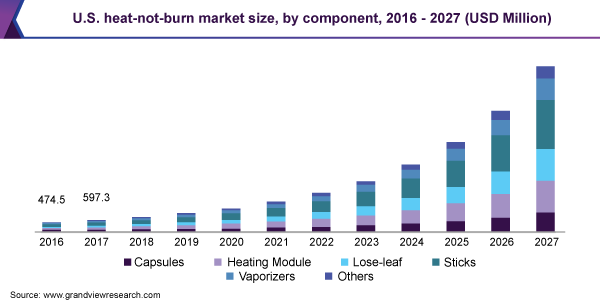

Heat-not-Burn Market Size, Share & Trends Analysis Report By Component (Capsules, Heating Module, Sticks, Vaporizers), By Distribution Channel, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-733-9

- Number of Pages: 154

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry:Technology

Report Overview

The global heat-not-burn market size was valued at USD 7.3 billion in 2019 and is projected to grow at a compound annual growth rate (CAGR) of 32.8% from 2020 to 2027. The market is driven by the continuous decline in traditional cigarette sales with rising demand for possibly Reduced Risk Products (RRPs). Heat-not-burn devices do not burntobacco, instead, they implement the use of convective and radiant heat. Thus, the devices have a low presence of nicotine and chemicals. Further, the rising prohibition and taxes on cigarettes across different countries and the growing awareness of the dangerous side-effects of tobacco consumption are driving the growth of this heat-not-burn (HNB) device market. The health risks related with chewing tobacco and cigarettes are estimated to drive the adoption of heat-not-burn devices, particularly among young population.

低风险和高需求的前女友pected to urge global manufacturers to invest in the market for heat-not-burn devices. Moreover, heat-not-burn devices are getting approval from regulatory authorities for sale in big markets such as the U.S., China, and Europe, which is anticipated to bode well for market growth. For instance, in 2018, Philip Morris International Inc. received U.S. FDA approval for the sale of heat-not-burn devices in the U.S.

Heat-not-burn devices produce a vapor containing nicotine and these can be used multiple times, which is making it popular among youngsters as they do not have to spend much for multiple purchases. As such, the devices can also be used for longer periods of time. Further, the technological improvements have led to the development of heat-not-burn devices that produce large amounts of vapor, which is seeing increased preference among enthusiasts. Heat-not-burn devices have helped many smokers quit smoking thus, making them an effective substitute for smoking. Such factors are expected to accelerate the adoption of heat-not-burn devices among individuals.

The rising adoption of e-cigarettes is expected to restrict the adoption of heat-not-burn devices, thus, hampering the growth of the market. E-cigarettes do not have tobacco and are believed to comprise lesser amounts of toxic substances than in conventional tobacco products. Such benefits are expected to boost the adoption of e-cigarettes and may deter the growth of the heat not burn market. Furthermore, the stringent regulations imposed by local authorities across countries such as Australia, the U.S., and Germany have restrained market growth. Some countries have banned the sale and distribution of vapor products, which in turn has significantly impacted the sales and has restrained market growth.

增加在线销售和市场促销活动y the manufacturers are expected to drive the heat not burn devices market in the forthcoming years. For instance, the campaigning of heat-not-burn devices by Philip Morris International Inc. in South Africa was done through TV programs. The companies promote heat-not-burn devices as a brand and the most popular devices that are available in the market include BAT’s Glo, iQOS, Ploom TECH, and iFuse. Furthermore, the high promotion, advertising, and research and development activities by the companies are also boosting the market growth.

COVID-19 Impact Insights

The Coronavirus disease (COVID-19) epidemic has been stated a pandemic by the World Health Organization (WHO), causing a huge impact on people's lives. With the COVID-19 virus pushing the governments across different countries for complete lockdown, it has subsequently forced companies to stop the manufacturing, sale, and distribution of non-essential goods such as tobacco products. Moreover, the use of tobacco products may increase the risk of suffering from severe symptoms due to COVID-19 illness. Initial research indicates that, compared to non-smokers, people having a history of smoking pose a greater risk of adverse health consequences for COVID-19 as it directly impacts the lungs.

As people confront the coronavirus, they are being encouraged to quit smoking and to stop using all types of tobacco products, including e-cigarettes, heat-not-burn devices to protect their health. The manufacturing companies of these products will see reduced growth in the market for heat-not-burn devices in the year 2020 due to lockdown in major parts of the world. However, after the restrictions are lifted, the market is likely to see exponential growth as socializing will increase, which will positively impact market growth.

Component Insights

The sticks segment dominated the market with over 25.0% of the revenue share in 2019. Dominance can be attributed to the high adoption of tobacco sticks in heat-not-burn devices as a premium product. Moreover, it is priced higher compared to other components due to which it is anticipated to drive the revenue growth in the near future. Tobacco sticks are also available in various flavors and additives other than combustible cigarette products, which is anticipated to further fuel market growth. Further, Japan Tobacco International and Philips Morris International are two key players in this market that offer heat-not-burn device with tobacco sticks, which is further propelling market growth.

The loose-leaf component segment is expected to witness the fastest growth in the heat not burn devices market over the forecast period. The loose-leaf is witnessing rising demand due to its low and effective pricing. The demand is also driven by its easy manufacturing process compared to the stick variants, which is expected to boost growth of the segment. Heat-not-burn device users also prefer loose-leaf tobacco as it is a natural substance, which gives feel of tobacco with much less harm. Moreover, it is available with options such as marijuana, which is anticipated to impel the demand.

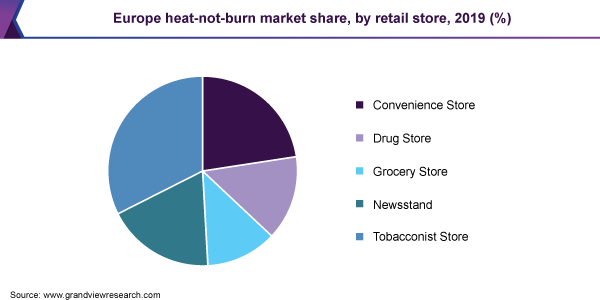

Distribution Channel Insights

The retail store segment accounted for the largest revenue share of 85.9% in 2019 and is anticipated to maintain its dominance over the forecast period. Heat-not-burn devices were initially sold in retail outlets such as vape shops and gas stations. The retail store helps users to select from a wide range of devices. Moreover, retail stores enable users to test the device before making the purchase decision. Furthermore, the provision of separate smoking zones by clubs and organizations is anticipated to positively influence the retail store segment's growth. The availability of attractive packaging of heat-not-burn device attracts people for making purchase decisions through offline retail store.

在线旅游行业预计将见证了快est growth over the next eight years. The online marketplaces offer benefits in terms of accessibility, competitive pricing, and access to wider variety of products which are encouraging people to purchase online. Online websites offer a larger variety of products compared to retail stores. Moreover, the growth is propelled by an increase in sales by companies through their own online networks or company exclusive websites, offering a wide variety of products. The online option provides information about offers and deals, discounted items, which further encourages people to go for online marketplace, thereby boosting the growth of the segment.

Regional Insights

Asia Pacific accounted for the largest revenue share of 52.7% in 2019 and is expected to continue its dominance over the forecast period. The market for heat-not-burn devices is driven by the rise in consumption of IQOS brand heat-not-burn devices in countries such as South Korea and Japan. However, strict regulations regarding the use of heat-not-burn products in countries such as Australia may hinder regional growth. Furthermore, changing lifestyles and rising disposable incomes among individuals in this region are some of the factors contributing to market growth. Moreover, the region has presence of the largest smoking population, which acts as a catalyst in pushing the demand for such products in the region.

欧洲收入的份额超过23.0%在3月举行ket for heat-not-burn devices in 2019. The popularity of the device has increased owing to its features such as reduced amount of toxic substances and tar. Health bodies in the region are approving heat-not-burn devices from vendors, such as Imperial Brands Plc’s Blu and British American Tobacco Plc’s Vype as a better substitute for tobacco smoking. Additionally, higher penetration of manufacturers such as Japan Tobacco International, British American Tobacco, and Philips Morris International in countries such as Poland, Croatia, Italy, Russia, and Germany are expected to drive regional growth. For instance, in January 2018, British American Tobacco invested USD 400.0 million to expand its operations in Croatia.

Key Companies & Market Share Insights

Prominent players in the market engage in business strategies such as product innovations, endorsements, capacity expansions, marketing campaigns, and acquisitions. Industry players are observed making heavy investments in research and development activities with the objective of increasing their market share and ensuring the organic growth of their companies. Furthermore, these players are actively engaging in new product development initiatives in order to improve and expand their existing products and components portfolios, thus offering these companies an opportunity to acquire new customers. For instance, in June 2019, Japan Tobacco Inc. launched nationwide sales of Ploom TECH+ and four types of Ploom TECH+ tobacco capsules. Sales started in around 57,000 convenience stores and 2,000 tobacco retail stores. Some of the prominent players in the heat-not-burn device market include:

Altria Group, Inc.

Japan Tobacco Inc.

Philip Morris International

Imperial Brands

KT&G Corp.

British American Tobacco

Shenzhen Yukan Technology Co., Ltd.

PAX Labs, Inc.

Vapor Tobacco Manufacturing LLC

Firefly Vapor

Heat-not-Burn Market Report Scope

Report Attribute |

Details |

Market size value in 2020 |

USD 9.4 billion |

Revenue forecast in 2027 |

USD 68.3 billion |

Growth Rate |

CAGR of 32.8% from 2020 to 2027 |

Base year for estimation |

2019 |

Historical data |

2016 - 2018 |

Forecast period |

2020 - 2027 |

Quantitative units |

Revenue in USD million and CAGR from 2020 to 2027 |

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

Segments covered |

Component, distribution channel, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; Germany; U.K.; China; Japan; South Korea; Brazil |

Key companies profiled |

Altria Group, Inc.; Japan Tobacco Inc.; Philip Morris International; Imperial Brands; KT&G Corp.; British American Tobacco; Shenzhen Yukan Technology Co., Ltd.; PAX Labs, Inc.; Vapor Tobacco Manufacturing LLC; Firefly Vapor |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global heat-not-burn market report based on component, distribution channel, and region.

Component Outlook (Revenue, USD Million, 2016 - 2027)

Capsules

Heating Module

Loose-leaf

Sticks

Vaporizers

Others

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2027)

Online

Retail Store

Convenience Store

Drug Store

Grocery Store

Newsstand

Tobacconist Store

Regional Outlook (Revenue, USD Million, 2016 - 2027)

North America

The U.S.

Canada

Europe

Germany

The U.K.

Asia Pacific

China

Japan

South Korea

拉丁美洲

Brazil

MEA

Frequently Asked Questions About This Report

b.The global heat-not-burn market size was estimated at USD 7.31 billion in 2019 and is expected to reach USD 9.36 billion in 2020.

b.The global heat-not-burn market is expected to grow at a compound annual growth rate of 32.8% from 2020 to 2027 to reach USD 68.30 billion by 2027.

b.Asia Pacific held the largest share of 52.68% in 2019. The market is driven by the rise in consumption of IQOS brand Heat-Not-Burn (HNB) device products in countries such as South Korea and Japan. Moreover, the region has presence of the largest smoking population, which acts as a catalyst in pushing the demand for such products in the region.

b.Some key players operating in the heat-not-burn market include Altria Group, Inc., Japan Tobacco Inc., Philip Morris International, Imperial Brands, KT&G Corp., British American Tobacco, Shenzhen Yukan Technology Co., Ltd., PAX Labs, Inc., Vapor Tobacco Manufacturing LLC, and Firefly Vapor.

b.Key factors that are driving the market growth include continuous decline in traditional cigarette sales with rising demand for possibly Reduced Risk Products (RRPs). Heat-not-burn devices do not burn tobacco, instead, they implement the use of convective and radiant heat. Thus, the devices have low presence of nicotine and chemicals. Further, the rising prohibition and taxes on cigarettes across different countries and the growing awareness of the dangerous side-effects of tobacco consumption are driving the growth of this market.