Fire Department Software Market Size, Share & Trends Analysis Report By Software Type, By Deployment (Cloud Based, On-premise), By Enterprise Size, By End-users, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-010-6

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Technology

Report Overview

The globalfire department software market sizewas valued atUSD 860.5 million in 2022and is expected to grow at a compound annual growth rate (CAGR) of 11.6% from 2023 to 2030. In affluent nations, several fire departments have migrated to public and private clouds to avail effective record-keeping, personnel monitoring, and training. As more governments launch various projects and raise funds for modernizing their fire departments, the need for fire department software is anticipated to rise globally. The market for software for fire departments benefited from the COVID-19 epidemic. Strict lockdown rules were put in place as a result of the pandemic's unexpected onset to stop the virus from spreading. Since the bulk of people were confined to their houses, there were much fewer fire occurrences during the lockdown. This allowed fire services to redirect resources towards streamlining and modernizing its processes and duties.

The adoption of fire department software is being driven by smart agility, practicality, and affordability. Dynamic reporting criteria due to changing regulations and evolving operational standards add to the difficulty of administering a fire department, driving up demand for fire department software solutions. For instance, the National Fire Protection Association (NFPA) Standard 1221 outlines the records that fire departments must keep. Another standard, NFPA 1620, places emphasis on the value of pre-incident preparations that give firemen essential information before they leave.

消防部门必须管理和跟踪ir staff, incident reporting, maintenance, training, and equipment regardless of their budget or size. Some of the key factors influencing the market growth include the rising demand for modernization and the application of software solutions to better manage the needs of a fire department, as well as the rising investment in research and innovation by market players to provide new solutions and software. Several new market companies, including ESO; stationSMARTS; GovPilot; and SmartServ, have entered the market as a result of the increased need for software solutions across the government sector, particularly in the relatively narrow and expanding fire department software industry.

Software Type Insights

The fire detection segment accounted for the largest market share of 40.7% in 2022. Fire detection software employs computer vision algorithms to analyze video feeds from cameras or images recorded by sensors to detect various indicators including flames, smoke, and excessive heat, which can indicate a fire outbreak. The software often embeds machine learning algorithms, such as deep neural networks, to gain information from large data sets of videos and images of fires to identify different patterns and distinguish between real alarms and false alarms. This is expected o propel the demand for the fire department software industry.

火灾风险分析部分预计将grow at a CAGR of 12.7% during the forecast period. Fire risk analysis software helps building owners and safety professionals in determining and evaluating fire hazards associated with a building. This type of software often analyses building construction, materials used, and occupant behavior to identify potential fire hazards. Fire risk analysis software helps building owners and safety professionals in determining and evaluating fire hazards associated with a building. This type of software often analyses building construction, materials used, and occupant behavior to identify potential fire hazards. These features are expected to boost the demand for the fire risk analysis software type thereby supporting the growth of the market.

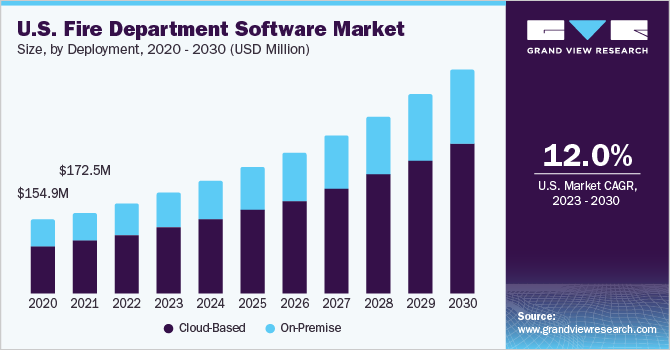

Deployment Insights

The cloud-based segment accounted for a market share of 63.4% in 2022. Users of the cloud-based segment do not need to maintain or install any software or hardware to use it. This is because access and control of the fire department software are done through a platform maintained by a third-party provider. Cloud-based fire department software frequently uses pay-as-you-go pricing structures, making it more affordable for small organizations than conventional on-premise software. The ability to access cloud-based fire department software from any location with an internet connection is also one of its main benefits.

The on-premise segment is anticipated to grow at a CAGR of 11.1% during the forecast period. On-premises fire department software is installed and runs locally on a fire department's local servers and computer systems. The fire department is responsible for procuring and maintaining the appropriate hardware, software, and other necessary IT infrastructure to run on-premises software. One of the major benefits of on-premises fire department software is that it provides fire departments with greater authority over data and software, which could fuel the demand for on-premise solutions.

Enterprise Size Insights

The large enterprise segment accounted for a market share of 61.5% in 2022. Large enterprises include fire departments that cover a wide area for fire incident responses and have more firefighters, staff, and management compared to small & medium enterprises. There is an ever-increasing need for the modernization of large fire departments, especially in developing countries to better manage their records, training, scheduling, and other necessary activities.

The small & medium enterprises segment is anticipated to grow at a CAGR of 12.0% during the forecast period. In the coming years, SMEs are anticipated to quickly adopt fire department software solutions, since they are experiencing strong digitization and the increasing need to modernize their operation to respond quickly to fire incidents and efficiently manage the operations of the department.

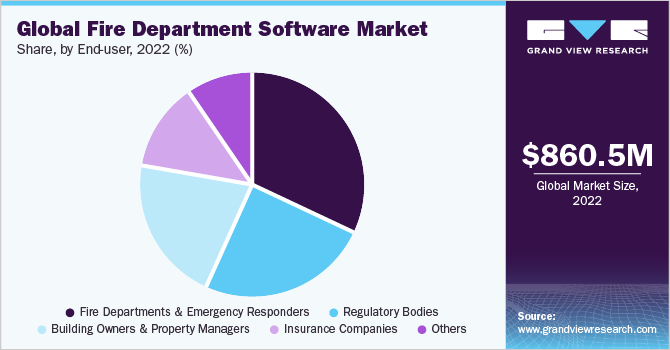

End-users Insights

The fire departments and emergency responders segment accounted for a market share of 32.3% in 2022. Fire department software allows responders to obtain real-time information related to the location and severity of the fire and updates on the status of the response effort. This information can help them make more accurate decisions on resource allocation and responses. Fire department software can assist emergency responders in effectively managing resources, including manpower, equipment, and vehicles, thereby aiding in ensuring that appropriate resources are deployed to the appropriate location at the earliest and in improving reaction times and overall efficiency.

The regulatory bodies segment is anticipated to grow at a CAGR of 13.1% during the forecast period. Regulatory bodies examine fire department software for safety issues and may issue warnings or other remedial measures if required to make sure that the fire department software is safe for both firefighters and the general public. Regulatory agencies offer guidance toward best practices for fire departments looking forward to implementing new software and technology so that fire departments can utilize the most productive and effective software.

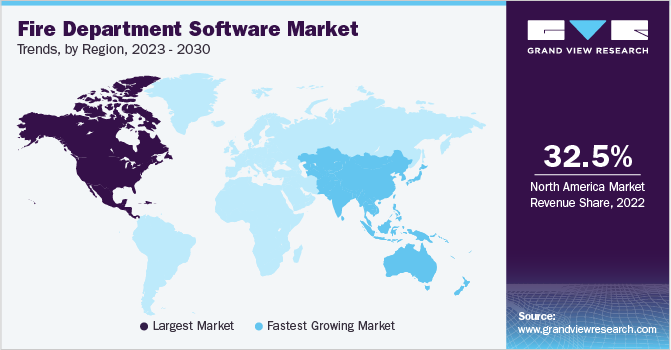

Regional Insights

北美的主要份额的32.5%target market in 2022 and is anticipated to retain its position over the forecast period. The increasing adoption of fire department software and tools in this region is a major factor behind the market growth. In addition, North America has a high saturation of fire department software providers, which makes North America a promising region. The region is likely to witness significant growth owing to the increasing government regulations and competition among the market players.

Asia Pacific is anticipated to grow as the fastest-developing regional market at a CAGR of 12.4%. The market for fire department software in this region is driven by the rise in investments in the IT sector, the growth of the government sector, and the increased funding for fire protection services. Infrastructure development is on the rise in Asia Pacific in line with unabated economic growth. As such, shopping malls, industrial facilities, transportation hubs, and residential buildings are increasingly being developed, especially across the emerging economies in Asia Pacific.

Key Companies & Market Share Insights

To broaden their product offering, industry companies utilize a variety of inorganic growth tactics, such as partnerships, regular mergers, and acquisitions. In October 2021, ESO Solutions, Inc. announced a strategic partnership with Bound Tree Medical, a distributor of healthcare products. The partnership will enable ESO solutions to integrate its ESO Inventory platform to build a holistic ecosystem for inventory management and streamline restocking, and purchasing. Some prominent players in the global fire department software market include:

firecloud365

Vector Solutions

ESO Solutions, Inc.

Tyler Technologies, Inc.

Accela, Inc.

ZOLL Medical Corporation

ImageTrend

EPR Systems, Inc

Robert Bosch GmbH

Eaton

Gentex Corp.

United Technologies Corp

Space Age Electronics

Halma plc

Hitachi Ltd.

Siemens Building Technologies

Hochiki Corp.

Nittan Company, Ltd.

Honeywell International, Inc.

Napco Security Technologies, Inc.

Johnson Controls

FirePrograms Software

StationSmarts

CivicPlus

Adashi Systems, LLC

Fire Department SoftwareMarket Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 956.7 million |

Revenue forecast in 2030 |

USD 2.06 billion |

Growth Rate |

CAGR of 11.6% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Report updated |

June 2023 |

Quantitative units |

Revenue in USD million, CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, trends |

Segments covered |

Software type, deployment, enterprise size, end-users, region |

Regional scope |

North America; Europe; Asia Pacific; Middle East & Africa; Latin America |

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; U.A.E.; Saudi Arabia; South Africa |

Key companies profiled |

firecloud365, Vector Solutions; ESO Solutions, Inc.; Tyler Technologies, Inc.; Accela, Inc.; ZOLL Medical Corporation; ImageTrend; EPR Systems, Inc; Robert Bosch GmbH; Eaton; Gentex Corp.; United Technologies Corp; Space Age Electronics; Halma plc; Hitachi Ltd.; Siemens Building Technologies; Hochiki Corp.; Nittan Company, Ltd.; Honeywell International, Inc.; Napco Security Technologies, Inc.; Johnson Controls; FirePrograms Software; StationSmarts; CivicPlus; Adashi Systems, LLC. |

Customization scope |

免费定制(相当于8肛交报告ysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Fire Department Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global fire department software market based on software type, deployment, enterprise size, end-users, and region.

Software Type Outlook (Revenue, USD Million, 2018 - 2030)

Fire Detection

Fire Response and Dispatch

Fire Risk Analysis

Others

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

Cloud-Based

On-Premise

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

Small & Medium Enterprises

Large Enterprises

End-users Outlook (Revenue, USD Million, 2018 - 2030)

Building owners and property managers

Fire departments and emergency responders

Insurance companies

Regulatory bodies

Others

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Italy

Spain

Asia Pacific

China

India

Japan

Australia

South Korea

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

U.A.E

Saudi Arabia

South Africa

Frequently Asked Questions About This Report

b.The global fire department software market size was estimated at USD 860.5 million in 2022 and is expected to reach USD 956.7 million in 2023.

b.The global fire department software market is expected to grow at a compound annual growth rate of 11.6% from 2023 to 2030 to reach USD 2.06 billion by 2030.

b.North America dominated the fire department software market with a market share of 32.45% in 2022. Technological advancements, product innovation, and increasing investments in fire services are some of the factors contributing to regional market growth.

b.Some key players operating in the fire department software market include firecloud365, Vector Solutions, ESO Solutions, Inc., Tyler Technologies, Inc., Accela, Inc., ZOLL Medical Corporation, ImageTrend, EPR Systems, Inc, Robert Bosch GmbH, Eaton, Gentex Corp., United Technologies Corp, Space Age Electronics, Halma plc, Hitachi Ltd., Siemens Building Technologies, Hochiki Corp., Nittan Company, Ltd., Honeywell International, Inc., Napco Security Technologies, Inc., Johnson Controls, FirePrograms Software, StationSmarts, CivicPlus, and Adashi Systems, LLC.

b.Key factors driving the market growth include surged government spending on the modernization of fire departments and increased undertaking of fire safety initiatives.