Geospatial Analytics Market Size, Share & Trends Analysis Report By Component, By Type, By Application (Surveying, Medicine & Public Safety), By Region And Segment Forecasts, 2020 - 2025

- Report ID: GVR-3-68038-358-4

- Number of Pages: 142

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry:Technology

Report Overview

The global geospatial analytics market size was valued at USD 51,700.7 million in 2018, registering a CAGR of 15.0% from 2019 to 2025. Geospatial analytics refers to the collection and manipulation of data based on location. It uses multiple technological tools includingGlobal Positioning Systems(GPS),Geographic Information Systems(GIS), georeferencing, metadata, and remote sensing to provide accurate modeling, trend analysis, and predictions. These analytics also filters out relevant and useful data from irrelevant data sets.

Increasing penetration and adoption of theInternet of Things(IoT) across the globe coupled with the introduction of Artificial Intelligence (AI) and big data analysis are expected to result in significant growth of the market over the forecast period. Also, various advancements in AI and big data have enabled providers of geospatial analytics solutions and services to offer on-demand analytics of large and complex datasets. These advancements have also enabled the integration of information systems with a hybrid cloud computing environment.

The geospatial analysis applies various analytical techniques such as statistical analysis to analyze geographical and spatial data. It also uses software solutions that are capable of processing spatial data and rendering maps as well as applying analytical methods to geographic or terrestrial datasets with the help of GIS and geomatics. Besides, geospatial information systems can be easily integrated into an organization’s existing enterprise information systems. These advantages are the major driving factors for the geospatial analytics market growth.

然而,一些hampe的关键制约因素ring the market growth include high acquisition costs and operational concerns such as lack of skilled human resources, the limited presence of open standards and interoperability mechanisms, and integration issues between GIS and Environmental Resources Management (ERM) systems. Although the overall cost of geospatial analytics solutions has drastically declined over the last decade, owing to the increased availability of open source tools and plunging hardware costs, it remains a major cause of concern for Small and Medium Scale Enterprises (SMEs).

Geospatial analytics was initially developed to tackle challenges faced by the environmental and life sciences industries, majorly focusing on ecology, epidemiology, and geology. However, the technology is now being widely adopted to cater to many different industries including government and defense, utilities, public safety, healthcare, and natural resources. It also finds major applications in Climate Change Adaptation (CCA) and Disaster Risk Reduction and Management (DRRM).

Geospatial Analytics Market Trends

Geospatial analytics was initially developed with an aim to tackle challenges faced by the environmental and life sciences industries, majorly focusing on ecology, epidemiology, and geology. Over the years, the technology is now being widely adopted to cater to many different industries including government and defense, utilities, public safety, healthcare, and natural resources. It also finds major applications in Climate Change Adaptation (CCA) and Disaster Risk Reduction and Management (DRRM).

与此同时,地理空间技术的进步y have also increased the volume of the data collected and the frequency of data collection, and analyzing the large volumes of data being generated is turning out to be a major concern for organizations. AI and ML are helping the organizations in analyzing these large volumes of geospatial data and gaining valuable insights to undertake an actionable approach and make informed business decisions. Similarly, advances in AI are allowing geospatial analytics solutions and service providers to offer cloud-based geospatial analytics solutions capable of providing on-demand analytics to run large and complex datasets to the connected devices. These advances are facilitating the integration of information systems with hybrid cloud computing environments.

The increased adoption of technologies such as big data analytics, cloud computing, IoT, AI, and other business intelligence tools is driving the geospatial analytics market growth. Additionally, the abundant availability of remote sensing satellites, availability of high-speed internet and communication network infrastructure, and widespread adoption of UAV technology to gather geospatial data are expected to further contribute to the market growth.

Moreover, technological developments in augmented reality are likely to foster market growth as augmented reality uses 3D platforms and GIS information to provide virtual information. The advancements in AI and big data have enabled providers of geospatial analytics solutions and services to offer on-demand analytics of large and complex datasets. These advancements have also enabled the integration of information systems with hybrid cloud computing environment.

Further, vendors operating the market are focused on product development for increasing their customer base. For instance, in June 2019, Hexagon’s geospatial division launched Luciad V2019 at its digital solutions conference named HxGN LIVE 2019. The solution is enabling smart cities, organizations, and nations to leverage real-time location intelligence for driving real-time decision-making.

The introduction of smart city initiatives has boosted the demand for innovative technologies in developing economies across the globe. Geospatial analytics is playing a major role in analyzing the migration of population and in smart city planning. Moreover, the leading organizations prefer geospatial analytics solutions for determining strategies, future investments, and expansion programs to be implemented.

While the rising adoption of geospatial technologies coupled with the introduction of other supporting technologies, such as cloud services and embedded sensors, and the growing popularity of social media are making it difficult to analyze and map the data, the introduction of big data analytics is enhancing the data handling capabilities by processing large volumes of data in the shortest possible time durations. As a result, the demand for geospatial analytics solutions along with big data capabilities is anticipated to increase over the forecast period.

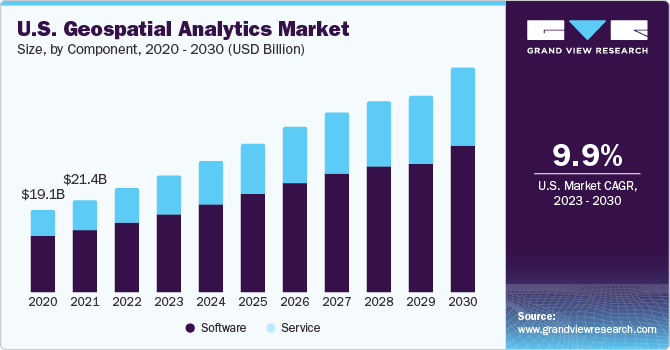

Component Insights

Based on the component, the market has been segmented into software and service. The software segment dominated the market in 2018 owing to the increasing adoption of software solutions by companies for acquiring location-based Business Intelligence (BI) for informed decision making. In addition, there has been a significant rise in the adoption of analytics software for environment monitoring, forest management, and traffic monitoring. Moreover, the development of 4-dimensional GIS software bodes well for the growth of the software segment.

The service segment is anticipated to emerge as the fastest-growing segment over the forecast period. This can be attributed to the increasing requirement of installation, training, and support services to support the increasing deployment of software and solutions. Government agencies and public safety organizations are deploying analytics to monitor natural resources, infrastructure projects, and detect cross-border infiltration as well as to offer enhanced safety and security to vehicles. In addition, companies are also offering Geospatial Analytics-as-a-Service. For instance, the IBM Cloud Geospatial Analytics service enables users to accurately monitor locations of moving mobile devices in real-time. These factors are further anticipated to increase the demand for services over the forecast period.

Type Insights

Based on type, the market has been classified into network & location analytics, visualization, surface & field analytics, and others. The surface & field analytics segment dominated the market in 2018 owing to its wide adoption by government and private companies for infrastructure development projects, to determine the flow of water, and to design and construct drainage systems. This type of geospatial analytics service is also used in the agriculture sector to analyze topsoil erosion.

与此同时,the network & location analytics segment is anticipated to emerge as the fastest-growing segment over the forecast period owing to its increased use to optimize marketing strategies and develop and deliver highly-customized promotional content. Location is a vital component of geospatial analytics. The technology helps in enhancing the functionality, utility, and relevance of data analytics. It also has the capability of analyzing and organizing a large amount of data in real-time to derive decisive business insights. Additionally, it allows visualizing, understanding, and interpreting data in a number of ways to reveal relationships, trends, and patterns in the form of globes, maps, charts, and reports for marketing activities. This is crucial for any company looking to expand its operations, explore new markets, and achieve customer satisfaction.

Application Insights

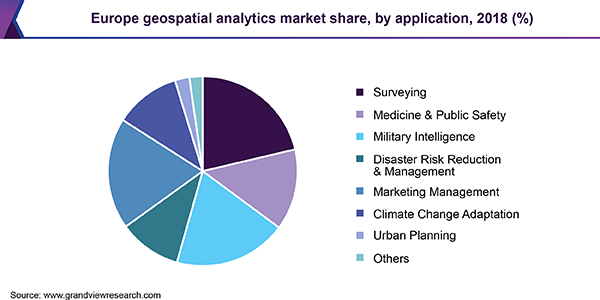

Based on application, the market has been classified into surveying, medicine & public safety, military intelligence, disaster risk reduction & management, marketing management, Climate Change Adaptation (CCA), urban planning, and others. The surveying segment dominated the market in 2018 owing to its wide-scale adoption in agriculture and natural resource monitoring. However, the military intelligence segment is expected to emerge as the fastest-growing segment over the forecast period. This may be attributed to the increasing number of remote sensing satellites globally for border patrolling, which demands the use of geospatial analytics.

Remote sensing is majorly used for land surveying and in most of the earth's science disciplines including hydrology, ecology, meteorology, oceanography, glaciology, and geology. Apart from the commercial, economic, planning, and humanitarian applications, remote sensing is also used for military intelligence purposes by countries with the most powerful military capabilities, such as the U.S., North Atlantic Treaty Organization (NATO), Russia, Japan, Israel, China, and India. Moreover, organizations such as National Emergency Management Agency (NEMA) use geospatial analytics for improving disaster response and preparedness as the technology helps in devising effective disaster management strategies through proper disaster visualization, deployment of rescue teams, and planning of post-disaster activities such as reconstruction and rehabilitation.

Regional Insights

North America dominated the market in 2018 owing to the wide presence of key industry players offering geospatial analytics software and solutions in the region. Major players operating in the region include DigitalGlobe (U.S.), Alteryx, Inc. (U.S.), Harris Corporation (U.S.), Trimble Navigation Ltd. (U.S.), Pitney Bowes (U.S.), ESRI (U.S.), and Google LLC (U.S.). The increased adoption of emerging technologies such as big data analysis, cloud computing, IoT, AI, and other business intelligence tools in the region is one of the major factors driving the growth of the market in North America. In addition, the high number of available remote sensing satellites, availability of high-speed internet and communication network infrastructure, and widespread adoption of UAV technology to capture geospatial data is expected to further contribute to the market growth.

与此同时,亚太地区预计将emerge as the fastest-growing market owing to the growing demand in China, India, and Japan. The increase in demand in China is mainly attributed to its rapid industrialization and growth of the infrastructure and logistics sectors. These countries are extensively using analytics solutions for disaster control, environment monitoring, and forest management. Moreover, there has been a significant rise in the adoption of geospatial analytics by government and public safety agencies in the region.

The U.S. is the leader in geospatial data infrastructure and the first to develop the GPS technology, which is widely used across the globe. With the Wide Area Augmentation System (WAAS), satellite-based augmentation system, and an efficient geodetic infrastructure, the U.S. sets an example for its counterparts in terms of governance mechanism and data infrastructure. Other countries are highly dependent on the U.S. technologies, which has boosted the growth of the geospatial analytics market in the country.

The U.S. and Canada have dedicated geospatial domain startup creation and support programs such as Startup VISA Canada. These national innovation programs attract global innovators and bring new talent into the marketspace to help gather, understand, and implement geospatial data. Owing to these factors, North America is expected to continue leading the market over the forecast period.

Key Companies & Market Share Insights

Key industry players operating in the market include Alteryx, Inc., DigitalGlobe, Fugro N.V., Hexagon AB, RMSI, SAP SE, Trimble Inc., Maxar Technologies Inc., MapLarge, Harris Corporation, Bentley Systems Incorporated, ESRI, General Electric Company, Oracle Corporation, and Google LLC. Numerous companies are focusing on various growth strategies such as new product launches, product enhancements, agreements, partnerships, and collaborations. For instance, in August 2016, IBM Watson formed a partnership with MAPBOX to offer analysis services to business users. These services enabled users to gain insights into the patterns of their location-related business data for improving marketing strategies and operations. The partnership also enabled IBM to provide valuable insights to customers operating in retail, insurance, defense, natural resources, utilities, medicine, social sciences, and public safety. In addition, the users were able to create custom maps for solving specific business cases and had an option to add natural language processing to geospatial insights.

Similarly, Munich Re, one of the largest and reputed re-insurance companies in the world, uses predictive analytics, simulation, and spatial data processing capabilities of SAP HANA, an application that combines GIS and mapping with business data processes. The company has also deployed SAP HANA’s cloud-based Earth Observation Analysis Service (EOAS) to analyze natural disaster data with public safety agencies to improve its decision-making capabilities with respect to insurance risks.

Geospatial Analytics Market Report Scope

Report Attribute |

Details |

Market size value in 2020 |

USD 65.8 billion |

Revenue forecast in 2025 |

USD 134.5 billion |

Growth Rate |

CAGR of 15.0% from 2019 to 2025 |

Base year for estimation |

2019 |

Historical data |

2014 - 2018 |

Forecast period |

2020 - 2025 |

Quantitative units |

Revenue in USD billion and CAGR from 2020 to 2025 |

Report coverage |

收入预测,公司排名、竞争局域网dscape, growth factors, and trends |

Segments covered |

Component, type, application, and region. |

Regional scope |

North America; Europe; Asia Pacific; South America; Middle East & Africa |

Country scope |

U.S.; Canada; Germany; India; Japan; China; Brazil. |

Key companies profiled |

Alteryx, Inc.; DigitalGlobe; Fugro N.V.; Hexagon AB; RMSI; SAP SE; Trimble Inc.; Maxar Technologies Inc.; MapLarge; Harris Corporation; Bentley Systems Incorporated; ESRI; General Electric Company; Oracle Corporation; and Google LLC. |

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global geospatial analytics market report based on component, type, application, and region:

Component Outlook (Revenue, USD Million, 2014 - 2025)

Software

Service

Type Outlook (Revenue, USD Million, 2014 - 2025)

Surface & Field Analytics

Network & Location Analytics

Geovisualization

Others

Application Outlook (Revenue, USD Million, 2014 - 2025)

Surveying

Medicine & Public Safety

Military Intelligence

Disaster Risk Reduction & Management

Marketing Management

Climate Change Adaptation (CCA)

Urban Planning

Others

Regional Outlook (Revenue, USD Million, 2014 - 2025)

North America

The U.S.

Canada

Europe

The U.K.

Germany

Asia Pacific

China

India

Japan

Latin America

Brazil

Middle East & Africa