High Flow Needle Sets Market Size, Share & Trends Analysis Report By Volume (Less Than 10 ml, 10-100ml), By Material (Stainless Steel, Polycarbonate), By Type, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-149-9

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry:Healthcare

High Flow Needle Sets Market Size & Trends

The globalhigh flow needle sets market size was estimated at USD 1.02 billion in 2023and is anticipated to witness a compound annual growth rate (CAGR) of 6.36% from 2023 to 2030. This can be attributed to the rising popularity of minimally invasive surgical procedures, a growing aging population, increasing prevalence of chronic diseases, including conditions that necessitate the use of suchneedles. High-flow needle sets represent a significant advancement in medical technology, prioritizing the safety and comfort of patients. These specialized needles are helpful when it comes to managing thick or viscous treatments, accelerating a faster and less painful drug delivery process compared to traditional needles.

The major key driver behind the growth of the market is the rising prevalence of chronic diseases, which include cancer, cardiovascular diseases, and bleeding disorders. According to the WHO 2023 report, non-communicable diseases (NCDs) accounted for 41 million annual deaths worldwide, or 74% of all deaths. Around 17 million of these deaths occurred before the age of 70, and 86% of them occurred in low- and middle-income countries. This rise in chronic illnesses underscores the need for advanced medical tools like high-flow needle sets to enhance patient care.

In addition, the rising aging population, advancements in healthcare technology, and launch of new products are some of the factors that augment the market growth. For instance, in April 2019 , RMS medical product high-flo super26 subcutaneous needle sets received FDA 510(k) clearance, allowing subcutaneous medication infusion in various settings, including homes, hospitals, and ambulatory care centers. By facilitating high flow rates, these needle sets offer a favorable solution to reduce patient discomfort and improve the overall healthcare experience.

Volume Insights

The 10-100ml segment held the largest revenue share of 49.81% in 2023 owing to its versatile utility in various medical procedures. High-flow needle sets with a volume capacity of 10-100ml are suitable for various applications including drug delivery, blood transfusions, and parenteral nutrition, thereby creating higher demand. This versatility caters to the diverse needs of healthcare facilities and practitioners, contributing to the segment's dominant market share.

The less than 10ml segment held a significant market share in 2023. The less than 10ml needles are majorly used for smaller volume injections, such as insulin injections. Novel needle designs are making it possible to administer smaller volumes of medication more quickly and comfortably, thereby surging its preference. Rising awareness regarding the benefits of self-injection is anticipated to drive the demand for less than 10ml needles for home healthcare use.

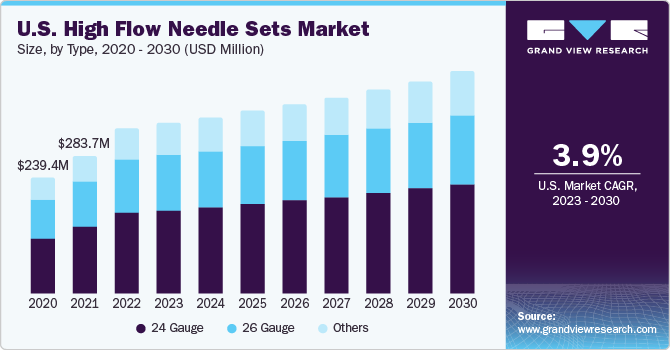

Type Insights

The 24-gauge needle sets segment held the largest market share of 48.37% in 2023. The 24-gauge needles are the smallest gauge needles that are typically used for subcutaneous injections. This makes them ideal for patients who are sensitive to needle pain or who have small veins. The 24-gauge needles are also able to deliver drugs more quickly than larger gauge needles. This is because they have a smaller internal diameter, which minimizes the resistance to fluid flow. Furthermore, 24-gauge needles are also becoming more popular for home healthcare use, as they are relatively easy to use and can be used to administer a variety of medications, including insulin,antibiotics, and pain relievers.

The others segment is anticipated to have lucrative growth during its forecast period. The others segment includes 32-gauge and 16-gauge. The high demand for these high-flow needle sets can be attributed to their versatility in various medical procedures, offering healthcare professionals greater flexibility and precision. These are the most common gauge needles used for intravenous injections. This is because they are large enough to accommodate a variety of fluids, including blood, saline, and medications.

Material Insights

The stainless-steel segment held the largest market share of 71.81% in 2023. This can be attributed tostainless steelbeing a popular material choice for needles, known for its biocompatibility and resistance to corrosion and staining. High-flow needle sets made of stainless steel are designed for subcutaneous flow rates and come in various lengths and gauges to suit diverse medical needs.

不锈钢部分是regi预期ster the fastest CAGR during the forecast period owing to its exceptional properties, making it suitable for various medical procedures. For instance, stainless-steel high-flow needle sets are commonly used in insulin administration, chemotherapy, and other procedures requiring a high flow rate. Thus, the above-mentioned factors are estimated to positively contribute to the segment growth.

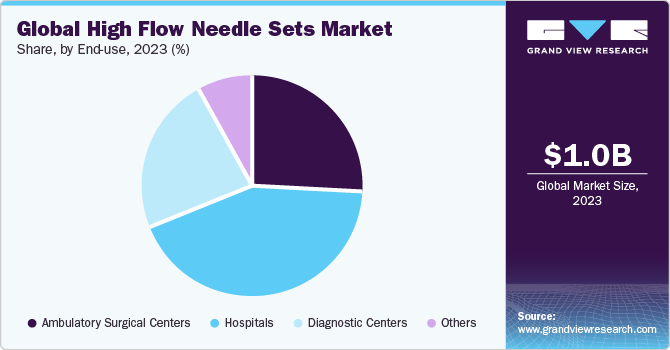

End-use Insights

The hospitals segment held the largest market share of 43.04% in 2023. This can be attributed to the rising number of surgical procedures being performed in hospitals. Hospitals rely majorly on high-flow needle sets to deliver a variety of fluids and medications to patients. Hospitals are performing minimally invasive surgical procedures, such as laparoscopy and angioplasty. These procedures require the use of high-flow needle sets to deliver fluids and medications to the surgical site. Hence, rising usage of high flow needle sets in hospital settings is anticipated to foster market growth.

The diagnostic centers segment is anticipated to witness significant growth over the forecast period as these centers provide a broad range of medical tests, imaging services, and diagnostic treatments. With a growing demand for early disease detection, prevention, and wellness check-ups, the demand for diagnostic services has been steadily increasing. High-flow needle sets are essential in various diagnostic procedures, such as blood tests and biopsies. In addition, the expansion of diagnostic centers and the introduction of advanced medical technologies will further fuel the demand for high flow needle sets.

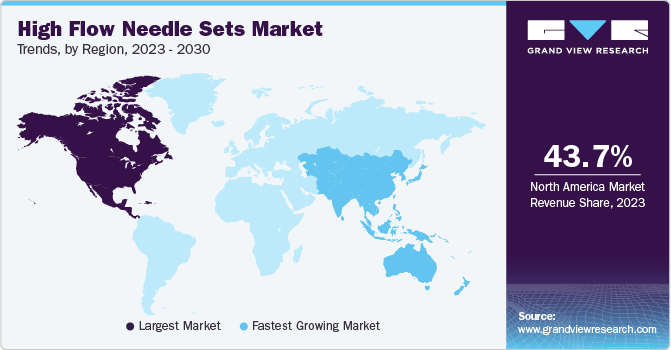

Regional Insights

Based on region, North America held the largest market share of 43.74% in 2023. This can be attributed to its well-developed healthcare infrastructure, rising incidence of chronic disease, and continuous innovation in needle design. A recent report from the National Association of Chronic Disease Directory in 2022 underscores the extreme impact, revealing that approximately 60% of American adults suffer from one or more chronic diseases. The main causes of death in the U.S. are chronic diseases such as diabetes, cancer, and cardiovascular diseases.

亚太地区是预期的见证the fastest CAGR during the forecast period. The regional growth is attributed to the increasing investments in healthcare infrastructure and medical services. The region is also becoming a prominent destination for medical tourism, with the government and private sector requiring significant resources to align service quality with Western standards. In addition, the rising number of patients dealing with chronic disease is fueling the demand for high-flow needles in the region, reflecting the evolving healthcare landscape in the Asia Pacific.

Key Companies & Market Share Insights

The development of new products, product modifications, and major investments in R&D are among the key strategies adopted by market players to gain a competitive edge. For instance, in May 2023 , B. Braun Medical Industries (BMI) Sdn Bhd, the Malaysian division of the B. Braun Group, is prepared to begin a new chapter of growth and innovation in Penang, Malaysia.

Key High Flow Needle Sets Companies:

- AmDel

- B. Braun Medical Inc

- Concordance Healthcare Solutions

- KORU Medical Systems

- Medline Industries, Inc.

- Norfolk Medical

- Integrated Medical System (IMS)

- Thermo Fisher Scientific

- MEDIWIDE SDN BHD

- Jordan Medical

- McKesson Corporation

- AngioDynamics, Inc.

High Flow Needle Sets Market Report Scope

Report Attribute |

Details |

Market size value in 2024 |

USD 1.08 billion |

Revenue forecast in 2030 |

USD 1.56 billion |

Growth Rate |

CAGR of 6.36% from 2024 to 2030 |

Base year for estimation |

2023 |

Historical data |

2018 - 2022 |

Forecast period |

2024 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Volume, type, material, end-use |

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa, Saudi Arabia; UAE; Kuwait |

Key companies profiled |

AmDel; B. Braun Medical Inc; Concordance Healthcare Solutions; GEORGE PHILIPS MEDICAL ENGINEERING Pvt. Ltd; KORU Medical Systems; Medline Industries, Inc.; Norfolk Medical; Integrated Medical System (IMS); Thermo Fisher Scientific; MEDIWIDE SDN BHD; Jordan Medical |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options. |

Global High Flow Needle Sets Market ReportSegmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030.For this study, Grand View Research has segmented the global high flow needle sets market report based on volume, type, material, end-use, and region:

Volume Outlook (Revenue, USD Million, 2018 - 2030)

Less than 10ml

10-100ml

More than 100ml

Type Outlook (Revenue, USD Million, 2018 - 2030)

26 Gauge High Flow Needle Sets

24 Gauge High Flow Needle Sets

Others

Material Outlook (Revenue, USD Million, 2018 - 2030)

Stainless Steel

Polycarbonate

End-use Outlook (Revenue, USD Million, 2018 - 2030)

Hospitals

Ambulatory Surgical Centers

Diagnostic Centers

Others

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Italy

Spain

Denmark

Sweden

Norway

Asia Pacific

Japan

China

India

Australia

South Korea

Thailand

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

UAE

Kuwait

Frequently Asked Questions About This Report

b.The global high flow needle sets market size was estimated at USD 1.02 billion in 2023 and is expected to reach USD 1.08 billion in 2024.

b.The global high flow needle sets market is expected to grow at a compound annual growth rate of 6.36% from 2024 to 2030 to reach USD 1.56 billion by 2030.

b.North America dominated the high flow needle sets market with a share of 43.7% in 2023. This is attributable to government support for quality healthcare, and rising product demand in home care settings and increasing prevalence of chronic disorders.

b.Some key players operating in the high flow needle sets market include AmDel, B. Braun Medical Inc, Concordance Healthcare Solutions, GEORGE PHILIPS MEDICAL ENGINEERING Pvt. Ltd, KORU Medical Systems, Medline Industries, Inc., Norfolk Medical, Integrated Medical System (IMS), Thermo Fisher Scientific, MEDIWIDE SDN BHD, Jordan Medical, Mc Kesson Corporation, and AngioDynamics, Inc.

b.Key factors that are driving the high flow needle sets market growth include the rising prevalence of chronic disorders and rising preference for minimally invasive surgical procedures.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."