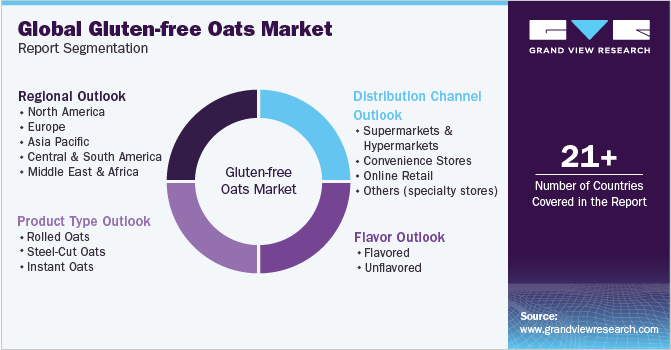

Gluten-free Oats Market Size, Share & Trends Analysis Report By Product Type (Rolled Oats, Instant Oats), By Flavor (Flavored, Unflavored), By Distribution Channel (Supermarkets & Hypermarkets), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-069-1

- Number of Pages: 89

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Consumer Goods

Report Overview

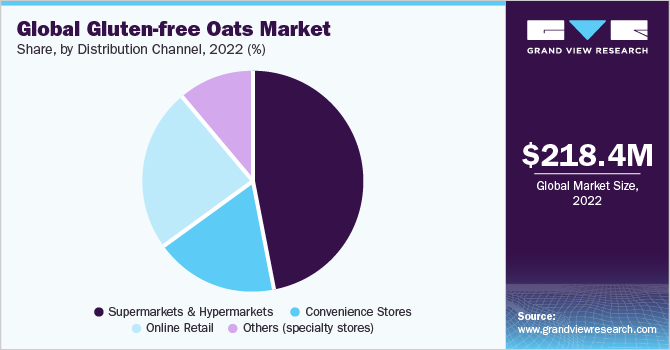

The globalgluten-free oats market sizewas valued atUSD 218.4 million in 2022and is expected to grow at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. Rising awareness among consumers about the nutritional and health benefits associated with gluten-free food is boosting product demand. The Food and Drug Administration (FDA) has stated that gluten-free food is beneficial for customers that suffer from celiac disease. FDA labels foods as ‘gluten-free’ if the product has less than 20 parts per million (PPM) of gluten. Oats are however a naturally gluten-free product but encountering wheat, rye or barley could make gluten induced in oats. As more individuals are diagnosed with these conditions, there is a growing demand for gluten-free alternatives, including oats, which are considered a safe option for those with gluten sensitivity or celiac disease. Health-conscious consumers increasingly adopt gluten-free diets as part of their healthy lifestyles. Oats, known for their nutritional benefits, are gaining popularity among health-conscious individuals, and gluten-free oats are seen as a healthy choice for those who want to avoid gluten in their diet. The increase in vegan and gluten-free populations across the world is also shaping the product market.

The food industry has been witnessing an expansion in gluten-free product offerings, including gluten-free oats, as food manufacturers and retailers are responding to the increasing demand for gluten-free options. The expansion of gluten-free product offerings is a significant factor driving the growth of the gluten-free oats industry. This has led to more availability of gluten-free oats in various forms such as whole oats, oat flour, rolled oats, and instant oats, which has further fueled the market growth.

With increasing awareness and demand for gluten-free options, food manufacturers and retailers are actively expanding their product offerings to cater to this growing consumer segment. Moreover, the availability of gluten-free oats in different forms and packaging sizes has increased, providing consumers with more choices and convenience. This has been made possible through advancements in processing techniques and testing methods to ensure that oats are free from gluten contamination, thus meeting the strict requirements of gluten-free diets.

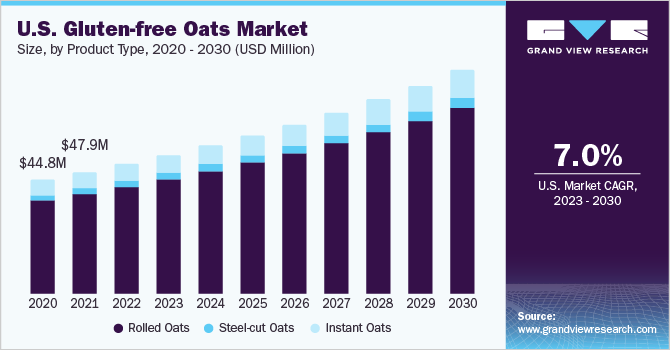

Product Type Insights

产品类型、燕麦片th主导e global market with the largest market share of the total revenue in 2022, holding 84% of the total market in 2022. Increased consumption and production of rolled oats in key regions such as Europe and North America are likely to complement the overall market growth. Rolled oats are also expected to accelerate with a CAGR of 7.1% during the forecast period. Rolled oats are easy to prepare and can be used in a variety of recipes, from oatmeal breakfast bowls to baked goods. As busy lifestyles become more prevalent, consumers are looking for convenient and versatile ingredients to use in their cooking and meal preparation.

Flavor Insights

The unflavored oats market is also a significant segment in the food industry, and are expected to hold 84.4% of the total market. Unflavored oats are the basic form of oats and are not infused with any added flavors or ingredients. They are a popular breakfast option for people who prefer a plain and simple meal or who prefer to add their own flavors. Unflavored oats, which include steel-cut oats, quick oats, and rolled oats, are popular breakfast food and ingredient in many recipes. They could be easily flavored and customized by customers on their ends.

Flavored oats are expected to pace at a growth rate of 7.9% during the forecast period. Flavored oats are a perfect fit for this demand as they are easy to prepare, high in fiber and protein, and come in a variety of flavors. The market for flavored oats is also being driven by the increasing availability of different flavors and varieties. Companies are constantly introducing new flavors and combinations, such as apple cinnamon, blueberry, and maple brown sugar, to keep up with the demand. Additionally, the rise ofe-commercehas made it easier for consumers to purchase different varieties and brands of flavored oats, further boosting the growth of the market.

Distribution Channel Insights

Supermarkets and hypermarkets are expected to hold a market share of 46.9% of the total market in 2022. Manufacturers are investing in research and development to improve the quality and taste of their products, as well as develop innovative products made from gluten-free oats. This has led to the introduction of new gluten-free oat-based products in the market, such as snacks, granola, and breakfast cereals, which have attracted consumers and fueled the market growth.

The easy availability of food products in these markets and accessibility by customers have led to increased online distribution. Online marketplaces and retailers, such as Amazon, Walmart, and Target, offer a wide range of gluten-free oats and gluten-free oat-based products, including oatmeal, granola bars, and oat milk. These retailers provide a convenient and efficient way for consumers to purchase oats and often offer delivery options that save time and effort. The rise of e-commerce has also allowed smaller oat brands and businesses to reach a wider audience.

During the forecasted period, online retail is anticipated to experience a significant growth rate with a compound annual growth rate (CAGR) of 8.7%. This growth is attributed to the increasing prevalence of mobile payments in the e-commerce sector, as evidenced by a study conducted by SalesForce in June 2022, which found that mobile consumers constitute 60% of the global e-commerce traffic. Additionally, the rising adoption of digital wallets worldwide is expected to further propel the growth of online retail during the forecast period.

Regional Insights

欧洲占主导地位的市场份额/ 34.9% in 2022. Europe is a significant market for gluten-free oats, with countries like the UK, Germany, and Italy showing substantial demand for gluten-free products, including oats. The European market is driven by the increasing prevalence of gluten-related disorders, rising consumer awareness about gluten-free diets, and growing health consciousness. Additionally, regulatory bodies in Europe, such as the European Food Safety Authority (EFSA), have established guidelines for gluten-free labeling, which has further supported the growth of the gluten-free oats market in the region.

The Asia Pacific region is emerging as a potential market for gluten-free oats, as awareness about gluten intolerance and celiac disease is growing, and consumers are becoming more health-conscious. The region is expected to accelerate with a CAGR of 10.1% during the forecast period. Countries like India, Australia, and China are witnessing increasing demand for gluten-free oats, driven by the rising prevalence of gluten-related disorders, and changing dietary preferences. The Asia-Pacific market also presents opportunities for market players to develop innovative gluten-free oat-based products tailored to local tastes and preferences.

Key Companies & Market Share Insights

There has been a rise in the availability of ready-to-eat oatmeal cups that are gluten-free. These convenient on-the-go options are typically single-serving cups that are pre-portioned with gluten-free oats, dried fruits, nuts, and other ingredients, making them a convenient and quick breakfast or snack option for those following a gluten-free diet. Manufacturers are also introducing flavored gluten-free oats to offer more variety to consumers. These flavored options may include different flavors such as maple brown sugar, apple cinnamon, and blueberry, among others, to provide additional taste options for those who prefer flavored oats.

In 2022, Bob's Red Mill, introduced a new line of gluten-free oats, made from certified gluten-free oats sourced from dedicated gluten-free fields and processed in a gluten-free facility to ensure purity and safety for consumers with celiac disease or gluten sensitivity.

In 2020, General Mills, announced that it has expanded its gluten-free product offerings, including gluten-free oats, under its popular brands such as Cheerios and Chex, to cater to the increasing demand for gluten-free options among consumers.

Some of the key players operating in the global gluten-free oats market include:

Bob's Red Mill

Nature's Path

General Mills

Quaker Oats

Freedom Foods Group

Glutenfreeda Foods

Bakery On Main

Purely Elizabeth

Thrive Market

Trader Joe's

Gluten-free OatsMarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 235.3 million |

Revenue forecast in 2030 |

USD 398.4 million |

Growth rate |

CAGR of 7.8% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million, and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product type, flavor, distribution channel, region |

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Spain; Russia; China; India; Japan; Australia; Brazil; Argentina; South Africa; Turkey |

Key companies profiled |

Bob's Red Mill; Nature's Path; General Mills; Quaker Oats; Freedom Foods Group; Glutenfreeda Foods; Bakery On Main; Purely Elizabeth; Thrive Market; Trader Joe’s |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Gluten-free Oats Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global gluten-free oats market report based on product type, flavor, distribution channel, and region:

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

Rolled Oats

Steel-Cut Oats

Instant Oats

Flavor Outlook (Revenue, USD Million, 2017 - 2030)

Flavored

Unflavored

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

Supermarkets and Hypermarkets

Convenience Stores

Online Retail

Others (Specialty Stores)

Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Mexico

Europe

U.K.

Germany

France

Spain

Russia

Asia Pacific

China

India

Japan

Australia

Central & South America

Brazil

Argentina

Middle East & Africa

South Africa

Turkey

Frequently Asked Questions About This Report

b.Gluten-free oats market is worth USD 218.37 million in 2022. and is anticipated to reach 235.3 million in 2023.

b.Gluten-free oats market is expected to accelerate at a CAGR of 7.8%.

b.Rolled oats are the most preferred gluten-free oats and account for 83.9% of the total market share in 2022.

b.Bob's Red Mill, Nature's Path, General Mills, Quaker Oats, Freedom Foods Group, Glutenfreeda Foods, Bakery On Main, Purely Elizabeth, are among some of the key players in the market.

b.Health-conscious consumers increasingly adopt gluten-free diets as part of their healthy lifestyles and this is boosting the revenue of gluten-free oats market.