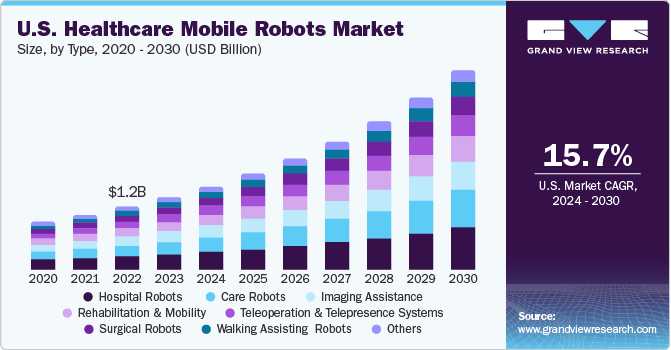

Healthcare Mobile Robots Market Size, Share & Trends Analysis Report By Type (Hospital Robots, Care Robots, Imaging Assistance, Surgical Robots), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-127-9

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

The globalhealthcare mobile robots market sizewas estimated atUSD 3.34 billion in 2022,估计年复合增长增长th rate (CAGR) of 16.0% from 2023 to 2030. Mobile robotics involves using independent or semi-independent devices to move and perform tasks without direct human control. In healthcare, these robots are crucial for various tasks. The market’s growth can be attributed to the introduction of technologically advanced robotic equipment in the healthcare sector, rapidly growing elderly population worldwide, shortage of skilled nurses and healthcare staff, and increasing healthcare spending. Moreover, mobile robotics offers a significant advantage in healthcare by enhancing patient care. They can handle repetitive, time-consuming, and risky tasks, such as transporting medication and supplies, and help staff focus on crucial responsibilities, leading to quicker responses and better patient outcomes. Moreover, mobile robots boost efficiency by performing tasks precisely and quickly, reducing errors, and streamlining processes. For instance, they can accurately sort and deliver medication, preventing mistakes that often occur in healthcare facilities.

As the aging population increases and a shortage of skilled human labor becomes apparent, governments worldwide are considering the integration of robots to address this gap. According to a report by the United Nations, the global population of individuals aged 60 and above is projected to rise significantly, from 962 million in 2017 to 2.1 billion by 2050 and 3.1 billion by 2100. Concurrently, in the U.S., the healthcare sector employs over 4.5 million professionals encompassing nursing and orderly aids, home health caregivers, and personal care assistants. Owing to this, the deployment of AI-enabled elderly care robots is gaining traction. The potential benefits of these robots lie in providing companionship and assistance to senior citizens, who often face challenges in staying engaged and active, particularly if they are retired and living independently.

In September 2022, UBTECH ROBOTICS CORP LTD organized a forum focused on "Integrating High Technology with Elderly Care Services," alongside unveiling their "Global Strategy of Smart Elderly Care." The event convened healthcare and elderly care experts to explore the technology-powered smart elderly care system's creation and application, facilitating a valuable exchange of insights. Notably, UBTECH revealed its strategy encompassing sub-systems tailored to specific elderly care scenarios and introduced robotics products tailored to healthcare and elderly care. Noteworthy collaborations with entities like China Merchants Health Care, Medical Care Service Company Inc (MCS) in Japan, and China Academy of Transportation Sciences Group were also announced. This initiative holds potential not only for advancing elderly care through robotics but also for driving progress in the broader market.

此外,有效的消毒的必要性ion and cleaning within hospitals is a driving force behind the growth of healthcare mobile robots. Hospitals are high-risk environments for infection transmission, leading to substantial financial burdens and compromised patient care. For instance, as per the World Health Organization, hospital infection treatment costs approximately USD 7.66 billion annually in Europe and USD 6.5 billion in the U.S. Cleaning and disinfection robots offer a solution by providing consistent, precise, and thorough sanitization, minimizing the risk of hospital-acquired infections. The COVID-19 pandemic has heightened awareness of hygiene, accelerating the adoption of these robots. As per the article published by the International Federation of Robotics, in 2020, over 30 new disinfection robot models from various manufacturers were introduced, with the International Federation of Robotics (IFR) anticipating substantial growth in this sector in the near future. These mobile disinfection robots, often employing UV light for germ eradication, offer easy operation by cleaning staff and can eliminate 99.9% of microorganisms in a hospital room within 10 minutes. Some models employ chemical disinfectant sprays as an alternative approach. Moreover, these robots can navigate complex hospital layouts and autonomously disinfect a wide range of surfaces, reducing the workload on healthcare staff and allowing them to focus on more critical tasks. As the demand for enhanced infection control and operational efficiency increases, the healthcare mobile robot market experiences significant growth, with a range of innovative technologies emerging to address this pressing need.

However, regardless of the potential benefits of healthcare mobile robots, there are some challenges to overcome. One of the major concerns is the cost of maintaining and implementing these advanced systems. Despite high initial costs, supporters contend that long-term gains in patient care and efficiency will surpass expenses. In addition, there are concerns about the possibility of losing jobs for the human workforce as robots take on more tasks. However, experts anticipate integratingmobile roboticswill lead to new roles in system development, maintenance, and operation, countering potential job losses.

Future of Mobile Robots in Healthcare

The growing variety of tasks accomplished by collaborative and mobile robots will likely lead to an upsurge in the adoption of robotics across all facets of the healthcare industry. The application ofArtificial Intelligencehas played a pivotal role in enhancing this field. AI-driven software solutions for healthcare mobile robots facilitate tasks such as patient monitoring and telemedicine. For instance, the Automation, Robotics, and Mechatronics Group at the University of Almería collaborated with InTouch Health, a U.S. company, to develop a mobile robot capable of conducting basic examinations and navigating medical facilities. These advanced tools, already operational in hospitals across the United States and Germany, were equipped with GPS sensors and perception software. This development marks a significant step toward increasing the adoption of mobile robots in the healthcare sector in the near future, indicating improved patient care and operational efficiency.

Type Insights

Based on type, the hospital robots segment held the largest revenue share of 21.16% in 2022. As hospitals require a wide range of tasks to be performed efficiently, including medication delivery, equipment transportation, and patient assistance, mobile robots excel in executing these tasks, contributing to the smooth functioning of hospitals. Robots enhance operational efficiency by automating routine tasks such as delivering supplies, transporting specimens, and managing logistics within the hospital environment. This streamlined workflow benefits hospital staff and patients alike. Moreover, hospital-acquired infections are a major concern. Mobile robots can play a significant role in reducing the risk of infection transmission by handling tasks that involve less direct human interaction.

The care robots segment is expected to witness the fastest CAGR of 17.2% over the forecast period. As the global population ages, there is an increasing demand for elder care and assisted living. Care robots can provide valuable support in activities of daily living, medication reminders, and companionship for the elderly, contributing to their well-being and independence. For instance, The ElliQ, a personal care robot launched by Intuition Robotics, a company founded in Israel in 2016, is specially designed to accompany and support elderly people on the journey to age independently while reducing isolation and loneliness.

Moreover, many regions face shortages of healthcare workers, especially in the caregiving sector. Care robots can help fill this gap by assisting with tasks that do not require direct human intervention, alleviating the burden on human caregivers. Consequently, this growing need to support the elderly population and mitigate the adverse effects of isolation and inactivity is driving the increased demand for care robots tailored to the needs of seniors. These robots not only offer practical assistance but also contribute to enhancing the overall quality of life for the elderly by promoting social interaction and maintaining a sense of purpose and engagement.

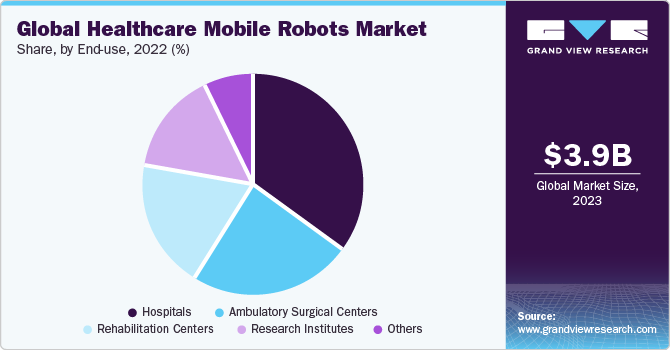

End-use Insights

In terms of end-use, the hospitals segment held the largest revenue share of 35.11% in 2022 and is expected to witness the fastest CAGR of 16.4% over the forecast period. Hospitals operate in intricate and dynamic settings that demand various tasks to be executed efficiently. Mobile robots are well-suited to navigate these complexities and perform tasks like patient transportation and supply management. They can also contribute to improved patient care by handling routine and non-clinical tasks, allowing healthcare professionals to focus on direct patient interactions and critical medical procedures. Moreover, robots streamline hospital operations by autonomously performing tasks such as material transport, waste disposal, and sterilization. This leads to reduced operational bottlenecks and enhances overall efficiency. For instance, in August 2020, five hospital departments at Zealand University Hospital in Denmark implemented MiR100, a mobile robot from Mobile Industrial Robots (MiR). The robot travels over 10 km weekly, minimizing storage space, improving service, and preventing shortages. In addition, these robots play a pivotal role in maintaining a hygienic environment by performing tasks that minimize human contact and the spread of infections. They can disinfect hospital rooms, deliver medications, and transport contaminated materials safely.

Advancements in robotics, AI, and sensors enhance mobile robots, making them adaptable in complex hospital layouts. Moreover, the pandemic highlights the need for contactless interactions, driving robots' roles in supply delivery, patient monitoring, and distancing. Growing recognition of robots' healthcare benefits can lead to supportive regulations, fostering hospital adoption. Hospitals prioritize cost-effective care, and robots streamline operations, cutting errors and boosting efficiency. Their ability to drive efficiency, elevate patient care, and adapt to changing healthcare dynamics positions the hospital segment for a rapid growth rate in the forecast period.

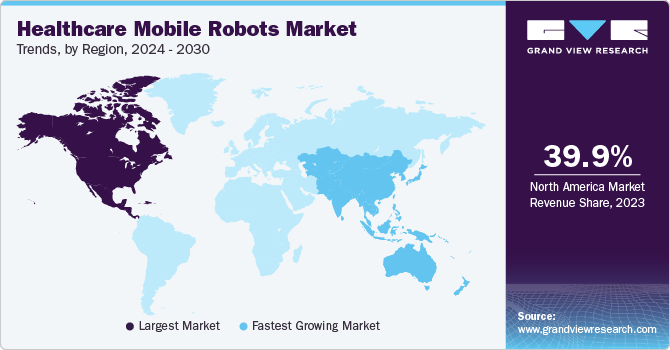

Regional Insights

In terms of region, North America dominated the market in 2022 with the largest revenue share of 40.03%. This is due to the presence of favorable government initiatives and highly developed healthcare infrastructure. In addition, rising disposable income levels, increasing adoption of robotic technologies, including service robots in healthcare institutions, and product launches in the market are some factors anticipated to support regional market growth.

The Asia Pacific region is expected to witness the fastest CAGR of 16.8% over the forecast period. Emerging robotics startup companies are playing a pivotal role in propelling the growth of the Asia Pacific regional market. The growth of the regional market is attributed to the introduction of new healthtech start-ups that are reshaping healthcare by innovating medical technologies that optimize patient care, enhance healthcare delivery, and reduce costs. For instance, as per the article published by the Times of India, in March 2023, India has witnessed explosive growth from 452 to nearly 90,000 such ventures since 2016. With over 8,000 health tech start-ups valued at around USD 2 billion and growing at a rapid 40% rate, their impact is undeniable. Union Finance Minister highlighted India's third-largest global start-up ecosystem status and second in innovation quality among middle-income nations, backed by initiatives like the Startup India Seed Fund Scheme and a National Data Governance Policy. This environment benefits diverse sectors, including this market, where technological advancements from health tech start-ups can drive the development of advanced robotic solutions, improving patient care and healthcare processes.

Key Companies & Market Share Insights

在市场经营的关键球员专注于stratocaster电吉他egic collaborations, partnerships, and geographical expansion in emerging and economically favorable regions. In October 2019, ABB Ltd. inaugurated its first worldwide healthcare research hub at the Texas Medical Center (TMC) premises in Houston, Texas. The hub serves as a platform to showcase a range of innovative technologies, including a mobile YuMi robot. This robot is purposefully developed to support medical and laboratory personnel by efficiently managing various logistics and laboratory operations tasks within hospital settings. Some prominent players in the global healthcare mobile robots market include:

Toyota Motor Corp.

ABB Ltd

Aethon

Omron Corporation

Amazon

Mobile Industrial Robots

Nordson Corp.

Teradyne

Ateago Technology

VGo Communications, Inc.

Awabot

Techcon

Xenex Disinfection Services, LLC

Intuition Robotics

Healthcare Mobile Robots MarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 3.85 billion |

Revenue forecast in 2030 |

USD 10.88 billion |

Growth rate |

CAGR of 16.0 % from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Type, end-use, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

Key companies profiled |

Toyota Motor Corp.; ABB Ltd; Aethon; Omron Corporation; Amazon; Mobile Industrial Robots; Nordson Corp.; Teradyne; Ateago Technology; VGo Communications, Inc.; Awabot; Techcon; Xenex Disinfection Services, LLC; Intuition Robotics |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Healthcare Mobile Robots MarketReportSegmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare mobile robots market report based on type, end-use, and region:

Type Outlook (Revenue, USD Million, 2018 - 2030)

Hospital Robots

Care Robots

Imaging Assistance

Rehabilitation and Mobility

Teleoperation and Telepresence Systems

Surgical Robots

Walking Assisting Robots

Others

End-use Outlook (Revenue, USD Million, 2018 - 2030)

Hospitals

Ambulatory Surgical Centers

Rehabilitation Centers

Research Institutes

Others

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Italy

西班牙

Denmark

Sweden

Norway

Asia Pacific

China

India

Japan

South Korea

Australia

Thailand

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

UAE

Kuwait

Frequently Asked Questions About This Report

b.The global healthcare mobile robots market was valued at USD 3.34 billion in 2022 and is estimated to grow to USD 3.85 billion in 2023.

b.The global healthcare mobile robots market is estimated to grow at a compound annual growth rate (CAGR) of 16.0% from 2023 to 2030 to reach USD 10.88 billion in 2030.

b.North America dominated the global healthcare mobile robots market and held the largest revenue share of 40.03% in 2022. This is due to the presence of favorable government initiatives & highly developed healthcare infrastructure.

b.Some of the major players in the healthcare mobile robots market are: o Toyota Motor Corp. o ABB Ltd o Aethon o Omron Corporation o Amazon o Mobile Industrial Robots o Nordson Corp. o Teradyne o Ateago Technology o VGo Communications, Inc. o Awabot o Techcon o Xenex Disinfection Services, LLC o Intuition Robotics

b.The market’s growth can be attributed to the introduction of technologically advanced robotic equipment in the healthcare sector, the rapidly growing elderly population worldwide, the shortage of skilled nurses and healthcare staff, and the increasing healthcare spending.