Fusion Biopsy Market Size, Share & Trends Analysis Report By Biopsy Route (Transrectal, Transperineal), By End-use (Hospitals, Diagnostic Centers, Ambulatory Care Centers), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-844-2

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry:Healthcare

Report Overview

The global fusion biopsy market size was valued at USD 489.1 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 11.6% from 2021 to 2028. Increasing prevalence of prostate cancer, growing awareness about the importance of regular clinical interventions, and developing reimbursement policies are factors likely to boost the demand for targeted MR/ultrasound biopsy systems over the forecast period.

The global number of fusion biopsy procedures declined by around 50.0% during the first semester of the COVID-19 pandemic. Among the procedures that happened during this time, prostate MRI was preferred in most hospitals. The number of procedures, and thus, the demand for new devices resumed after July 2020 as the number of the cases stabilized at a global level. The low-risk patients were managed by an active surveillance strategy which helped minimize the hospital visits associated with COVID-19 risks. Availability of COVID-19 vaccines and resuming procedures with strict guidelines are expected to restore market growth by the end of 2021.

The primary diagnostic test of prostate cancer includes prostate-specific antigen and digital rectal examination. If this preliminary test shows abnormal results, then further ultrasound imaging is recommended. However, the ultrasound scans have a high possibility to miss significant tumors, especially which are smaller in size and may cause clinical complications in the future. Therefore, urologists refrain to take risks and try to make a diagnosis as promptly and accurately as possible. This has led to the growing demand for prostate biopsy procedures contemplating its safety, reliability, and sensitivity in prostate cancer diagnosis.

The government and private bodies are committed to improving the health outcomes for men with prostate cancer by making significant investments into R&D for early and accurate diagnostic tools. For instance, since 2013, the government of Australia has spent over USD 84 million in prostate cancer treatment and diagnostic research through Cancer Australia, Prostate Cancer Research Foundation Australia, and National Health Medical Research Council Australia. Similarly, in October 2018, the U.K. government announced a budget of USD 19 million dedicated for the procurement of advanced diagnostic scanners, as well as training radiologists to deliver medical services for prostate cancer.

Biopsy Route Insights

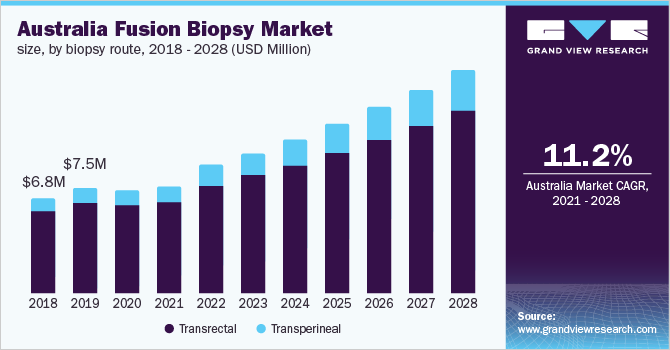

The transrectal segment dominated the market for fusion biopsy and accounted for the largest revenue share of 86.7% in 2020 because it was considered as the gold standard in performing prostate biopsy worldwide in the past decades. Most of the commercially available fusion biopsy was limited to the transrectal approach, contributing to its largest market share. However, patients reporting fever, sepsis, hematuria, and rectal bleeding after transrectal fusion biopsy resulted in its sluggish growth in the market for fusion biopsy.

Transperineal fusion biopsy is an emerging trend and is expected to experience the fastest CAGR of 15.2% during the forecast period. Lower risk of infection and rectal bleeding in comparison to the traditional approach is expected to contribute towards the segment growth. Moreover, the transperineal approach is efficient in assessing the ventral prostate areas that are typically omitted with transrectal fusion biopsy. The market players such as Koelis and Biopsee are offering both transrectal and transperineal accessories with their fusion biopsy system giving urologists the flexibility of providing personalized patient care.

End-use Insights

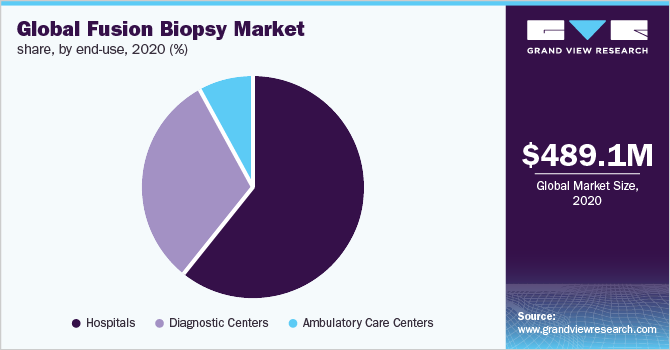

付家的医院主导了市场ion biopsy and held the largest revenue share of 61.0% in 2020 owing to their high purchasing power. The average unit price of a fusion biopsy system is expensive, making it unaffordable for private diagnostic centers. However, the adoption of these systems in ambulatory care centers is reported to be increasing with the growing demand for prostate cancer care in rural areas. The availability of skilled personnel and resources in hospitals, such as MRI scanners, anesthesiologists, radiologists, and urologists, allows them to perform fusion biopsies on demand. There is an increase in participation by private sector players in the hospital industry, making patient comfort a primary outcome. Thereby, a transperineal fusion biopsy system is adopted more to gain greater acceptance in hospitals, boosting the market.

The diagnostics centers segment is expected to grow at a significant rate in the market for fusion biopsy over the forecast period. Shorter wait times, cost efficiency, and a developing reimbursement paradigm are the factors expected to drive the growth of this segment. As a targeted MR/Ultrasound biopsy system is an emerging technology, the high cost is a major barrier for its implementation in diagnostic centers. However, it is observed that two diagnostic centers partnering to purchase an MR/Ultrasound fusion biopsy system, contemplating its quick ROI and surging demand for fusion biopsy.

The ambulatory care centers segment is expected to grow at the fastest rate of 12.6% during the forecast period. The rising prevalence of prostate cancer in rural areas having limited access to healthcare services is the factor expected to drive the growth of the segment. Moreover, the introduction of highly portable and low-cost MRI is expected to enhance the adoption rate of targeted MR/Ultrasound biopsy in ambulatory care centers, thus, expected to boost the overall market growth.

Regional Insights

North America dominated the market for fusion biopsy and accounted for the largest revenue share of 46.2% in 2020 and is expected to continue its dominance over the forecast period. The Asia Pacific is anticipated to register the fastest growth in the fusion biopsy market. The presence of key players, increase in the incidence of prostate cancer, and development of healthcare infrastructure are factors likely to propel market growth.

Europe held the second-largest share of the market for fusion biopsy in 2020. Developed economies and favorable regulatory procedures are some factors creating huge opportunities for major market players in this region. Thus, the market is expected to exhibit lucrative growth during the forecast period. Some key markets in the region are the U.K., Germany, France, Italy, and Spain.

In Asia Pacific, the market for fusion biopsy is anticipated to witness a CAGR of 12.0% during the forecast period. The Asia Pacific exhibits a lucrative growth opportunity with the emerging economies at the forefront of development. The major factors driving the growth of the market include rising awareness of prostate cancer, increasing population base, and rising disposable income levels as well as high unmet needs of the patients in emerging countries such as India, Japan, and China. The growing unhealthy lifestyles in the region along with the aging population are leading to the growing occurrence of various diseases and cancers. Thus, the growing demand for diagnosis within the region is expected to propel market growth.

Key Companies & Market Share Insights

市场融合活检fragmente的像样的衣服d, with the top few players holding the majority of the share. However, increasing demand for efficient diagnostic tools in prostate cancer management is creating growth opportunities for new players to enter the market. The market players are adopting various strategies such as mergers and acquisitions, product launches, collaborations, reinforcing distribution networks, and entering untapped markets especially developing economies to strengthen their market presence. For instance, in May 2020, EDAP TMS SA, a global leader in robotic energy-based therapies, signed a distribution agreement with Exact imaging. EDAP was expected to market Exact Imaging’s micro-ultrasound devices, along with its high-intensity focused ultrasound systems. Some of the prominent players in the fusion biopsy market include:

MedCom

ESAOTE SPA

KOELIS

Focal Healthcare

GeoScan Medical

UC-Care Medical Systems Ltd.

Fusion Biopsy Market Report Scope

Report Attribute |

Details |

Market size value in 2021 |

USD 514.6 million |

Revenue forecast in 2028 |

USD 1.11 billion |

Growth rate |

CAGR of 11.6% from 2021 to 2028 |

Base year for estimation |

2020 |

Historical data |

2016 - 2019 |

Forecast period |

2021 - 2028 |

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2028 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Biopsy route, end-use, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Switzerland; Belgium; India; Japan; China; Thailand; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE |

Key companies profiled |

Eigen; Koninklijke Philips N.V.; Hitachi, Ltd.; MedCom; ESAOTE SPA; KOELIS; Focal Healthcare; UC-Care Medical Systems Ltd.; GeoScan Medical |

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global fusion biopsy market report on the basis of biopsy route, end-use, and region:

Biopsy Route Outlook (Revenue, USD Million; 2016 - 2028)

Transrectal

Transperineal

End-use Outlook (Revenue, USD Million, 2016 - 2028)

Hospitals

Diagnostic Centers

Ambulatory Care Centers

Regional Outlook (Revenue, USD Million, 2016 - 2028)

North America

U.S.

Canada

Europe

Germany

U.K.

France

Italy

Spain

Switzerland

Belgium

Asia Pacific

China

Japan

India

Thailand

韩国

Australia

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

UAE

Frequently Asked Questions About This Report

b.The global fusion biopsy market size was estimated at USD 489.1 million in 2020 and is expected to reach USD 514.6 million in 2021.

b.The global fusion biopsy market is expected to grow at a compound annual growth rate of 11.6% from 2021 to 2028 to reach USD 1.11 billion by 2028.

b.North America dominated the fusion biopsy market with a share of 46.4% in 2020. This is attributable to the rising prevalence of prostate cancer in the U.S. and Canada, the presence of a large installed base of fusion biopsy units, increasing research activities related to prostate cancer treatment, and the presence of effective screening programs.

b.Some key players operating in the fusion biopsy market include Eigen; Koninklijke Philips N.V.; Hitachi, Ltd., MedCom; ESAOTE SPA; KOELIS; Focal Healthcare; UC-Care Medical Systems Ltd.; and GeoScan Medical.

b.关键因素推动融合活检market growth include the growing demand for targeted biopsy, the development of efficient reimbursement policies in several countries, and the launch of intuitive and attractive fusion biopsy software systems.