Germany Automotive Aftermarket Size, Share & Trends Analysis Report By Replacement Part (Tire, Lighting & Electronic Components), By Distribution Channel, By Service Channel, By Certification, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-4-68038-136-8

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry:Technology

Industry Insights

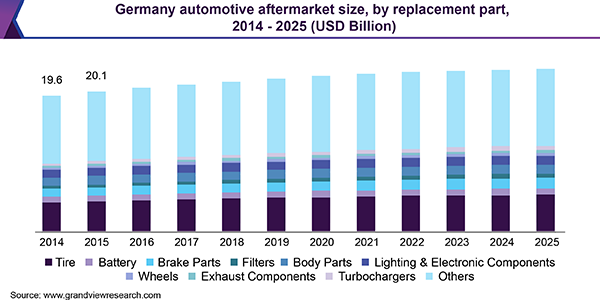

The Germany automotive aftermarket size was valued at USD 21.5 billion in 2018 and is expected to register a CAGR of 1.1% from 2019 to 2025. The aftermarket has gained high traction with increasing service orientation and new product innovation. High capacity engines, turbochargers, and lighting and electronic components are some of the aftermarket products mainly considered for a company’s product line innovation strategy. Moreover, automotive manufacturers and suppliers provide innovative and intelligent solutions to promote safe and sustainable mobility.

The market is affected by several major disruptions, such as digitalization, changing consumer preferences, and shifting competitive dynamics. With rapid digitalization, the use of smartphones has increased. The rise in sales of smartphones will enable mobility services such as e-hailing with a substantial information purchase, which has moved online sales of auto parts.

增加汽车的根源motive parts sales in Germany is growing sales of hybrid andelectric vehiclesin the last few years. Owing to government regulations for environment prevention, consumers have moved from conventional vehicles to electric vehicles. This in turn is expected to create a significant shift in the sales of replacement parts such as batteries and turbochargers. Furthermore, a rise in the number of aging vehicles, increasing accidental repairs, and growing wear and tear repairs are some of the major factors supporting the demand for advanced and cost-effective auto parts in the aftermarket.

Automotive players in Germany are undergoing numerous consolidations to secure and expand their positions in the domestic market. Several distributors as well as large buying groups are pursuing mergers and acquisitions to increase their size and establish an international footprint. The rising sale of automobiles has compelled OEM businesses to engage in mergers and acquisitions as well. This can be attributed to a decrease in the aftermarket share with the entry of new players in the market.

Replacement Part Insights

Based on the automotive replacement part, the market is segmented into the tire,battery, brake parts, filters, body parts, lighting and electronic components, wheels, exhaust components, turbochargers, and others. In 2018, the tire segment accounted for the maximum share in the market. The turbocharger segment is expected to register a high CAGR over the forecast period. Turbochargers have shown high demand in the aftermarket as these are helpful in meeting standards regarding the emission of harmful gases such as CO2 andnitrous oxide在车辆。

Recent developments in sales ofautomotive tires, body parts, and brake parts, with the introduction of variable nozzle technology turbocharger-an advanced variable geometry turbocharger, have created significant traction in the market. Turbochargers have gained a popularity shift inapplicability in HCV, LCV, and passenger cars. The growth of the segment is mainly influenced by factors such as changing consumer preferences for greater power generating vehicles and stringent emission regulations in Europe.

Distribution Channel Insights

Based on the distribution channel, the Germany automotive aftermarket is bifurcated into retailers as well as wholesalers and distributors. In 2018, the retailer's segment accounted for the largest share in the market. The wholesalers and distributors segment is estimated to witness high growth over the forecast period. The adoption of e-commerce distribution channels impacts their strategy and accelerates demand for auto parts.

Dealers mainly sell automotive parts at a retail level through dealership contracts with OEMs suppliers and provide spare parts and maintenance. Some distributors are keen on trading with suppliers from developing countries. Fleet management services and mobility services companies have contract services with OEMs to provide spare parts and maintenance services. Increasing initiatives for green energy products also increase the distribution and production of aftermarket products.

销售渠道Insights

Based on the service channel, the market has been segmented into do-it-yourself (DIY), do-it-for-me (DIFM), and original equipment (OE). In 2018, the OE segment accounted for the maximum share in the market, followed by the DIFM segment. The DIY segment is estimated to exhibit a high CAGR over the forecast period. While do-it-yourself components and accessories are increasingly popular online in the automotive industry, the market for DIFM replacement part categories is expected to grow as sellers adopt smarter fulfillment models for customers.

增加销售的DIY和DIFM段, there are numerous growth opportunities for market competitors to invest in the same. Furthermore, in the last few years, growing investments by companies in the domestic market have led to a high stock value of do-it-for-me, which has outperformed auto aftermarket do-it-yourself stocks. Demand for the DIFM segment is highly driven by the need to maintain and repair vehicles.

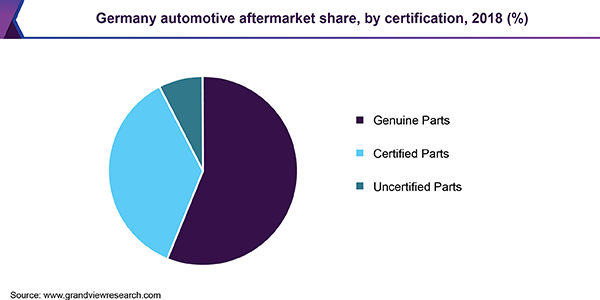

Certification Insights

The market is categorized based on certification into genuine parts, certified parts, and uncertified parts. The genuine parts segment is anticipated to dominate the aftermarket throughout the forecast period while certified parts will witness the highest CAGR from 2019 to 2025. Genuine automotive parts are manufactured either by car manufacturers or OEMs. These replacement parts promise quality, diversity, availability, and warranty. The flipside, however, is that these parts are costly and need to be purchased from authentic dealers.

Over the past few years, the need to ensure new vehicle models adhere to given passenger safety standards have increased tremendously. Original and certified parts assure standard and quality and as a result, these two segments will continue to dominate the aftermarket. Uncertified automotive parts are counterfeit parts that have not been approved by the carmaker nor have been tested or certified by certified organizations. However, they are much cheaper, and as a result, numerous auto collision repair shops offer these for consumers looking for less expensive replacement part alternatives.

Germany Automotive Aftermarket Share Insights

Key industry participants include 3M, Continental AG, Delphi Automotive PLC, Denso Corporation, and Federal-Mogul Corporation. The current aftermarket environment has been witnessing an intense competition between key players to achieve market domination via enhancement of product and service quality. This has resulted in growing market consolidation through strategic initiatives such as alliances, mergers, and acquisitions. This is primarily due to the brand value and loyalty base accrued by prominent players, along with the establishment of a global presence. Furthermore, the companies offer a varied range of automotive parts at low cost with individual customer requirements.

Report Scope

Attribute |

Details |

The base year for estimation |

2018 |

Actual estimates/Historical data |

2014 - 2017 |

Forecast period |

2019 - 2025 |

Market representation |

Revenue in USD Billion and CAGR from 2019 to 2025 |

Country scope |

Germany |

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

15% free customization scope (equivalent to 5 analysts working days) |

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization |

Segments Covered in the Report

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the Germany automotive aftermarket report based on the replacement part, distribution channel, sales channel, and certification:

Replacement Part Outlook (Revenue, USD Billion, 2014 - 2025)

Tire

Battery

Brake parts

Filters

Body parts

Lighting & Electronic components

Wheels

Exhaust components

Turbochargers

Others

Distribution Channel Type Outlook (Revenue, USD Billion, 2014 - 2025)

Retailers

W&D

销售渠道Outlook (Revenue, USD Billion, 2014 - 2025)

DIY

DIFM

OE

Certification Outlook (Revenue, USD Billion, 2014 - 2025)

Genuine Parts

Certified Parts

Uncertified Parts