Green And Bio-based Plastic Additives Market Size, Share & Trends Analysis Report By Product, By Type (Plasticizers, Flame Retardants), By Application (Packaging, Consumer Goods & Electronics), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-133-1

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Bulk Chemicals

Green & Bio-based Plastic Additives Market Size & Trends

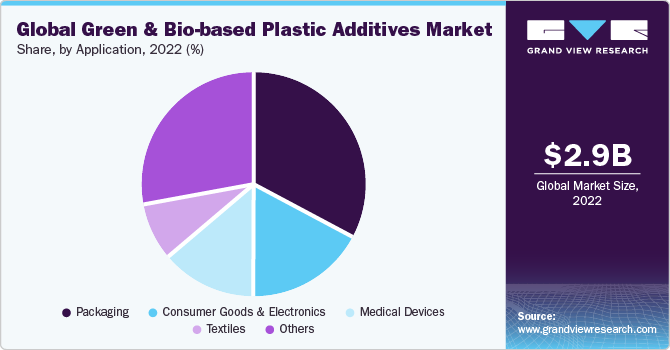

The globalgreen and bio-based plastic additives marketsizewas estimated atUSD 2.92 billion in 2022and is anticipated to grow at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030. The rising global sustainability and environmental concerns among people are increasing the demand for bio-based plastic additives. Conventional plastic additives are often derived from fossil fuels and can contribute to environmental issues such as greenhouse gas emissions and plastic pollution. Bio-based additives, on the other hand, are derived from renewable sources such as plants and biomass, making them a more sustainable and eco-friendly choice.

The growing production and demand forbioplasticsare among the primary factors driving market growth. The increasing awareness of environmental issues, particularly plastic pollution and climate change, has led to a greater demand for environmentally friendly alternatives to traditional plastics. Bioplastics are considered a more sustainable option because they are often derived from renewable resources and can be biodegradable or compostable.

According to European Bioplastics e.V., global bioplastics production capacities were recorded at approximately 2.2 million tons, and this figure is expected to reach around 6.3 million tons by the end of 2027. This growth in bioplastics production is expected to propel the market.

Various types of additives are used in the manufacturing ofplastics. Some of the primary additives include plasticizers, flame-retardants, anti-static agents, anti-fogging agents, antimicrobial agents, stabilizers, colorants, fillers, and others. Conventional plastics incorporate chemical-based, non-biodegradable additives. In contrast, bioplastics utilize renewable-based or plant-based additives in the manufacturing process.

Product Insights

The bio-based plastic additives emerged as the leading product segment and accounted for the maximum share of over 85.0% of the overall revenue in 2022. Bio-based plastic additives are additives used in plastics made from renewable, biological sources such as plant-based feedstock. These additives are specifically designed for bioplastics and work to enhance their properties or performance.Bio-based plastic additives are used to improve the properties of bioplastics, such as their mechanical strength, thermal stability, and processability. They help enhance the overall performance of plastics derived from renewable resources. Players such as Emery Oleochemicals, BASF SE, Greenchemicals S.r.l., and InKemia Green Chemicals, Inc., are offering various types of green and bio-based plastic additives.

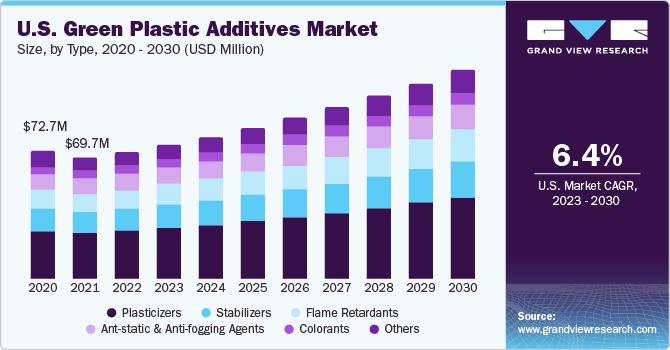

The green plastic additives segment is expected to grow at a CAGR of 7.1% during the forecast period. Green plastic additives typically refer to additives used in conventional petroleum-based plastics (often called "green" to imply they are more environmentally friendly). These additives aim to make traditional plastics more sustainable by improving their recyclability, and biodegradability, or reducing their environmental impact. Numerous companies are introducing innovative green and bio-based products as part of their sustainability initiatives. For example, in October 2019, Clariant AG unveiled 11 novel additives derived from renewable feedstock, marketed under the Licocene Terra and Exolit OP Terra brands. Additionally, the company introduced two new natural-based waxes and dispersing agents-Ceridust 1060 Vita and Licocare RBW 360 TP Vita—tailored for use in engineering plastics and biopolymers.

Type Insights

The plasticizers emerged as the leading type segment and accounted for the largest revenue share of around 37.7% in 2022. Based on type, the market has been segmented into plasticizers, flame-retardants, fillers & reinforcement agents, antimicrobial agents, anti-static & antifogging agents,colorants, stabilizers, and others. Plasticizers are important additives in plastic manufacturing. Plasticizers increase the flexibility and durability of plastics, they help plastic materials become more pliable and less brittle, making them suitable for various applications where flexibility is required, such as in vinyl flooring, cables, and hoses. Plasticizers also enhance the processability of plastic materials during manufacturing. These additives also lower the glass transition temperatures of polymers.

Theflame retardantssegment is expected to grow at a CAGR of 7.1% over the forecast period. Flame retardants are essential additives in plastic manufacturing. These additives make plastic products more resistant to ignition and combustion, ultimately enhancing the fire safety of the product. Furthermore, various countries and regions have regulations and standards that require certain products, especially those used in building construction and transportation, to meet specific fire safety standards. Flame retardants are used to ensure that plastics meet these requirements and pass fire safety tests.

Flame retardants are crucial additives inautomotive plasticsmanufacturing as they help withstand exposure to high temperatures. Companies such as Clariant AG; Devan; BASF SE; and Avient Corporation, among others, are offering green and renewable-based flame retardants. The increasing use of plastics in the construction, automotive, and electronics industries is driving up the demand for flame retardants. According to Plastics Europe, the European building & construction industry consumes approximately 10 million tons of plastics each year, accounting for 20% of the total European plastic consumption.

Application Insights

segme包装成为领先的应用程序nt and accounted for the maximum share of 33.2% of the overall revenue share in 2022. Based on application, the market has been segmented into packaging, consumer goods & electronics, medical devices, textiles, and others. The packaging segment is further bifurcated into non-food andfood packaging. The increasing demand for packaging, especially in the food sector, is driving the demand for bio-based food packaging plastics. This, in turn, is expected to boost the industry. Rising environmental concerns and regulations on single-use plastics are driving the demand for bio-based plastics in the packaging sectors. For instance, in July 2022, the government of India banned the manufacture, sale, use, import, stocking, and distribution of single-use plastic items. Such regulations are expected to drive the demand for alternative plastics, such as green & bio-based plastics, which are degradable and environmentally friendly.

The consumer goods & electronics segment is expected to grow at a CAGR of 8.2% during the forecast period. The consumer goods sector is the largest market for bioplastics after packaging and fibers. The increasing demand for electronic devices and growing concerns about plastic waste are encouraging manufacturers to incorporate bioplastics into various consumer goods and electronic devices. According to Invest India, there has been over two-fold growth in the production of electronics in India in just six years. Domestic electronics production has increased from USD 43 billion in 2017 to USD 87 billion in 2022. This growth in the consumer electronics industry is driving the bioplastics market, which, in turn, is expected to propel the market in the future.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 36.2% in 2022. Asia Pacific is the largest producer of bioplastics in the world. According to European Bioplastics e.V., in 2022, Asia Pacific accounted for a 41.4% share of the global bioplastics production capacity. China is among the top producers of bioplastics in the world. The consumption of bio-based plastic additives is directly proportional to the production of bioplastics; the more bioplastics are produced, the more bio-based plastic additives will be required. Increasing demand for plastic packaging and several government regulations on conventional plastics in countries such as China, Japan, and India are further expected to drive market growth.

Europe is expected to grow at a CAGR of 8.1% during the forecast period. Europe has a strong focus on sustainability and environmental protection. With a growing awareness of plastic pollution and its impact on the environment, there is a heightened demand for alternatives to traditional plastics. Bioplastics are viewed as a more environmentally friendly option as they are often biodegradable or derived from renewable resources. Various major players, such as BASF SE, Clariant AG, and Devan, among others, operating in the market, are based in Europe. According to European Bioplastics e.V., Europe is the second-largest market for bioplastics in terms of production, accounting for around 26.5% of the global bioplastics production capacity.

Key Companies & Market Share Insights

The market is highly competitive, with a large number of manufacturers accounting for a majority of the market share. Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach. For instance, in September 2023, BASF SE made a significant announcement by introducing the industry's inaugural biomass balance offerings for plastic additives. Among the initial offerings are certified products, including Irganox 1076 FD BMBcert and Irganox 1010 BMBcert. These products have received certification from TÜV Nord for mass balance compliance with the ISCC PLUS standards. These pioneering solutions actively encourage the substitution of renewable feedstock for fossil feedstock, aiding BASF's customers in realizing their sustainability objectives. Some prominent players in the global green and bio-based plastic additives market include:

Avient Corporation

BASF SE

Clariant AG

Emery Oleochemicals

Greenchemicals S.r.l.

InKemia Green Chemicals, Inc.

Dow

Evonik Industries AG

DIC Corporation

LANXESS

Solvay

ACS Technical Products

Matrìca S.p.A.

Composition Materials Co., Inc.

Roquette Frères.

Devan

Green And Bio-based Plastic Additives MarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 3.12 billion |

Revenue forecast in 2030 |

USD 5.37 billion |

Growth rate |

CAGR of 7.9% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion, volume in kilotons, and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

产品、类型、应用区域 |

Regional scope |

North America; Europe; Asia Pacific; Central & South America; MEA |

Country scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Poland; Russia; China; Japan; India; South Korea; Australia; Malaysia; Indonesia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa |

Key companies profiled |

Avient Corporation; BASF SE; Clariant AG; Emery Oleochemicals; Greenchemicals S.r.l.; InKemia Green Chemicals, Inc.; Dow, Evonik Industries AG; DIC Corporation; LANXESS; Solvay; ACS Technical Products; Matrìca S.p.A.; Composition Materials Co., Inc.; Roquette Frères.; Devan |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Green And Bio-Based Plastic Additives Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global green and bio-based plastic additives market report based on product, type, application, and region:

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Green Plastic Additives

Bio-based Plastic Additives

Green Plastic Additives Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Plasticizers

Flame Retardants

Ant-static & Anti-fogging Agents

Colorants

Stabilizers

Others

Bio-based Plastic Additives Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Plasticizers

Flame retardants

Fillers & reinforcement agents

Antimicrobial agents

Others

Application Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

Packaging

Food Packaging

Non-food Packaging

Consumer Goods & Electronics

Medical Devices

Textiles

Others

Regional Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

North America

U.S.

Canada

Mexico

Europe

UK

Germany

France

Italy

Spain

Russia

Poland

Asia Pacific

China

Japan

India

Australia

Thailand

South Korea

Indonesia

Malaysia

Central & South America

Brazil

Argentina

Middle East and Africa

Saudi Arabia

South Africa

UAE

Frequently Asked Questions About This Report

b.The global green and bio-based plastic additives market size was estimated at USD 2.92 billion in 2022 and is expected to reach USD 3.13 billion in 2023.

b.The global green and bio-based plastic additives market is expected to grow at a compound annual growth rate of 7.9% from 2023 to 2030 to reach USD 5.37 billion by 2030

b.Asia Pacific dominated the green and bio-based plastic additives market with a share of 36.2% in 2022. This is attributable to the increasing production of bioplastics and growing demand for bio-based additives in plastic manufacturing

b.Some key players operating in the green and bio-based plastic additives market include Avient Corporation, BASF SE, Clariant AG, Emery Oleochemicals, Greenchemicals S.r.l., InKemia Green Chemicals, Inc., Dow, Evonik Industries AG, DIC Corporation, LANXESS, Solvay, ACS Technical Products, Matrìca S.p.A., Composition Materials Co., Inc., Roquette Frères., Devan

b.Key factors that are driving the market growth include the rising global sustainability and environmental concerns among people and increasing demand for bioplastics in the packaging, automotive, consumer goods and healthcare sectors.