Hand-held X-rays Market Size, Share & Trends Analysis Report, By Application (Dental, Orthopedic, Others), End-use (Hospitals, Outpatient Facilities), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-042-7

- Number of Pages: 97

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

全球手持式x射线市场规模是有价值的乐鱼体育手机网站入口at USD 726.5 million in 2022 and is projected to impel at a compound annual growth rate (CAGR) of 10.9% from 2023 to 2030. Hand-held x-rays can be used to capture diagnostic images of a patient's body. These devices are designed to be small, lightweight, and easy to maneuver, allowing healthcare professionals to take X-rays in a variety of settings, including emergency rooms, operating rooms, and remote locations. Hand-held x-ray machines typically use digital imaging technology to capture high-quality images quickly and efficiently. Rising technological advancements in the hand-held x-ray segment, increasing usage in dental, orthopedic, and other sectors and a growing number of chronic disorders such as osteoporosis are expected to help the hand-held x-rays market grow over the forecast period.

Hand-held x-rays are commonly used in dentistry to diagnose and monitor oral health conditions. Here are some common uses of dental X-rays:

Detecting tooth decay: X-rays can reveal cavities that may not be visible to the naked eye, particularly those between teeth.

Assessing bone density: X-rays can show the bone structure supporting the teeth and help identify signs of bone loss due to gum disease or other conditions.

Evaluating tooth root health: X-rays can help dentists diagnose and treat root canal problems, such as abscesses or infections.

Planning orthodontic treatment: X-rays can help orthodontists evaluate the alignment of the teeth and the development of the jaw to determine the best course of treatment.

Assessing impacted teeth: X-rays can help identify teeth that are unable to emerge from the gum line (impacted teeth), which may require extraction or other treatment.

The frequency of X-rays depends on the individual's oral health status, age, and risk factors for dental problems. Overall, dental X-rays are a safe and important tool for maintaining good oral health. Thus, as a result of the above-mentioned uses, the demand for hand-held x-rays is expected to grow over the forecast period.

此外,牙齿问题,如牙科骑兵上升ities, infections, and bone loss in the area are estimated to drive the hand-held x-rays market. For instance, as per CDC, among people aged and above, around 90% have at least one cavity. Similarly, according to the WHO estimates, globally around 2 billion people suffer from dental caries, while 514 million children suffer from caries of primary teeth. As hand-held x-ray machines are particularly useful for diagnosing dental cavities in young children, elderly patients, and patients with mobility issues, the rising population suffering from cavities may increase the demand for the hand-held x-rays market.

Application Insights

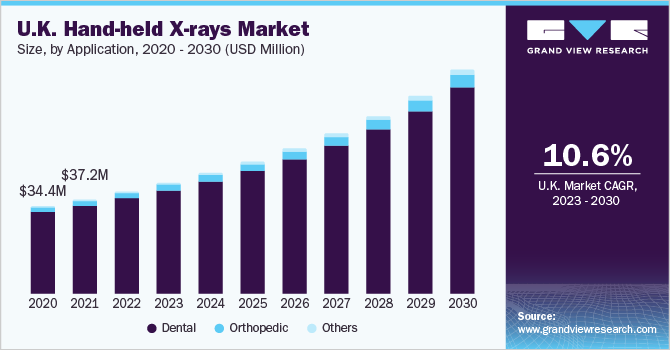

牙科领域占据了手持式x射线market with a market share of 93.4% in 2022 and is expected to impel at a significant growth rate. An increasing number of people suffering from several dental problems and a rise in the availability of products are expected to help the segment dominate. Moreover, increasing product launches in this segment is further propelling the market segment. For instance, in October 2022, Videray Technologies, Inc. announced the launch of PX Ultra. PX Ultra was industry’s first hand-held x-ray machine with a 160 keV. Therefore, such launches are expected to help the segment growth.

The orthopedic segment is projected to impel at a CAGR of 12.3% over the forecast period. Increasing number of orthopedic surgery can be attributed to the growth rate. Similarly, as orthopedic physician use x-ray to assess and view abnormalities, broken joints, bones, and spine injuries, the rising number of fracture is expected to further impel the growth rate of the segment. For instance, as perThe Lancet, in 2019, 179 million of fracture cases were estimated globally. Thus, such instances is expected to boost the segment growth over the forecast period.

End-use Insights

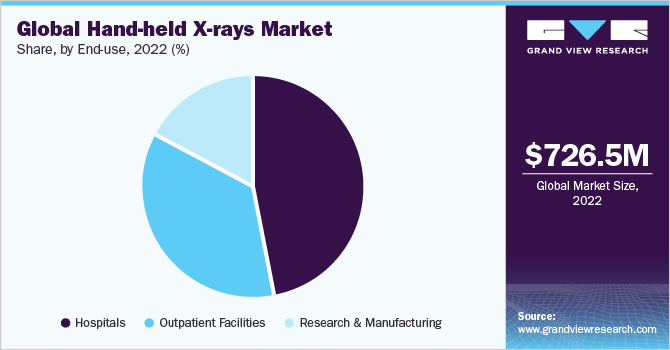

The hospitals segment dominated the market with a market share of 47.1% in 2022. This can be attributed to growing hospital industry, increasing number of orthopedic surgeries, and rising patient pool across all age groups. For instance, According to the India Brand Equity Foundation, the country's hospital sector is expected to grow to a value of USD 132 billion by 2023, representing about 80.0% of India's overall healthcare market. Additionally, the number of orthopedic surgical cases are increasing globally. For instance, according to American Academy of Orthopedic Surgeons (AAOS), around 7 million Americans went under orthopedic surgery in 2019. As a result of these factors, the demand for hand-held x-rays is projected to increase globally.

The outpatient facilities segment is projected to witness fastest growth rate of 11.2% during the forecast years. Outpatient facilities segment includes specialty clinics such as dental clinics, diagnostic labs such as pathology & imaging, and ambulatory surgical centers. Diagnostic labs provide a comprehensive range of diagnostic and preventative health services. Moreover, radiologists have a chance to offer independent outpatient imaging facilities because of the rising number of patients with chronic illnesses. Therefore, as a result of aforementioned factors, the outpatient facilities segment is anticipated to witness significant growth rate.

Regional Insights

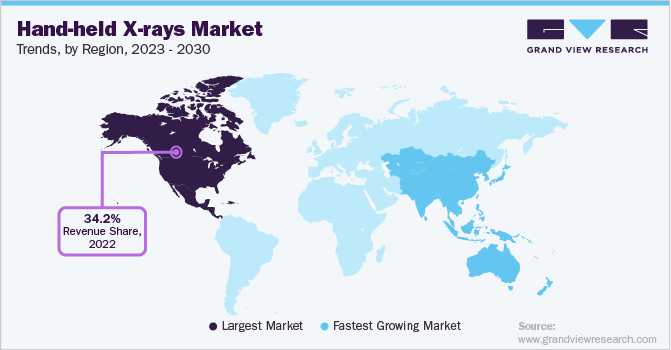

North America is anticipated to dominate the hand-held x-rays market in 2022, with a market share of 34.2%. This can be attributed to presence of major service providers, and rising number of surgical procedures, companies in this region. For instance, as per a study by NCBI in 2020, around 40 - 50 million surgeries are performed in the U.S. every year. Similarly, as per Canadian Institute for Health Information (CIHI), in 2019-2020, there were over 687,000 surgical and other therapeutic procedures performed on bones, joints and connective tissues in Canada. Such instances are anticipated to help the region dominate hand-held x-rays market.

However, Asia Pacific is projected to witness fastest growth rate of CAGR 11.3% during the forecast period. The growth can be attributed to growing population, impelling medical tourism, increased demand for better imaging devices and supportive government initiatives for improving healthcare infrastructure in the region. Moreover, major players in the market are trying to expand, and tap the untapped market in the Asia Pacific, which is further expected to increase awareness and thereby boost the market in coming years. Additionally, increasing prevalence of chronic disorders, and rising number of surgical cases in this region may further increase the usage of hand-held x-rays across the Asia Pacific region.

Key Companies & Market Share Insights

Key players are involved in adopting strategies such as geographic expansion, partnership to strengthen their foothold in the market for hand-held x-rays market. Some of the prominent players in the global hand-held x-rays market include:

Dental Imaging Technologies Corporation

REMEDI Co.,Ltd

Genoray

OXOS Medical

MaxRayCocoon.com

Digital Doc LLC.

EVIDENT

Carestream Dental LLC

Hand-held x-rays Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 791.3 million |

Revenue forecast in 2030 |

USD 1,628.6 million |

Growth Rate |

CAGR of 10.9% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2028 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Application, end-use, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA) |

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

Key companies profiled |

Dental Imaging Technologies Corporation; REMEDI Co., Ltd; Genoray; OXOS Medical; MaxRayCocoon.com; Digital Doc LLC.; EVIDENT; Carestream Dental LLC. |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

GlobalHand-held X-rays Market ReportSegmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hand-held x-rays market report based on application, end use, and region:

Application Outlook (Revenue, USD Million, 2018 - 2030)

Dental

Orthopedic

Others

End-use Outlook (Revenue, USD Million, 2018 - 2030)

Hospitals

Outpatient Facilities

Research & Manufacturing

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

U.K.

Germany

France

Italy

Spain

Denmark

Sweden

Norway

Asia Pacific

Japan

China

India

Australia

Thailand

South Korea

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

UAE

Kuwait

Frequently Asked Questions About This Report

b.The global hand-held x-rays market size was estimated at USD 726.5 million in 2022 and is expected to reach USD 1,628.6 million in 2023.

b.The global hand-held x-rays market is expected to grow at a compound annual growth rate of 10.9% from 2023 to 2030 to reach USD 1,628.6 million by 2030.

b.North America dominated the hand-held x-rays market with a share of 34.2% in 2022. This is attributable to rising growing number of surgical procedures being conducted in this region.

b.Some key players operating in the hand-held x-rays market include Dental Imaging Technologies Corporation, REMEDI Co.,Ltd, Genoray, OXOS Medical, MaxRayCocoon.com, EVIDENT, Carestream Dental LLC.

b.Key factors that are driving the ethylene oxide sterilization services market include increasing technological advancements, rising number of dental procedures, growing orthopedic surgical cases, and surge in chronic disorders globally.