Flow Diverters Market Size, Share & Trends Analysis Report By Diameter Size (2-3 mm, 3-4 mm, 4-5 mm, >5 mm), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-184-2

- Number of Pages: 85

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry:Healthcare

Report Overview

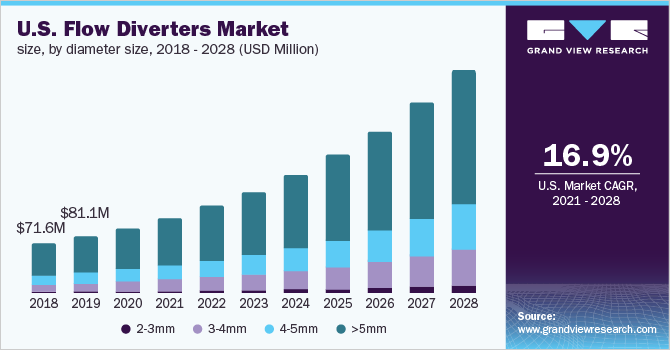

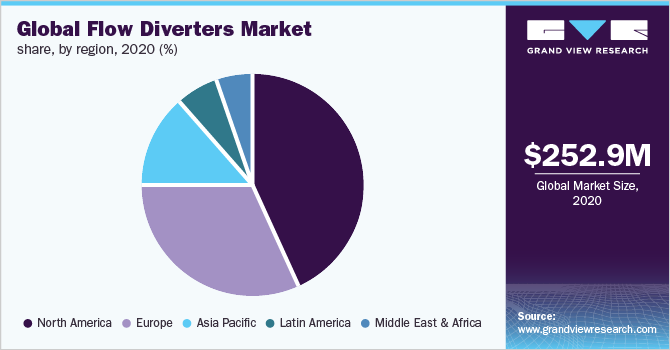

The global flow diverters market size was valued at USD 252.92 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 16.9% from 2021 to 2028. The rising prevalence of brain aneurysm and risk factors associated with it and the growing inclination towards minimally invasive procedures are among the key factors driving the market. In addition, growing awareness among people regarding the treatment and initiatives taken by the government to prevent the rate ofintracranial aneurysm很少有其他因素导致市场growth. Flow diverters have observed greater traction in 2020 as numerous products have been approved by the FDA for use in the intracranial aneurysm. This recent approval for flow diverters is expected to devour the market of embolic coils, which were earlier considered the gold standard for intracranial aneurysm treatment. Moreover, the surgical procedure for flow diverters is less complicated than embolic coils and requires a shorter inpatient time. Therefore, the COVID-19 pandemic had a favorable effect on the manufacturers of flow diverters in terms of product demand.

The increasing incidence of brain aneurysm globally is expected to positively impact the market growth over the forecast period. A brain aneurysm is also known as intracranial or cerebral aneurysm, which is a bulge or ballooning in a blood vessel inside the brain. This aneurysm can rupture and cause bleeding in the adjacent subarachnoid space, thereby leading to a stroke or brain hemorrhage. Flow diverters are mainly used to treat untreatable intracranial aneurysms and are placed in the parent artery to divert blood flow.

In addition, the presence of a large geriatric patient base is anticipated to be one of the key success factors for the growth of the market over the forecast period. For instance, as per the research study published in NCBI 2017, the prevalence rate of unruptured cerebral aneurysms in elderly patients is rapidly increasing, especially among patients aged 70 years or older. According to the World Ageing report, in 2019, it is estimated that there were approximately 703 million people aged 65 years or over globally. Hence, as the elderly population increases, the demand for flow diverters is also expected to increase.

Furthermore, the increasing incidence of brain aneurysm in some of the developed and developing countries has driven the launch of technologically advanced products in the market. Key companies are making continuous efforts for introducing technologically advanced products in the market. For instance, in August 2020, in the U.S., Stryker Corporation launched the Surpass Evolve Flow Diverter. It is a 64-wire cobalt chromium flow diverter designed for the treatment of unruptured giant and large wide-neck cerebral aneurysms. This approval is likely to help the company expand its neurovascular unit as well as its geographical presence.

Countries such as the U.S. and Canada have witnessed a high incidence rate of intracranial aneurysm in recent years. As per the Neuro Intervention Report 2017, more than 6.0 million people in the U.S. have developed an unruptured intracranial aneurysm. It is also reported that the geriatric population and individuals aged 35-60 are at a higher risk of developing an intracranial aneurysm.

Diameter Size Insights

The >5 mm flow diverters segment dominated the market with a share of 64.50% in 2020 owing to their wide spectrum application in treating large and wide intracranial aneurysms. Most of the ruptured aneurysms are larger in size, which means more than 10 mm in diameter, therefore, >5 mm flow diverters are utilized to implant in large-sized vessels and are ideal to achieve a high rate of stable aneurysm occlusion. Thus, the increasing prevalence rate of brain aneurysm is anticipated to boost the demand for >5 mm flow diverters during the forecast period.

The 3-4 mm flow diverters segment is expected to register the highest CAGR from 2021 to 2028 owing to a rise in the number of product approvals and an increase in the demand for minimally invasive procedures. For instance, in July 2020, Balt Extrusion obtained CE mark approval for its Silk Vista flow diverting stent used to treat small or medium-sized intracranial aneurysms (unruptured). This product will be commercialized in over 30 European countries. Similarly, in February 2019, Medtronic received U.S. FDA approval for an expanded indication of the Pipeline Flex embolization device. This device can be used for the treatment of patients with small or medium, wide-necked aneurysms.

Regional Insights

North America accounted for the largest share of 43.29% in 2020. This is due to the high prevalence of intracranial aneurysm and a rise in the demand for minimally invasive neurological procedures. For instance, according to the Brain Aneurysm Foundation, in the U.S., more than 6.5 million suffered from an unruptured cerebral aneurysm. In the U.S., approximately, 30,000 people suffer from intracranial aneurysm rupture every year. Rapid technological advancements are also contributing to the market growth in North America. Furthermore, supportive government initiatives and favorable reimbursements are expected to fuel the market growth.

Asia Pacific is expected to expand at the highest CAGR of 17.0% from 2021 to 2028. This is due to the presence of a large patient base suffering from neurovascular disorders in the emerging economies, such as India and China, along with the rising healthcare expenditure in this region. Moreover, mandatory healthcare insurance in some countries, rapid technological advancements, and increasing government initiatives are high-impact rendering drivers of the market. For instance, the China Intracranial Aneurysm Project (ICAP) is an observational, prospective, and multicenter registry study of risks, rupture, diagnosis, and treatment of intracranial aneurysm. Five studies are under ICAP. CIAP-1 is the observational study of unruptured intracranial aneurysm. This is anticipated to impel the market growth over the forecast period.

Key Companies & MarketShare Insights

Key market players account for a considerable share in the market owing to their broad product offerings. In recent years, flow diverters are getting attention from neurosurgeons owing to their success rate in managing brain aneurysm.

Several key players are focusing on research activities for addressing the pitfalls associated with the existing treatment options. For instance, in April 2020, Cerus Endovascular received CE mark approval for Neqstent Coil assisted flow diverter intended to treat intracranial aneurysms. Neqstent is designed to treat a range of aneurysm morphologies, including wide-necked bifurcation and bifurcation aneurysms. Some prominent players in the global flow diverters market include:

Medtronic

Stryker Corporation

MicroVention, Inc. (Terumo Corporation)

BALT Extrusion SA

MicroPort Scientific Corporation

Penumbra Inc.

Phenox GmbH

Acandis

Flow Diverters MarketReport Scope

Report Attribute |

Details |

Market size value in 2021 |

USD 293.23 million |

Revenue forecast in 2028 |

USD 874.10 million |

Growth rate |

CAGR of 16.9% from 2021 to 2028 |

Base year for estimation |

2020 |

Historical data |

2016 - 2019 |

Forecast period |

2021 - 2028 |

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2028 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Diameter size, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Colombia; Argentina; South Africa; Saudi Arabia; UAE |

Key companies profiled |

Medtronic; Stryker Corporation; MicroVention, Inc. (Terumo Corporation); BALT Extrusion SA; MicroPort Scientific Corporation;Penumbra Inc.; Phenox GmbH; Acandis |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global flow diverters market report on the basis of diameter size and region:

Diameter Size Outlook (Revenue, USD Million, 2016 - 2028)

2-3 mm Flow Diverters

3-4 mm Flow Diverters

4-5 mm Flow Diverters

>5 mm Flow Diverters

Regional Outlook (Revenue, USD Million, 2016 - 2028)

North America

U.S.

Canada

Europe

Germany

U.K.

France

Italy

Spain

Asia Pacific

Japan

China

India

Australia

South Korea

拉丁美洲

Brazil

Mexico

Argentina

Colombia

Middle East and Africa (MEA)

South Africa

Saudi Arabia

UAE

Frequently Asked Questions About This Report

b.The global flow diverters market size was estimated at USD 252.92 million in 2020 and is expected to reach USD 293.23 million in 2021.

b.The global flow diverters market is expected to grow at a compound annual growth rate of 16.9% from 2021 to 2028 to reach USD 874.10 million by 2028.

b.North America dominated the flow diverters market with the highest share of 43.29% in 2020. This is attributable to rising healthcare awareness coupled with the introduction of technologically advanced products and constant research and development initiatives.

b.Some key players operating in the flow diverters market include Stryker, Medtronic, and MicroVention.

b.Key factors driving the flow diverters market growth include rising demand for minimally invasive surgeries; increasing government initiative, favorable government policies, and rising incidence of intracranial aneurysms.