of fertility supplements have aided the overall market growth as well as the product demand.

According to the American Society for Reproductive Medicine, in the U.S., approximately 35% and 30% of men and women of reproductive age smoke cigarettes. The prevalence of smoking is higher in developed countries than in emerging economies. Even fertility treatments such as IVF may not be helpful in conceiving for smoking women, which has prompted fertility manufacturers to look for ingredients that can eliminate the effects of smoking on fertility. This factor is anticipated to create growth opportunities for the fertility supplement manufacturers over the forecast period.

Increasing importance of food products such as avocados, olive oil, whole grains, and high fat dairy products used in increasing fertility is expected to amplify the scope offunctional foodand beverages in the near future resulting in hindering the overall growth.

Increasing adoption of herbal medicines (botanicals) owing to rising concerns regarding the harmful effects associated with traditional pharma drugs is anticipated to create growth opportunities for the product manufacturers. Various government initiatives for creating awareness about the advancements in supplement research and superior technology have helped consumers make supplement choices based on what is good for their health rather than picking products on the basis of packaging and impressive marketing.

Over the past few years, the consumers from Brazil and Argentina are focusing on improving sexual health as well as wellbeing, and as a result are willing to spend more money on the relevant products which is anticipated to surge the demand for fertility supplements over the next seven years.

Product Insights

With respect to product segmentation, the market is categorized into capsules, tablets, soft gels, powders, and liquids. Fertility supplement powder segment is expected to witness significant gains on account of increasing awareness regarding the nutritional benefits associated with these products along with delicious tastes and easy incorporation in meals.

Capsules segment led with over 42.8% of the revenue share in 2018 and is expected to register a significant CAGR over the forecast period. These products enable unique mixes of ingredients, provide protection from sensitive ingredients, reduce gastrointestinal irritation, and ensure oil and fat-soluble nutrient delivery. This factor is anticipated to bode well for segment growth. However, high prices incurred during blistering packaging method are projected to refrain manufacturers from using capsule formulation over the forecast period.

平板电脑是第二大产品段anticipated to ascend at a CAGR of 7.0% over the forecast period. Easy absorption, disintegration, and cost-effectiveness of the product is anticipated to drive the segment growth. However, the size of tablets is a drawback as they are hard to swallow and do not offer the dosing flexibility that powders and liquids do, which is expected to restrict the growth in the near future.

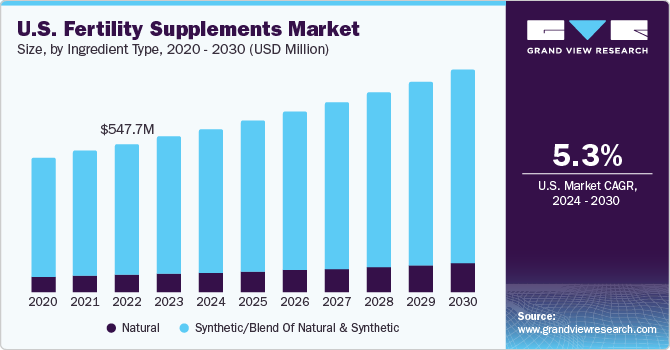

Ingredient Insights

With respect to ingredient segmentation, the market is categorized into natural and synthetic/blend of synthetic and natural ingredients. Zinc, selenium,folic acid, vitamin C, vitamin B6, Myo-Inositol, and CoQ10 were the major synthetic ingredients contributing significantly to the overall growth owing to the easy availability and increased demand.

Introduction of innovative products and technological advancements in health and wellness industry are anticipated to boost the growth of natural fertility supplement segment over the forecast period. Increasing utilization of plant-derived products for a healthy lifestyle and to reduce the risk of side effects is expected to further propel the demand in the near future.

Rising consumption of plant extracts, particularly herbs, in pharmaceutical industry owing to increasing awareness regarding biologically-derived ingredients is expected to reduce the availability of raw materials among natural food product manufacturers over the next seven years. Despite the booming growth of natural ingredients, lack of scientific back up for the claims is hindering the segment growth to an extent. Several governments have been funding studies to boost the adoption of natural products, which is expected to propel the product demand during the forecast period.

End-Use Insights

On the basis of end-use, the market is segmented into men and women. Immune system factors, hypogonadism, varicocele, systemic disease, sexual factors, urogenital infection, and undescended testicles are some of the prominent factors leading to fertility problems in men.

In the last 50 years, the sperm concentration has fallen by 52% among men in Western countries. Four decades ago, the average Western man had a sperm concentration of 99 million per milliliter. By 2018, that had fallen to 47.1 million according to the Hebrew University public health research. The plummet is alarming because sperm concentration below 40 million per milliliter is considered below normal and can impair fertility. All these factors have resulted in an increasing demand for fertility supplements for men.

According to the National Survey of Family Growth, the percentage of married women aged 15 to 44 years who are infertile has remained relatively stable since 2010. However, among married infertile women aged 40 to 44 years had the greatest prevalence of fertility issues, followed by women aged 35 to 39. Initiatives by government and nonprofit organizations to provide advice and medical help has helped bring awareness resulting in creating opportunities for the product manufacturers in the market.

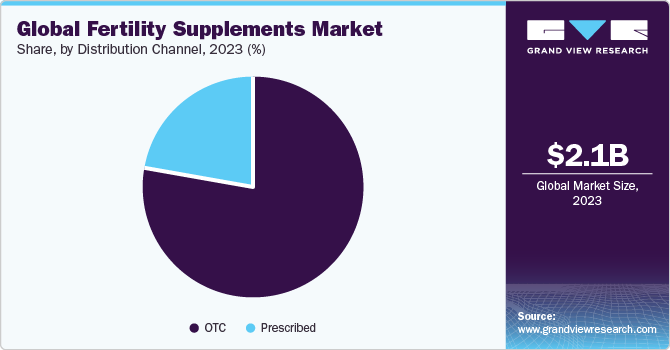

Distribution Channel Insights

More than 79% of the total sales came from over the counter distribution channel in 2018. The fertility supplements market is highly fragmented owing to the easy availability of raw materials, rising demand, and lenient regulations. In order to enter this highly competitive market, the companies need to focus on incorporating ingredients that have been regulated by the FDA and have undergone a significant number of clinical trials/studies.

The manufacturers endorse their products by providing clinical evidence for the ingredients included rather than focusing on the finished product. However, companies such as Fairhaven, Lenus Pharma, and Gonadosan, Innovamed Ltd. have provided evidence from the clinical trials of their finished products, which has resulted in an increased demand for fertility supplements across the globe.

Self-medication for the treatment of fertility issues is one of the key trends in the OTC segment, in addition, convenience of direct purchase and cost-effectiveness is expected to create opportunities for the manufacturers in near future.

Regional Insights

Asia Pacific is anticipated to reach USD 680.6 million by 2025, expanding at a CAGR of 10.5% from 2019 to 2025. Rising awareness in China and India regarding nutritional enrichment is expected to remain a favorable factor for regional growth. Furthermore, expansion in retail market in emerging markets including China, Indonesia, Malaysia, and India in light of regulatory support to promote investments is expected to increase the accessibility to buyers over the forecast period.

政府的政策就像“独生子女”阿宝licy subjected to forced sterilizations or abortions resulted in decreasing the fertility of women. However, the abolishment of one and two child per couple policies and major amendments in family planning regulations is expected to have a positive effect on fertility rates resulting in hindering the market growth in China.

The market is expected to witness high growth in Canada owing to the rising initiatives taken by Government and nonprofit organizations like Fertility Matters Canada to create awareness about the medication and treatment of fertility problems coupled with the increasing rate of obesity and sexually transmitted infections.

Fertility Supplements Market Share Insights

succ制造商正在致力于改善治疗ess rates and treatment experience. Companies such as Orthomol, TTK HealthCare, and Fairhaven Health are putting a strong emphasis on extending and innovating their portfolio to provide support to people wanting a baby. Companies continue to advance innovation in fertility supplements to increase success rates through life cycle management, which is also inclusive of new indications and new combinations.

Leading fertility supplement manufacturers are focusing on providing new products by investing in R&D along with technological advancements to provide cost-effective products with superior quality. Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market share and expand their geographical reach. Companies are also focusing on raising awareness among consumers regarding the ambiguity concerning the ingredients used, while strictly adhering to international regulatory standards.

Report Scope

Attribute |

Details |

Base year for estimation |

2018 |

Actual estimates/Historical data |

2014 - 2017 |

Forecast period |

2019 - 2025 |

Market representation |

Revenue in USD Million & CAGR from 2018 to 2025 |

Regional scope |

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors and trends |

Country Scope |

U.S., Canada, Mexico, Germany, U.K., France, Italy, China, Japan, India, Brazil and South Africa |

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global fertility supplements market report based on ingredient, product, end-use, distribution channel, and region:

Ingredient Outlook (Revenue, USD Million, 2014 - 2025)

Natural

Synthetic/Blend of Natural & Synthetic

Product Outlook (Revenue, USD Million, 2014 - 2025)

Capsules

Tablets

Soft Gels

Powders

Liquids

End-Use Outlook (Revenue, USD Million, 2014 - 2025)

Men

Women

Distribution Channel Outlook (Revenue, USD Million, 2014 - 2025)

OTC

Prescribed

Regional Outlook (Revenue, USD Million, 2014 - 2025)

North America

The U.S.

Canada

Mexico

Europe

Germany

France

Italy

The U.K.

Asia Pacific

China

Japan

India

Central & South America

Brazil

Middle East & Africa

South Africa